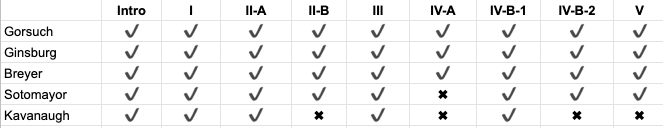

Today the Supreme Court decided Ramos v. Louisiana. (Eugene and Jon blogged about it earlier). The votes are very, very complicated:

GORSUCH, J., announced the judgment of the Court, and delivered the opinion of the Court with respect to Parts I, II–A, III, and IV–B–1, in which GINSBURG, BREYER, SOTOMAYOR, and KAVANAUGH, JJ., joined, an opinion with respect to Parts II–B, IV–B–2, and V, in which GINSBURG, BREYER, and SOTOMAYOR, JJ., joined, and an opinion with respect to Part IV–A, in which GINSBURG and BREYER, JJ., joined. SOTOMAYOR, J., filed an opinion concurring as to all but Part IV–A. KAVANAUGH, J., filed an opinion concurring in part. THOMAS, J., filed an opinion concurring in the judgment. ALITO, J., filed a dissenting opinion, in which ROBERTS, C. J., joined, and in which KAGAN, J., joined as to all but Part III–D.

Justice Kavanaugh offered this explanation of the breakdown:

As noted above, I join the introduction and Parts I, II–A, III, and IV–B–1 of JUSTICE GORSUCH‘s opinion for the Court. The remainder of JUSTICE GORSUCH‘s opinion does not command a majority. That point isimportant with respect to Part IV–A, which only three Justices have joined. It appears that six Justices of the Court treat the result in Apodaca as a precedent and therefore do not subscribe to the analysis in PartIV–A of JUSTICE GORSUCH‘s opinion.

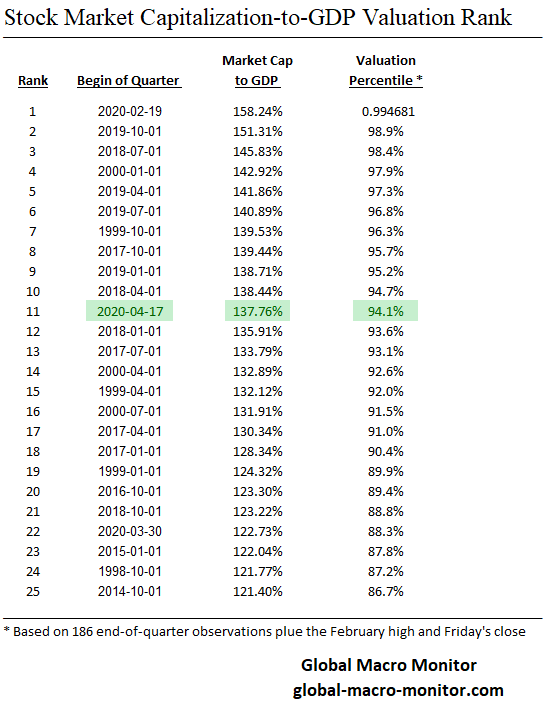

This graph (as best as I can tell) charts the votes in the majority.

I will update the post as I make my way through the 87-page opinion.

Update: The remainder of this post explains the complicated breakdown of the Ramos majority.

Part II-B

Justices Gorsuch, Ginsburg, Breyer, and Sotomayor joined Part II-B . This brief section (pp. 9-11 of the slip opinion) tries to make sense of Apodaca v. Oregon:

So what could we possibly describe as the “holding” of Apodaca?

Really, no one has found a way to make sense of it. In later cases, this Court has labeled Apodaca an “exception,” “unusual,” and in any event “not an endorsement” of JusticePowell’s view of incorporation.34 At the same time, we have continued to recognize the historical need for unanimity.35 We’ve been studiously ambiguous, even inconsistent, about what Apodaca might mean.

Justice Kavanaugh did not join Part II-B.

Part IV-A

Justices Gorsuch, Ginsburg, and Breyer joined Part IV-A (pp. 16-20 of the slip opinion). This section responds to Justice Alito’s dissent. It begins:

If Louisiana’s path to an affirmance is a difficult one, the dissent’s is trickier still. The dissent doesn’t dispute that the Sixth Amendment protects the right to a unanimous jury verdict, or that the Fourteenth Amendment extends this right to state-court trials. But, it insists, we must affirm Mr. Ramos’s conviction anyway. Why? Because the doctrine of stare decisis supposedly commands it. There are two independent reasons why that answer falls short.

Justices Sotomayor and Kavanaugh did not join Part IV-A, for different reasons.

Part IV-B-2

Justices Gorsuch, Ginsburg, Breyer, and Sotomayor joined Part IV-B-2 and Part IV. Justice Kavanaugh did not join Part IV-B-2 and Part IV.

from Latest – Reason.com https://ift.tt/3buNbYg

via IFTTT