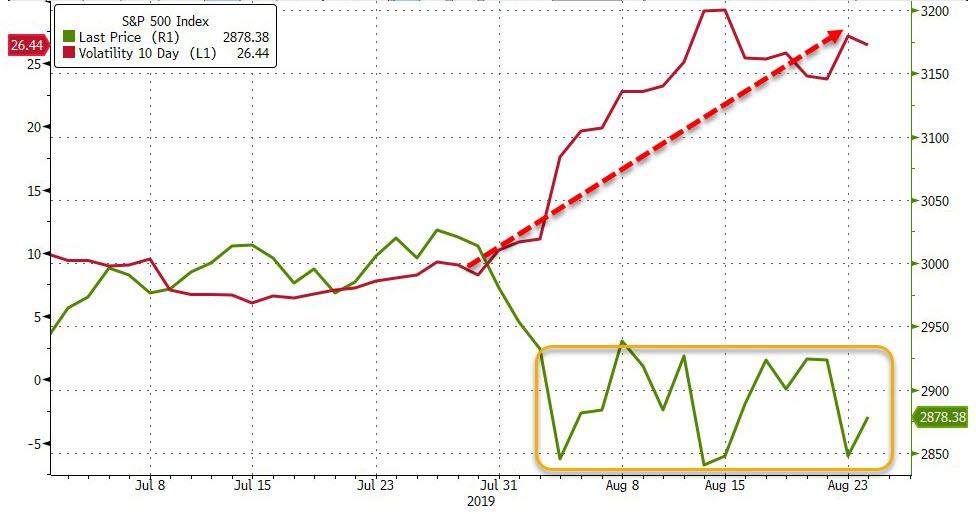

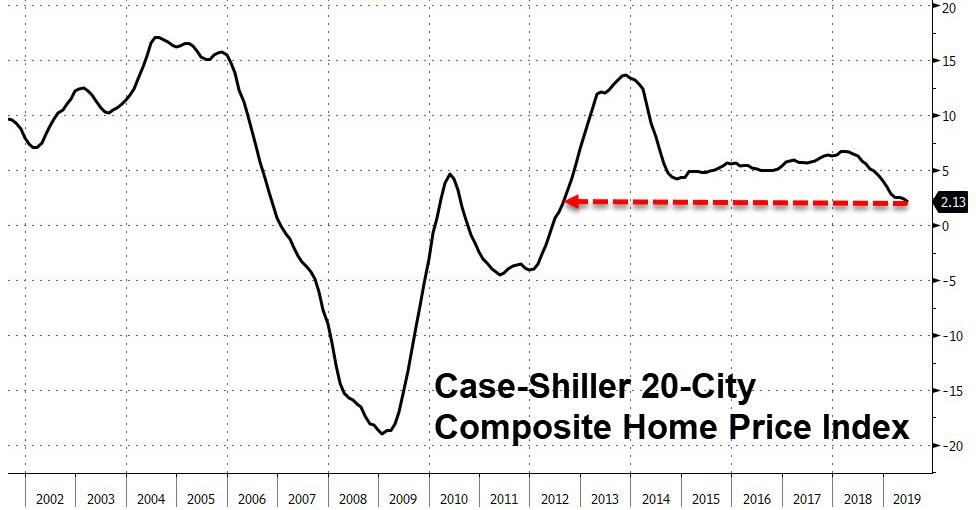

Despite huge intraday swings, stocks have been range-bound for a month as Treasury yields tumble and the yield curve inversions extend to 12-year lows.

Source: Bloomberg

But, despite the relatively tranquile range of stocks, former fund manager and FX trader Richard Breslow notes that traders are having a devil of a time dealing with intraday volatility.

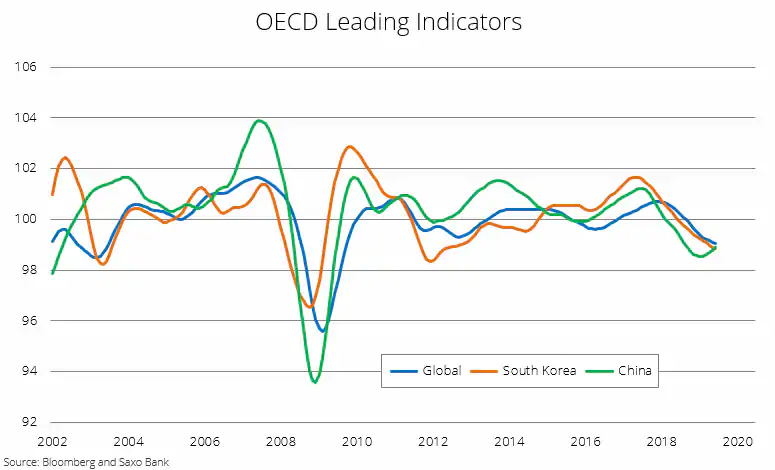

But, Breslow notes, perhaps the most useful skill one can have in these unsettled markets is picking your canaries judiciously. It’s easy to pick out ones that match your outlook and go with them. Ignoring the ones that don’t suit. Especially in an environment where it is hard to find all that many people who are feeling optimistic.

It’s as if investors have moved away from watching the stock ticker to watching the Trump Tweet ticker.

He is now seemingly responsible for every market move up or down 1/2 https://t.co/JtIIwGaic9

— Peter Atwater (@Peter_Atwater) August 27, 2019

Via Bloomberg,

Emerging market currencies as an asset class certainly look ugly. That’s often a good one to keep an eye on. The MSCI Emerging Market Currency Index made a new year-to-date low today. The inversion of 2s/10s on the U.S. Treasury yield curve might fit the bill. Yet after the early August dramatics, the MSCI Asia ex-Japan equity index looks positively stable, and is trading currently at a price seen multiple times over the last few weeks. Hong Kong’s Hang Seng, which has every right to be falling, sits some 2.5% above important technical support, having handily held that level — which it tested two weeks ago.

German economic numbers continue to look appalling while the spread of BTPs to Bunds, as wacky as it can be, traded today within 5 basis points of its narrowest levels of the year. There are a lot of conflicting signals out there. More than most traders probably expect. Even within the Governing Council of the ECB you can find diverging opinions to suit your view. Jens Weidmann’s “Dr. No” versus Olli Rehn’s “let’s give the market a package that will really impress them.”

Earlier this month there were suggestions that the Fed might consider convening an emergency rate meeting. A few days later the S&P 500 was attempting to get back above its 55-day moving average. Last Friday a lot of people were sure the gauge was going to collapse. It never took a serious look at its 200-DMA. And despite sometimes feeling like death, Monday’s close was at a price we saw on eight of the previous 15 trading days.

Source: Bloomberg

Particularly at this time of the summer, with two long weekends either side of the week, it is completely understandable if an individual proprietary trader decides to call a time-out. And who could fault someone working in Hong Kong for having a very different world view and perception of risk than a short-term interest rate trader with an office in Canary Wharf?

I’m sure quantitative models have taken down leverage on their own just based on their ability to forecast P&L volatility. They don’t like random social media broadsides either. Just less so than humans, who may find it’s prudent to pick their spots more selectively, be very mindful of lining up liquidity sources and stick closer to their knitting. In retrospect, taking a “nothing can go wrong” approach to Argentina was perhaps somewhat cavalier.

Source: Bloomberg

But there isn’t anything to suggest that the markets have become untradeable. And whether it’s appropriate or not, will ultimately do any good or not, central banks are unambiguously in easing mode. Think how easy it was earlier today for RBA Deputy Governor Guy Debelle to make it clear quantitative easing is very much in their toolkit if needed. Thankfully, he seemed to have steered away from the notion of negative rates. So, extra credit to him.

No one said it was guaranteed to be easy. Or even fun. Obviously things can go wrong. And there are plenty of candidates trying to make that happen. But as one of the most successful quantitative hedge fund managers I’ve ever known told me, to take off risk just because you are scared or tired is a self-defeating strategy.

You can forecast many things, but not when opportunities will present themselves.

via ZeroHedge News https://ift.tt/341FDsy Tyler Durden