Submitted by Michael Every of Rabobank

A weekend binge-watching Netflix’s conspiracy theory thriller ‘Designated Survivor’ was either the best, or the worst, way to prepare for the news-flow we start Monday with. Jeffrey Epstein, the US billionaire–a man who nobody can explain how he made or maintained his wealth–who has been publicly linked to a paedophile sex-ring and names such as Bill Clinton, Donald Trump, Prince Andrew, and ex-Israeli PM Ehud Barak, managed to commit suicide over the weekend before he could provide testimony in his upcoming trial. That was despite the fact that he had already attempted suicide previously in the top security prison he was being kept in. ‘Designated not to survive?’ is what some are asking, even at the highest levels.

At this stage it’s tempting to shift from Epstein to Bernstein, as in Woodward & Bernstein, the investigative reporters who brought down the Nixon “if the president does it then it’s legal” administration. That can feel thrillingly like being your own Agent Wells from Designated Survivor.

Similarly, some will no doubt mutter darkly about ‘who is really behind all this’, including the US president in one of his latest tweets, which takes us down a dangerous alley towards Goldstein: that’s Emmanuel Goldstein from Orwell’s ‘1984’, the made-up hate-figure the controlled and brain-washed public channel its hate at instead of the noxious reality in front of it.

However, let’s not forget that truly outrageous states of affairs can exist in front of us for years without any conspiracy other than awkward silence. Think of Harvey Weinstein, for example, and how many YouTube clips there are of him being fawned over while clutching awards on stage in a tux. Everyone knew what was actually going on, according to his accusers, but it was just poor politics to ever say it out loud.

Indeed, as far sharper minds than mine have pointed out, let’s not forget that where one spots a conspiracy, there can just be plain incompetence. For example, while it seems incredible that an experienced high-security prison might put Epstein in solitary confinement just after he had already attempted suicide; or that it would not have put him on suicide watch; or that it would not have monitored him 24/7 if he were on suicide watch, consider this; his prison guards were allegedly working back-to-back overtime shifts to try to compensate for institutional understaffing, which one can presume might have been aimed at keeping costs down. In short, the real culprit here may just be the depressingly-familiar short-term profit-over-performance-focused Frankenstein that is modern market capitalism. After all, it’s also not as if we are short of other ‘conspiracy theories’ standing there in the open if we are brave enough to point to them.

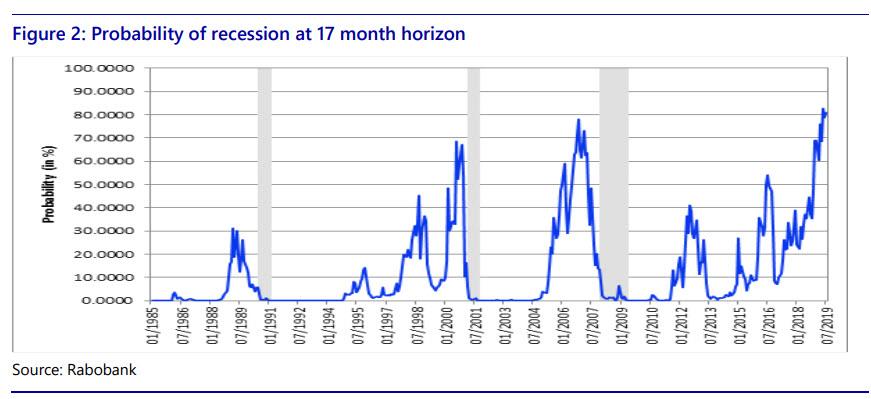

One example: we are now projecting Fed Funds to fall back to zero over the next two years. That’s even as the Fed claims this is a “mid-cycle adjustment”, and that just months after they promised further hikes ahead. In effect, the Fed don’t know what they are doing – or all they can do is blow bubbles that rate hikes then blow up.

Another example: the RBA deciding it needs a 4.5% unemployment rate ASAP after crowing for years about labour-market strength around 5% and predicting higher wages that never arrive – which conveniently now allows it to slash rates to save the housing market that they really care about most (and where we also think rates will end up close to zero as a result).

Another example is the ECB, who are going to have to cut rates as well just after declaring “mission accomplished”- they just haven’t created the correct Emmanuel Goldstein to explain it yet. I suspect “trade war” will stand in for the Frankenstein of an uneven, QE- and debt-driven economic structure that can never allow borrowing costs to rise or liquidity to be tightened. Let’s also not forget that we have the ‘Weinstein’ of USD trillions of Euro bonds with negative yields, including 14 junk bonds, while Denmark is now offering negative-yielding mortgages.

There are, of course, some real “Ah ha!” moments still to come. Consider that it was revealed late Friday that China has helped to prop up Turkey’s FX reserves, which might explain something about both its foreign policy shifts and the performance of TRY. However, questions about China’s own FX reserves continue to be asked – and it will be a true ‘Designated Survivor’ shock if those suggestions are accurate (…on which note, Turkey’s central bank has just fired nine high-ranking officials, including the head of research and risk management).

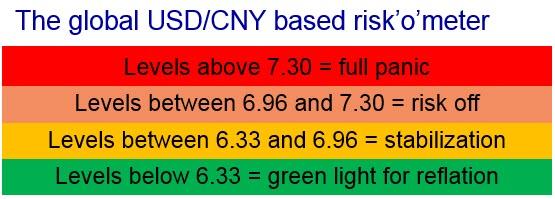

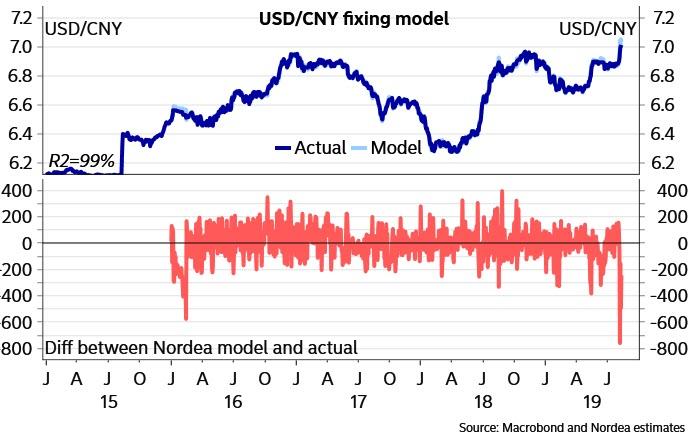

Indeed, markets cannot avoid a CNY focus again this week, especially as Friday saw President Trump underline that he may continue trade negotiations in September or he may not. Today’s CNY fixing at 7.0211 suggests that we are still in a steady grind lower rather than a plunge given the Friday close was 7.0623.

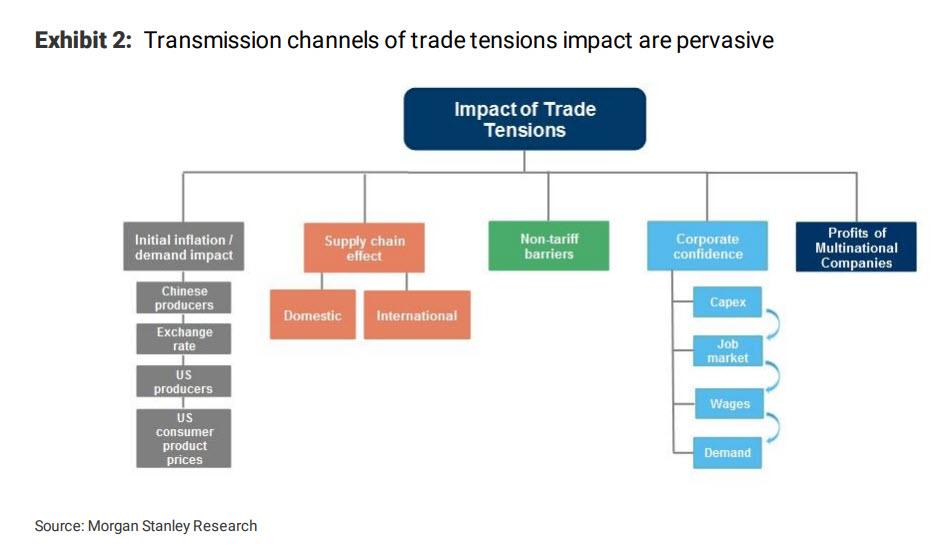

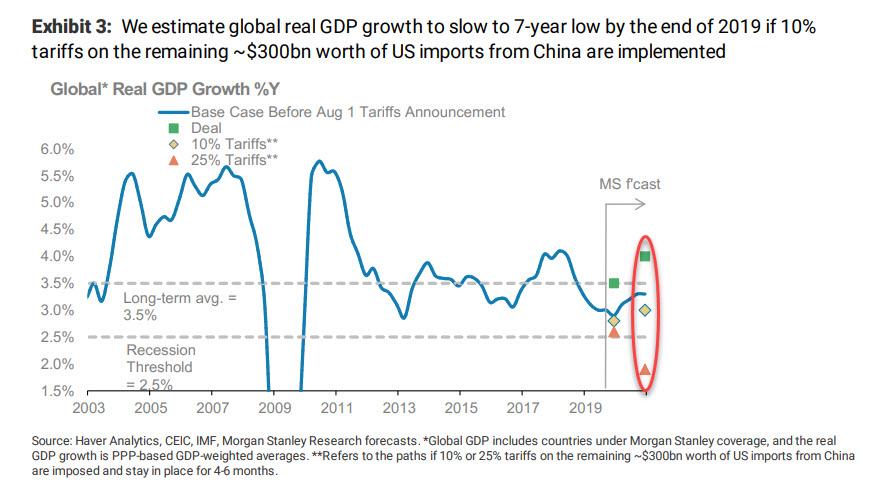

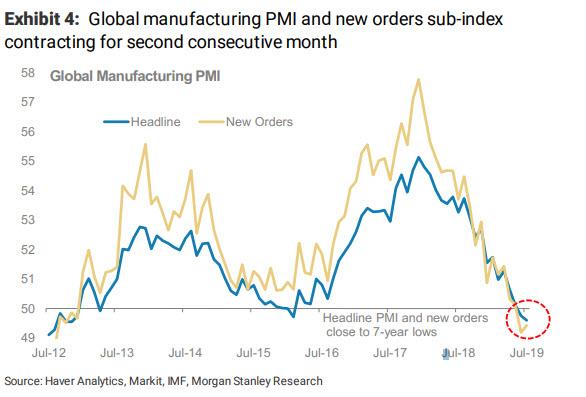

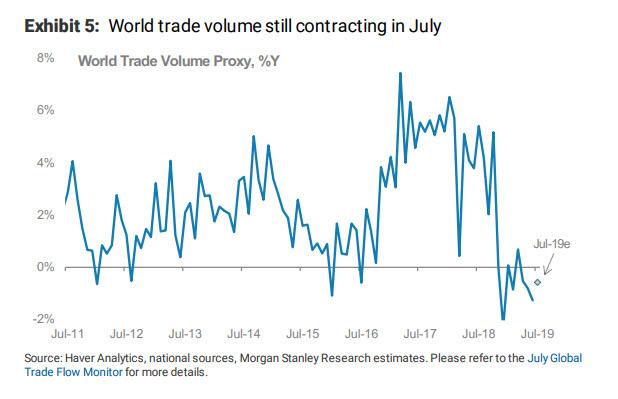

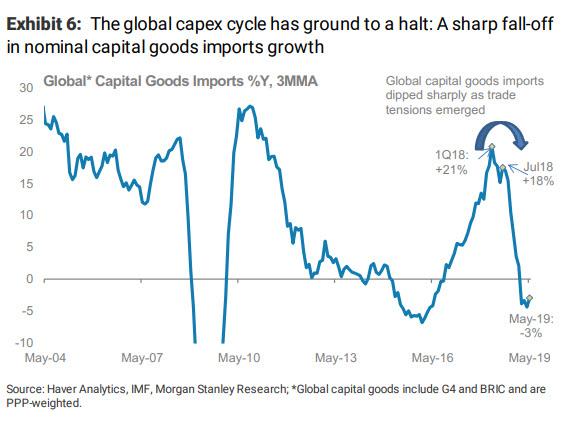

But let’s not point to the fact that the global economy is seeing a synchronised slowdown, that we are edging towards an epic FX war and a stronger USD that hits EM hard, that central banks are all out of both ideas and credibility, that trade tensions continue to escalate, that Hard Brexit is looking more and more likely, and that geopolitics is a mess on many fronts. Otherwise we too might end up on suicide watch – with an underpaid, over-worked security guard to keep an eye on us.

via ZeroHedge News https://ift.tt/2ZYj1Xi Tyler Durden