One month after Morgan Stanley cut its allocation to stocks to the lowest on record, and less than two weeks after the bank’s chief equity strategist Michael Wilson laid out graphically why he thought stocks were about to crash just as the S&P was hitting new all time highs…

… Wilson was happy to take his victory lap and in a report this morning in which he declared that not only is “the bear alive and kicking”, with the S&P reversing perfectly off Morgan Stanley’s previous resistance level, and sliding more than half way to the current support of 2,700…

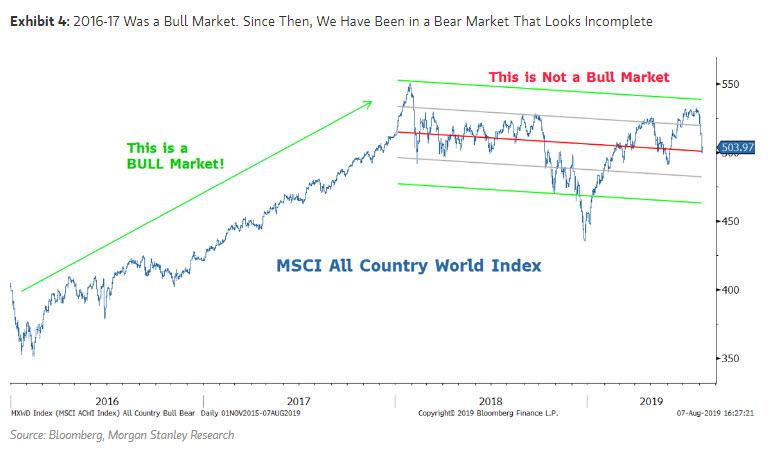

… but went on to say that the bear market actually started all the way back in late 2017 when the bull market for global equities ended, and has been drifting even lower since.

And while many market strategists have been fixated on the S&P 500 (the highest quality and most defensive equity market in the world) making new all-time highs this year, Wilson would point out that almost 80 percent of all major indices we track have not made new highs and are more than 10 percent below those highs. This, to the Morgan Stanley strategist, is a very different picture than what was observed in January 2018 when virtually every major equity index around the world was at an all-time high and overbought and why the bank made its call for a cyclical bear market to begin during 2018. Indeed, the chart above shows a striking difference between the 2016-17 period (a bull market) and then 2018-19, which to Wilson, “looks like an incomplete cyclical bear.” And no, the S&P 500 does not look much different, having gone nowhere since January 2018.

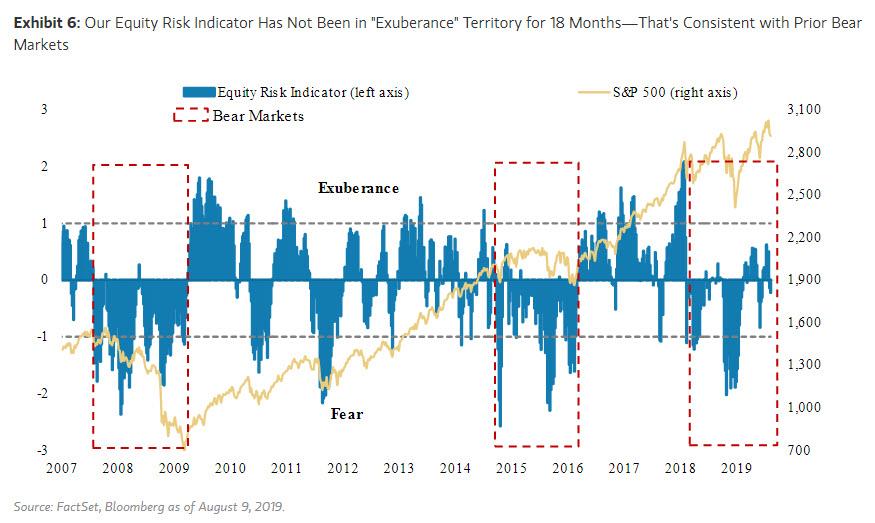

Other indicators seem to suggest that every burst of enthusiasm is nothing more than a squeeze in a sweeping bear. One is Morgan Stanley’s Equity Risk Indicator (ERI), a gauge of US equity market sentiment and positioning, which has not reached “exuberance” territory for 18 months.

As Wilson explains, “this trend is consistent with the persistently negative sentiment seen during the bear markets of 2008-2009 and 2015-2016 and helps to reinforce our view that we have been in a rolling bear market since early 2018.” A key difference between today’s environment and those periods is that the market has made multiple new highs since January 2018 while sentiment has been depressed. This reinforces the notion that, below the benchmark level, there has been little confidence, and returns have been difficult to generate. And as MS further notes, “the pessimistic sentiment/positioning environment we have been in is a reflection of the challenging asset allocation backdrop that has persisted since early 2018.”

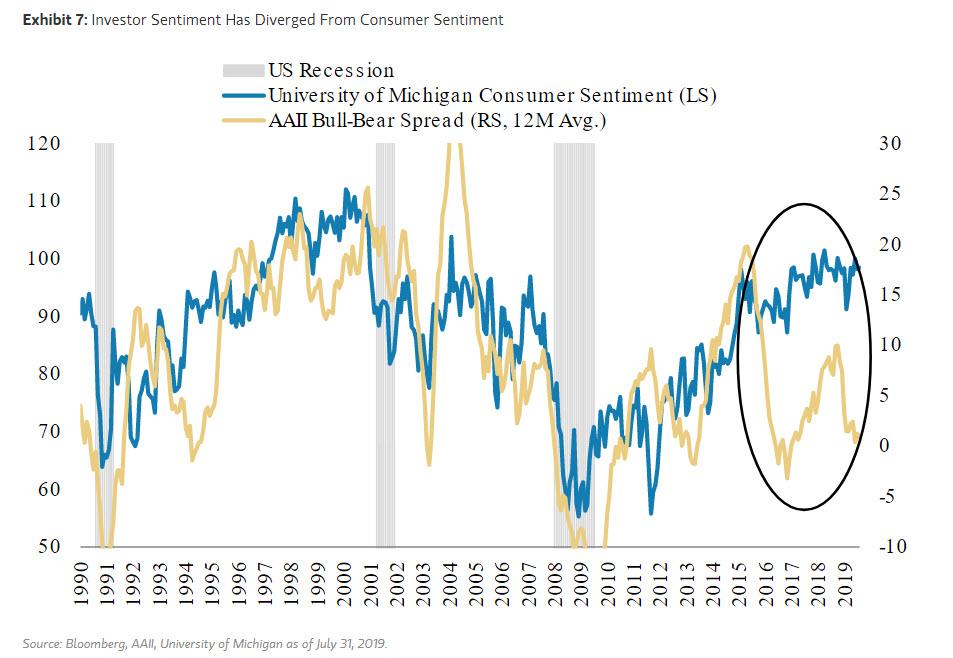

Wilson also finds it interesting that individual investor sentiment – as measured by the AAII Survey Bull vs. Bear Spread – has meaningfully diverged from consumer sentiment. Despite the fact that the market is still near all-time highs and consumer sentiment has remained elevated, individual investors have expressed a more pessimistic tone. This is in line with what MS has been pounding the table on in recent months, as the bank believes that “late 2017/early 2018 was the euphoric top for this cycle and do not expect… individual investor sentiment to return to euphoric levels for a sustained period of time before the end of this cycle.“

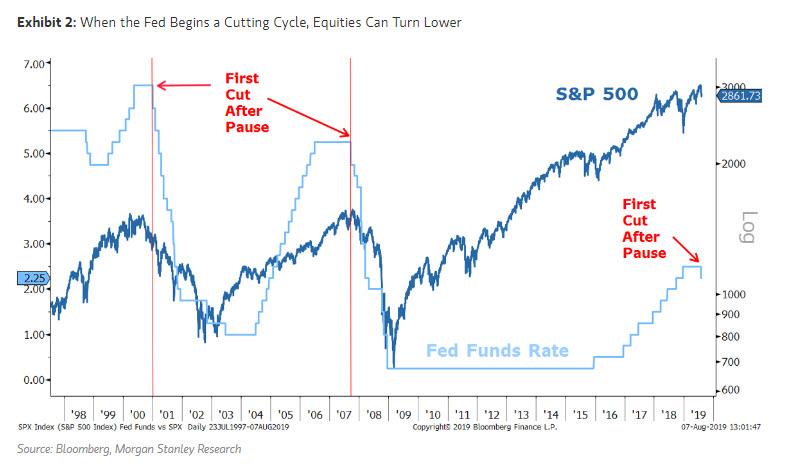

Curiously, it may have been none other than the Fed that vindicated the Morgan Stanley bearish call. As Wilson writes, explaining why he thought recently the S&P would fail to break out – as has been now confirmed – whereas many commentators have either blamed the Fed’s poor communication or the re-escalation of trade tensions, Morgan Stanley thinks it is more about the market simply focusing back on fundamentals and risks that were always there. And as noted on many prior occasions, a Fed pause is always bullish for stocks but once the Fed actually starts cutting rates, it typically spells trouble because cuts usually accompany the end of the cycle, not a mid cycle pause. All one has to do is look back at the last two cycles to see that once the Fed cut it did not bode well for equity markets.

That’s precisely what appears to be happening this time around…. but don’t blame the Fed: according to MS, Powell simply reversed his position over the past 9 months because the outlook for the economy, both here and abroad, deteriorated significantly, and as a result, Wilson believes that many investors are too complacent about the risks to the US economy from the ongoing corporate profits recession.

While trade tensions are weighing on corporate confidence and the various Purchasing Manager Indices (PMIs), we think the deterioration in corporate profits and margins is the bigger driver.

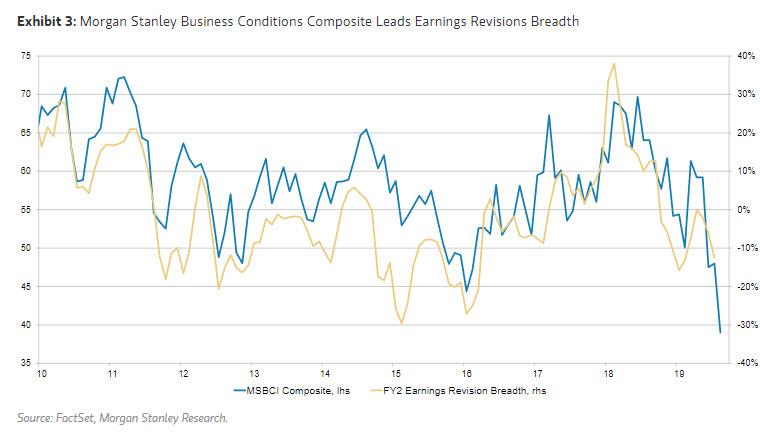

Indeed, after the Morgan Stanley Business Conditions Index plunged back in May, the outlook for corporate confidence and PMIs has failed to improve As the most recent Morgan Stanley Business Conditions Index (MSBCI) published last week revealed, after a snap back in June, it moved sharply lower again to the second-lowest reading since the last recession.

This is concerning because as we discussed two months ago, there is a very close relationship between the MSBCI and the PMIs. Worse, there is an even tighter relationship between the MSBCI Composite Index and FY2 earnings revisions – the two have a correlation around 80%. A quick look at the two series suggests downward earnings revisions have yet to bottom and may retest the lows of the 2015/16 global recession, and further deterioration in the MSBCI would suggest even more downside to earnings, which likely does not bode well for stocks in the near term.

Of course, with both sentiment and earnings now likely to suffer continued downward pressure, it only underscore the Morgan Stanley proposition that a bear market started as long as two years ago. Indeed, when looking at the US markets alone, the S&P 600 (small caps) and S&P 400 (mid caps) have both failed to make new highs this year and are both more than 10 percent below those levels from last September. The same is true for the even broader Value Line Index.

Meanwhile, only 5 out of the 11 S&P 500 sectors have made new highs this year, 3 of which are defensive (Utilities, Staples, and REITs). The other 2 are Technology and Consumer Discretionary, and while growth potential for many companies in the Technology sector is clear, the potential for most stocks in Consumer Discretionary is less clear. The sector’s performance has also been skewed by Amazon, which is more a technological disrupter than a good read on the consumer.

* * *

But perhaps the most convincing evidence for those who question if we are still in the midst of a cyclical bear market – according to Wilson – is the fact that long-term Treasury bonds have defeated the best equity market in the world over the past 18 months, especially since September. The technical pattern in the chart below looks incomplete, suggesting further downside to come for the S&P 500 versus long-term Treasuries. However, on a longer-term basis, this relationship holding the uptrend supports a somewhat more optimistic view that a long-tailed secular bull is still intact, even if we are still working through a cyclical bear market in that larger context. The question then is whether bonds will outperforming equities to such an extent that the red support line is breached, in which case the support for a secular bull market will slowly fade away as the Albert Edwards “Ice Age” takes its place.

In any event, as the MS strategist notes, “we suspected this bear market would be an unsatisfying one – to the bears – as it often feels like a bull market even if the sector leadership and breadth doesn’t support the claim we are in a bull market.”

So in conclusion to its latest bearish screed, Morgan Stanley repeats that its point is that “the rolling bear is still alive and kicking, leaving the average index and stock still well below its highs from last year.” As a result, it makes sense for investors to have crowded into defensive and growth areas in the presence of rapidly decelerating economic growth. And while Wilson and his colleagues have leaned defensively in their sector recommendations, they remain skeptical that “this rolling bear market is finished and think it will complete much like the first wave did last year – meaning many growth areas may be vulnerable.”

via ZeroHedge News https://ift.tt/2YLOsaX Tyler Durden