Platts: 5 Commodity Charts To Watch This Week

Via S&P Global Platts Insights blog,

Demand destruction from the coronavirus outbreak will be top of mind for power and gas traders this week, while the ripples in the oil market are being felt in Saudi Arabia and Vietnam, albeit in different ways. The iron ore market, which is faring better, rounds out this week’s pick of commodity charts by S&P Global Platts news editors

1. Lockdowns in Europe, Asia push TTF gas price to 16-year low…

What’s happening? The coronavirus lockdowns in Europe and now India are hitting gas prices hard, with the TTF month-ahead falling to its lowest level since S&P Global Platts began assessments in 2004 of just Eur7.15/MWh. Reduced industrial activity in Europe has led to lower gas demand while declarations of force majeure by Indian LNG buyers mean deferred cargoes are likely to land on European shores.

What’s next? With the lockdowns likely to endure for weeks if not months, the bearish sentiment is not expected to lift, especially as maintenance work on gas fields and pipelines offshore Norway has been largely shelved on coronavirus fears. That means a market share battle between Norwegian gas, LNG and Russian supplies is set to intensify.

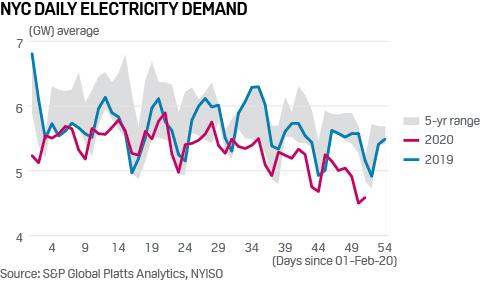

2. …and US sees power demand decline as coronavirus pandemic spreads

What’s happening? New York City electricity loads have been weaker year-over-year this winter so far due to milder weather, but are now trending significantly below the recent five-year average, indicating a virus-related slowdown, according to Manan Ahuja, manager of North America power at Platts Analytics. These demand numbers could slow down even further as people stay home and businesses remain shuttered to prevent spreading the virus.

What’s next? US power system impacts from the coronavirus pandemic are beginning to emerge, with shifting load patterns, significant load declines in a number of areas and projections that mild weather and business shutdowns will continue to suppress load during the coming weeks.

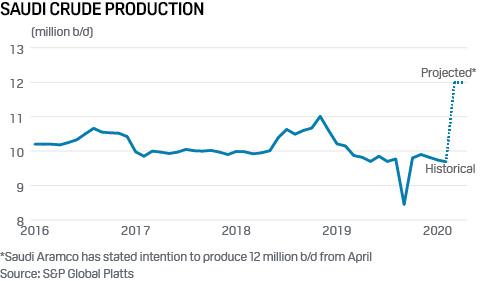

3. Saudi Arabia poised for ramp-up in production, exports

What’s happening? Saudi Arabia has directed state oil company Aramco to supply 12.3 million b/d of crude to the market starting in April, once the OPEC+ accord expires. Aramco CEO Amin Nasser has said that 300,000 b/d of that amount will come out of the company’s inventories, leaving 12 million b/d to come from production. That is Aramco’s maximum production capacity, and Nasser has said the company can maintain that level of output for a year without any additional investment.

What’s next? Aramco, which has the exclusive right to pump all crude within the kingdom, has never produced that much before, and some analysts doubt its ability to sustain such high volumes. Aramco may also have difficulty finding enough buyers for its barrels, with many refineries cutting runs due to the coronavirus outbreak’s hit to gasoline and jet fuel demand. Countries seeking to fill up their strategic reserves may snatch up the barrels, but for commercial buyers, inventory costs are getting more expensive, especially for floating storage, amid a growing crunch in tank space availability.

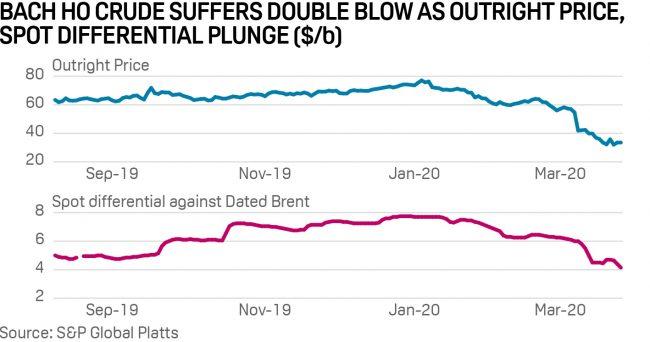

4. Low prices to hurt Vietnam’s sweet crude output and sales

What’s happening? Vietnam, a major participant in Southeast Asian spot trade, is suffering from low global oil prices. Crude sales and export earnings for the country are estimated to fall by $225,000/day for every $1/b decline in outright prices. If prices are quoted at around $30–$35/b, state-run PetroVietnam said the company is likely to lose $3 billion in annual sales. Platts assessed Vietnam’s Bach Ho crude at record lows in March. The grade had an average outright price of $42.45/b to date this month, falling more than $25/b from $68.34/b on average in 2019, Platts data showed.

What’s next? The Southeast Asian sweet crude market may witness spot cargo volumes decline sharply as Vietnam scales back exports. PetroVietnam aims to produce 10.62 million mt of crude oil in 2020, down 18.9% from 13.09 million mt in 2019. Vietnam will pay more attention to building crude reserves than exports as low prices open new opportunities for PetroVietnam to stock up at lower costs, general director Le Manh Hung said. Building strategic reserves to ensure energy security is becoming more relevant to Vietnam as its import requirements have risen sharply in recent years, according to JY Lim, oil markets adviser at Platts Analytics.

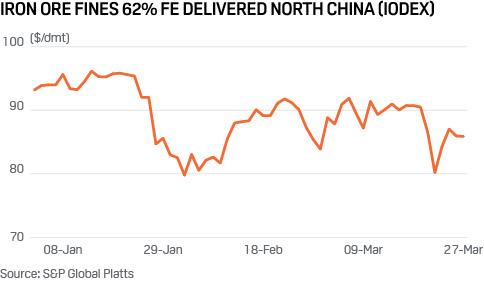

5. Iron ore prices hold firm in face of lockdowns

What’s happening: Iron ore prices have held firm in recent weeks on supply side factors, even as steel prices have slumped on weaker demand as automotive and other industries have closed amid coronavirus-related curbs.

What’s next: Disruption to shipments due to 21-day lockdowns announced last week in South Africa and India – where iron ore exporters have declared force majeure – and new government directives from Canada may continue to support iron ore prices, offsetting the current collapse in European demand, which accounts for 9% of seaborne iron ore demand.

Tyler Durden

Mon, 03/30/2020 – 14:20

via ZeroHedge News https://ift.tt/2WQ5WRk Tyler Durden