Morgan Stanley: Here Comes The “Rate Scare”

Tyler Durden

Mon, 10/05/2020 – 12:07

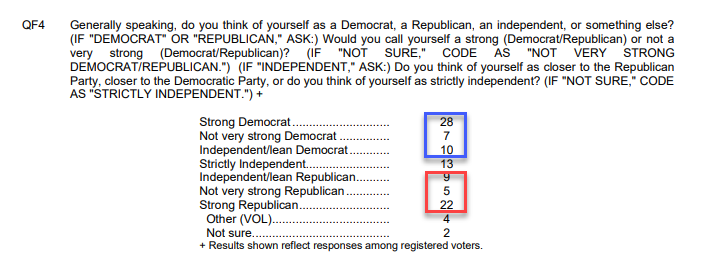

One day after Morgan Stanley’s chief global strategist Andrew Sheets surprised traders by calling the 2020 market cycle “normal“, on Monday morning his colleague Michael Wilson, head of global equity strategy at Morgan Stanley reminds bank clients that late in August he called for “a Growth Scare to be followed by a Rates Scare” a narrative supported by his view that Congress appeared be entering a period of gridlock with respect to the next round of stimulus and the inevitable second wave of COVID-19.

So fast forward to today when the first leg of that narrative seems to have played out as Wilson expected, with the S&P 500 falling close to 11% from it’s high on September 2nd, led by the Nasdaq’s 14% “plunge.”

Addressing the “growth scare” first, Wilson notes that in addition to the congressional gridlock and fear of a second wave/lock downs, “the nation has also experienced a heightened level of social unrest and rising uncertainty about the election process and timing of a definitive outcome. Collectively, these headwinds present a risk to both the pace and sustainability of the recovery.”

Sure enough, as October begins, the Morgan Stanley strategist says that said growth scare continues to dominate his discussions with clients: “Will Congress pass the CARES2 fiscal stimulus bill before the election or not?” a debate we focused on in our morning market wrap, when we said that Trump’s health scare appears to have given a second life to expectations of a 5th fiscal deal getting done before the election. Morgan Stanley has more:

That question gained further attention after both POTUS and FLOTUS tested positive for COVID-19. In general, just as the consensus had moved toward a no deal before the election outcome, there was a distinct reversal on Friday with an increased likelihood of a fiscal deal getting done sooner rather than later. Obviously, the ramifications of such a deal are important for equity markets.

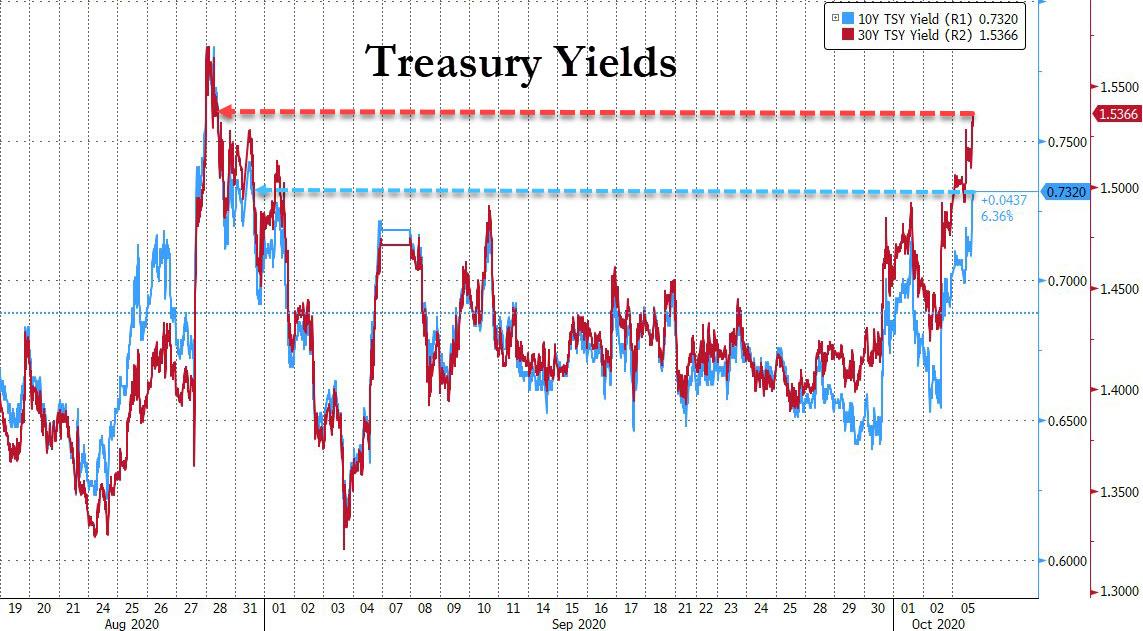

One immediate ramification is today’s move higher in not only stocks, led by reflation-sensitive sectors, but especially among long-end yields due to said repricing in stimulus expectations, which as discussed earlier pushed the 10Y yield rise to a level not seen since late August, while the 30Y is trading just shy of its 200DMA, both key levels which suggest further yield upside is in store.

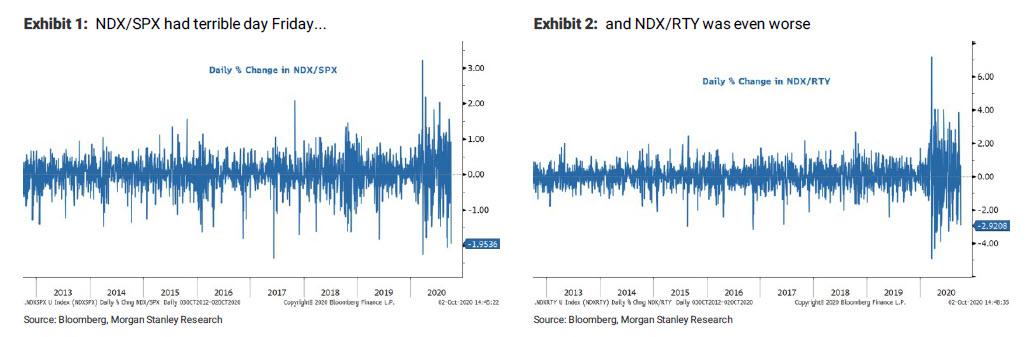

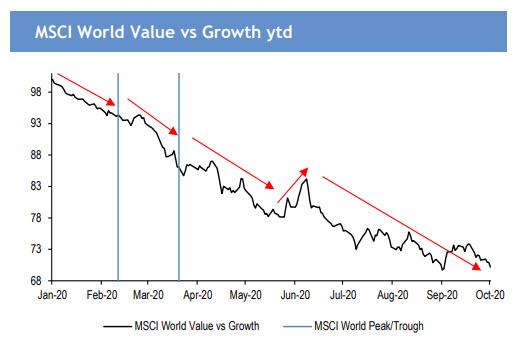

Commenting on this sharp move, Wilson confirms that the market most mispriced “is the back end of US Treasury curve with expensive growth stocks not far behind.” Indeed, Friday saw these yields rise even as broader equity markets traded lower, suggesting that a tech sector hit would likely drag the broader market lower even if value stocks rose (something JPM now expected to happen). By association, Wilson believes that this makes the second most mispriced market for further stimulus the long duration growth stocks – read the FAAMGs – that are also over owned. Therefore, as he shows in the charts below, “it should be no surprise that Nasdaq had one of it’s worst relative performance days of the year on Friday.”

When looking at these charts more closely, it’s also apparent that these ratios have exhibited extraordinary volatility since the Recession began in March. In short, as the MS strategist further notes, “the correlation between the Nasdaq and the broader market appears to be breaking down and we think that is the equity market’s way of discounting the increased influence long term rates.“

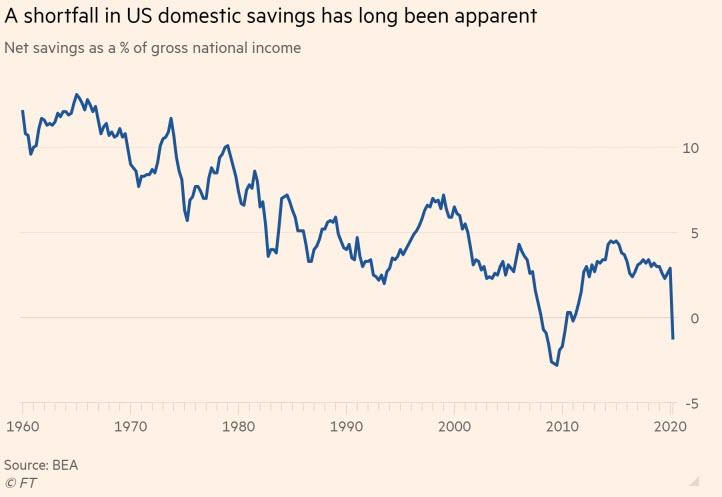

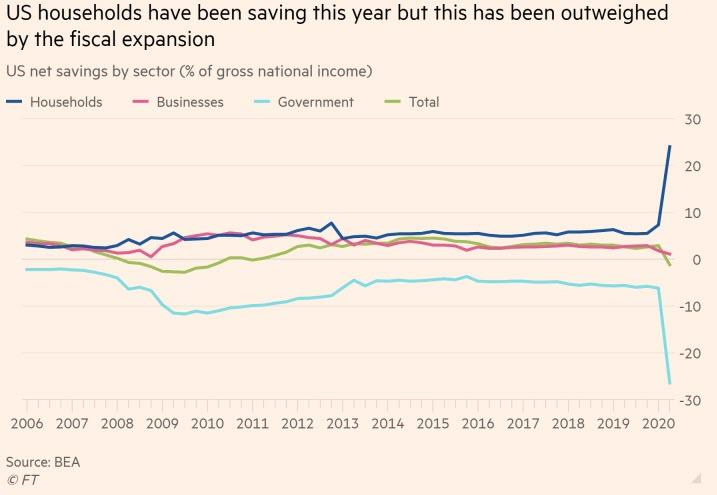

With the growth scare now somewhat priced in, and as a fiscal deal now looks more likely either before or after the election, Wilson warns that “the risk for rates to move higher in a non-linear manner is greater.” And, by extension, that also increases the risk of a move lower in those assets most tied to long term interest rates, a risk which Morgan Stanley believes is underappreciated.

So with that backdrop on the growth scare, Wilson warns that the second part the correction narrative may now be ready to play out – the rate scare. As he explains, “in addition to the obvious catalyst of a fiscal deal getting passed sooner than what is now expected, we also have the election uncertainty holding back the move we expect.”

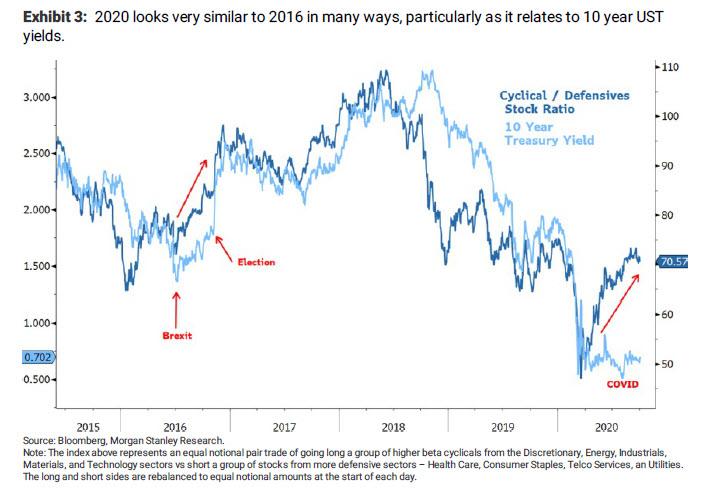

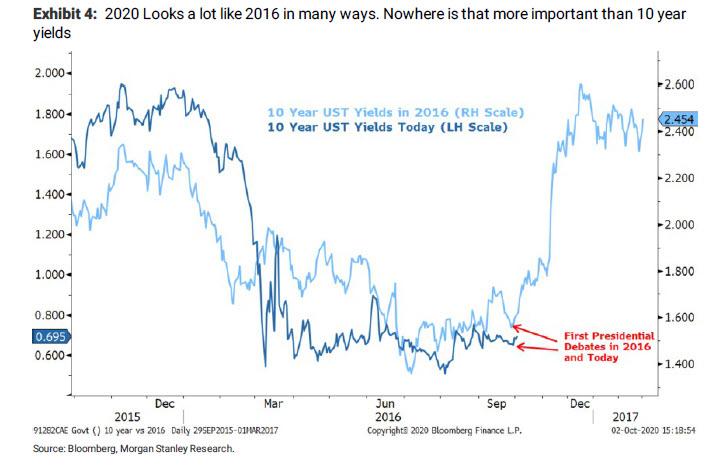

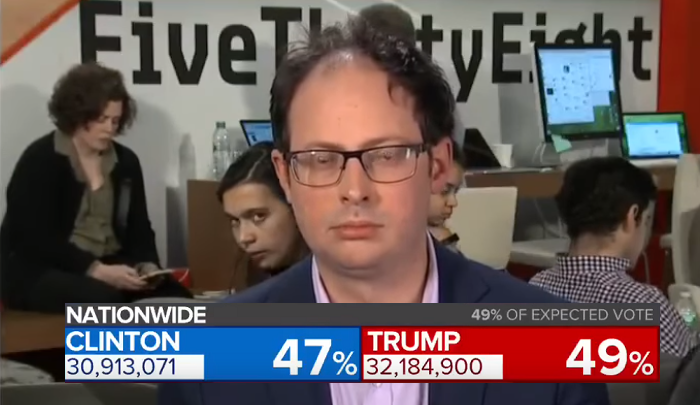

For market timers, this means that “2020 now looks very similar to 2016 in many ways…global recession with policy stimulus driving a solid recovery and cyclicals outperforming defensives. However, rates diverged just like they are today held back by Brexit and the election. This time it’s COVID and the election.”

As shown in the next chart, back in 2016 the rates market divergence from the cyclical/defensive stock ratio began to close after the first Presidential debate.

Incidentally, as we have shown on various occasions in the recent past, a sharp move higher in yields is also supported by the recent surge in China’s credit impulse, which has a roughly12 month lead effect on US real yields as shown in the chart below.

In any case, going back to the debate as a potential trigger event, Wilson next asks “could last week’s debate have the same effect this time around” Wilson asks, a question which can be rephrased effectively as “Will Biden be the reflation candidate this time around, the same way Trump was after he won in 2016.” Wilson’s answer: “we think it might as this debate signals we are getting closer to the end of this period of ambiguity. Just like in 2016, it’s not as important who wins but rather closure to the process that will allow Congress and the country to move forward.”

At that point, Wilson notes, the rates market will quickly discount what the stock market and other asset markets have been saying all year – “the recovery in on good footing and is likely to continue in 2021”, which again is another way of saying that $90 trillion in central bank liquidity sloshing around means there is only one way for stocks and yields to go.

As the MS strategist concludes, “the next round of fiscal is coming one way or another and it’s just a matter of size and timing” an observation which also aligns with the bank’s recommendation to focus on the recovery stocks even during this growth scare as that is where the upside is greatest: “A move higher in rates should only further support that view as most recovery stocks are positively correlated to such a move, led by financials.”

One final point: what Wilson fails to discuss is how the handoff from a tech-led to a value-led rally will take place. And there is good reason for that to avoid that in the context of a bullish wrapper: on 80% of previous occasions, when the Nasdaq slumped it dragged the broader market lower, and since never before has so much investment been concentrated in a handful of tech stocks which also happen to have an extremely pronounced impact on the S&P and most global stock indexes, it is virtually assured that a rout in tech will lead to a steep drop across all risk assets. As such, while Morgan Stanley’s optimism may prove prescient again, the real question that emerges is when and how will the tech rout end, allowing value stocks to finally ascend after years of underperformance.

via ZeroHedge News https://ift.tt/2F8ybUY Tyler Durden