Schwab To Buy TD Ameritrade For $26 Billion, Creating $5 Trillion Retail Brokerage Giant

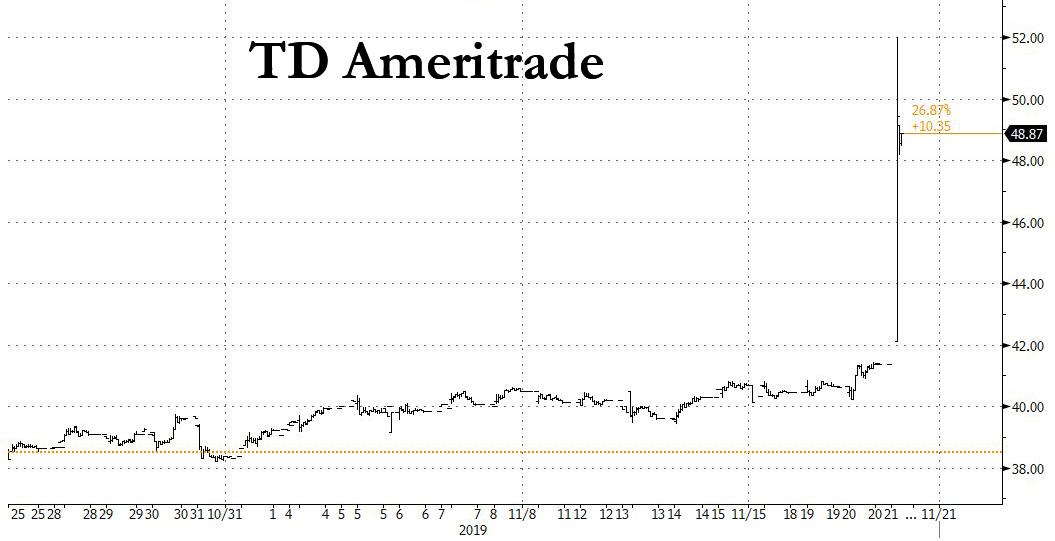

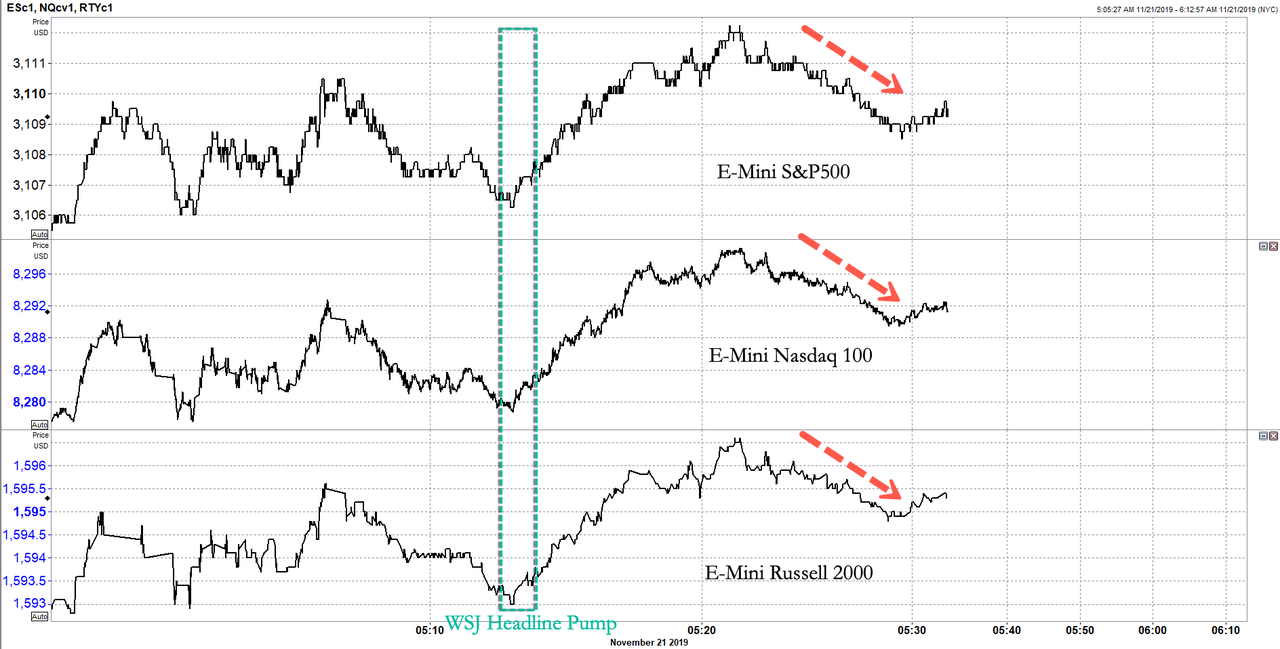

One month after brokerages, prompted by money-losing competitor Robinhood, dropped all transaction fees in hopes of gaining market share – a move which has yet to generate any material new users – this morning Fox Business reported that in a giant move amid discount online brokerages, Charles Schwab would buy TD Ameritrade for $26 billion. Both shares of TD Ameritrade and Schwab were sharply higher on the news, up 18% and 2.4% respectively, with other brokers up as well on the news (ETFC +2.5%, IBKR +2.1%).

TD Ameritrade CEO Tim Hockey, who announced in July that he would leave by the end of February, acknowledged last month that his firm’s decision to adopt zero commissions would prompt speculation about mergers.

“We will take a look at anything that makes financial and strategic sense,” he said in October outlining the company’s plans to make up for lost revenue of as much as $240 million a quarter from the new commission structure. “Scale is important. We have scale. We’re very comfortable with our earnings power now, even in this new environment.”

Last month, Schwab started a revolution in the retail brokerage space, when it announced it would eliminate almost all commissions for online trades, causing rivals E-Trade and Fidelity to follow suit. Eliminating the $4.95 per trade commission will cost Schwab $90 million to $100 million in quarterly revenue, or about 3 percent to 4 percent of its total.

Schwab stock had risen 7.8% this year, while TD Ameritrade has fallen 15.5%, although it appears set to erase losses with today’s move.

TD Ameritrade, which began as First Omaha Securities, was founded by Joe Ricketts in1975. In 1988, it became the first firm to let clients make trades by touch-tone phone, then went public three years later. TD bought Scottrade in a $4 billion cash-and-stock deal in 2016, tying up two major players in the industry.

While the news that Schwab is buying TD Ameritrade will be positive for possible acquisition target E*Trade, it may weigh on some asset managers as the combined company would be able to exert even more pressure on industry fees, according to Vital Knowledge’s Adam Crisafulli.

“The key for this industry is asset aggregation and that’s SCHW’s ultimate goal – it had $3.768t of client assets as of the last quarter and adding AMTD’s $1.3t would take the combined company to >$5t,” he said.

And while E*trade may be considered more of a deal target now, there aren’t many obvious buyers left if SCHW, AMTD combine, Crisafulli said, noting that industry consolidation “isn’t shocking,” and that AMTD was thought to be a potential buyer, perhaps of ETFC.

Tyler Durden

Thu, 11/21/2019 – 07:03

via ZeroHedge News https://ift.tt/2qzLMx1 Tyler Durden