She resolutely refuses to talk policy specifics. Her voice sounds like a “televangelist crossed with a glass of Chardonnay,” to borrow a phrase from Robby Soave. She says things like “dark psychic force” and “emotional turbulence” when discussing politics. And she was the breakout star of Tuesday night’s Democratic presidential debate in Detroit.

Before yesterday, Marianne Williamson’s candidacy existed mostly as a meme. She seemed interesting and weird and destined to drop out of the polls and then the race. But a funny thing happened on her way to the remainder bin: Not only did the quirky and possibly insane self-help author make it back for round two of the #DemDebates, she also stole the show.

As candidates like Sens. Bernie Sanders (D–Vt.) and Elizabeth Warren (D–Mass.) huffed and puffed about the putrid centrism of fellow candidates, and the purported centrists griped and swiped at their more radical counterparts, Williamson beamed with calm, sturdy energy and fired off quietly devastating barbs.

“I look at some of you and I almost wonder why you’re Democrats—you almost think something is wrong with using the instruments of government to help people,” she chastised colleagues at one point. Later, she ripped into “politicians, including my fellow candidates,” for taking “tens of thousands—and in some cases, hundreds of thousands—of dollars from… corporate donors” while acting like they “now have the moral authority to say we’re going to take them on.”

Questioned about the environmental crisis in Flint, Michigan, she turned it into a referendum on Donald Trump’s aura:

The racism, the bigotry, and the entire conversation that we’re having here tonight—if you think any of this wonkiness is going to deal with this dark psychic force of the collectivized hatred that this president is bringing up in this country, then I’m afraid that the Democrats are going to see some very dark days.

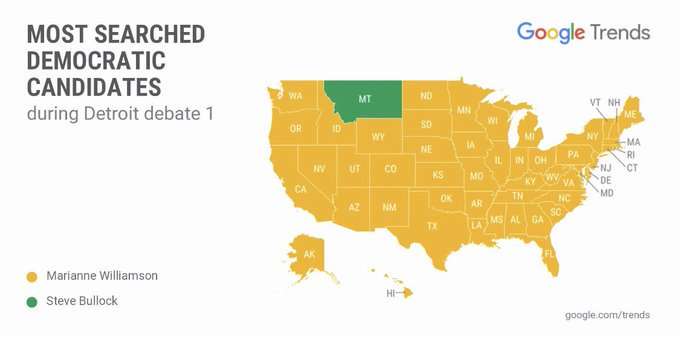

America, apparently, ate it up. Williamson was the most-searched candidate on Google last night in every state except Montana (where their own governor and debate-stage newbie Steve Bullock got the most Google queries). CNN hosts fawned over her in the post-debate analysis. Even the antagonize-everyone teens behind Mike Gravel’s candidacy were digging Williamson’s vibes.

we stan pic.twitter.com/uaNpw5J4oc

— Mike Gravel (@MikeGravel) July 31, 2019

Political reporters and pundits on the left, right, and posts further afield had positive things to say about Williamson’s performance, if not necessarily her ideas or ability to win. Yet even those estimations seemed to rise last night for some.

People who agree on nothing in my feed, down to the most basic questions of humans and God, agree @marwilliamson won the debate

— James Poulos (@jamespoulos) July 31, 2019

As Rep. Thomas Massie (R–Ky.) pointed out during the last election, Americans love “the craziest son of a bitch in the race.” Among Democrats this year, that’s Williamson. Her Big “Santa Fe Aunt Energy” is a refreshing change of pace compared to the other career politicians on stage. Her New Age-ness makes her relatable to some, and an easy target for low-stakes ribbing for many of us. Her long-shot candidacy makes it feel harmless to ironically cheer her on.

Santa Fe Aunts: amazing for asking about how to heal your broken heart, not amazing when it comes to returning the investment you made in their batik business

— rachel syme (@rachsyme) July 31, 2019

But are we failing to take Williamson seriously at our own peril? Not everyone seems to think that elevating her is harmless fun.

Not only does Williamson buy into the litany of bad, big-government proposals that most of the Democratic candidates do, she has also written a host of bizarre (and some say dangerous) things about both mental and physical health (among other things).

Calling entrenched ignorant bigotry a “dark psychic force,” like it’s something from Sauron as opposed to an ugly and entrenched human characteristic, badly misreads it.

— UAEApprovedHat (@Popehat) July 31, 2019

For more on Williamson overall, see Jesse Walker’s excellent profile of Williamson from earlier this month. For more on her debate performance last night, check out these write-ups from The Spectator and from Buzzfeed.

As for how Williamson herself thought the debate went, she told reporter Sarah Mucha last night: “I’ll tell you later when I see the memes.”

FREE MINDS

Latino voters split on whether President Donald Trump is racist:

Look at the Latinos number.

I disagree with this — I think there is overwhelming evidence to suggest that 'racist' is a fair descriptor — but one more time: The idea that there is a unified bloc of "people of color" or even Latinos who share a set of political beliefs… no. https://t.co/UUTRAVF7Gh

— Jesse Singal (@jessesingal) July 31, 2019

FREE MARKETS

Buttigieg would destroy independent contractors. South Bend Mayor and Democratic presidential candidate Pete Buttigieg wants to unionize “gig economy” workers, he told debate watchers last night. He has proposed similarly before. “But in order to successfully execute that plan, the presidential hopeful would need to ensure those workers are reclassified as fully-fledged employees, as opposed to independent contractors,” points out Billy Binion.

That may be a tough sell: The National Labor Relations Board (NLRB) already ruled that Uber drivers cannot unionize because they are independent contractors, and the Department of Labor similarly declined to classify gig economy participants as employees. Both agencies said that those individuals are free to work when they please, can set their own hours when it best suits them, and are permitted to work for competing companies. Those criteria, and several others, make them contractors.

And this change could be devastating to not just employers that rely on them and those who use the services they provide but to the workers themselves.

QUICK HITS

- “Tony Timpa wailed and pleaded for help more than 30 times as Dallas police officers pinned his shoulders, knees and neck to the ground. ‘You’re gonna kill me! You’re gonna kill me! You’re gonna kill me!'” he shouted. Police laughed as they did.

- During health care discussions in last night’s Democratic debate, “neither Sanders nor Warren even acknowledged the possibility that Medicare for All could affect providers adversely. Instead, they kept returning to the profits of drugmakers and insurance companies, as if that were the entire problem.”

"a no-knock warrant for an unpaid gas bill"https://t.co/jdFeS9tF9E pic.twitter.com/Gb38Ysi1xh

— habit forming timothy (@TimCushing) July 31, 2019

- “Conspiracy theories about social media are undermining American institutions,” warns the R Street Institute’s Jeffrey Wesling.

- Pete Buttigieg held up alcohol Prohibition as evidence that we could abolish the Second Amendment.

.@PeteButtigieg: “This is a country that once changed its constitution so you couldn't drink. And then changed it back because we changed our minds about that. And you're telling me we can't reform our dmeocracy?”

Spot on. pic.twitter.com/khYdXaj4uV

— Brian Tyler Cohen (@briantylercohen) July 31, 2019

- Sen. Josh Hawley introduced another terrible technology bill yesterday.

- Happy birthday, Milton Friedman!

from Latest – Reason.com https://ift.tt/2yosMCd

via IFTTT