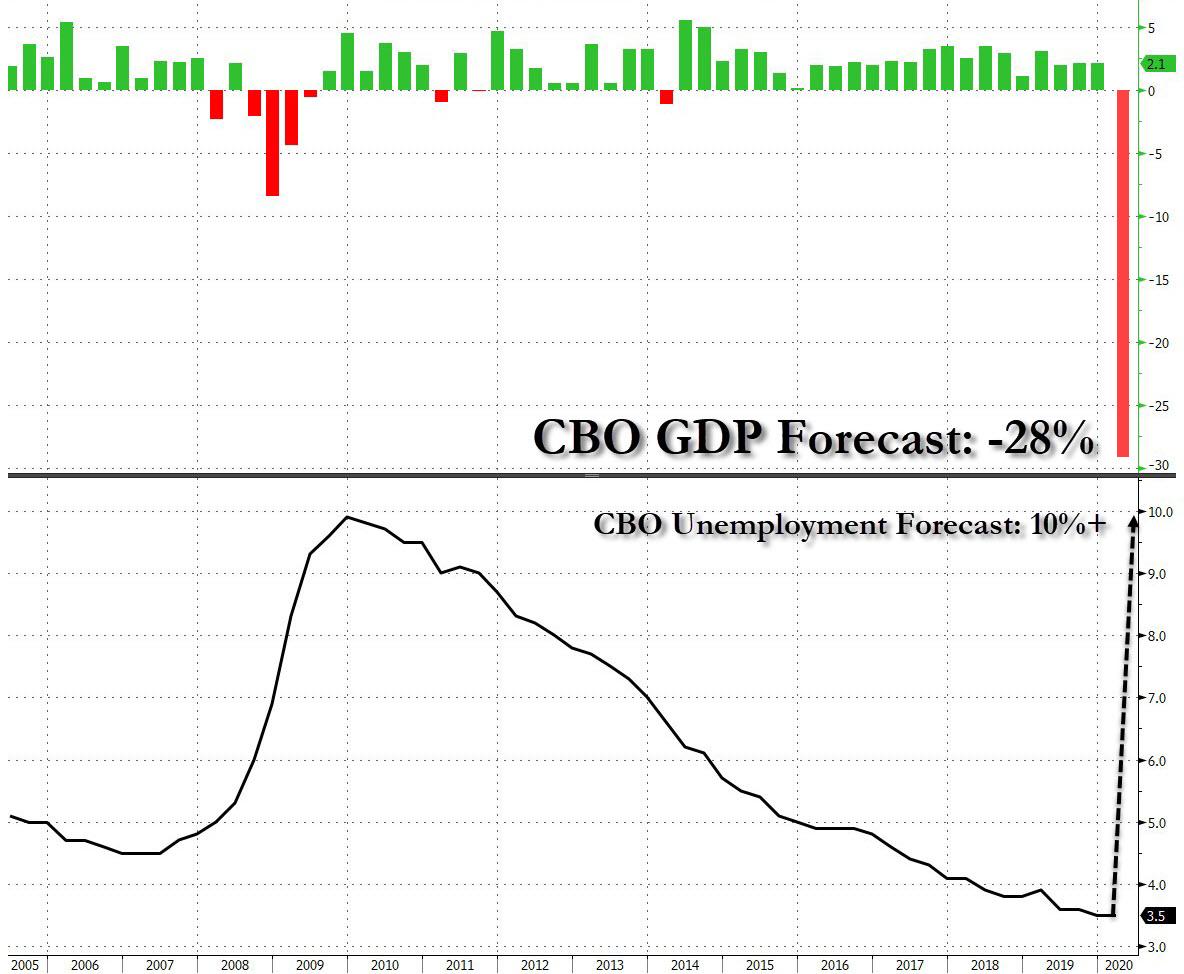

CBO Reveals Apocalyptic Forecast: Expects -28% GDP, 10% Unemployment Rate

One of the many side effects of the coronavirus pandemic is that it has thrown out all recent economic forecasts right out of the window, certainly those of the perpetually cheerful CBO. In a publication released on Thursday afternoon, the CBO said that it now expects the economy to contract sharply during the second quarter of 2020 as a result of the continued disruption of commerce stemming from the spread of the novel coronavirus. What it expects now is, at least in the short-run, nothing short of a depression, with Q2 GDP expected to plunge to -28% as unemployment soars to 10%

The following are CBO’s latest preliminary estimates, based on information about the economy that was available through this morning and which include the effects of an economic boost from recently enacted legislation.

-

Gross domestic product is expected to decline by more than 7 percent during the second quarter. If that happened, the decline in the annualized growth rate reported by the Bureau of Economic Analysis would be about four times larger and would exceed 28 percent. Those declines could be much larger, however.

-

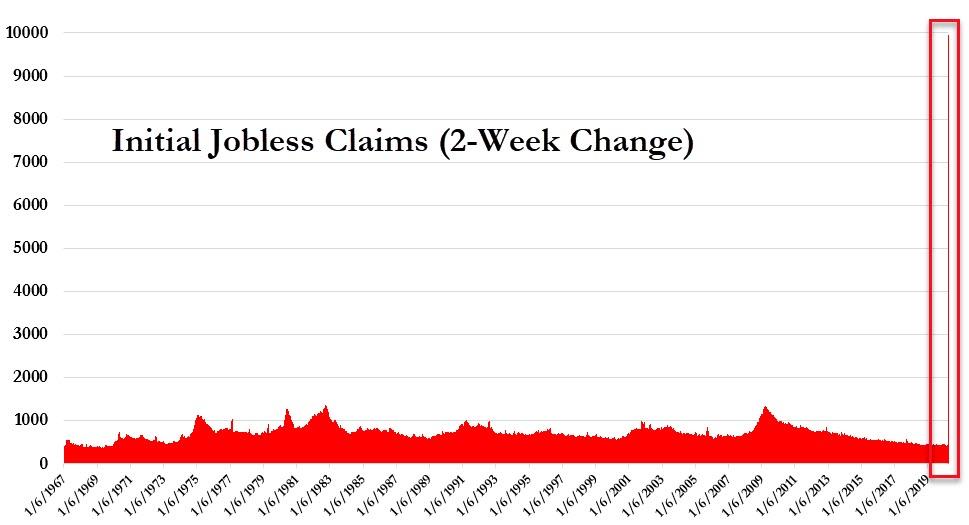

The unemployment rate is expected to exceed 10 percent during the second quarter, in part reflecting the 3.3 million new unemployment insurance claims reported on March 26 and the 6.6 million new claims reported this morning. (The number of new claims was about 10 times larger this morning than it had been in any single week during the recession from 2007 to 2009.)

-

Interest rates on 10-year Treasury notes are expected to be below 1% during the second quarter as a result of the Federal Reserve’s actions and market conditions. This is hardly a surprise, and the real question is when will rates turn negative.

And visually:

That’s about as far as the CBO will go. As it admits, its “economic projections, especially for later periods, are highly uncertain at this time.”

Below are some details on what specific updates are incorporated in Today’s Cost Estimate:

To estimate the costs of legislation that is especially sensitive to economic conditions, such as provisions affecting unemployment insurance benefits, CBO is taking into account as much economic information as possible. Later today, CBO will publish a preliminary estimate of the costs of H.R. 6201, the Families First Coronavirus Response Act, which was enacted as Public Law 116-127 on March 18. The estimate incorporates an updated projection of the unemployment rate that was based on information that was available about the economy through March 27. It was not based on all information available as of this morning because of the time needed to process new information about economic developments and incorporate it into cost estimates. (Also, following the conventions of cost estimating, the economic projections used for the estimate do not include the effects of the act itself or the larger effects of P.L. 116-136, the subsequently enacted CARES Act.)

The unemployment rate underlying the cost estimate for H.R. 6201 was 12 percent in the second quarter of 2020. The extent of social distancing was a key factor in that projection. The analysis incorporated an expectation that the current extent of social distancing across the country would continue—on average, and with local variation—for the next three months. That expectation was broadly consistent with the projections of the virus’s spread that have been reported by the Administration’s coronavirus task force.

CBO’s projections also included the possibility of later outbreaks of the virus. To account for that possibility, social distancing was projected to diminish by only three-quarters, on average, during the second half of the year. And CBO expected the effects of job losses and business closures to be felt for some time; the unemployment rate underlying the cost estimate was 9 percent at the end of 2021.

Future Updates

CBO is currently working to develop central projections of economic variables that take information into account that has become available since March 27—information that has been more negative than anticipated. The agency is also preparing central estimates of the economic effects of recent legislation enacted to help boost the economy. All of that information will be provided with CBO’s next baseline projections of the economy and the budget; those projections will be published later this year.

Tyler Durden

Thu, 04/02/2020 – 16:15

via ZeroHedge News https://ift.tt/2R9mU9I Tyler Durden