“Deeper Than Corona” – The Real Causes Of The Oncoming Economic Collapse

Authored by Matthew Ehret via The Strategic Culture Foundation,

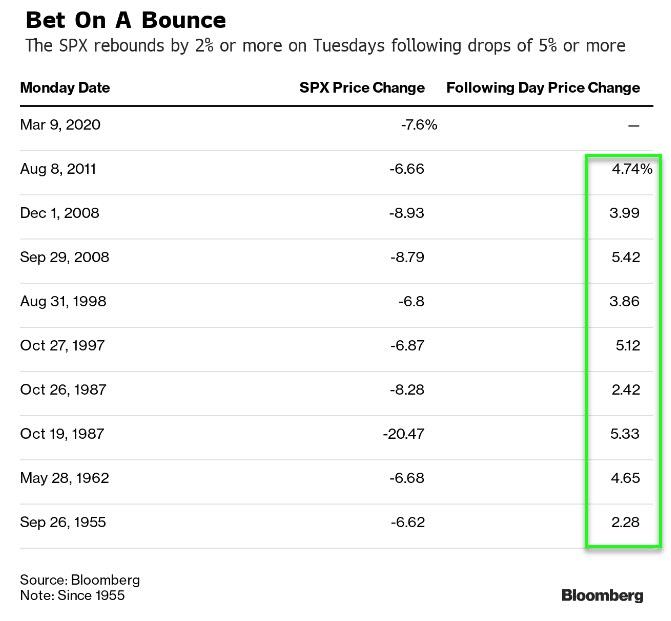

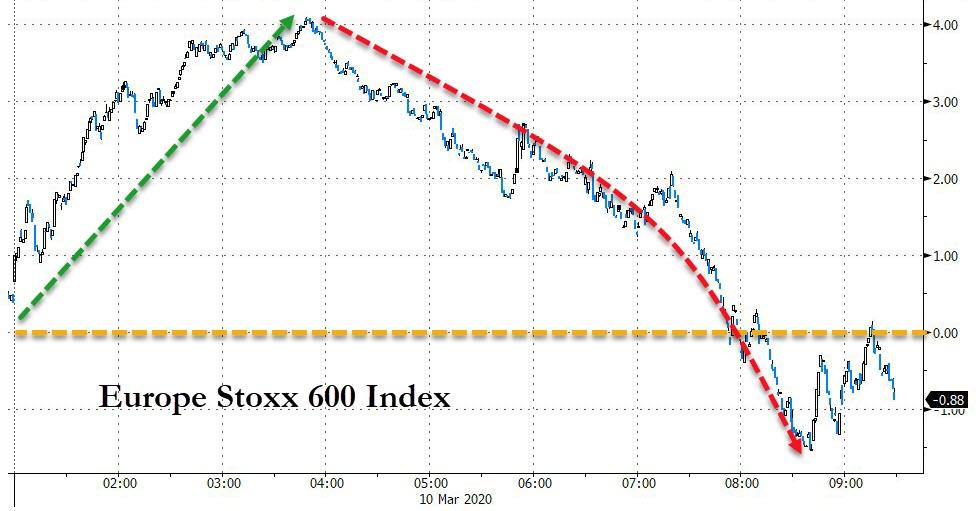

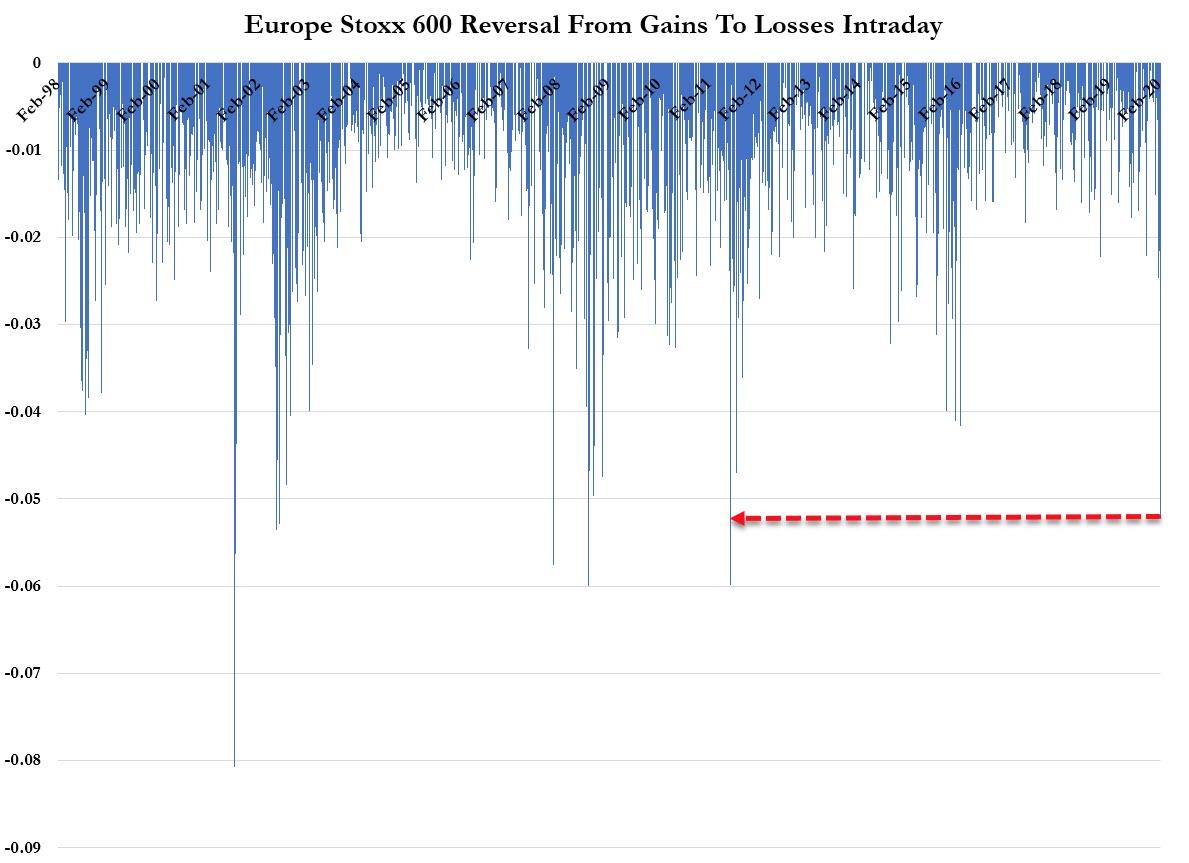

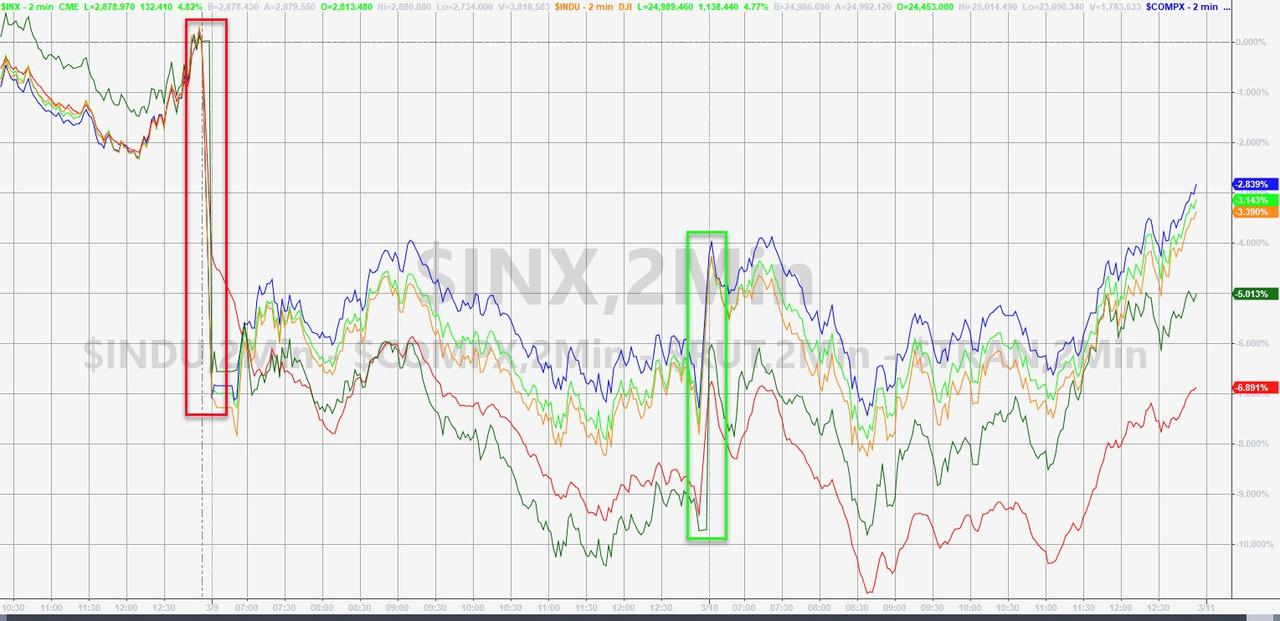

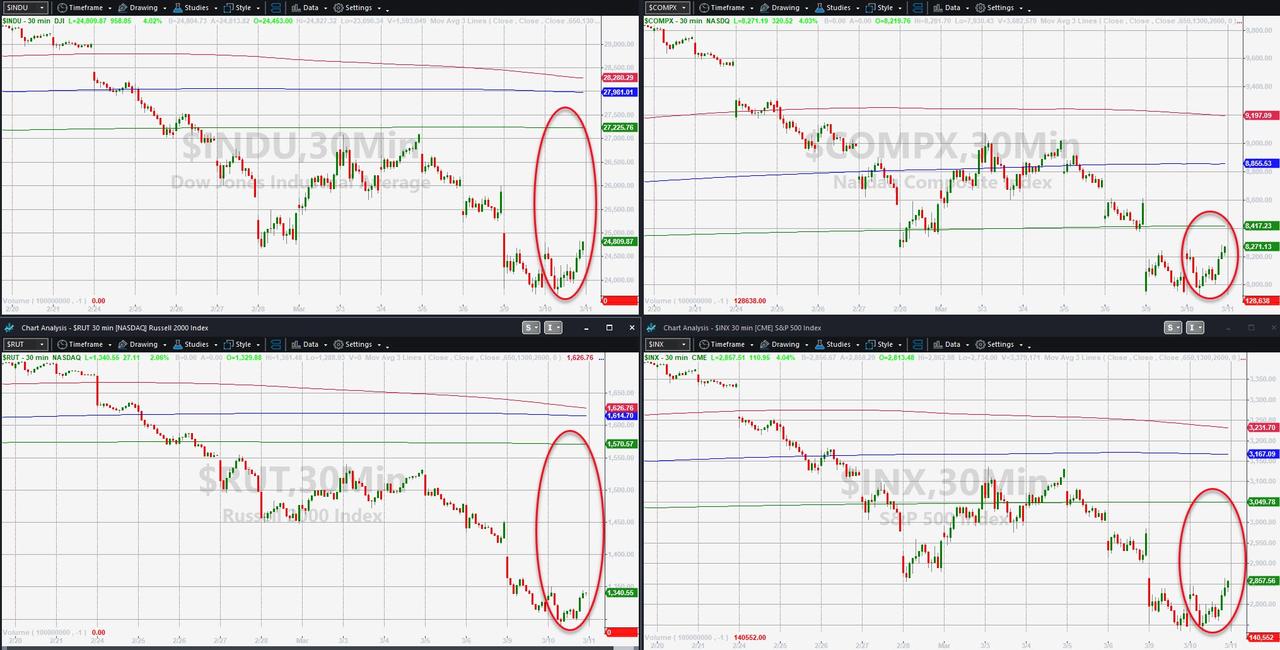

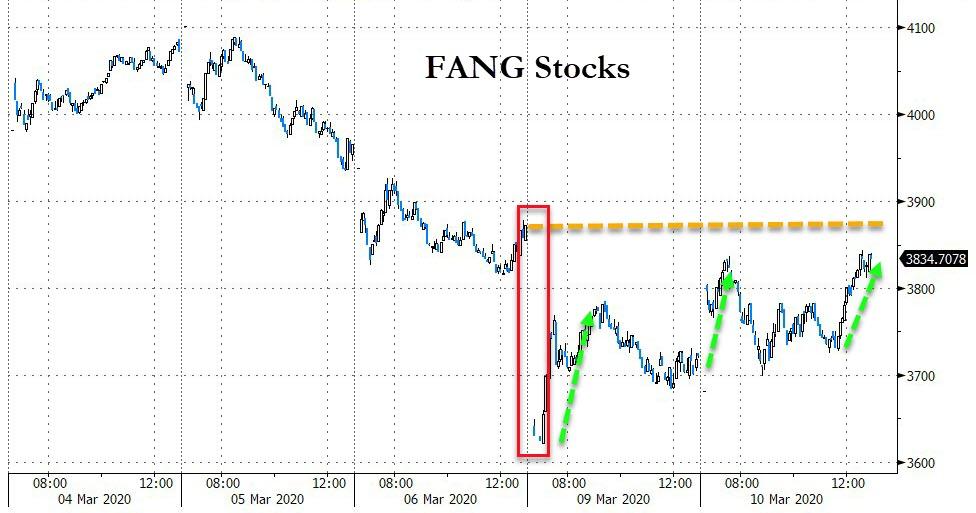

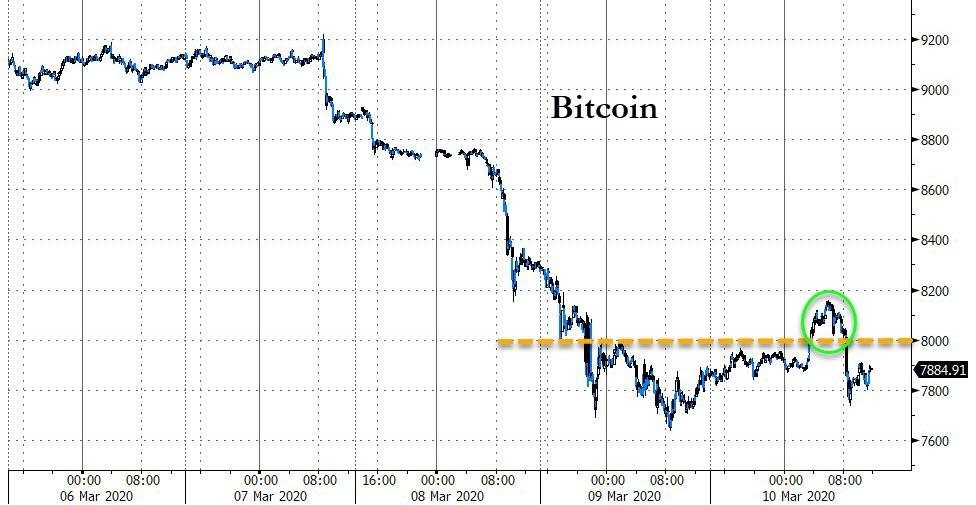

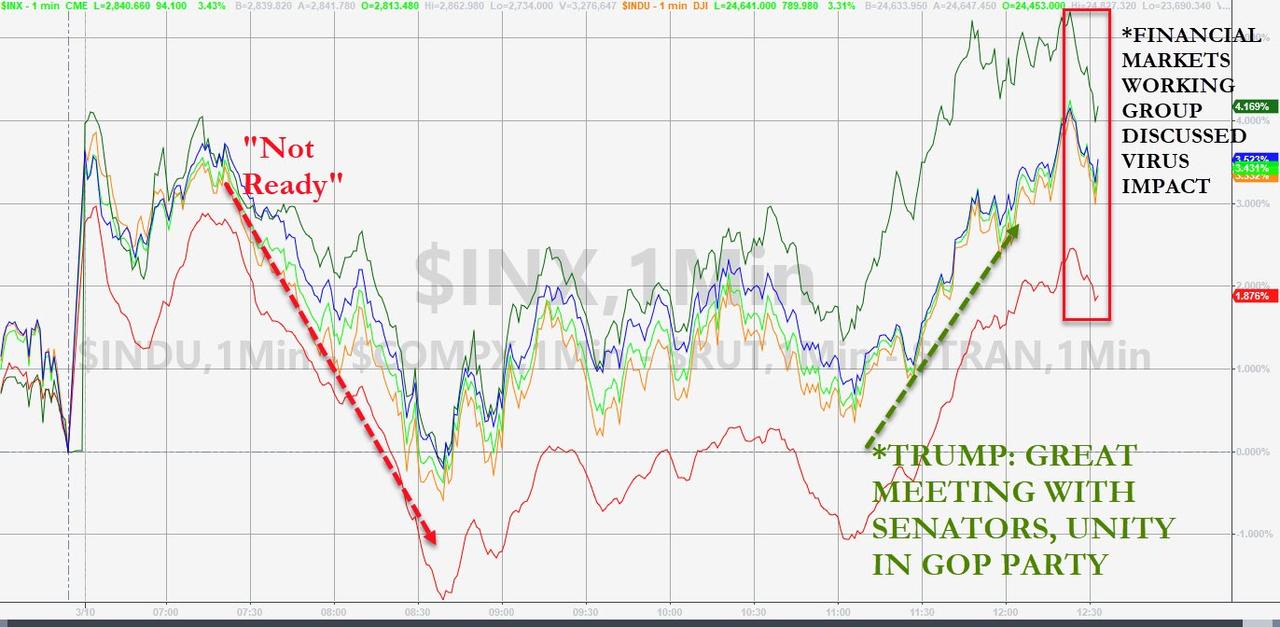

The last week has seen The Dow make several 1000-point-plus swings which were more than a little startling for many investors, veering dangerously close to a precipice which has 1929 written all over it. Across the internet, panicky discussion has erupted over whether this foretells another 1987 collapse as Donald Trump warned, or something more akin to Black Tuesday of 1929. Others have pondered whether this is more similar to a 1923 Weimar hyperinflation where Germans became millionaires overnight (not much to celebrate when bread costs billions).

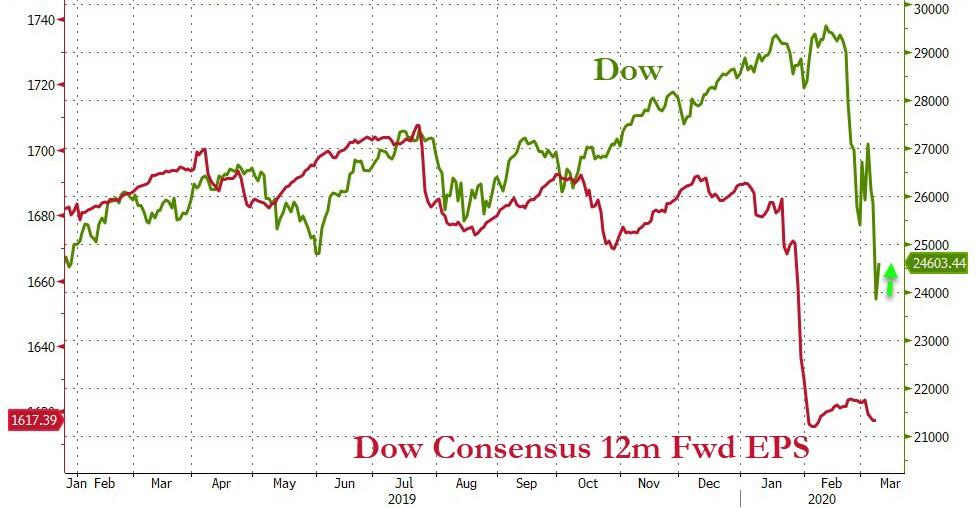

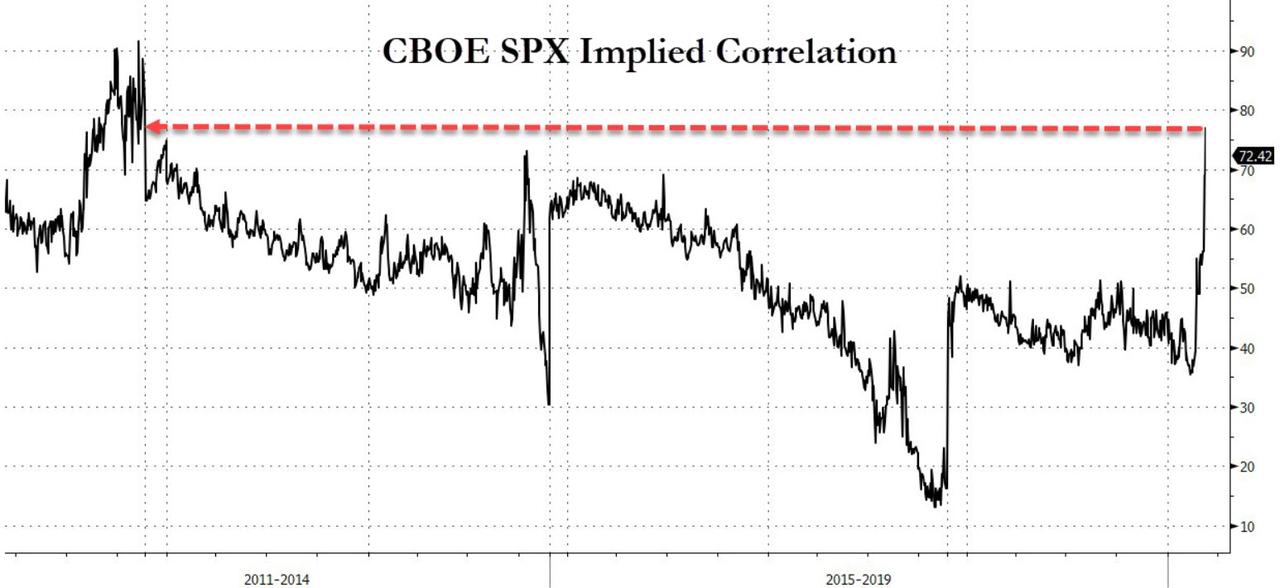

The fact of the oncoming collapse itself should not be a surprise- especially when one is reminded of the $1.5 quadrillion of derivatives which has taken over a world economy which generates a mere $80 trillion/year in measurable goods and trade. These nebulous bets on insurance on bets on collateralized debts known as derivatives didn’t even exist a few decades ago, and the fact is that no matter what the Federal Reserve and European Central Bank have attempted to do to stop a new rupture of this overextended casino bubble of an economy in recent months, nothing has worked. Zero to negative percent interest rates haven’t worked, opening overnight repo loans of $100 billion/night to failing banks hasn’t worked- nor has the return of quantitative easing which restarted on October 17 in earnest. No matter what these financial wizards try to do, things just keep getting worse.

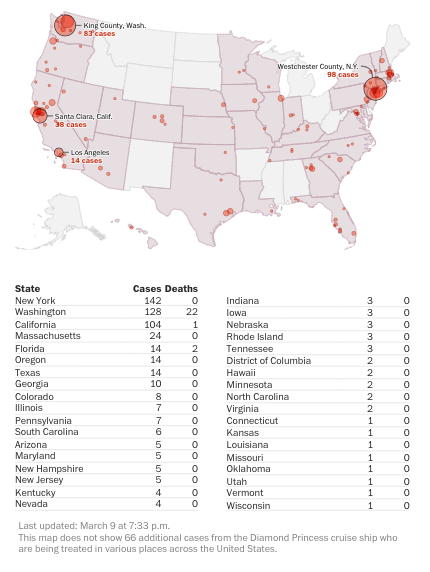

Rather than acknowledge what is actually happening, scapegoats have been selected to shift the blame away from reality to the point that the current crisis is actually being blamed on the Coronavirus!

Deeper than Corona

Let me just state outright:

That while the coronavirus may in fact be the catalyzer for the oncoming financial blowout, it is the height of stupidity to believe that it is the cause, as the seeds of the crisis goes deeper and originated much earlier than most people are prepared to admit.

To start getting at a more truthful diagnostic, it is useful to think of an economy in real (vs purely financial) terms – That is: Simply think of the economy as total system in which the body of humanity (all cultures, nations and families of the world) exist.

This co-existence is predicated on certain necessary powers of production of food, clothing, capital goods (hard and soft infrastructure), transportation and energy production. After raw materials are transformed into finished goods, these physical goods and services move from points A to B and are consumed. This is very much akin to the metabolism that maintains a living body.

Now since populations tend to grow geometrically, while resources deplete arithmetically, constant demands on new creative discoveries and technological application are also needed to meet and improve upon the needs of a growing humanity. This last factor is actually the most important because it touches on the principled element that distinguishes humanity from all other forms of life in the ecosystem which Lincoln identified wonderfully in his 1859 Discoveries and Inventions Speech:

“All creation is a mine, and every man, a miner. The whole earth, and all within it, upon it, and round about it, including himself, in his physical, moral, and intellectual nature, and his susceptibilities, are the infinitely various “leads” from which, man, from the first, was to dig out his destiny… Man is not the only animal who labors; but he is the only one who improves his workmanship. This improvement, he effects by Discoveries, and Inventions.”

During a 1994 address to Russian scientists in Moscow, a modern adherent to Lincoln’s system (the late economist Lyndon LaRouche) addressed this concept from a modern perspective by asking:

“Mankind is different than any other animal; how do we prove this? And how does that bear on this question of technology? If the hominids-mankind-were higher apes or animals, we would have the population potential (approximately) of higher apes, baboons (which some people behave like), or chimpanzees. In that case, in the past 2 million years of the interglacial period, at no time would the human population of this planet have exceeded 10 million persons approximately… we have increased the world population to 5.3 billion people. Twenty or twenty-five years ago, we had the basis for, in a normal fashion, going to 25 billion people, without any great problem. In the past 30 years, we have destroyed so much of the planet’s productive technology and productive capacity, that we are in a disaster.”

What these men laid out in their own manner are not mere hypotheses, but elementary facts of life which even the most ardent money-worshipper cannot get around.

Of course money is a perfectly useful tool to facilitate trade and get around the awkward problem of lugging bartered goods around on your back all day, but it really is just that: a supporting element to a physical process of maintenance and improvement of trans-generational existence. When fools allow themselves to loose sight of that fact and elevate money to the status of a cause of all value (simply because everyone wants it), then we find ourselves far outside the sphere of reality and in the Alice in Wonderland world of Alan Greenspan’s fantasy world where up is down, good is evil, and humans are little more than vicious monkeys.

So with that in mind, let’s take this concept and look back upon today’s crisis.

Greenspan and the Controlled Disintegration of the Economy

When Alan Greenspan confronted the financial crisis of October 1987, markets had collapsed by 28.5% and the American economy was already suffering from a decay begun 16 years earlier when the dollar was removed from the fixed exchange rate and was “floated” into a world of speculation. This departure from the 1938-1971 Industrial growth model ushered in a new paradigm of “post-industrialism” (aka: nation stripping) under the new logic of “globalization”. This foolish decision was celebrated as the consumer-driven, “white collar society” which would no longer worry about “intangible things” like “the future”, infrastructure maintenance, or “growth”. Under this new paradigm, if something couldn’t generate a monetary profit within 3 years, it wasn’t worth doing.

Paul Volcker (Greenspan’s predecessor at the Federal Reserve) exemplified this detachment from reality when he called for the “controlled disintegration of society” in 1977, and acted accordingly by keeping interest rates above 20% for two years which destroyed small and medium agro industrial enterprises across America (and the world). Greenspan confronted the 1987 crisis with all the gusto of a black magician, and rather than re-connect the economy to physical reality and rebuild the decaying industrial base, he chose instead to normalize “creative financial instruments” in the form of derivatives, which quickly grew from several billion in 1988 to $2 trillion in 1992 to $70 trillion in 1999.

When Bill Clinton repealed Glass-Steagall bank separation of commercial and investment banks as his last act in office in 1999, speculators had un-bounded access to savings and pensions which they used with relish and went to town gambling with other people’s money. This new bubble continued for a few more years until the $700 trillion derivatives time bomb found a new trigger and the subprime mortgage market nearly burned the system down. Just like in 1987, and the collapse of the Y2K bubble in 2001, the Mammon worshipping wizards in the ECB and Fed solved this crisis by creating a new system of “bailout” which continued for another decade.

Today, western economies have been hollowed out of the very life blood that caused value by supporting human life in the first place.

The Ugly Truth of Today’s Crisis

New “sub-prime” bubbles have been created in the Corporate Debt sector which has risen to over $13.8 trillion (up 16% from the year earlier). A quarter of which is considered junk, and another half graded at BB by Moodies (a step above junk).

Household debt, student and auto debt has skyrocketed and since wages have not kept up with inflation causing even more unpayable debts have been incurred in desperation. Industrial jobs have collapsed consistently since 1971, and low paying service jobs have taken over like a plague.

The last report from the American Society of Civil Engineers concluded that America desperately needs to spend $4.5 trillion just to bring its decayed infrastructure up to safety levels. Roads, bridges, rail, dams, airports, schools all received near failing grades with the average age of Dams clocking in at 56 years, and many water pipes over 100 years old, and transmission/distribution lines are well over 60 years. The factories which once supplied those infrastructure needs are long outsourced, and much of the productive workforce that had that living knowledge to build a nation are retired or dead leaving a deadly generation knowledge gap in its place filled with millennials who never knew what a productive economy looked like (and aging baby boomers who have tried hard to forget what it was).

American farmers have probably been the most devastated in all this with dramatic population losses across the entire farm belt of America and the average age of farmers now 60 years. It was recently reported that 82% of U.S. Agricultural family income comes from off farms, as mega cartels have taken over all aspects of farming (from equipment/supplies, packaging and the even the actual farming in between).

Why was this permitted to happen? Well besides the obvious intention to induce “a controlled disintegration of the economy” as Volcker so coldly stated, the idea was always to create the conditions described by the late Maurice Strong (sociopath and Rothschild cut-out extraordinaire) in 1992 when he rhetorically asked:

“What if a small group of world leaders were to conclude that the principal risk to the Earth comes from the actions of the rich countries? And if the world is to survive, those rich countries would have to sign an agreement reducing their impact on the environment. Will they do it? The group’s conclusion is ‘no’. The rich countries won’t do it. They won’t change. So, in order to save the planet, the group decides: Isn’t the only hope for the planet that the industrialized civilizations collapse? Isn’t it our responsibility to bring that about?”

How do we get back to health?

Like any addict who wakes up one morning at rock bottom with the sudden terror that his death is nigh, the first step is admitting we have a problem.

This means simply: acknowledging the true nature of the current economic calamity instead of trying to blame “coronavirus” or China, or some other scapegoat.

The next step is begin to act on reality instead of continuing to take heroine (a fine metaphor for the addiction to derivatives speculation).

An obvious first step to this recovery involves restoring Glass-Steagall in order to 1) break up the Too Big to Fail banks and 2) impose a standard of judging “false” value from “legitimate” value which is currently absent from the modern psycho that lost all sense of needs vs wants. This would allow nations to re-create a purge of the unpayable fictitious debt and other claims from the system while preserving whatever is tied to the real economy (whatever is directly connected to life). This process is sort of akin to cutting a cancer.

This act would look very similar to what Franklin Roosevelt did in 1933 which I outlined in my recent paper How to Crush a Bankers’ Dictatorship.

At this point nation states will have re-asserted their true authority over the pirates of private finance controlling the Trans-Atlantic financial system like would-be gods of Olympus (unbounded perverted vices and all).

President Trump and other sane patriots from both parties of America would then have to figure out how to start the long but vital process of forcing credit to regenerate the destroyed productive base of America and Europe with a focus on advanced infrastructure, science and technological progress. This later investment into space science, atomic power, and transportation (high speed and magnetic levitation) would drive new breakthroughs necessary to overcome the current “limits to growth” that Green New Dealing oligarchs believe justify reducing the world population to less than two billion.

Where Franklin Roosevelt had to drive this process solo in the 1930s, today’s America luckily has a China-Russia alliance that have created a powerful “New Deal” of win-win cooperation in the form of the evolving Belt and Road Initiative with invitations for western nations to jump on board.

Tyler Durden

Tue, 03/10/2020 – 16:25

via ZeroHedge News https://ift.tt/3aKJJrz Tyler Durden