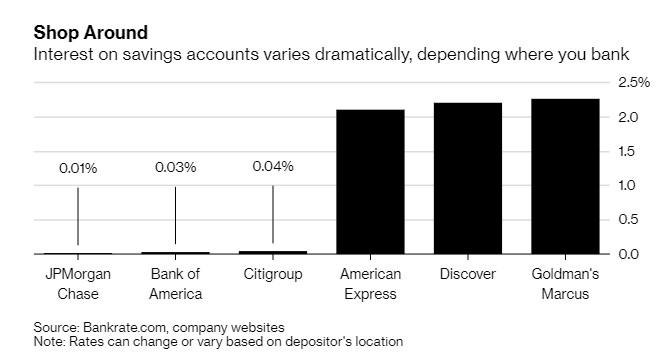

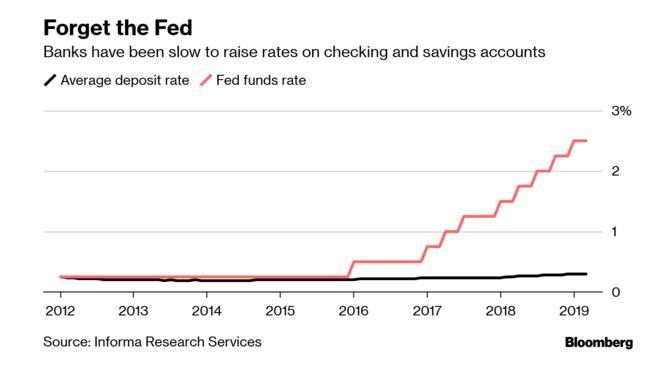

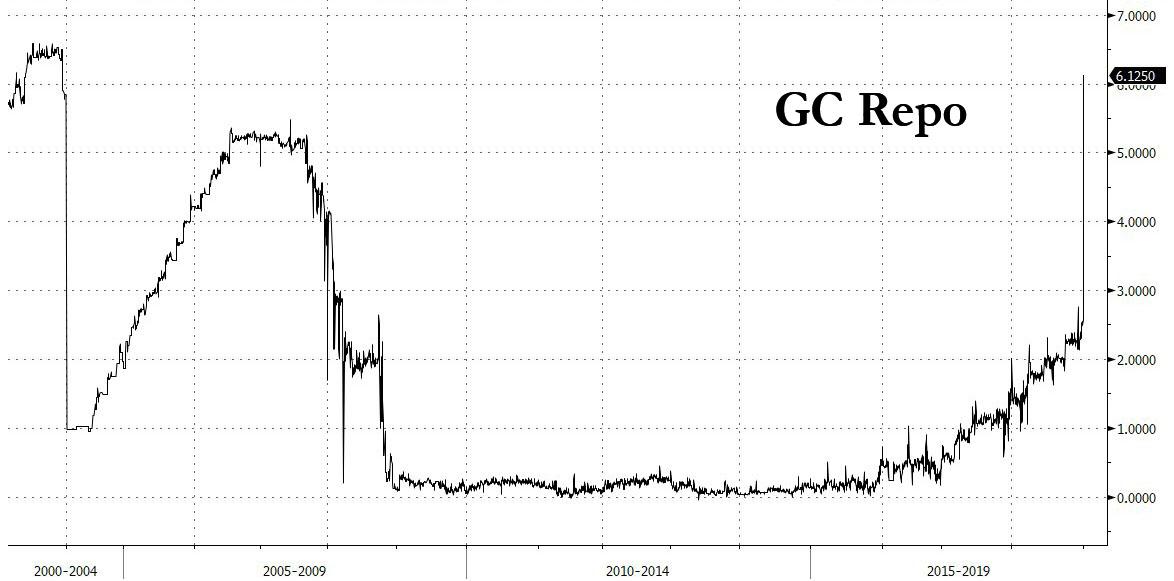

Even though the Federal Reserve has been raising its benchmark interest rate somewhat consistently – it at small increments – most accounts are still not earning meaningful interest. In fact, as the chart below from Bloomberg shows, accounts at traditional money centers banks are earning next to nothing: Citigroup is paying 0.04% and JP Morgan is paying just 0.01% interest, despite rates rising.

This is mostly a result of clients not caring about getting paid more – they continue to deposit new money, so banks haven’t felt pressure to raise rates. It goes to show how attitude on yield for your money in this country has shifted significantly from a focus on interest-bearing accounts to deploying capital in investments like stocks and bonds. It’s almost as if, due to insane low rate Fed policy, the country has forgotten that depositors are supposed to be “rewarded” for saving and putting their capital in a bank’s hands.

But we digress. Because while the big banks, drowning in trillions of excess reserves don’t care about the incremental liquidity provided by deposits, that doesn’t mean that there aren’t a rising number of banks out there, hungry for new cash, that are eager to lure depositors with higher rates. Online “banks” at American Express and Goldman’s new Marcus consumer unit, are offering savings account rates of 2% or more.

Historically, this isn’t a lot, but when compared to the Fed’s benchmark rate, which is now at 2.5%, and the 2.4% you would get on a US 10 year treasury, it isn’t bad, especially in a “low inflation” economy. As a result, some investors are taking notice and deposit growth at many of these online banks is accelerating.

The flows into these new banks aren’t of such a significant magnitude that they are having a tangible effect on the nation’s largest banks, but some regional banks are feeling pressure as a result. For example, Citizen’s Financial Group and US Bancorp have both said in recent weeks that they’re finding it harder to attract deposits due to the rates that competitors are offering (maybe Citizen’s and USB should consider raising their own deposit rates).

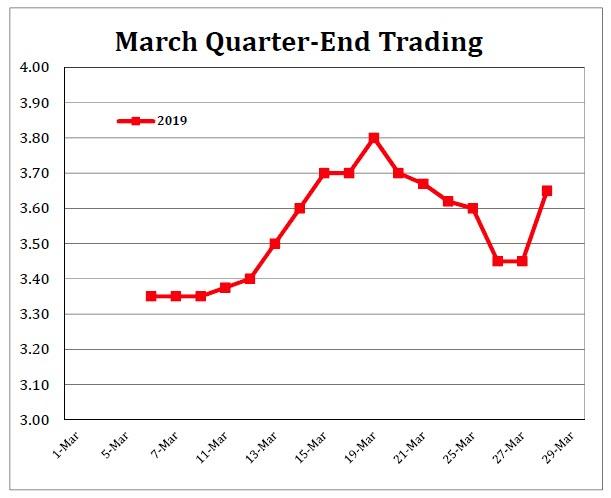

Allen Tischler, an analyst at Moody’s said that “First-quarter results probably will show a continued rise in deposit costs. Even if the Fed’s on pause and rates aren’t necessarily rising, not all depositors have taken advantage of rates that are higher today than they were a year ago. So there probably will be continued catch-up, particularly on the consumer side.”

Across all depositor institutions, the average rate on a checking account is just 0.29%, up from just 0.24% or year ago. Ray Montague, Informa’s director of deposit-product research told Bloomberg: “It went from really, really bad rates to just really bad rates.”

But ultimately, rates haven’t been high enough for consumers to want to move their cash. Somebody with $1000 in savings would see a difference of about $22 between a bank offering 0.05% and 2.25% for the year. Then the question becomes whether or not it is worth it to move the money.

RBC Capital analyst Gerard Cassidy said: “Is it worth it for $20 to move your money? The answer is no. If you have $100,000, it’s worth it. I think what you’re finding with Marcus and these other products is the average deposit is quite large because it is that money that is moving to higher rates.”

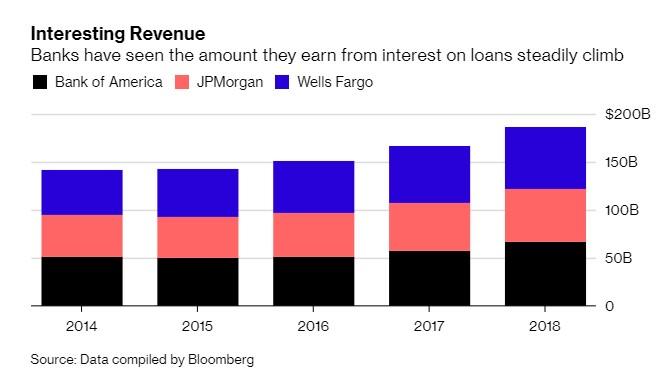

Meanwhile, banks continue to be the beneficiary of the Fed’s rate hikes, which allows them to capture the spread between what they charge on loans and what they give out on deposits, also known as the net interest margin. Deposits at banks like JPMorgan continue to rise, despite the low rates. That said, after the latest curve inversion, it is generally expected that bank interest income is about to take a major hit.

Thasunda Duckett, who leads consumer banking at JPMorgan, said: “The incremental deposits we acquired in this time alone would be enough to create the seventh largest U.S. bank. We’ve been successful because we’ve won at both acquiring new relationships and satisfying existing ones.”

Ironically, this perhaps best indicates that despite Americans’ ongoing complaints about low interest rates, when rates do go up, few savers actually take advantage. And now, that more are finally starting to take advantage of better deposit conditions the Fed is preparing to start cutting rates again.

via ZeroHedge News https://ift.tt/2U2js41 Tyler Durden