The ’80s “Fear Of Inflation” & “Ignorance” Now – Polar Opposites

Excerpted from a Twitter thread by Garic Moran,

Polar opposites

My first job in the investment field was as an intern at a local brokerage firm in New Orleans in the summer of 1981. At that time the Federal Reserve was a couple of years into targeting money supply.

President Carter had nominated Paul Volcker Jr. as Fed Chairman in August of 1979. The dollar’s status as the reserve currency of the world was in serious doubt.

U.S. investors convinced that inflation would never come down were dumping Treasury’s at any price & panicking into Gold, which peaked in January of 1980 @ $875…

18 months later in the summer of 1981, all traders were transfixed Thursday afternoons with the release of the money supply report.

Interest rates & Gold would move the following morning, rates were floating; the Fed was targeting money supply!

The Fed had already allowed 1 recession in 1980; causing President Carter to lose the election (IMO).

By June of ’81, Fed Funds returned to 19%; a 2nd recession began. The greatest bond bull in history also began. As an aside; Michael Steinhardt was leveraged long Treasury’s & his partners thought he was crazy.

Peak inflation psychology was crushed by the Fed’s targeting of money supply! 3 1/2 years later I started with Smith Barney as a broker selling 30 year BBB Ga Power bonds yielding 13.5%. They were popular as money market rates & bank CD’s had plummeted; yet, investors were deeply skeptical of the BBB rating & concerned about the potential of inflation returning.

Interestingly, we were using leads compiled by people who had bought oil & gas limited partnerships in the late ’70’s., many of which had turned into horrible investments as Chair Volcker had defeated inflation.

Gold mining equities peaked at 8% of the S&P 500 in ’81 as investors paid up for miners after the peak in Gold with the fear that inflation would return. Today, Newmont Mining (less than .5%) is only miner in S&P 500.

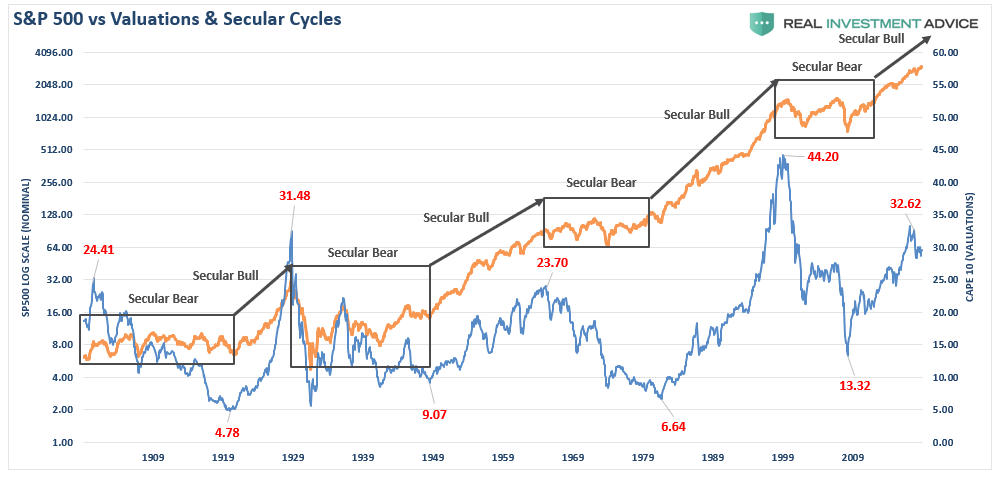

Today is the polar opposite

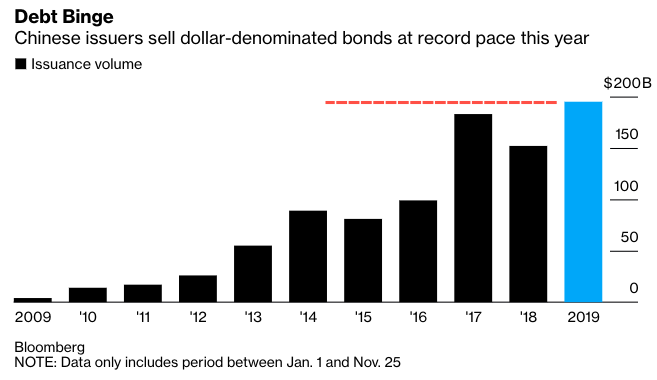

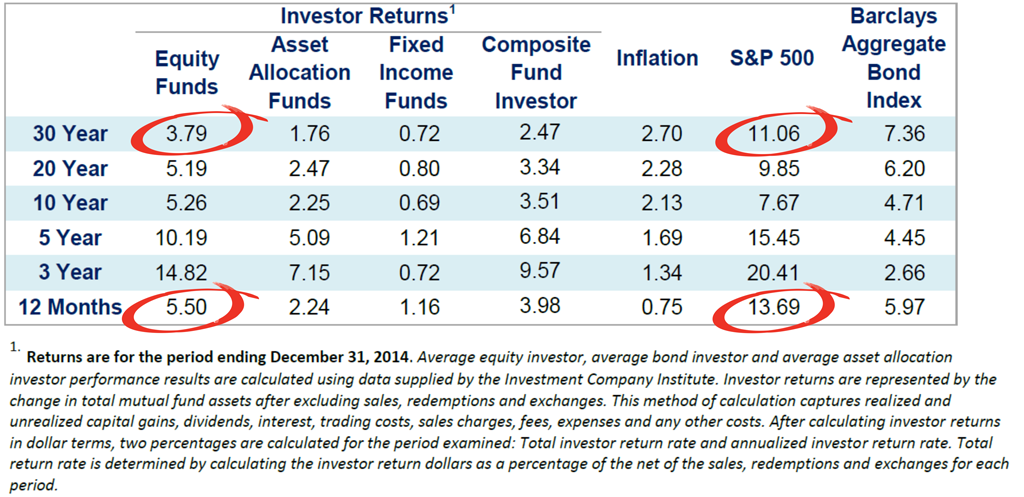

U.S. investors have bought $250B worth of bond ETF’s, YTD. BBB credit has never been a greater % of bond fund holdings. Corporate debt to GDP is at an all-time-high.

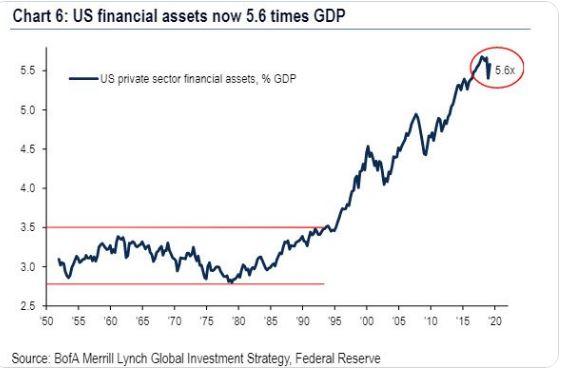

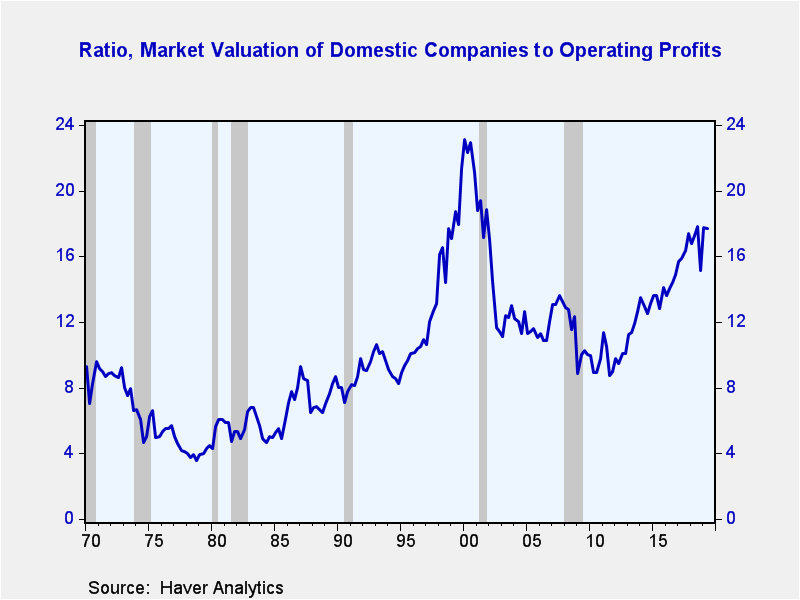

Total Financial Assets to GDP have never been higher.

In 1980 Total Financial Assets to GDP bottomed at 2.7X; today they are valued at twice that level.

This summer Chair Powell said the last 2 recessions were caused by financial crises; he would not allow that again unlike Volcker, he has no tolerance for a recession & appears to be supporting the current President (IMO, just as Chair Yellen did with the previous President).

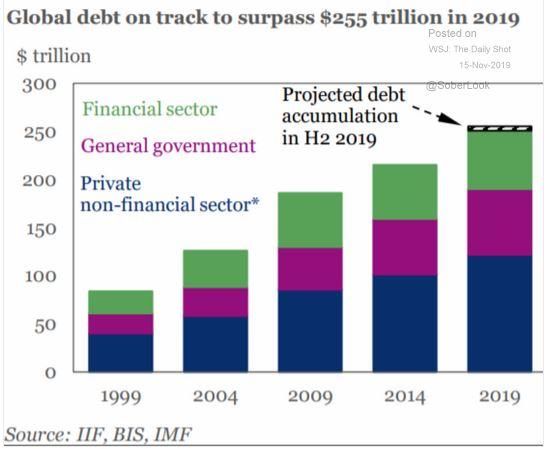

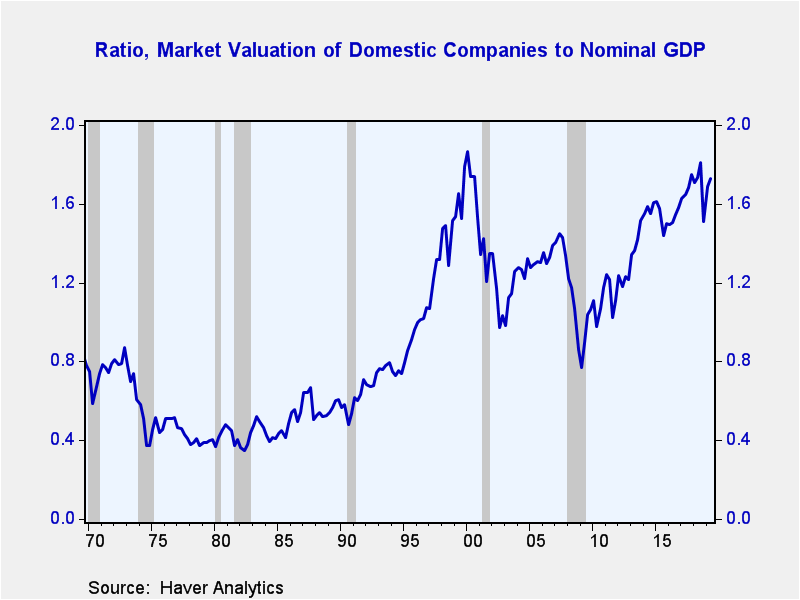

Investors have responded by bidding stocks to new All-Time-Highs & global bond debt is reported to be over $250T.

Incredibly many hedge fund managers are leveraged long negative yielding bonds; their partners have no fear of inflation (polar opposite).

IMO, we will all look back one day & wonder what Central Banks & investors were thinking when $17T of global bonds carried negative rates. Iit will be obvious that was the peak in disinflationary psychology.

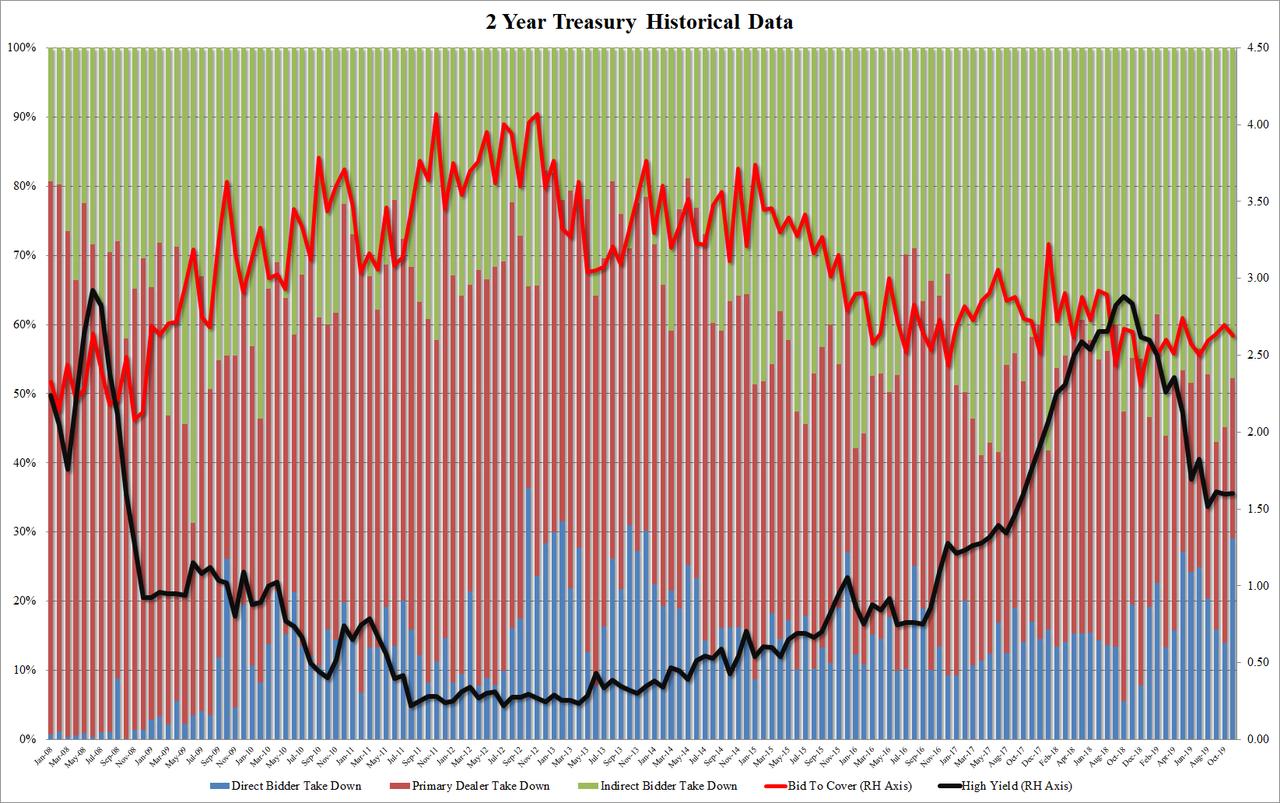

So Chair Powell said he would not allow the greatest financial bubble in the history of the world to pop & cause a recession. By this September repo rates spiked as the supply of Treasury Bills from a run-away deficit soaked up liquidity in the financial system: the Fed responded with a Friday afternoon conference call where they unanimously approved $60B in monthly T-Bill purchases (monetization).

At the same time stress in the shadow banking community increased as leveraged loans default rates began to increase. Venture Capital Funds came under pressure as money losing Unicorns began to fail. Private Equity default rates are rising.

The Fed responded with overnight repo’s to provide financing to holders of worthless securities. With real corporate profits down 6%, YOY, stress in the most leveraged corporations in history will continue to grow. The Fed’s commitment to keep Financial Conditions will also continue to grow.

Since repogeddon in September, U.S. M2 has accelerated to a 13.8% annual rate.

They have committed to buying T-BIlls into Q2/20, the above chart will continue to rise. If you look closely at the below chart, M2 appears to be in the early stages of going parabolic.

Yet, I am not aware of any trading desks or investors who are transfixed to the weekly money supply reports. Indeed, disinflation psychology is at such extremes, investors continue to pile record capital into bonds that are yielding less than the current inflation rate. They have chosen to ignore that Cleveland Fed Median CPI is rising.

The Federal Reserve is now allowing money supply to grow at whatever rate it takes to stop “deflation”, but what they are really trying to stop is the greatest financial bubble (which they created) from popping; they have no tolerance for a recession.

There is no concern for the dollar as the reserve currency of the world or future inflation rates: polar opposites.

This is not investment advice; just an observation from 38 years of following capital markets & human psychology!

Tyler Durden

Mon, 11/25/2019 – 13:55

via ZeroHedge News https://ift.tt/2qIvQIU Tyler Durden