Google Faces Backlash Over Claims It ‘Deleted’ Palestine From Maps

Tyler Durden

Mon, 07/20/2020 – 17:10

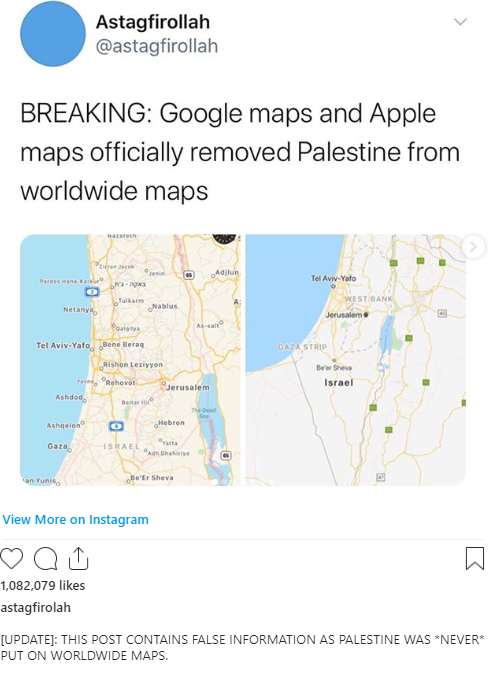

Over the weekend social media posts claiming that US tech giants Google and Apple “removed” Palestine from their map applications went viral.

The posts were somewhat misleading, notably one which garnered over a million “likes” on Instagram, given it appears Palestine had never been labeled on the searchable maps in the first place.

Yet it still unleashed a storm of controversy, leading to Palestinian leaders calling for a boycott of Google among their population, and the Palestinian Authority (PA) declaring it would look for an “alternative”.

Put #PALESTINE back on the MAP. 🗺 #Google pic.twitter.com/1B1CUWCEcD

— Maher Zainians (@MaherZains) July 16, 2020

As people in the West Bank and Gaza brace for an expected Israeli annexation of the Jordan Valley and up to 30% of West Bank territories, the PA vowed in the wake of the Google controversy: “this is a revolutionary year, and we will fight for the needed change to bring Palestine on the maps,” according to a statement.

Iran also weighed in, with a top diplomatic official in Egypt saying, “Palestine and its history is dug into the hearts of the Palestinian people and the free people of the world. Although Google removed the name of Palestine from the map search, you will not forget the awakened human consciences of Palestine,” as quoted by the Iranian Student News Agency (ISNA).

In prior statements Google appears to have denied the substance of what are actually long running accusations:

“Our approach to photographing the areas on the maps has not changed, as Google gets information from organizations and mapping sources when determining how to place the disputed borders, and we are still neutral with regard to geopolitical differences and making every effort to objectively display these areas,” it said.

The Independent noted above the above viral social media post:

Apple and Google have been accused of deleting Palestine from their online maps, despite it never being labelled in the first place.

Searching for Palestine on Apple Maps and Google Maps shows an outline for the Gaza Strip and West Bank territories, but no labels for Palestine.

The claims that it was removed appear to stem from a viral Instagram post by a user called “Astagfirvlah” on Wednesday, which accused the technology giants of “officially removing” Palestine from their maps.

Still, it will be interesting to see how fast Google moves if and when Israel moves to annex swathes of West Bank territory, as PM Netanyahu has recently promised.

Should this actually become the reality on the ground, we wonder: how fast will the deeply contested “change” be reflected in Google maps?

via ZeroHedge News https://ift.tt/39dR3MN Tyler Durden