Morgan Stanley: Brace For A Spike In Inflation As Congress Is Now In The Money Supply Driver’s Seat

Tyler Durden

Sun, 08/02/2020 – 17:50

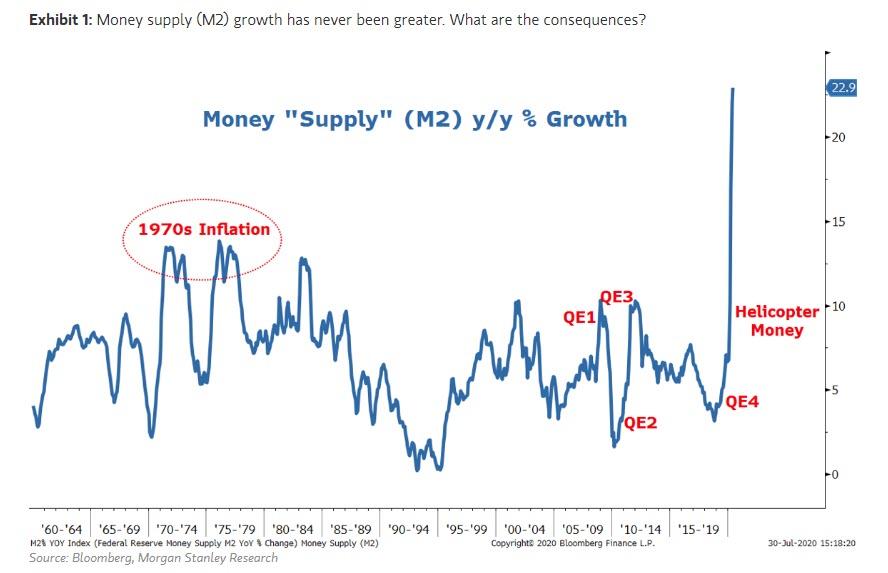

Just days after the famous (former) deflationista (turned reflationist) Russell Napier explained why he believes that central banks have “become irrelevant” in a world in which governments have taken control of the money supply, none other than Morgan Stanley’s Michael Wilson (whose bullish market outlook on risk assets is predicated on the foundational view that the coming reflationary tsunami will lift all boats) has published a note agreeing with Napier and pointing out that not only is M2 exploding at a pace never seen before, but also writing that “Congress is now a critical player in driving money supply growth, given that the Fed has already committed to expanding its balance sheet as much as needed to support the recovery.”

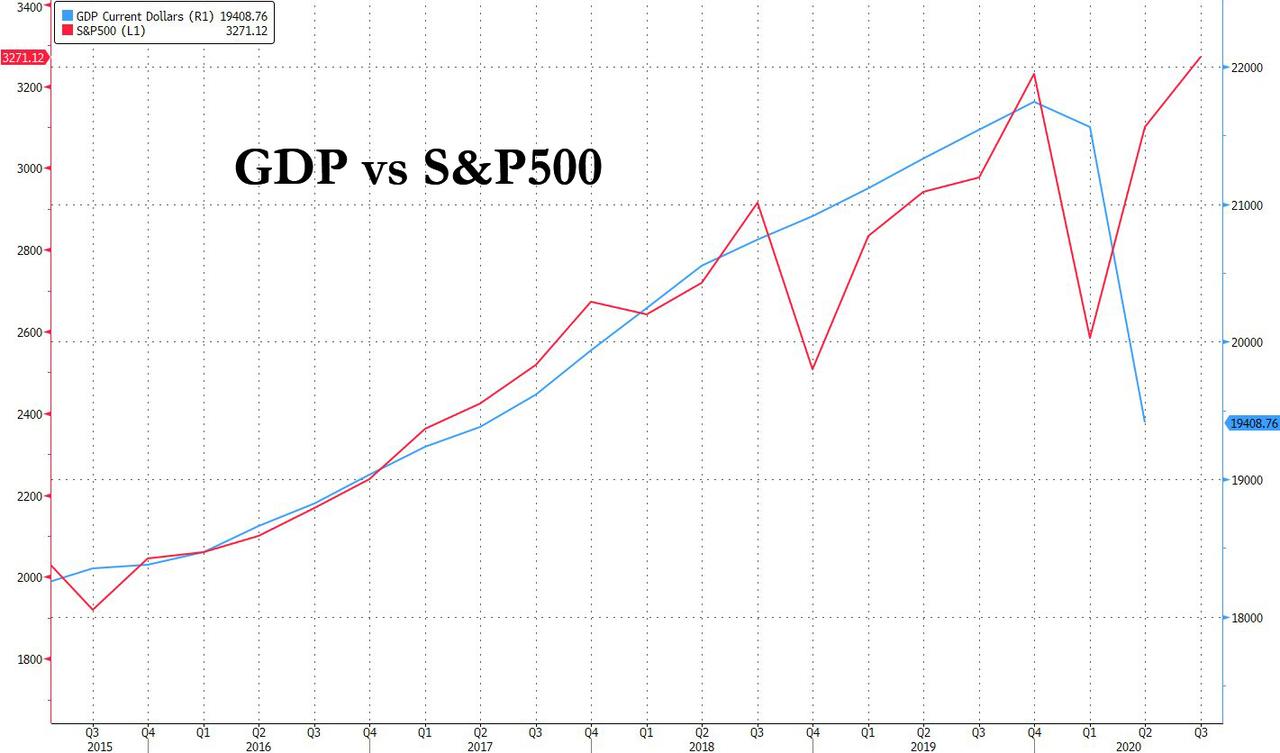

But how is that any different from the post financial crisis period when M2 also soared yet broad inflation failed to materialize (at least when measured with faulty CPI metrics)? Well, according to Wilson, “this time around, with the financial system in much better shape, and the direct intervention of Congress, there’s a real chance that the money multiplier doesn’t fall so much, and money supply growth remains elevated, thereby driving aggregate demand and inflation – i.e., nominal GDP growth.”

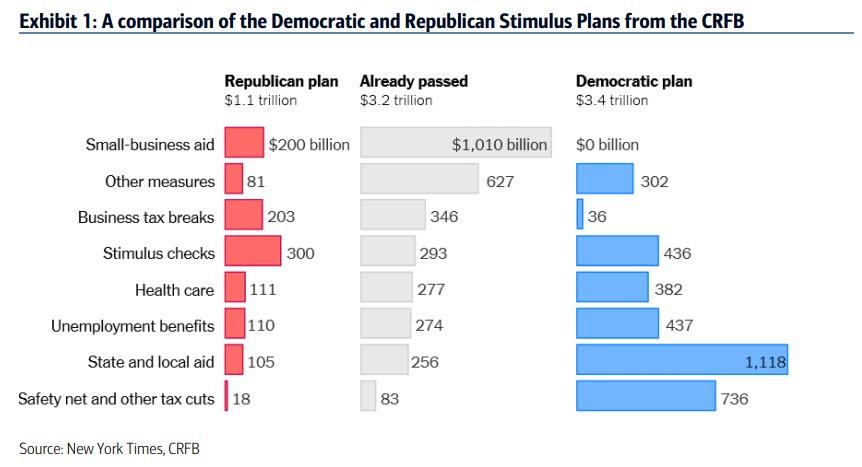

And while Wilson warns that there may be some near-term weakness in stocks due to “uncertainty” until Congress passes the next stimulus round, the long-term picture is clear and “Congress is now in the driver’s seat when it comes to the money supply with its fiscal programs and, as Milton Friedman also famously said, “Nothing is so permanent as a temporary government program.”

This, to Wilson, is potentially more inflationary than appreciated, which means that back-end rates can rise and as the MS strategist concludes “very few portfolios are prepared for such an outcome. Such shifts can happen quickly when they are so unexpected, which invokes one of our own favorite sayings, “being early is on time and arriving on time is late“.“

Below we republish the full note from Michael Wilson, chief equity strategist at Morgan Stanley, as posted in the latest Morgan Stanley Sunday Start.

Who’s Really Driving the Bus?

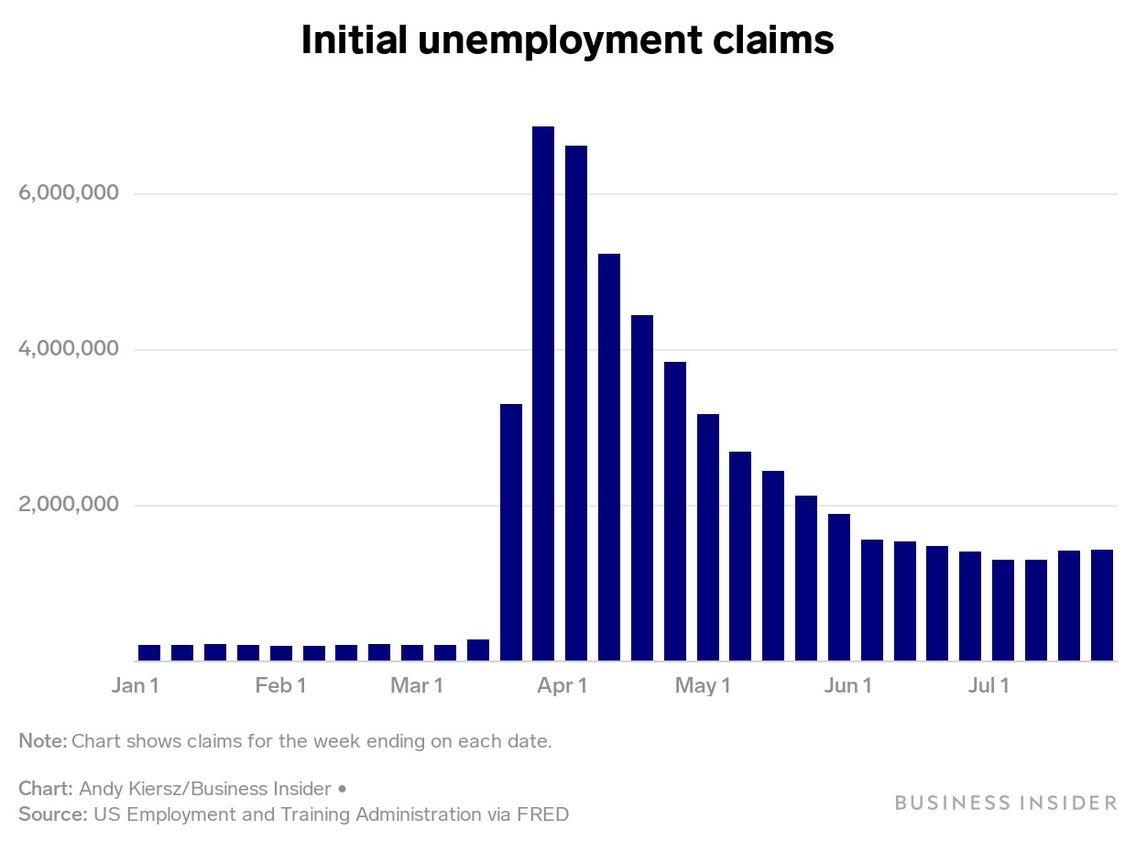

With the US and global economies in the midst of one of the deepest recessions and output gaps on record, most investors we speak with have dismissed our call for higher inflation risks. They ask how in the world are we going to get inflation with unemployment north of 10%, excess supply in everything from oil to hotel rooms and services no longer in demand?

While we are likely to experience big imbalances in the real economy for several more quarters, if not years, the most powerful leading indicator for inflation has already shown its hand – money supply, or M2. As Milton Friedman famously said 50 years ago,”inflation is always and everywhere a monetary phenomenon”. It’s fair to say we have never observed money supply growth as high as it is today (Exhibit 1). If Mr. Friedman was correct, then isn’t the risk of higher inflation greater than it’s ever been, too? Indeed, the sharp moves higher in breakevens and precious metals suggest that markets are considering the possibility.

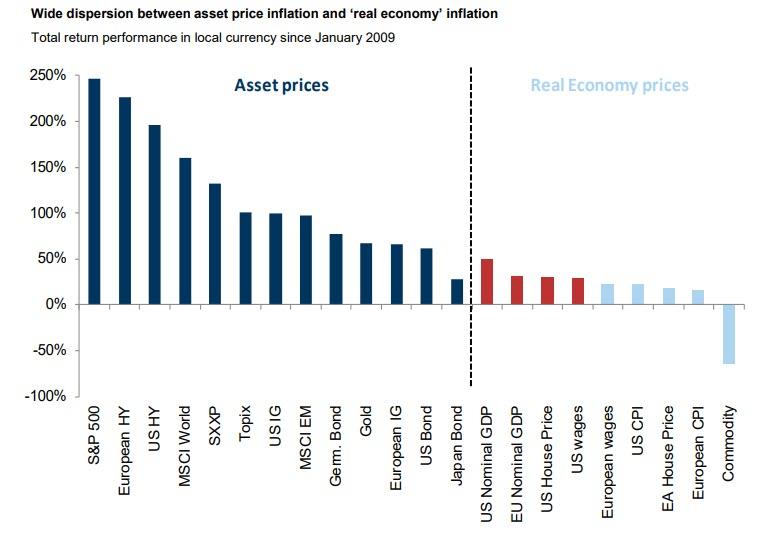

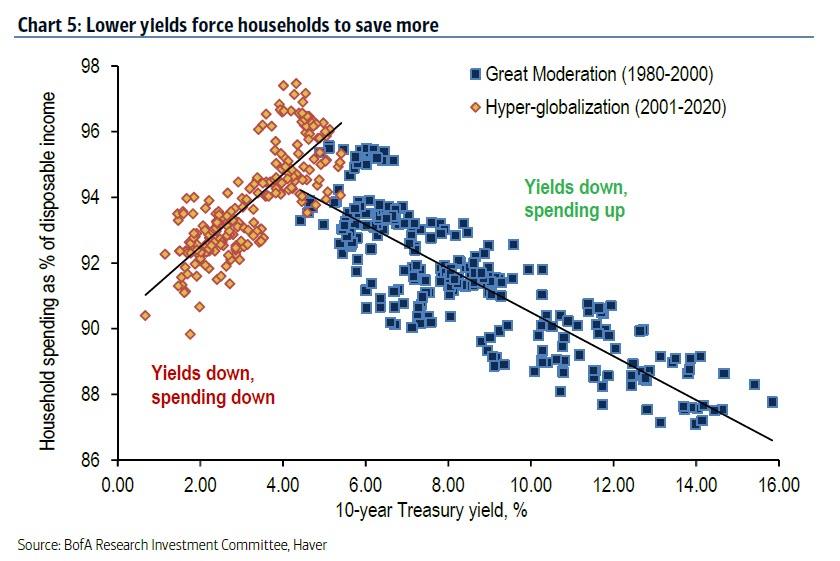

Of course, money supply also grew rapidly after the global financial crisis (GFC) and we never saw inflation appear in a meaningful way. This fact has emboldened the view that the Fed can print money at whatever rate it wants and it won’t lead to inflation, at least not enough inflation to cause nominal and real long-term interest rates to rise. Given the current mispricing of long-end rates and crowdedness of long-duration investments of all kinds, this may prove to be a costly assumption.

We’ve argued for the past several months that the policy response to this crisis has been very different than what was used during the GFC. On the monetary front, the Fed reacted much more swiftly and aggressively with its immediate bazooka-style response and direct intervention in credit markets. In short, it went all-in from the beginning, showing no hesitation to do whatever it takes to support markets and the economy. Part of that aggressiveness was also likely attributable to the fact that we didn’t get any meaningful inflation after US$4 trillion in quantitative easing following the GFC. However, it’s the fiscal response that’s really different this time.

- First, the government has been sending money directly to both consumers and small businesses as a means of supporting the economy during the lockdown and reopening – aka ‘helicopter money’.

- Second, it has directly intervened in the lending markets by making loans via the Paycheck Protection and Main Street Lending Programs.

- Finally, and perhaps most importantly for the inflation call, is the decision by Congress to guarantee loans made by commercial banks and to offer mortgage and other liability (rent) forbearance via the CARES Act.

To me, this means that Congress is now a critical player in driving money supply growth, given that the Fed has already committed to expanding its balance sheet as much as needed to support the recovery. The health of the financial system matters too. The Fed can expand its balance sheet, but this might not necessarily translate to aggregate demand or inflation. This is what happened after the GFC. With the financial system impaired, banks were in no position to increase lending. Instead, they shrunk their loan books. This time around, with the financial system in much better shape, and the direct intervention of Congress, there’s a real chance that the money multiplier doesn’t fall so much, and money supply growth remains elevated, thereby driving aggregate demand and inflation – i.e., nominal GDP growth.

Finally, helicopter money and other stimulus programs are popular with the people and popular programs are what politicians run on. Therefore, we find it highly unlikely that Congress will fail to extend the benefits currently being negotiated in an election year. However, this doesn’t mean we won’t need to weather some uncertainty about it before it passes, and this may weigh on equity markets in the near term. In fact, this is what we expect, but we would use any weakness around such a delay to add to equities, especially cyclicals geared to higher inflation and economic growth.

To sum up, Congress is now in the driver’s seat when it comes to the money supply with its fiscal programs and, as Milton Friedman also famously said, “Nothing is so permanent as a temporary government program.” This is potentially more inflationary than appreciated, which means that back-end rates can rise. Very few portfolios are prepared for such an outcome. Such shifts can happen quickly when they are so unexpected, which invokes one of our own favorite sayings, “being early is on time and arriving on time is late“.

via ZeroHedge News https://ift.tt/2Xmu39I Tyler Durden