S&P futures struggled for direction on Thursday, with Nasdaq futs down following a plunge in Tesla following dismal guidance, even as European stock were modestly higher ahead of what many expect will be an easing signal by the ECB as a bevy of earnings reports again pointed to a slowing global economy, while holding up in the face of already reduced expectations.

The S&P 500 and Nasdaq hit a new all-time high once again on Wednesday after Texas Instruments hinted that a global slowdown in microchip demand would not be as long as feared, which countered bleak earnings from bellwether companies Boeing and Caterpillar.

The mood was more subdued on Thursday, when Tesla stock tumbled 12.3% and pressured Nasdaq futures after the electric carmaker pushed back its profit timeline once again after missing its quarterly financial targets. On the other hand, 3M rose 4.5% after the manufacturing conglomerate reiterated its full-year earnings forecast despite slowing growth in high-profile markets such as China. Facebook gained 1%, after the social media giant reported quarterly revenue that beat estimates, but said new rules and product changes aimed at protecting user privacy would slow its revenue growth into next year. Ford Motor dropped 4.6% after the automaker reported a lower-than-expected profit, weighed down by charges to restructure its units in Europe and South America, and gave a disappointing full-year earnings forecast.

Two weeks into the second-quarter earnings season, Reuters reports that about 77% of the 138 S&P 500 companies that have reported so far have topped earnings estimates. Overall earnings are now expected to fall 0.1%, compared with a prior estimate of a rise of about 1%.

Meanwhile, hopes that key central banks would take monetary measures to impede the impact of a protracted U.S.-China trade war has helped Wall Street’s main indexes hit record highs this month; moments ago Turkey became the latest country to join the easing bandwagon when its central bank cut rates by a whopping 425bps to 19.75%, in line with Erdogan’s demands.

In Europe, the Stoxx Europe 600 pared some of its earlier gains, with health care shares the top performers after earnings for AstraZeneca and Roche beat estimates. AEX (-0.1%) lagged peers, pressured by Unilever (-0.8%) post-earnings. Meanwhile, France’s CAC 40 (+0.5%) benefited from its largest weighted stock LVMH (+1.5%) which rose after the company posted a 20% Y/Y LFL sales increase in leather goods and fashions. Sectors are mixed with outperformance in Pharma names as heavyweight Roche (+1.3%) raised its 2019 revenue growth outlook. On the flip side, energy names lag on the back of the decline in oil prices yesterday. Individual movers include UK-listed Cobham (+34.7%) was bolstered to the top of the Stoxx 600 as the Co. is expected to be acquired for GBP 4.0bln including debt. Other interesting movers on the back of earnings, with Nokia (+6.3%), AstraZeneca (+5.6%), Kion (+4.6%) all at the top of the pan-European index. On the downside, JC Decaux (-5.2%) slid on the back of disappointing numbers whilst SMI-listed Clariant (-9.9%) fell to the foot of the Stoxx 600 after the Co. suspended talks with Sabic over the proposed JV.

Earlier in the session, Asian stocks advanced, heading for a third day of gains though Korean stocks declined for a second day, after U.S. equities climbed to record highs. Communications and technology were among the best-performing sectors. Most markets in the region were up, with the Philippines leading gains. The Topix added 0.2%, supported by chemical firms, as investors gauged a raft of mixed corporate results. Shin-Etsu Chemical Co. and Advantest Corp. jumped after reporting first-quarter operating profits above estimates. The Shanghai Composite Index rose 0.5%, with banks and Kweichow Moutai Co. among the biggest boosts. Beijing gave the green light for some companies to buy U.S. soybeans free of retaliatory import tariffs in a goodwill gesture amid trade negotiations with Washington. India’s Sensex gained 0.3%, set to end a five-day losing streak, as investors sought out value with equities near a two-month low. Most Nifty companies that have reported earnings so far have either met or exceeded analyst estimates.

In Rates, Germany’s 30-year bond yield fell to a record on deteriorating business confidence:

- German Ifo Business Climate New (Jul) 95.7 vs. Exp. 97.1 (Prev. 97.4, Rev. 97.5).

- German Ifo Current Conditions New (Jul) 99.4 vs. Exp. 100.4 (Prev. 100.8, Rev. 101.1)

- German Ifo Expectations New (Jul) 92.2 vs. Exp. 94.0 (Prev. 94.2, 94.0)

Ifo economists said that the German economy faces a turbulent time ahead. He sees a slightly positive growth rate in H2, although recession is spreading in all important sectors of German industry. Business Climate has deteriorated in key sectors except for the auto industry.

In FX, the euro fell for a fifth day and Treasuries gained along with European government bonds as the market braced for an easing signal from the European Central Bank’s latest meeting. The dollar was little changed, with the yen gaining ground and the Aussie dollar falling to a two-week low after the RBA said policy makers are prepared to lower interest rates again. The pound steadied as new U.K. Prime Minister Boris Johnson picked a pro-Brexit government team. The Turkish Lira first tumbled, then surged after the CBRT cut rates by more than expected 425bps to 19.75%, its biggest rate cut on record.

In geopolitics, North Korea fired 2 projectiles which flew 430km but did not reach Japan’s exclusive economic zone. Following news of the launch, South Korea Defence Ministry spokesperson urged North Korea to stop acts which are not helpful in easing military tensions, while Japanese PM Abe suggested the North Korea missile launch poses no threat.

Expected data include durable goods orders and wholesale inventories. Amazon, American Airlines, Alphabet, Intel, Starbucks, and T-Mobile are among companies reporting earnings.

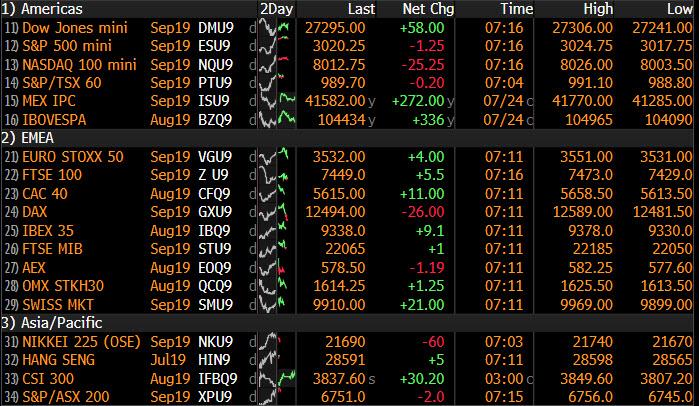

Market Snapshot

- S&P 500 futures little changed at 3,022.50

- STOXX Europe 600 up 0.2% to 392.51

- MXAP up 0.2% to 161.31

- MXAPJ up 0.3% to 530.23

- Nikkei up 0.2% to 21,756.55

- Topix up 0.2% to 1,577.85

- Hang Seng Index up 0.3% to 28,594.30

- Shanghai Composite up 0.5% to 2,937.36

- Sensex up 0.1% to 37,884.49

- Australia S&P/ASX 200 up 0.6% to 6,818.03

- Kospi down 0.4% to 2,074.48

- German 10Y yield fell 1.4 bps to -0.392%

- Euro down 0.07% to $1.1132

- Italian 10Y yield fell 10.7 bps to 1.143%

- Spanish 10Y yield fell 3.1 bps to 0.316%

- Brent futures up 0.7% to $63.62/bbl

- Gold spot up 1% to $1,427.32

- U.S. Dollar Index little changed at 97.76

Top Overnight News from Bloomberg

- Boris Johnson executed a brutal clear-out of more than half of his predecessor’s top team, installing supporters in key roles as the new prime minister signaled his intent to deliver Brexit in 98 days. Sajid Javid picked to steer the British economy through Brexit

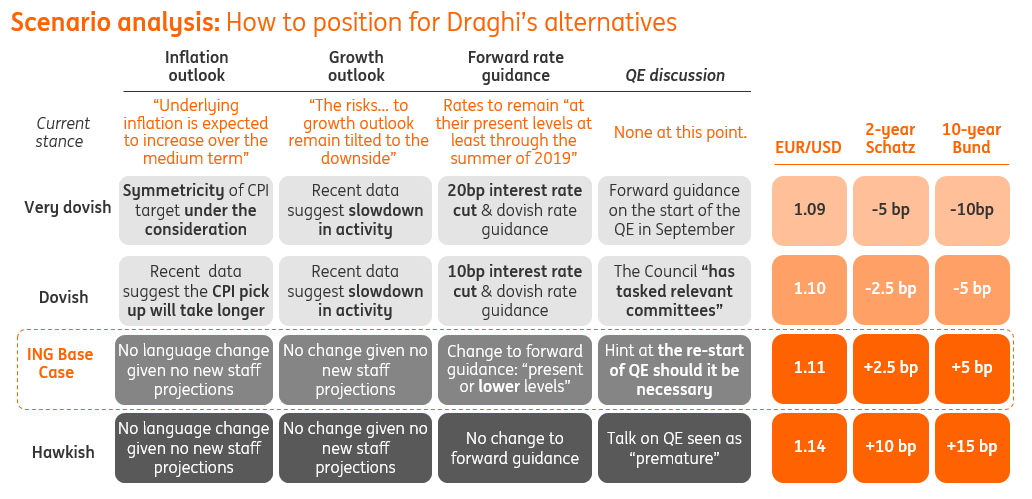

- The European Central Bank is set to signal that it is once again preparing to step in to support the euro zone. On the eve of the seventh anniversary of President Mario Draghi’s landmark “whatever it takes” speech, policy makers will decide how to confront an economic slowdown amid risks from U.S. protectionism to Brexit

- German companies’ business outlook tumbled to the lowest in a decade, adding to signs that Europe’s largest economy is getting dangerously close to a recession

- Treasury Secretary Steven Mnuchin said a strong dollar is good for the U.S. economy in the long term and that he wouldn’t advocate for a weak-dollar policy in the near future

- North Korea launched at least two short-range missiles into the sea east of the Korean Peninsula, stepping up pressure on the U.S. as it tries to resume nuclear disarmament talks with Pyongyang

- Former Federal Reserve Chairman Alan Greenspan endorsed the idea that the U.S. central bank should be open to an insurance interest-rate cut, to counter risks to the economic outlook, even if the probability of the worst happening was relatively low

- Oil held its biggest loss in a week as signs that growth is slowing in major economies overshadowed the longest run of declines in U.S. crude stockpiles since the start of 2018

Asian equity markets mostly traded with cautious gains after a similar performance on Wall St where strength in financials and tech fuelled the S&P 500 and Nasdaq to all-time record highs, although the DJIA underperformed on disappointing blue-chip earnings. ASX 200 (+0.6%) and Nikkei 225 (+0.2%) were higher but with gains capped by weakness in mining related sectors and with Tokyo trade also contained by an uneventful currency after source reports suggested a lack of consensus within the BoJ regarding additional easing measures at next week’s meeting. Elsewhere, the KOSPI (-0.4%) underperformed after North Korea conducted a short-range missile launch and with earnings also heavily in focus, while Hang Seng (+0.3%) and Shanghai Comp. (+0.5%) were choppy as another substantial liquidity drain by the PBoC was counterbalanced by trade optimism after suggestions that next week’s US-China trade meeting is to be held in Shanghai to allow the possibility of President Xi joining in and that the meeting will be followed up by talks in Washington. Finally, 10yr JGBs were relatively flat as they mirrored the rangebound trade in T-notes and with demand also dampened by the indecisive gains in the region, although prices later found mild support after the 2yr auction which attracted a higher b/c and narrower tail in price.

Top Asian News

- Digger Giant Warns of ‘Dark Turn’ as Chinese Sales Start to Ebb

- Hong Kong Names Eddie Yue as Next Monetary Authority Chief

- More Chances to Get Rich Quick in China’s New Stock Venue

- China’s Embattled Jinzhou Bank Courts Investors as Bonds Tumble

European equities are directionless with large-cap earnings dictating the state of play of thus far. AEX (-0.1%) lags its peers, pressured by Unilever (-0.8%) post-earnings. Meanwhile, France’s CAC 40 (+0.5%) is benefitting from its largest weighted stock LVMH (+1.5%) which rose after the Co. posted a 20% Y/Y LFL sales increase in leather goods and fashions. Sectors are mixed with outperformance in Pharma names as heavyweight Roche (+1.3%) raised its 2019 revenue growth outlook. On the flip side, energy names lag on the back of the decline in oil prices yesterday. Individual movers include UK-listed Cobham (+34.7%) was bolstered to the top of the Stoxx 600 as the Co. is expected to be acquired for GBP 4.0bln including debt. Other interesting movers on the back of earnings, with Nokia (+6.3%), AstraZeneca (+5.6%), Kion (+4.6%) all at the top of the pan-European index. On the downside, JC Decaux (-5.2%) slid on the back of disappointing numbers whilst SMI-listed Clariant (-9.9%) fell to the foot of the Stoxx 600 after the Co. suspended talks with Sabic over the proposed JV. Over in the States, Facebook (+1.2% pre-market) reported last night with miss on top line and a beat on bottom line. The Co. also noted that EPS would have been higher excluding the FTC legal fees of USD 5bln over privacy violations. Meanwhile, Tesla (-10.8% pre-market) missed on top and bottom line. Looking ahead, around 10% of the S&P 500 is reporting today, whilst DJIA component 3M is also on the docket, with a 4.5% weighting in the index.

Top European News

- German Business Confidence Deteriorates as Factory Slump Deepens

- Merkel Leaves Europe’s Sputtering Engine to Ride Out the Storm

- ECB Is Set to Signal Rate Cut as Economy Slows: Decision Day Guide

- ABB Beats Estimates as Activist-Driven Overhaul Bears Fruit

- Wizz Air Jumps on Raised Growth Target at Expense of Rivals

In FX, EUR/TRY are not the biggest currency movers, but both certainly prone to big reactions and price action depending on Central Bank policy decisions as the ECB and CBRT both deliver verdicts today. Market pricing for the former is extremely tight between no change and -10 bp, even though the ‘consensus’ leans towards a tweak in guidance for easing in September rather than any adjustments this time, with the probability roughly 50-50. However, the latter is unanimously expected to lower its benchmark and the uncertainty rests on how much given a gaping range of forecasts, from -100 bp to -500 bp, while some observers also suggest that a loud -800 bp call exists. In the run up, the single currency and Turkish Lira are on the defensive, with Eur/Usd teetering above ytd lows in a 1.1145-23 range and capped by yet another bleak German survey in the form of Ifo that missed consensus across the board and compounded by a gloomy statement from the institute noting the spread of recession through all key industrial sectors. Meanwhile, Usd/Try is pivoting 5.7100 and also acknowledging a deterioration in manufacturing sentiment and a decline in cap u.

- NZD/AUD – Dovish rate vibes are undermining the Kiwi and Aussie as well, with Westpac recalibrating its RBNZ outlook to match the RBA by pencilling in 2 more 25 bp eases from 1 previously. Nzd/Usd has retreated from 0.6700+ in response, but the Aud/Nzd cross remains anchored near 1.0400 as Aud/Usd slips a bit further from 0.7000 to 0.6965 in wake of comments from RBA Governor Lowe indicating further OCR reductions if demand disappoints and acknowledging that inflation will take time to hit target.

- JPY/CAD/GBP/CHF – All narrowly mixed vs a solid Greenback, as the DXY continues to test a key Fib retracement level at 97.776 within a tight 97.778-679 band, with the Yen still stuck around 108.00 and embroiled in decent option expiries (1.7bn from 107.75 to 107.80 and 1.5 bn between 107.90-108.00) vs technical resistance at 108.31 (also a Fib). Meanwhile, the Loonie hugs 1.3128-44 ahead of Canadian wage data, Cable retains a recovery tone within 1.2450-1.2500 and the Franc remains underpinned around 0.9850 vs the Buck and over 1.1000 against the Euro, expecting the SNB to match or counteract any ECB moves.

- ZAR – The Rand is underperforming after a stark warning from Moody’s that the latest state aid for Eskom will put further strain on the Government’s finances and threaten SA’s rating, with Usd/Zar nudging the top of 13.9750-8600 range.

In commodities, WTI and Brent futures are marginally firmer, albeit it seems to be more of a consolidation from yesterday’s DoE-induced decline and on the news that Kuwait and Saudi officials discussed resuming production from the neutral zone which had previously provided around 500k bpd of supply. WTI and Brent currently reside around the 56.00/bbl and 63.50/bbl levels with the former eyeing its 50 DMA at 56.87/bbl ahead of its 200 DMA at 57.11/bbl (with the psychological 57/bbl level in-between). News flow for the complex has been light thus far with traders eyeing the ECB’s latest monetary policy decision (full preview available in the Research Suite) for the next possible catalyst. Elsewhere, gold prices are relatively steady above the 1400/oz mark with Central Bank decisions very much in focus. Elsewhere copper is little changed amid the cautious/tentative risk tone whilst Shanghai lead climbed over 1% overnight amid revived supply concerns due to maintenance activity in China.

US Event Calendar

- 8:30am: Durable Goods Orders, est. 0.7%, prior -1.3%; Durables Ex Transportation, est. 0.2%, prior 0.4%

- 8:30am: Cap Goods Orders Nondef Ex Air, est. 0.2%, prior 0.5%; Cap Goods Ship Nondef Ex Air, est. -0.2%, prior 0.6%

- 8:30am: Advance Goods Trade Balance, est. $72.5b deficit, prior $74.5b deficit

- 8:30am: Wholesale Inventories MoM, est. 0.5%, prior 0.4%; Retail Inventories MoM, est. 0.2%, prior 0.5%

- 8:30am: Initial Jobless Claims, est. 218,000, prior 216,000; Continuing Claims, est. 1.69m, prior 1.69m

- 9:45am: Bloomberg Consumer Comfort, prior 64.7

- 11am: Kansas City Fed Manf. Activity, est. 2.8, prior 0

DB’s Jim Reid concludes the overnight wrap

Welcome to ECB day, and a meeting where we should move closer to what is likely to be a round of global policy easing in the months ahead. Mr Draghi paved the way at Sintra last month where he laid the foundations to make further policy easing feel less conditional. Our economists, in their preview note last week ( link ), believe that September is the natural occasion for the big decisions and details but expect some preparation today. They expect the “or lower” easing bias to be reintroduced into rates guidance and that this will be the prelude to a 10bp deposit rate cut and tiering in September. They also expect a further 10bp cut in December. They also believe we will see upgraded forward guidance used to underline the ECB’s “absolute commitment” to the price stability mandate. If the Council is unable to strengthen forward guidance sufficiently, a new wave of net asset purchases may be required in the not too distant future. If so, the team would not be surprised by new QE of EUR30bn per month for a minimum 9-12 months split equally between public and private assets and with a commitment to relax the limits if necessary.

Ahead of this, fixed income rallied across Europe yesterday as the European preliminary PMIs for July showed the manufacturing sector continuing to disappoint – something the ECB will have to acknowledge. The manufacturing PMI for the Eurozone fell to its lowest in over six years at 46.4 (vs 47.6 last month), the German figure fell to a seven-year low of 43.1 (vs. 45.0) and France recorded a flat 50.0 (vs. 51.9) reading. The services readings also fell, but were mostly in line with expectations, with the Eurozone figure at 53.5 (vs. 53.6 last month), Germany at 55.4 (vs. 55.8) and France at 52.2 (vs. 52.9). In response, ten-year bund yields closed down –2.3bps with the previous on the run hitting a fresh all-time low of -0.423%. BTPs fell -10.9bps to a fresh one-year low on news that auctions had been cancelled, while Greek ten-year yields fell -5.7bps to close below 2% for the first time ever. That takes their yield to -6.2bps lower than US treasuries, their lowest level versus the US benchmark since October 2007. Treasuries joined the European rally with 10-year yields ending -3.8bps lower at 2.043%.

Despite the rally for rates and the tepid manufacturing surveys, equities mostly rallied yesterday. The S&P 500 gained +0.47% to 3019.6, a new all-time high. The DOW (-0.29%) again lagged as Boeing (-3.12%) and Caterpillar (-4.48%) dragged on the index after their earnings reports. Boeing saw a net loss of -$2.94bn in the second quarter, paired with a -35% yoy drop in revenues, as the company continues to suffer from the grounding of the 737 MAX. Caterpillar is viewed as a global macro bellwether, and overall its guidance was soft, saying they expect profits “to be at the lower end” of their full-year outlook range. Digging into their results showed healthy sales growth in North America (+11%) and Latin America (+9%), but weakness in Europe, Africa, and the Middle East (-6% combined) and in Asia (-7%), which is consistent with the general trend of US macro outperformance.

Away from industrials, tech was also in focus yesterday. The NASDAQ and Philly semiconductor indexes advanced +0.85% and +3.10%, respectively, both to new record highs. The sector benefited from positive sentiment post Texas Instrument’s (+7.44%) strong earnings report from Tuesday night, plus further strong guidance from Taiwan Semiconductor Manufacturing co, the world’s biggest chipmaker. Facebook (+0.80% after hours) posted strong revenue and active users figures, which ended up trumping new regulatory headwinds for the company. Facebook announced that the Federal Trade Commission has opened an antitrust investigation of the company, which comes after Facebook said earlier that it had agreed to pay a $5bn settlement and accept new privacy restrictions on its social media platform, to address a separate investigation.

This morning in Asia markets are largely trading up with exception of the Kospi which is -0.60%. The Nikkei (+0.36%), Hang Seng (+0.26%) and Shanghai Comp (+0.29%) are all up. The Australian dollar is trading down -0.07% after the country’s central bank chief Philip Lowe said that he’s ready to ease policy further if his recent back-to-back cuts fail to revive economic growth and flagged “an extended period” of low interest rates. Elsewhere, futures on the S&P 500 are trading flat while those on the Nasdaq are down -0.26%. In terms of overnight data releases, South Korea’s preliminary Q2 GDP printed at +2.1% yoy (vs. +1.9% yoy expected and +1.7% yoy last quarter). In details it showed that private-sector investment shaved 0.5pp off quarterly growth, meaning government investment drove the expansion and underlines the fragility of the rebound in growth.

In other overnight news, India is considering an option to raise $10bn from its first sovereign foreign currency bond offering with bonds likely to be denominated in either the Japanese yen or euros to take advantage of lower yields. The proposed offering could come to markets in October. Elsewhere, North Korea launched at least two short-range missiles into the sea east of the Korean Peninsula, stepping up pressure on the US as it tries to resume nuclear disarmament talks with Pyongyang and bringing geopolitical risks back into some focus.

Back to yesterday and in the UK, Boris Johnson was appointed by the Queen as the prime minister yesterday, facing perhaps the most difficult set of circumstances of any incoming PM for decades. On the steps of Downing Street, Johnson struck an aggressive tone on Brexit, reiterating that the decision of the referendum in 2016 must be respected. He said he wanted to reach a “new deal” with the EU, with the backstop removed, and see the country leave on the October 31 deadline “no ifs or buts”. Johnson also said that he would prepare for a no-deal outcome and that “the doubters, the doomsters, the gloomsters are going to get it wrong again.” In a letter to the incoming Prime Minister, European Council President Donald Tusk said pointedly that “I look forward to meeting you to discuss – in detail – our cooperation.”

Johnson began assembling his cabinet after his appointment, and the clear signal is that committed supporters of Brexit are in the key positions, and also those who support his pledge to leave the EU without a deal if necessary by October 31. Former DB employee Sajid Javid was appointed as Chancellor of the Exchequer, while Dominic Raab was made foreign secretary. In terms of the market reaction, sterling was unaffected by Johnson’s speech, although it strengthened +0.33% against the dollar before Johnson’s meeting with the Queen.

Without a general election, Johnson faces much the same constraints as his predecessor, in that his party lacks a majority in the House of Commons and relies on the DUP’s 10 MPs in order to win key votes. With an upcoming parliamentary by-election next week in Wales, where pro-EU Liberal Democrats are favourites to take the seat off the Conservatives (per the Independent), that could shrink even further. So the honeymoon won’t last long.

In terms of other data released yesterday, the flash PMIs from the US also saw an increasing divergence between manufacturing and services, repeating the theme seen in Europe. The manufacturing reading fell to a flat 50.0 (vs. 50.6 last month), its lowest level since 2009, while the services reading rose to 52.2 (vs 51.5 last month). Elsewhere, the new home sales data disappointed, with the 646k reading for June below the 658k expected, while the previous month’s reading was revised down by 22k. In France, the Insee’s business climate indicator fell by one point to 105 in July (vs. 106 expected). The business climate indicators for both the manufacturing and services indicators also fell by one point, to 101 and 106 respectively, while the employment climate reading rose by one point to 107.

In terms of the day ahead, the aforementioned ECB policy decision and press conference will be the highlight, (along with Prime Minister Johnson’s first appearance as PM in the House of Commons). Looking at data releases, we have US durable goods orders, wholesale inventories, and weekly initial jobless claims. There’ll also be the Kansas City Fed’s manufacturing index, the German Ifo Survey, and the latest CBI data from the UK. Elsewhere, Amazon and Alphabet will be announcing earnings.

via ZeroHedge News https://ift.tt/2Yhj0QX Tyler Durden