Authored by Doug “Uncola” Lynn via TheBurningPlatform.com,

Everyone Wants to Win and Nobody Likes Being Wrong

The axiomatic adages contained in the title of this article would be labeled as common sense by most Americans; especially Americans because, in the United States, everyone loves a winner. It’s also true no one ever wins by being wrong – unless in the instances of dumb luck or corruption and these never ensure long-lasting success.

Of course, the inverse of this article’s title would be: Everyone wants to be right and nobody likes to lose. And, particularly, in America, the land of the free and the home of the brave. The shining city on a hill.

Such are the stories we tell ourselves.

Twenty years ago, this blogger had a friend and former co-worker who entered into a downward spiral in the wake of his father’s death. Being a former drinking buddy and someone I’d not seen in some time, we ran into each other again at a party and him with a real floozy on his arm. They were making out like teenagers and it was sort of embarrassing.

A short time after that, we sat in a bar together, just us two, and I listened to him while trying to remain polite; and keeping things light. He was in love and thought he was winning. So, after a while, I bought us another round and downed mine quickly. I said: “Buddy, I’m going to tell you what I think and, in this moment right now, I’ll make you a vow: From now on, I’ll never shine you on for as long as we live. From this moment onward, I will tell you exactly what I think in an honest and forthright manner.”

This is, after all, what friends do. Real friends, that is.

So, I told him what I perceived as the truth: That he was wigging out in the wake of his father’s death. And why not? Certainly, we see the beginning percentage of our lives and the end of our parent’s and, like Peggy Lee, we sing: “Is that all there is?” If so, it’s enough to drive anyone insane; and, furthermore, make us believe we’re justified in seeking comfort wherever it may be found.

I told my friend that I, and others, did NOT consider his current girlfriend to be that sweet – and that “the right woman will make ya and the wrong one will break ya”.

In so doing, I began to see him viewing himself as an “emperor with no clothes”. He didn’t take kindly to it at first, but it was a start and through the years, we both sharpened ourselves like iron. He also told me the truth while I kept my vow to always tell him my honest thoughts.

Fortunately, today, he is one of my best friends and his life his fantastic. Both his ex-wife and another of our mutual friends thanked me for staying loyal to him through thick and thin and, indeed, it was my pleasure.

You see, he wanted to win and he didn’t like being proven wrong. None of us do. But time and time again, like Charlie Brown trying to kick Lucy’s football, we fall short. Think about that. Charlie Brown wants to win (by kicking the football) and he wants to be right that Lucy, each time, will hold his balls so he can get them off. But Lucy is not that sweet.

So I ask you, Dear Reader, if you wanted to fool someone, what would be the best way to proceed?

Maybe by getting them to think they are concurrently right and winning; because these appeal to the American psyche like catnip to a feline; like heroin to an addict. And just like a drug, the addict will want more of it, even in the face of rising consequences.

It is, in fact, how the road to hell is paved with good intentions.

Hope and change. Make America great again. Are these not about being right and winning?

In life, and in business, it is always wise to have the endgame in mind before we begin anything. In so doing, not only does it allow us to see our destination, but also, to make course corrections when we take wrong turns.

But, we can only do this when we’re being honest.

Certainly, advertising works but propaganda works better and psyops are most effective when they make us believe we are right and winning.

Instincts and logic are evolutionary factors and perhaps Freud was onto something regarding the consideration of instincts as through the lens of life and death – psychic energy and biological drives and their vicissitudes.

Therefore, perhaps, the “spirit” of any given time is driven by dialectics as simple as life or death – or even truth versus untruth and the interacting manifestations of these, by degree.

Long ago, the byline of an article caught my attention. It said something like:

“What if everything you ever thought you knew about the world was that it wanted you dead?”

The narrative in our minds says history is akin to a tall tower – a tribute to the rise of man. But, in reality, it acts as a drain of time turning, swirling downward into a funnel. The funnel itself – the societal zeitgeists. Broad is the mouth until it narrows – always unto the same end: Depopulation.

The wheel of time. The change of the seasons. Birth, growth, decline, death.

What is the endgame of the globalists today? Obviously, it is their survival, and not yours, Dear Reader.

To MAGA supporters, Trumpy-Cat, Inc. appears as a corporate savior, a means to survive; mischievous, and playful, and more entertaining than any reality TV show.

But Red Flag laws aren’t funny, are they?

Maybe they are, to the Greatest Internet Troll Ever:

Would Chris Cuomo be given a Red Flag for his recent rant? Filthy language and a total loss of control. He shouldn’t be allowed to have any weapon. He’s nuts!

— Donald J. Trump (@realDonaldTrump) August 13, 2019

Of course President Trump tweeted that in response to CNN anchor Chris Cuomo’s profanity-laced rant at a guy who called him “Fredo”, in reference to the fictional Michael Corleone’s dim-witted brother in the “Godfather” movie.

Yet, there were those in the press who claimed Trump, in that very tweet, undermined his own support for Red Flag legislation:

Eager to dunk on one of his least favorite pundits, Trump confirmed gun rights advocates’ biggest concern with red flag laws: Namely, arbitrary standards that could easily be misinterpreted and exploited to strip citizens of their Second Amendment rights. After all, if an overreaction is enough to deprive Cuomo of his right to bear arms, what’s to stop a judge from broadly interpreting any emotional misstep as mental unfitness?

Trump’s sycophants, convinced as they are that the president is always five steps ahead, believe he undermined his policy intentionally. “I’m sorry, but he really is a very stable genius,” said one online pundit.

Certainly, if this is genius, then we can rest easy because Trump has assured us, he is not only genius but a stable genius and everyone knows that is much better than a mad genius. Obviously.

And, just in the nick of time as the senate democrats, the day before, warned the Supreme Court to “heal or face restructuring” in regard to guns:

The Democratic senators’ brief was filed in the case of New York State Rifle & Pistol Association, Inc. v. City of New York, which dealt with legal limitations on where gun owners could transport their licensed, locked, and unloaded firearms. They are urging the court to stay out of the case brought by the NRA-backed group, claiming that because the city recently changed the law to ease restrictions, the push to the Supreme Court is part of an “industrial-strength influence campaign” to get the conservative majority to rule in favor of gun owners.

It appears President Donald Trump leads the charge against the globalists and the gun-grabbers. But is Trumpy-Cat, Inc. a phenomenon or a psyop? A force or a symptom? A catalyst or a sign of the times? A spark to ignite a revolution or a passing fad?

President Trump, when asked about his ongoing trade war with China, deemed himself “the chosen one” when talking with reporters outside the White House on Wednesday. As Trump put it, when it comes to dealing with China’s trade practices, “somebody had to do it.” He then added “I am the chosen one” as he looked up to the sky.

…like he’s [Trump’s] the King of Israel,’ Trump’s tweet continued.

‘They love him like he is the second coming of God…But American Jews don’t know him or like him. They don’t even know what they’re doing or saying anymore. It makes no sense! But that’s OK, if he keeps doing what he’s doing, he’s good for…all Jews, Blacks, Gays, everyone. And importantly, he’s good for everyone in America who wants a job,’ Trump continued…

Trolling? Obviously. But who is being trolled by means of Messiah Complex? That ever remains the question, no?

In the meantime, the Charlotte Observer reported on “special warfare training being staged across 21 NC counties:

A series of Special Forces military training exercises — including gunfire with blanks — is being staged across 21 North Carolina counties starting Aug. 30, and the Army is telling the public not to be alarmed at the suspicious-looking activity.

Known as Robin Sage training, the unconventional warfare exercises can be likened to live-action role playing in the extreme, with hostile engagement playing out between Special Forces students, volunteer civilians and soldiers out of Fort Bragg. It continues through Sept. 12, said a press release.

…The students will match wits with more seasoned soldiers, who will “act as realistic opposing forces and guerrilla freedom fighters,” officials said in a release.

Realistic opposing forces? And guerrilla freedom fighters? Really?

Why, they’re acting like a bunch of conspiracy theorists.

But, hey! Did you hear Trump wants to buy Greenland?

Is Trumpy-Cat, Inc. a psyop? Was the election of Donald Trump a ruseinitiated by the globalists in order for him to, ultimately, go down in flames with his orange hair on fire? Because what better way to bleed the nation’s brake-lines before the “big stop”? What better way to ambush, and decisively discourage, gun-owners and constitutionalists once and for all?

And so, perhaps, the most important question is this: What do we do now?

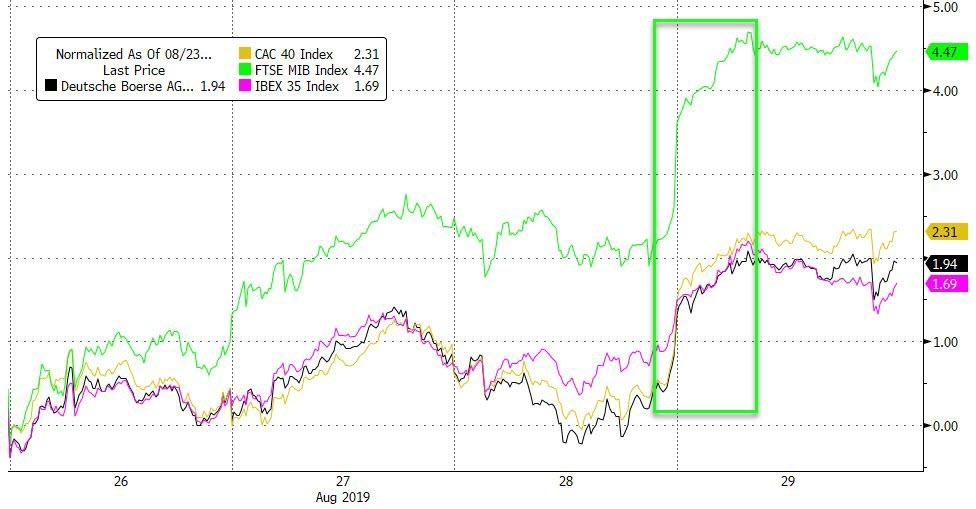

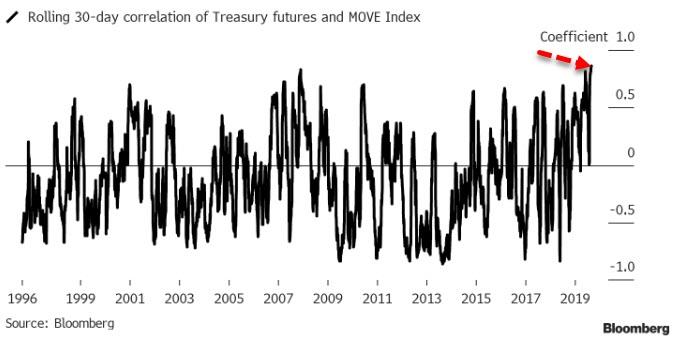

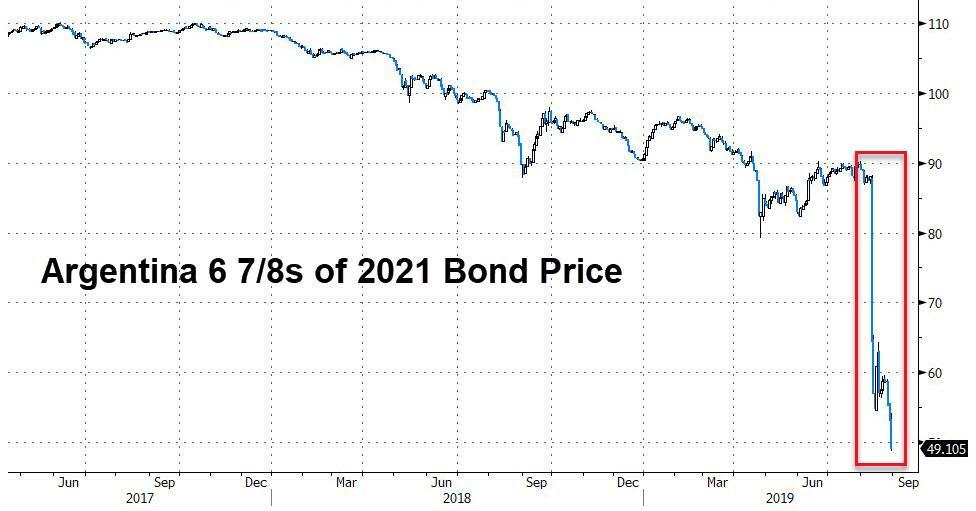

Because the entire world is about to be shaken in ways unprecedented. Economic and war cycles will soon coincide like clockwork and destroy the status quo – slowly at first and then suddenly; and at speeds of which we will barely comprehend.

In the meantime, a new system is set to arise from the ashes of the old. It is, in fact, already in place and, even now, the noose tightens more each day.

It is very possible, Trumpy-Cat, Inc., by either accident or design, will herald the digital solidification of the global technocracy. The Central Planners merely need to control the access points of any governing networks. And they already do. Politics, banking, healthcare, law enforcement, internet, and media. The all-seeing eye may decide what the snowflakes see, and it now, also, has your address.

If they can strangle the pedophile millionaire Jeffrey Epstein, while spoon-feeding, and piece-mealing, the narrative every step of the way, then no one is safe.

Epstein was the first inmate to have successfully committed suicide in over 20 years at the Metropolitan Correctional Center, New York (MCC) who, coincidentally, also happened to be one of the most important inmates in America at the time – and amid multiple strange happenings and inconsistencies.

Then, we discover the bones in the most-important inmate’s neck were broken in a manner that COULD have come from hanging.

Until, finally, the saga will eventually come to a close after Attorney General William Barr prosecutes the (so called) “negligence” of the prison staff for allowing such an important and prestigious inmate to end his own life via so many unfortunate and incompetent missteps, blunders, and gaffes.

Expect a very thorough investigation by the FBI and Department of Justice; followed by an exceedingly detailed report, of course.

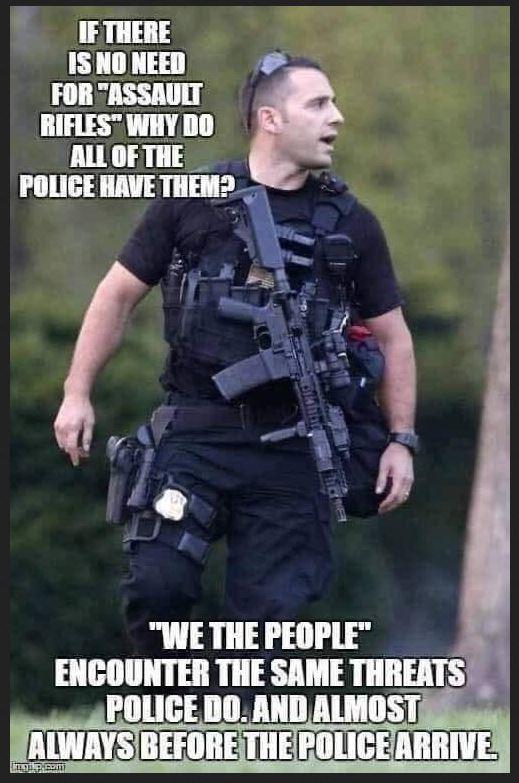

And now, just like clockwork, the political puppets, at the behest of the globalists, are going for the guns. Representative Peter King (R-NY) became the first Republican to sign the Assault Weapons Ban Act of 2019:

They are weapons of mass slaughter,” King told New York Daily News. “I don’t see any need for them in everyday society.”

“I think the assault weapons ban is timely now, especially in view of the shooting in El Paso and Dayton,” he said.

Obviously, King believes he is right and wants to win. But, so do other Americans. And there is one thing people hate more than their enemies, and that is a traitor. What is it about “shall not be infringed” the politicians don’t understand? Yet, the “gun debate” rages on. And what is there about “shall not be infringed” that is up for debate?

Obviously, it won’t end well. But that doesn’t mean we should not have our own endgame in mind.

What should we do now?

Survive and enjoy each moment.

Anything else?

Take ownership, prioritize, work specific problems and provide best-scenario solutions instead of excuses or complaints:

Make friends. Get to know those around you. Become involved in local and state politics. Get to know the local law enforcement or even strike up a conversation with the local cop on the street – then, use your best judgment in making assessments that might provide some benefit in your future.

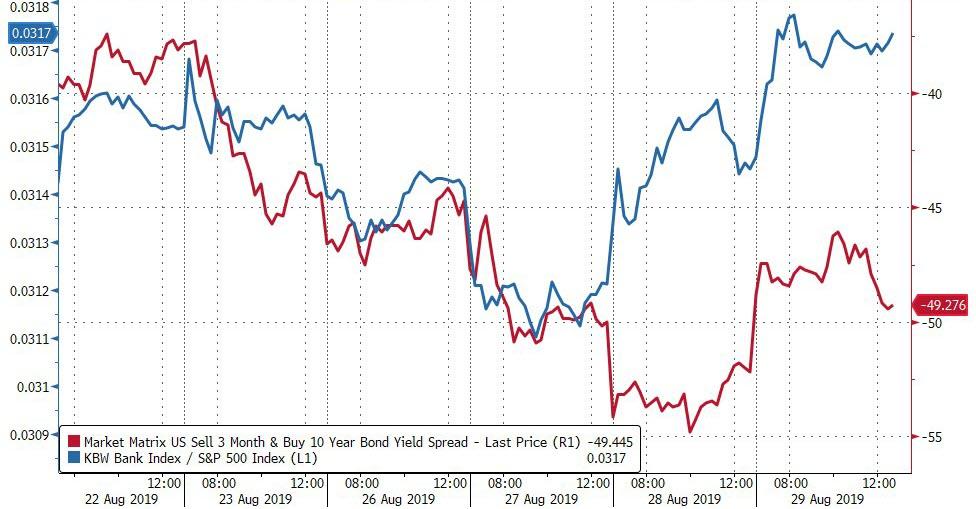

Since the global bankers have illegally hammered the price of precious metals; purchase some physical gold and silver coins while it’s still relatively inexpensive. If you can’t afford to buy gold, then buy some silver. A parabolic spike in the physical pricing of precious metals is forthcoming and you won’t be sorry. Moreover, it allows you to preserve some wealth outside of the “system” and, simultaneously, shove the fiat currency right back up the collective asses of the criminal cabal of elite bankers.

Additionally, have some extra food and supplies on hand. Consider how a good defense can be a great offense; and all this entails.

Learn a trade. If you only have a small amount of money, use it to buy canned goods and other survival type items. Buy local. Also, consider starting a business in order to trade locally.

If we know the endgame, perhaps we can parlay that into building trust with others now: Maybe entire regions could be fortified in a balkanized America, by reorganizing current civil administrations. All that would be required would be the heads of select institutions and agencies to work in coordination, quickly, and decisively as the proverbial excrement collides into the whirling flabellum. Roving bands, gangs, cartels, and feral feds, might then decide to move on to easier targets.

But any micro- constitutional republics must become self-sufficient very quickly; or at least before “every man for himself” requires a strongman to maintain order.

Things change. Shit happens. It is what it is. What matters most is what we do now and next.

via ZeroHedge News https://ift.tt/2HxZiXh Tyler Durden