Submitted by David Stockman via Contra Corner blog,

That was quick. With practically of the Brexit loss recovered in four days and the market now up for the quarter and the year, what’s not to like?

After all, the central banks are purportedly at the ready, and, in the case of the ECB and BOE, are already swinging into action according to their shills in the MSM. MarketWatch thus noted,

Markets were boosted by reports indicating the European Central Bank is weighing changes to its bond-buying program, while “the Bank of England also said they are all in,” said Joe Saluzzi, co-head of equity trading at Themis Trading.

The European Central Bank is considering changing the rules regarding the types of bonds it can buy as part of its stimulus package to amid concerns it could run out of securities to buy under current stipulations, according to Bloomberg News. The report followed comments from Bank of England Gov. Mark Carney, who indicated the central bank is poised to further ease monetary policy to combat

Well now, by the sound of it you would think that the madman Draghi is fixing to uncork the mother of all QEs if there is a danger that the ECB will “run out of securities to buy”.

Who would have thought that the debt engorged governments of the eurozone couldn’t manufacture enough IOUs to satisfy Mario’s “buy” button? In fact, with public debt at 91% of GDP you would think that the $12.5 trillion outstanding would be more than enough to go around.

It turns out, however, that the operative phrase is “under current stipulations”. In a fit of apparent prudence, the ECB determined that in buying $90 billion of government bonds and other securities per month, it would only purchase securities with a yield higher than its negative 0.4% deposit rate.

That’s right. Stumbling around in their monetary puzzle palace, the geniuses at the ECB determined that subzero rates are just fine with one condition. Namely, so long as they don’t have to pay more to own German bonds, for example, than German banks are paying to deposit excess funds at the ECB.

Stated differently, the ECB apparently determined it will not go broke in subzero land even if it is driving insurance companies, pension funds, banks and plain old savers in exactly that direction.

But then comes the catch-22. The more bonds Draghi promises to buy, the more the casino front-runners scarf-up those same bonds on 95% repo leverage—-knowing that Mario will gift them with a big fat gain on their tiny sliver of capital at risk.

That drives bond prices ever higher and yields lower, of course. At length, the stampede to buy today what Mario is buying tomorrow has driven yields below the negative 0.4% cutoff point for an increasing share of the German yield curve.

The Brexit event only compounded the absurdity. As shown below, it caused another $1.3 trillion of worldwide sovereign bonds to enter the subzero zone. This brought the global total to $11.7 trillion or 26% of all government debt outstanding on the planet, including more than $1 trillion each of German and French government debt and nearly $8 trillion of Japanese government debt.

Especially notable in the above chart is the swelling amount of longer-term debt now trading at negative yields. This means that the ECB’s insensible “scarcity” problem just got worse.

In part, that’s because the ECB’s money printing rules require its bond purchases to be allocated on roughly a pro rata basis among its member countries.

So the punters who piled into bunds in response to the Brexit event, drove even more of the German yield curve below the ECB’s negative 0.4% cut-off points. There is now a “no buy zone” out to 8-years on the German government yield curve.

Nor is that the extent of the subzero lunacy. As also indicated in the chart, the Swiss yield curve is negative all the way out to 48 years, where the bond actually traded at -0.0082%, and the JGB 40-year bond yields a scant 6 basis points.

Yes, by 2056 Japan’s retirement colony will be bigger than its labor force, and its fiscal and monetary system will have crashed long before. But no matter. Before it self-destructs, the BOJ will buy all the Japanese government debt, anyway. It already owns 426 trillion yen worth—an amount that equals fully 85% of GDP.

When it comes to government debt, therefore, it can be well and truly said that “price discovery” is dead and gone. Japan is only the leading edge, but the trend is absolutely clear. The price of sovereign debt is where central banks peg it, not where real money savers and investors will buy it.

Needless to say, this is something new under the sun, and not in a good way. While the casino’s day traders may not have noticed that NIRP has not always been with us, this graph shows how rapidly the contagion is spreading. In less than 2-years, one-quarter of the world’s sovereign debt has slid into the nether region of NIRP.

Paying governments to borrow money makes carrying coals to Newcastle sound like a vast understatement. But in today’s unhinged casinos the gamblers care not a wit.

The culture of stimulus entitlement has become so embedded that the age-old truth that governments are inherently dangerous fiscal miscreants has been completely lost. The only thing the “market” looks at is how soon the next dollop of stimulus will be coming down the pike.

But the destruction of price discovery in the sovereign debt market is not simply an academic curiosity to be jawed about by the few remaining fiscal scolds in the world. To the contrary, it is already having massive toxic consequences in the arenas of fiscal governance and capital markets alike.

As to the former, consider the case of France and its $1 trillion of negatively yielding government debt. That amounts to nearly one-half of its relentlessly rising total, which has grown by nearly 50% just in the last nine years, and now amounts to 85% of GDP.

The fact is, France is a socialist basket case in which the state is steadily and surely devouring the entire private economy. The state share is now pushing 57% of GDP, and it has not stopped climbing toward the upper right of the graph for nearly four decades.

Yet France is now being paid to spend and borrow even more, thereby begging a self-evident question. What happens when France’s tax and dirigisme impaired economy sinks into permanent decline (its almost there now) and the ECB is finally forced to shut down its printing press?

Nor is the eventual collapse of France $2.4 trillion sovereign bond bubble necessarily a matter for the distant by-and-by.

The populist candidacy of Marine Le Pen was already well in the lead for France’s 2017 presidential election. Brexit has now given dramatic new impetus and credibility to her anti-EU platform.

Even the possibility of a Frexit win next year would trigger a relentless wave of selling by the Draghi front-runners who were today buying the 10-year bond of this terminal-ill state at a mere 7 basis point yield.

Stated differently, in theory the clueless Draghi is pegging French bond rates in the subzero zone in order to jump start inflation. In practice, he is setting up a monumental FED (financial explosive device) that could erupt at any moment owing to Frexit risk, European recession, a German revolt at the ECB or numerous other potential catalysts.

The hair-trigger risk embedded in the financial insanity of sovereign ZIRP was neatly illustrated by Wolf Richter in a recent post on this topic. What he pointed out in the case of the German bund is applicable to the entire $11.7 trillion of subzero debt outstanding.

To wit, the front-runners and bond market speculators are sitting on giant capital gains that were caused by the systematic falsification of bond prices by the central banks. You don’t have to be a bond quant to understand that any serious break in confidence will cause these punters to grab their gains and dump there bonds:

What does this mean for investors that bought bonds with long maturities years ago? For example the German 4.75% Bund, issued in 2008 and due in July 2040 trades at 202.3 cents on the euro, having doubled its value over the past eight years. The sellers of those bonds are the true beneficiaries of Draghi’s monetary policies, and they can sell them right to the ECB.

This observation puts the lie to a related Wall Street delusion. The crowd which insists there is no bond bubble—– notwithstanding that fully $25 trillion of government debt is yielding 1% or less—–says its just Mr. Market discounting a weak, deflationary economy in the period ahead.

No it’s not. It’s the law of supply and demand at work.

Between the $21 trillion of debt already owned by the central banks, and the trillions more held by front-running speculators who expect them to buy more, there is a big fat thumb on the scale; and, as a consequence, there are hideously large and unearned windfalls being captured by these same speculators.

Ironically enough, when the bond bubble eventually blows, ground zero for the meltdown is likely to be among Italy’s $2.4 trillion of outstandings—–some part of which was issued during Mario Draghi’s days at the Italian treasury.

The notion that today’s yield of 1.15% on the Italian 10-year bond even remotely compensates for the risk embedded in Italy’s fiscal and economic chamber of horrors is just plain laughable. And that’s to say nothing of the risk the Brexit is just stage one, and that the EU itself will ultimately succumb to a wave of populist insurgency, including a Five Star led move to take Italy out of the euro.

Indeed, Italy is truly a case of the blind leading the blind. Its giant, bloated banking system is essentially insolvent with nearly $400 billion in NPLs (non-performing loans), but Italy’s languishing economy would be toast if it’s banks are not propped up by the state or an EU bailout.

That’s because the footings of Italy’s banking system exceed $4.4 trillion or more than 2X the size of its GDP. On a comparable scale basis, current US aggregate banking balance sheets of $15 trillion would be upwards of $40 trillion. That is to say, Italy’s massive banking sector suffuses every nook and cranny of its $2 trillion economy.

As shown below, footings have nearly tripled during the past 16 years, even as Italy’s economy remains smaller in real terms than it was in 2007.

And that’s not the half of it. In addition to the massive trove of bad loans to the private sector, embedded in the total footings shown below are nearly $400 billion of Italian government bonds.

Needless to say, these securities are vastly over-valued owing to the Draghi bond-buying spree, and they would plummet in price were the speculators who have been front-running Draghi’s QE campaign ever to loose confidence in the ECB or the ability and willingness of an Italian government to continue the giant fiscal charade now in place.

As it happens, that existential challenge is materializing right now. Italy’s major banks are bleeding losses, and have been subject to a massive sell-off in the stock market. Share prices are down 50% to 75% since the beginning of the year alone.

So the Renzi government has been desperately attempting to organize a bailout, but has run smack into the kind of catch-22 that’s buried everywhere in the jerry-built EU bailout regime. To wit, under the new EU banking rules which became effective in 2016, Italy cannot inject government funds into its banking system until it has first forced a trauma-inducing “bail-in” at any bank getting aid.

That not only would mean massive losses for depositors and bank debt-holders, but also the instant collapse of the Renzi government. Italy’s third largest and most insolvent bank, in fact, is virtually an auxiliary of his social democratic party.

Accordingly, Renzi attempted to get a waiver of the new rules on the grounds that the Italian banking crisis has been dramatically intensified by the Brexit shock. But Merkel shot that down at yesterday’s EU leaders meeting faster than it could be translated into German for a powerfully self-evident reason. Namely, that the new bail-in rules are designed to prevent new fiscal crisis in member states and the need for more German funded bailouts.

Now Italy faces the real possibility of a depositor run on its banks, and a devastating liquidity crisis in its $4.4 trillion banking sector. Accordingly, it has apparently been authorized by the EU to establish a back-up liquidity line of up to $150 billion, but under EU rules it can only be used for solvent banks——of which Italy doesn’t have many.

Needless to say, that won’t solve the problem, but could force the kind of showdown with Brussels and Berlin that is the very reason why the EU’s days are numbered. As Zero Hedge observed,

Brexit will be just the scapegoat used by Renzi and Italy to circumvent any specific eurozone prohibitions. And if it fails, all Renzi has to do is hint at a referendum of his own. Then watch as Merkel scrambles to allow Italy to do whatever it wants, just to avoid the humiliation of a potential “Italeave.”

In short, either the EU opens up the floodgates to a renewed round of bailouts, which would likely result in the collapse of Merkel’s government, or it authorizes Italy to spend upwards of $50 billion to recapitalize its banks and keep the $400 billion of government debt they hold safely in their vaults.

Then again, with public debt already at 133% of GDP, why would anyone except Mario Draghi’s printing press be buying 10-year bonds at a 1.15% yield?

Once upon a time, price discovery by the bond vigilantes kept governments quasi-sober and functionally solvent. No more.

The Italian Job now underway is just the opening round in a world of failed states and broken markets.

Needless to say, the vast falsification of sovereign debt prices has not happened in a vacuum. It has caused a massive scramble for yield among bond managers and homegamers alike, which, in turn, has distorted and deformed the corporate debt markets like never before.

The $400 billion or high yield bonds and loans now being gutted and liquidated in the shale patch are but one example. The record level of money flows into newly minted subprime auto lenders and CLO funds are another.

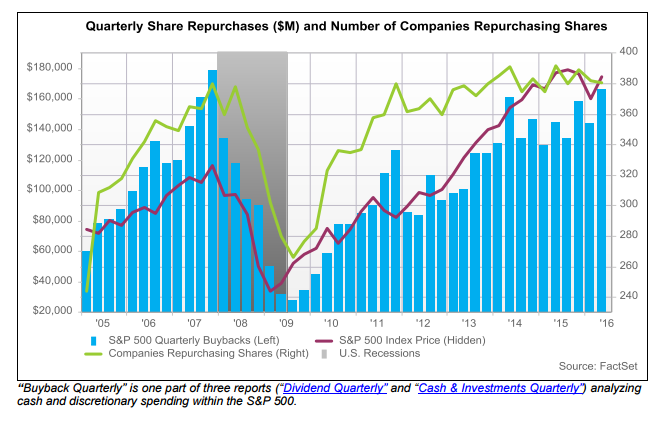

In the US alone, corporate bonds outstanding have risen from $3 trillion on the eve of the financial crisis to upwards of $7 trillion today. Overwhelmingly, that massive gain in outstandings have been cycled back into the casino to fund financial engineering schemes, most especially share buybacks.

In a word, without honest price discovery the debt markets of the world have been transformed into a massive doomsday machine. They are paying governments to bankrupt themselves in the subzero zone, while incentivizing the C-suite to strip-mine their balance sheets in order to goose their stock prices today, even as they fatally impair their capacity to compete and grow in the future.

As we said – price discovery, R.I. P.

via http://ift.tt/29hHGAb Tyler Durden