Cost-Cutting And COVID-19 Could Catalyze Election Day Chaos

Tyler Durden

Sun, 07/12/2020 – 20:30

State and local governments are already setting up for what is likely going to be one of the most difficult elections to manage in decades due to the pandemic. Compounding the issues that come with the coronavirus is the fact that many states and municipalities are also facing budget cuts, suffocating their ability to make the changes necessary to keep voters safe in November.

States remain on different footing with how they want to approach November. For example, in Ohio, election officials want to equip polling places with safety measures to constrain the virus. In Georgia, officials are considering making absentee ballots easier to get.

Regardless, across the nation, it’s a situation that could lead to “chaos” in November, Reuters reports.

Tina Barton, the city clerk and chief elections official in Rochester Hills, Michigan, a tightly contested election area, said: “What kind of price tag are you going to put on the integrity of the election process and the safety of those who work it and those who vote? Those are the things at risk.”

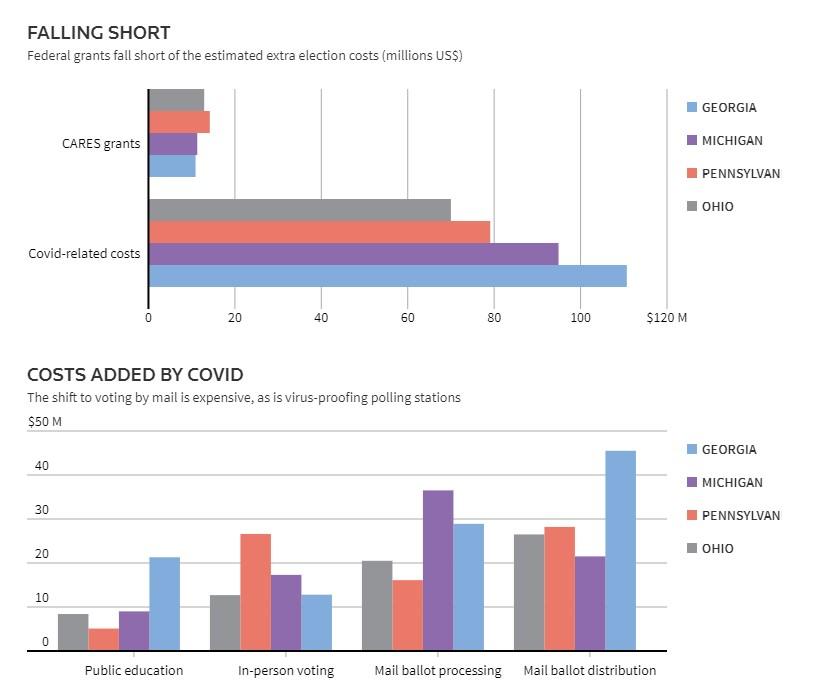

At the very least, elections will simply cost more this year: face masks, face shields and other virus-proofing equipment will need to be purchased in addition to a normal election budget. There are also costs associated with a larger volume of more mail-in ballots. Across the U.S., election officials are warning that they don’t have what they need to do the job properly.

Myrna Perez, director of the elections program at New York University’s Brennan Center for Justice, says there could be “widespread disenfranchisement,” as a result. “We run the risk of people really questioning the legitimacy of the election,” she commented.

Congress has already approved $400 million in federal funding to help states hold the elections as part of the CARES Act. But that is 10% of the $4 billion that experts believe will be necessary to hold “safe and fair” elections this year. Postage alone for mail-in ballots will cost almost $600 million.

An aid bill passed in May in the House included $3.6 billion in new election funding, but the bill has no chance of passing the Senate as Republicans have taken exception with mail-in voting rules changes that were included in the bill. Republicans remain worried that mail-in voting will encourage fraud and will favor the Democrats.

Hans von Spakovsky, a former Republican member of the Federal Elections Commission, thinks the answer is simply keeping polling places safe instead of switching to mail-in voting: “I’m not saying that this is easy but it is not going to be as difficult as all these people are predicting.”

Amy Klobuchar, the senior Democrat on the Senate rules committee that oversees federal grants for elections, says that money that is supposed to be used for election security is now being used for cleaning supplies: “That’s not a one-or-the-other choice. We need voters to be safe and we need our elections to be secure.”

Still some state and local governments are trying their best to make changes despite a combined $360 billion revenue loss over the next 36 months due to the Covid outbreak. According to Reuters:

- Georgia sent absentee ballot requests to all voters ahead of its June 9 elections, which officials cited in local media estimated would cost at least $5 million

- Philadelphia is faced with an election budget of $12.3 million, instead of $22.5 million and has already spent more than its expected CARES grant holding during its June 2 primary.

- Ohio’s Lucas County has simply ruled out buying safety equipment like Plexiglas sneeze guards for more than 300 polling stations that the county hopes to operate.

Finally, the budget cuts mean that election results may be in much later in the evening than we are currently used to. In places like Michigan, where election boards need machines to count ballots faster, there remains budget shortfalls in the tens of millions. Secretary of State Jocelyn Benson concluded: “This means … that election results may not be available until long after election night.”

via ZeroHedge News https://ift.tt/329YWRP Tyler Durden