Following last night’s blockbuster Chinese data, when virtually every key data point beat expectations in some cases notably, global markets and bond yields are broadly higher, if mutedly so, as traders evaluated whether China’s economic recovery will be enough to put rate hikes back on the table even as Germany’s economy ministry revised its growth forecast lower to just 0.5%. Global markets and futures are a sea of green but tentatively so as

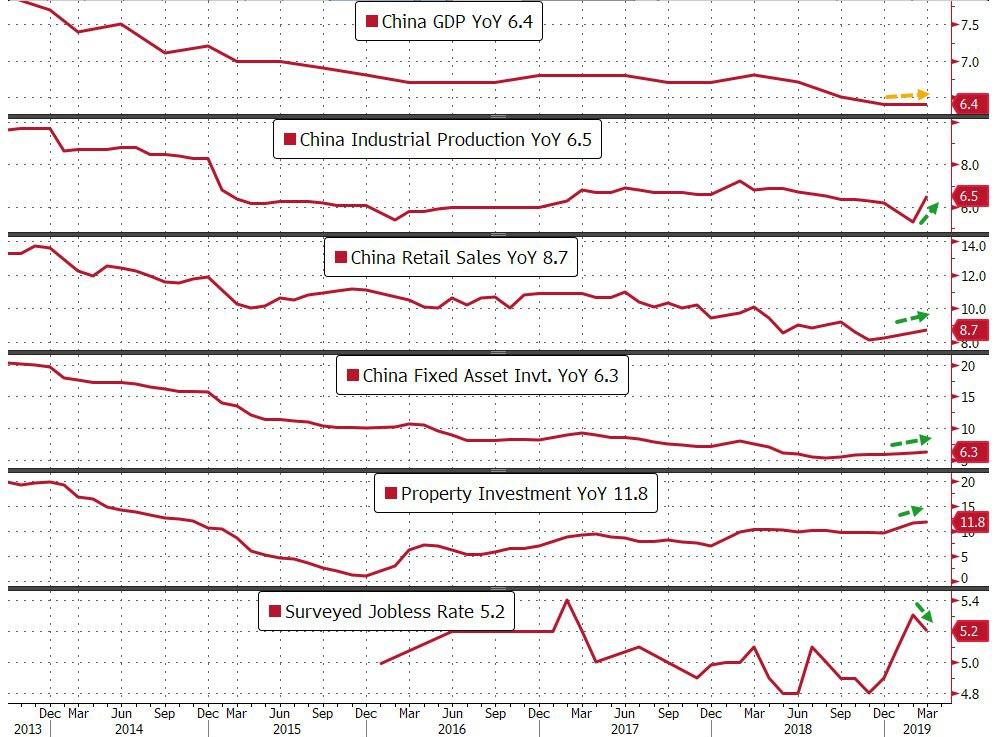

As a reminder, China reported that Q1 GDP rose 6.4% vs. Exp. 6.3%; Chinese Industrial Production burst higher by 8.5% smashing expectations of 5.9%; the fastest growth since July 2014, while Retail Sales for March jumped 8.7% vs. the Exp. 8.4%. Fixed asset investment was the only category that printed in line, at 6.3%.

China’s economy held up in the first three months as policy makers boosted stimulus to sustain growth, with the (goalseeked) data suggesting pro-cyclical policies are taking effect. While a report that the country’s leaders are considering more measures should provide comfort for stock bulls and damp demand for bonds, concerns still linger about the outlook for the euro region according to Bloomberg.

The far stronger Chinese data appears to have short circuited rate cut expectations for the time being, and as a result the risk asset response was marginal at best, with US equity futures rising less than 0.2% with gains were capped by disappointing quarterly reports from Netflix and IBM, while the Shanghai Composite flirted with the unchanged line for much of the session before closing just 0.3% higher.

Meanwhile a forecast of faster growth due to demand from China by semiconductor equipment maker ASML, pushed U.S. chipmakers higher in premarket trading, adding to yesterday’s historic Qualcomm gains after the company settled its long-running litigation with Apple; Intel, Advanced Micro Devices and Nvidia gained between 0.5% and 3.6%. At the same time, IBM declined 3.5% after reporting a bigger-than-expected drop in quarterly revenue.

Where things got interesting, is that after a subdued start, European stocks pushed into positive territory after reports China was considering even more stimulus measures to bolster consumption, with autos the notable outperformer, shrugging off weak sales numbers. Meanwhile, the German Government cut its 2019 GDP growth forecast to 0.5% vs. prev. 1.0%, in line with expectations, even as it projects a rebound to 1.5% in 2020; Inflation is seen at 1.5% in 2019, 1.8% in 2020.

This followed an advance in Asian shares, with Japan and Shanghai rising modestly after data showed China’s economic growth, industrial production and retail sales all better-than-expected

With earnings season in full swing, analysts now expect first-quarter S&P 500 profits to have dropped 1.8% year-on-year, according to Refinitiv data. While a solid improvement over recent estimates, it would still mark the first earnings contraction since 2016. Of the 42 S&P 500 companies that have posted so far, 81% have beaten consensus, compared with the 65% average beat rate going back to 1994.

While Brexit news are on the backburner this week, local UK Conservative party chairmen are circulating a petition which seeks an Extraordinary General Meeting to pass a no-confidence vote in PM May. The report states that the party will be obliged to hold a meeting if more than 65 association chairmen sign the motion; so far between 40-50 have signed it, with expectations that the threshold could be passed next week.

In global rates, Bund and USTs grind lower, 10Y German yields rise ~2bps with the long end steady after a decent auction. Gilt curve bear flattens slightly, 10Y Gilt futures find support at Monday’s lows after U.K. inflation stays below target. BTPs trade sideways, peripheral yield spreads all marginally tighter to core.

US Treasury futures broadly held earlier losses spurred by strong Chinese economic data. Yields were cheaper by 1.5bp-2bp from 5-year to long end, less in front end, steepening 2s10s by ~1bp; 10-year yields 2.605% after touching 2.612% during European morning, highest since March 20. Futures volumes were robust through 7am ET, 20% above 20-day average in TYM9.

In FX, the Bloomberg dollar index traded lower but within Tuesday’s range while commodity currencies traded well, with AUD the best performer in G-10, NZD continues to lag after soft inflation data. Yuan strength continues in Europe, rising ~0.4% vs USD following China’s data report.

In commodities, WTI crude traded sideways around Tuesday’s best levels as base metals predictably pushed higher led by copper and aluminium.

On the economic front, a Commerce Department report, due at 8:30 a.m. ET, is expected to show U.S. trade deficit widening to $53.5 billion in February; we also get data on wholesale inventories and the Fed’s Beige Book. Abbott, Morgan Stanley, PepsiCo, and Alcoa are among companies reporting earnings.

Market Snapshot

- S&P 500 futures up 0.2% to 2,916.25

- STOXX Europe 600 down 0.2% to 388.37

- MXAP up 0.2% to 163.92

- MXAPJ up 0.2% to 546.39

- Nikkei up 0.3% to 22,277.97

- Topix up 0.3% to 1,630.68

- Hang Seng Index down 0.02% to 30,124.68

- Shanghai Composite up 0.3% to 3,263.12

- Sensex up 1% to 39,275.64

- Australia S&P/ASX 200 down 0.3% to 6,256.38

- Kospi down 0.1% to 2,245.89

- German 10Y yield rose 1.9 bps to 0.085%

- Euro up 0.3% to $1.1316

- Italian 10Y yield rose 1.6 bps to 2.223%

- Spanish 10Y yield fell 0.4 bps to 1.082%

- Brent futures up 0.7% to $72.23/bbl

- Gold spot little changed at $1,276.03

- U.S. Dollar Index down 0.2% to 96.88

Top Overnight News from Bloomberg

- China’s economy rebounded through the first quarter, offering the government room for maneuver as trade negotiations with the U.S. enter a crucial stage. The economy expanded 6.4%, exceeding economist estimates. Factory output and retail sales also beat expectations in March to ease concerns about a slowdown

- Investors are the most optimistic on the euro in a year as conviction grows that Europe’s economy is recovering. Three-month risk reversals on the common currency, a gauge of sentiment, have turned in favor of calls over puts

- U.K. inflation unexpectedly stayed below target last month. The figures means wages are rising faster than prices, a boost for consumer spending, key for the British economy. The lack of headline inflationary pressure gives policy makers breathing space to keep interest rates on hold until the Brexit crisis is resolved

- Germany’s gross domestic product is to grow 0.5%, half as much as previously forecast amid slowing global expansion and concerns over Brexit and trade disputes, the economy ministry said on Wednesday.

- Foxconn billionaire founder Terry Gou announced Wednesday he’s running for Taiwan’s presidency, shaking up a race that will determine whether the island moves closer to China. Foxconn Technology Group is the main assembler of iPhones

- GAM Holding AG jumped the most since December after the company reported slowing outflows and said it would soon complete the liquidation of its scandal-hit bond fund

Asian equity markets traded indecisively following the cautious gains on Wall St due to mixed earnings and as the region failed to fully benefit from a slew of better than expected Chinese data. ASX 200 (-0.3%) was negative with the index led lower by underperformance in the mining sector after BHP reported weaker quarterly production numbers and amid declines in Chinese iron ore prices after Vale received approval to resume Brucutu mine operations, while Nikkei 225 (+0.2%) was positive although initial price action had mirrored a choppy currency. Hang Seng (U/C) and Shanghai Comp. (+0.3%) were indecisive with only brief support seen despite the better than expected Chinese GDP, Industrial Production and Retail Sales, as some suggested the data dampens prospects of PBoC action and after the central bank also recently suggested a preference for restraint in its quarterly monetary policy document. Furthermore, the PBoC conducted a liquidity injection of CNY 160bln through 7-day reverse repos but only announced CNY 200bln in MLF loans vs. the expiring CNY 366.5bln. Finally, 10yr JGBs were marginally lower as Japanese stocks remained afloat and on spillover selling from T-notes, while the US 30yr yield eyed the 3.0% level for the first time in nearly a month. Japan and the US have agreed to accelerate trade talks after an initial meeting in Washington suggested the two nations will stick to a narrow range of subjects

Top Asian News

- PBOC Trims Liquidity Supply in Sign It’s Dialing Back Stimulus

- Nippon Paint Buying Australia’s DuluxGroup for $2.7 Billio

- Jokowi Takes Early Lead in Unofficial Indonesia Vote Counts

- Turkish Opposition Claims Win in Istanbul After Vote Recount

- Singapore Takes Over Water Plant at Heart of Hyflux Debacle

Major European indices are little changed [Euro Stoxx 50 +0.1%] following on from indecisive overnight trade as Asian equity market were unable to capitalise on the strong Chinses data. The AEX (+0.2%) is marginally outperforming its peers, boosted by index heavyweight ASML (+1.5%) who have around a 12% weighting in the AEX and are higher following their earnings and the Co. confirming their full year guidance. Sectors are mixed, with underperformance seen in material names at the open, with the sector weighed on by BHP (-2.6%) after the Co. lowered their FY19 output guidance and Rio Tinto (-2.8%) in the red after being downgraded. Other notable movers this morning include ABB (+5.4%) following earnings and the surprise resignation of the Co’s CEO Spiesshofer, after being unable to placate shareholders with the sale of their power grid division in December. Elsewhere, Roche (+0.1%) have fallen from opening highs of around 1.6%; however, price action for the Co. was initially driven by the announcement that they are raising FY19 outlook to mid-single digit growth vs. Prev. low-mid single digit range, alongside expectations for further dividend increases.

Top European News

- Tech Stocks Outperform on ASML, Ericsson Results, Chip Gains

- Italy’s Populist Leaders Besiege the Central Bank, Lenders

- Juventus Plunges as Champions League Upset Sends Ajax Soaring

- ABB Chief Steps Down After Power-Grid Split Fails to Impress

- Pendragon Tumbles as U.K. Car-Price Slump Forces Strategy Review

In FX, first we look at USD, CNY – China’s economy unexpectedly held up in Q1 despite a slew of calls for a March bottom. GDP growth for the quarter topped estimates at 6.4% Y/Y, within the country’s 2019 target of 6.0-6.5%, whilst March IP and retail sales beats also provided extra impetus for the Yuan which breached 6.70 to the downside against the Dollar to print a low of just above 6.68. Hence, DXY lost the 97.000 handle upon the release and continues to edge lower in early EU trade. The Dollar index currently resides just off lows of 96.810 ahead of its 50 DMA at around 96.800. A light calendar for the US sees February trade data released at 13:30BST, ahead of Fed voter (and notorious dove) Bullard’s speech on the US economy and monetary policy.

- AUD, NZD – The Aussie is the marked beneficiary from the upbeat Chinese data wherein the jump in industrial production and a maintained GDP growth aided AUD/USD to briefly reclaim 0.7200 to the upside (from an intraday low of 0.7150) for the first time since February. The pair currently resides just below the figure, albeit above its 200 DMA at 0.7193 with Aussie jobs data on the overnight docket. Note: around USD 1.5bln options are set to expire between strikes 0.7190-7200. Conversely, the Kiwi does not bode so well amid dismal CPI figures in which markets pricing for a May OCR cut shifted to above 50%. On a brighter note for the NZD/USD, the overnight Chinese data resurrected the currency from a low of 0.6670 (vs. pre-data high of 0.6775) before stabilising above its 200 DMA at around 0.6730.

- EUR, GBP – An upbeat day for the Euro thus far amid the weakness in the Buck. The single currency was little swayed by the release of unrevised EZ inflation finals and the German government’s cut to 2019 GDP growth forecasts as was widely expected. EUR/USD breached its 50 DMA at 1.1300 to the upside in early hours and remains north of the figure where 1.4bln in options are set to expire at today’s NY cut. Elsewhere, Sterling took a hit from the benign inflation figures in which headline inflation printed at 1.9%, below the forecast 2.0%. As such, Cable lost the 1.3050 handle and resides close to session lows at 1.3033 ahead of its 50 WMA at 1.3029. ING argues that “British Retail Consortium had suggested that wholesale food costs had risen, on the back of adverse weather and higher global commodity prices”, hence overall inflation could be bumped up next month, possibly to the 2% target when combined with the rise in household energy caps. GBP now awaits for any potential direction from BoE Governor Carney scheduled to speak at 14:00BST.

- CAD – Another G10 winner from the pullback in the Dollar, also underpinned from the rise in oil prices following last night’s surprise drawdown in API stocks. USD/CAD currently resides below its 100 DMA at 1.3327, having briefly breached its 50 DMA to the downside at 1.3314 ahead of Canadian inflation data this afternoon, with headline expected to tick up to 1.9% from 1.5%.

- New Zealand CPI (Q1) Q/Q 0.1% vs. Exp. 0.3% (Prev. 0.1%). (Newswires) New Zealand CPI (Q1) Y/Y 1.5% vs. Exp. 1.7% (Prev. 1.9%) New Zealand RBNZ Sectoral Factor Model Inflation 1.7% (Prev. 1.7%)

In commodities, Brent (+0.6%) and WTI (+0.6%) prices are firmer with prices supported by the unexpected API draw of 3.1M vs. Exp. build of 1.7M. Elsewhere, strike action at Shells Pernis oil refinery [capacity of 404k BPD] is still ongoing, with most recent updates that union leaders state that the refinery is to remain at 65% operating rate, and there is currently no indication of when the refinery will return to full operation. Separately, Saudi Aramco are reportedly to purchase the 50% stake that Shell currently owns in SASREF, which is a joint venture between the two Co’s with a refining capacity in excess of 300k BPD. Later in the session we have the EIA weekly report, and due to scheduling for Easter holidays the Baker Hughes rig count will be released Thursday April 18th. Gold is flat and trading within a narrow USD 4/oz range, with price action from the softer dollar and stronger than expected Chinese data largely cancelling each other out. As such the yellow metal, is trading just above the prior sessions low of around USD 1272, which was the metals lowest level since December 27th. Elsewhere, the world’s largest iron ore miner Vale say they intend to resume operations at their Brucutu operations within the next 72 hours weighing on both the mining index and iron ore prices.

US Event Calendar

- 7am: MBA Mortgage Applications -3.5%, prior -5.6%

- 8:30am: Trade Balance, est. $53.4b deficit, prior $51.1b deficit

- 10am: Wholesale Inventories MoM, est. 0.3%, prior 1.2%; Wholesale Trade Sales MoM, est. 0.3%, prior 0.5%

- 12:30pm: Fed’s Harker Speaks on the Economic Outlook

- 12:45pm: Fed’s Bullard Speaks at Hyman Minsky Conference

- 2pm: U.S. Federal Reserve Releases Beige Book

- 5:30pm: New York Fed’s Logan Speaks at Money Marketeers of New York

DB’s Jim Reid concludes the overnight wrap

Over the last two days I’ve been doing an internal DB scheme where MD’s have multiple open door slots for more junior staff. The expectation is that we connect with people at an earlier stage of their career from all over the firm and offer them any guidance we can give. There were quite a few recent graduates signed up and in having the enjoyable meetings I couldn’t help chuckle at how different my experience as a graduate was in the mid 1990s to those we hire today. In my first two years (in sales) I got 30 people’s breakfast and coffees every day, burned through two suits with all the loose change making holes in my pockets, photocopied 100 x 50 pages of corporate bond price sheets everyday to be on all sales and traders desk by the time they got in at 7am and was generally treated like an errand boy. At one point I was asked to go 5 miles in a taxi to get food from my then boss’s favourite fish and chip shop one Friday lunchtime. My favourite memory though was that every grad was given an older mentor outside of his area to use as a sounding board. However my one was a grumpy guy in his late 40s who couldn’t think of anything worse than being a mentor. He was forced to take me out to lunch in my earliest days but instead took a friend of his and asked me to sit at the bar while he dined with his friend. I didn’t go back to him for any subsequent advice I sought. So it’s fair to say that the City has changed for the better over the last 25 years. So if any graduate wants some advice I’ll be very happy to provide it… in return for a coffee, a bacon sarnie and a fish supper!!! And maybe some painting and decorating at home!

We’re straight to Asia this morning where the latest Chinese growth data and activity indicators are out. They confirm our 2019 belief that the economy is improving as China’s mini stimulus filters through the economy. To start with China’s Q1 GDP came in one tenth above expectations at 6.4% yoy while all of the March activity indicators surprised on the upside with industrial production surging at +8.5% yoy (vs. +5.9% yoy expected) – the highest since July 2014. Retail sales printed at +8.7% yoy (vs. +8.4% yoy expected), YTD fixed assets ex rural came in line with consensus at +6.3% yoy and the jobless rate fell one tenth to 5.2%. This data confirms what we’d been expecting given the credit impulse numbers in recent months and should help European data over the coming weeks. The downside to the numbers will be a more hawkish PBOC. Their monetary policy statement yesterday described the appropriate policy stance as “moderately tight” and it seems today they injected much less liquidity into the market as was expected. So that’s the only sting in the tail to these numbers.

China’s markets have probably been weighing up these conflicting forces as the Shanghai Comp is currently trading flat after oscillating between gains and losses of as much as +0.47% and -0.42% respectively. Meanwhile, the Hang Seng (-0.22%) is down while the Nikkei (+0.29%) and Kospi (+0.02%) are up. Elsewhere, futures on the S&P 500 are trading flat (+0.07%).

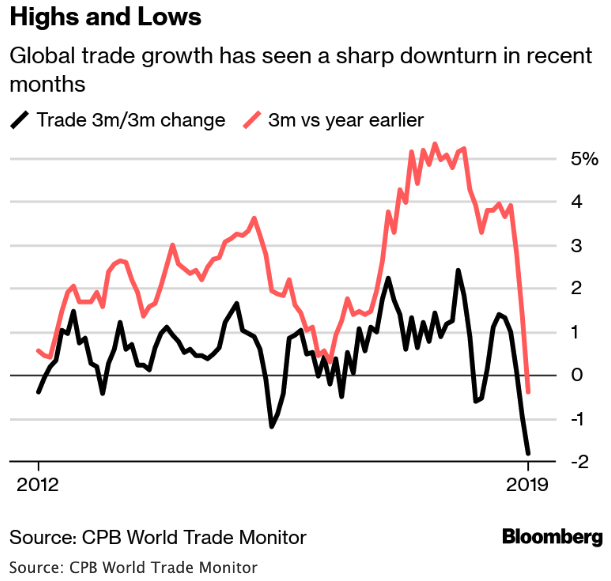

In other news, Japan’s economy minister Toshimitsu Motegi said that the first phase of trade talks with the US focused on agriculture and cars, with digital trade set to be discussed at a later date. He added, “From the next session onwards we will speed up discussions toward an early agreement, and will discuss digital trade at an appropriate time.” This morning we saw Japan’s March trade data with the adjusted trade balance standing at -JPY 177.8bn (vs. -JPY 242.5bn expected) as a slowdown in imports (at +1.1% yoy vs. +2.8% yoy expected) outpaced a slowdown in exports (at -2.4% yoy vs. -2.6% yoy expected), marking the fourth consecutive month where exports have shrunk.

The moves this morning follow another fairly damp squib of a day on Wall Street yesterday, albeit one which ended with markets nudging a bit higher. Indeed global equities edged up across the board as did bond yields. The S&P 500 finished +0.05% with volumes over 10% below average and with an intraday range of 0.96% which was the 6th smallest this year. It wasn’t a lot different for the NASDAQ (+0.30%) and DOW (+0.26%), with all three major US indexes now hovering within 2% of their all-time highs. Prior to this, the STOXX 600 edged up +0.29%. US HY spreads ended -3bps tighter while Treasuries (+3.6bps) nudged back up to 2.591%, their highest level in a month, with the move driven by real yields not inflation breakevens. The 2s10s yield curve steepened 1.8bps to 17.9 bps, edging toward the top of its year-to-date range of between 12-20 bps.

With bigger fish to fry for markets including this morning’s China data and the PMIs tomorrow though, it was earnings which by and large dictated the tempo yesterday with the headline reporters being Bank of America before the bell and Netflix after. Like all the other US banks so far, BoA earnings beat while sales also came ahead of consensus, though management also pointed towards an expected slowdown in net interest income for the remainder of the year. The share price pared a loss of -2.82% to end the session +0.10%, as the broader banks index advanced +1.35%, partially boosted by the rise in treasury yields. Morgan Stanley numbers – the last of the big US banks to report – are out today.

Away from BofA we also saw earnings beats for Blackrock (shares +3.24%) and Johnson & Johnson (+1.10%), though UnitedHealth (-4.01%) disappointed. Their CEO said that US political proposals for universal health insurance would result in “wholesale disruption” to the existing healthcare industry. After the close Netflix’s earnings basically met expectations overall as first quarter subscriber growth beat consensus forecasts but the company’s estimates moving forward were lower than expected. The share price slipped -0.84% overnight. Separately, freight giant CSX shares rose +4.63% after the close on strong profits and shipping volumes. It’s still very early in earnings season with just under 10% of the names having reported so far but the trend has been for a large number beating earnings expectations (39 out of 46) but only half (23 out of 46) beating sales expectations. Separate from the earnings reports, news (Bloomberg) broke late in the session that Qualcomm and Apple had settled all of their worldwide litigation, with Apple agreeing to pay a one-time fee as well as royalties for the next six years. Qualcomm said they expected a $2 per share boost to earnings, and its shares led gains for the NASDAQ, advancing +23.21%. Apple shares closed flat.

There was also a little bit of macro news to feed off, specifically a couple of ECB stories. The first was a headline on Reuters stating that “several” ECB policymakers had doubts about projections for a growth rebound in the second half of this year, however this appeared to be more about forecasting methodology rather than policy. About an hour later though a story on Bloomberg suggested that ECB officials lacked enthusiasm for sub-zero tiering. The full story suggested that ECB policy makers weren’t opposed to examining the impact however were yet to be convinced of the merits of a switch to tiering. European Banks lost about half a percent post the story hitting however within minutes had pared that move and ultimately ended the day with a steady +1.06% gain as bond yields climbed. The euro actually reacted more to the first story but also retraced the move to end the day -0.18%. 10y Bunds saw a mini rollercoaster after hitting 0.072% early on (ZEW helped – see below) before hitting an intraday low of 0.038% an hour later around the ECB headlines before ending 0.065%, +1.0bps higher on the day. Tomorrow’s PMIs are the next major landmark for bunds.

Also on the macro front, our global economic research teams from Europe, the US, Japan, and China pooled their expertise and published a report yesterday examining the policy space available to combat the next recession. Their report looks at the monetary and fiscal options in the four major economic zones. The US and China have the most scope to use monetary policy, while all countries have the potential to employ fiscal measures. The full report with details for each region is available here .

In other news, the data that was out yesterday played second fiddle to earnings and the ECB stories. Nevertheless for completeness in the US industrial production disappointed a bit in March, coming in at -0.1% mom versus expectations for +0.2%. Manufacturing production also came in below market (0.0% mom vs. +0.1% expected), while it was noted that vehicle production dropped -2.5%. A drop in capacity utilisation also followed to 78.8% while later on the April NAHB housing market index reading printed 1pt higher at 63, as expected.

Prior to this, in Germany the ZEW survey of expectations for April rose more than expected to +3.1 (vs. +0.5 expected) from -3.6 in the month prior. A reminder that the March reading saw an improvement of 9.8pts and in fact we’ve now seen this reading rise for six consecutive months and turn positive for the first time in over a year. There’s a bit of debate as to how useful this is as a macro forecasting tool however with the PMIs a much bigger focus unsurprisingly. Meanwhile, here in the UK wage growth stayed put at +3.4% 3m/yoy and the unemployment also held steady at 3.9%. Both signalling continued strength in the labour market.

To the day ahead now, which this morning includes more data out of the UK where the March CPI/RPI/PPI data docket is due. Not long after that we’ll get the final March CPI revisions along with the February trade balance for the Euro area, while this afternoon in the US we’ve also got the February trade balance, as well as February wholesale inventories and trade sales data. The Fed’s Beige book is also due tonight while scheduled speakers include the BoE’s Carney, ECB’s de Galhau and Lautenschlaeger, and the Fed’s Harker, Bullard and Logan. Germany’s Economy Minister Altmaier will also present Germany’s latest economic forecasts, while the earnings highlights include PepsiCo and Morgan Stanley.

via ZeroHedge News http://bit.ly/2PfleJF Tyler Durden