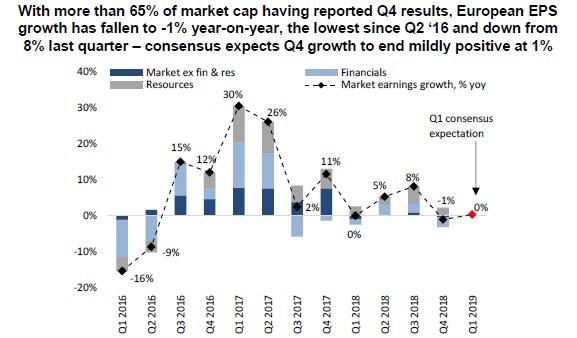

On Friday, we reported that with more than 65% of Europe’s public companies having reported results, historical Q4 European EPS growth stands at -1% year-on-year, the lowest since Q2 2016 and down from 8% for the full Q3 earnings season.

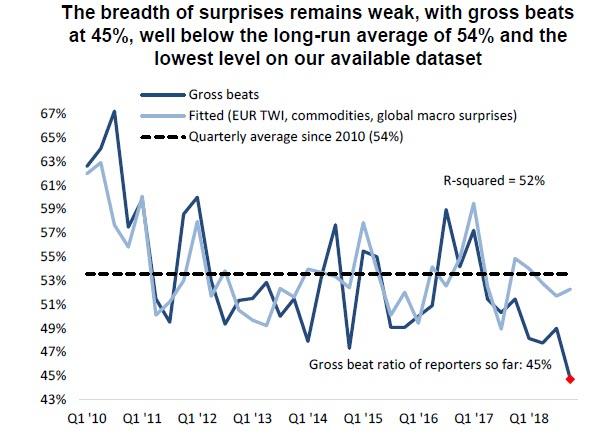

This, as Deutsche Bank observed, is a material 3% disappointment relative to consensus expectations for the companies that have reported so far and the largest negative surprise in four years. Just as bad, the breadth of “earnings beat” surprises, at 45%, is at the lowest level since at least 2010 and is below the long-run average of 54%.

What is even worse, however, is that as of this moment consensus expects European companies to post no growth in the first quarter, a number that is certain to deteriorate over the next few weeks, and indicating that Europe will almost certainly see two consecutive quarters of declining corporate profits, the definition of an earnings recession.

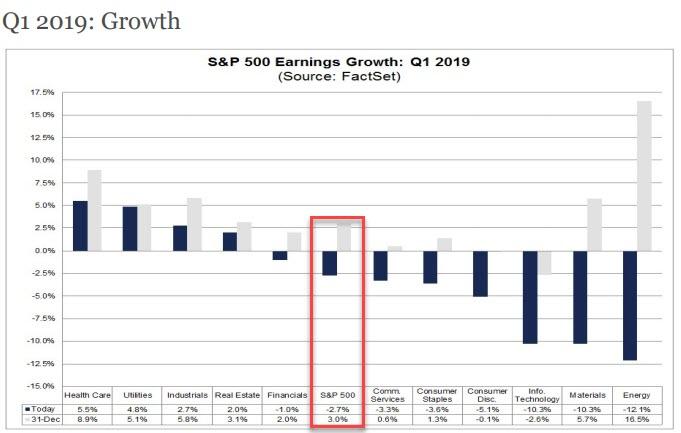

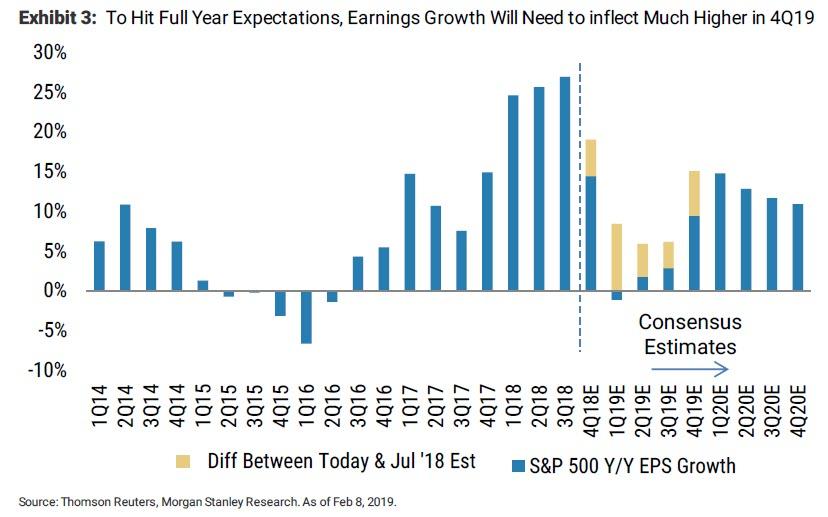

While not quite there yet, even though Morgan Stanley’s Mike Wilson recently claimed that the US is also about to enter an earnings recession, ironically after one of the strongest years for corporate profits on record, the picture of American companies is not much better. Not only is an above average number of companies issuing negative EPS guidance for Q1 2019 (of the 93 companies providing official guidance, 68 or 73%, have issued negative EPS guidance), but consensus EPS for Q1 is now deep in the red. According to Factset, the average Wall Street forecast now projects Q1 earnings per share to decline by 2.7% Y/Y, worse than a consensus -0.8% forecast drop three weeks ago, and starkly lower than the +3% EPS growth expected for Q1 at the start of the year.

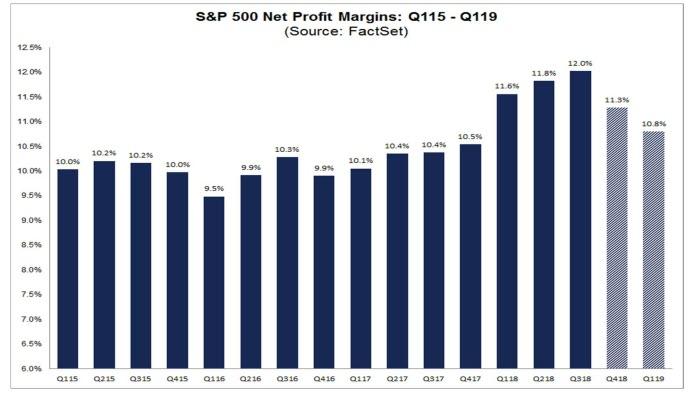

In a troubling twist, this EPS drop is taking place even as companies continue to buyback record amounts of stock (according to BofA’s client tracker, corporate repurchases are running 98% YTD compared to the same period last year when as a reminder, total announce buybacks topped a record $1 trillion). More perplexing is that the EPS drop will take place even as S&P500 revenue is still expected to post a solid 5.2% Y/Y growth, suggesting that profit margins peaked some time in 2018 and are now declining, as the following chart from FactSet shows.

The silver lining – for now – is that Q2 earnings are still expected to post a modest rebound and rise 0.7% from the prior year, then rebound even more strongly into the second half of the year, with consensus Q3 EPS growth of 2.2% Y/Y quadrupling to 8.8% by the fourth quarter.

Is such a hockey-stick rebound in EPS likely? Not according to Morgan Stanley’s Mike Wilson, who two weeks ago wrote that “we are increasingly convinced that consensus earnings expectations for 2019 have further to fall and that the optimistic uptick currently baked into 4Q19 estimates is unlikely to happen. A modest further decline in earnings will deliver the earnings recession we called for. “

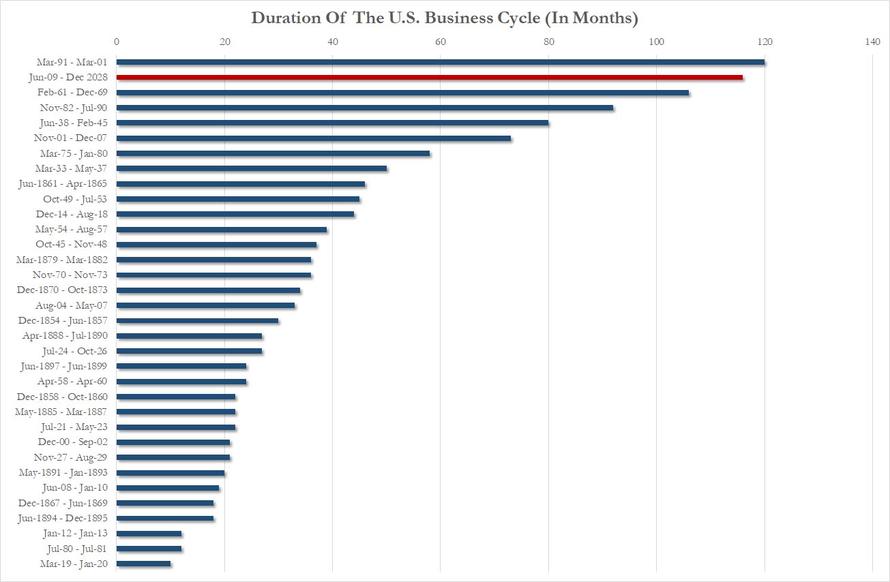

So let’s assume an earnings recession does take place, as Q1 and Q2 EPS both contract on an annual basis? What happens then: would that spell the end of America’s second-longest ever expansion, which clocking in at 116 months is second only to the 120 month long expansion that started in 1991 and ended with the bursting of the dot.com bubble?

Conveniently that is precisely the topic of a recent note out of Goldman’s economists who worked all Saturday to rescue the “

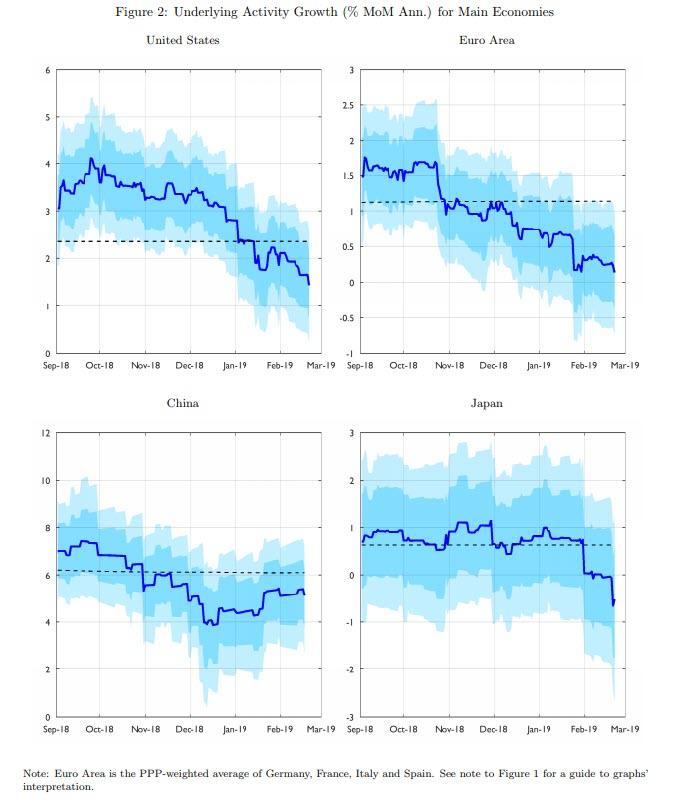

“economic growth” narrative, even as real-time economic growth indicators suggest that the US is perilously close to stall speed and following Europe and Japan into entering a contraction as the following charts from Fulcrum Asset Management show:

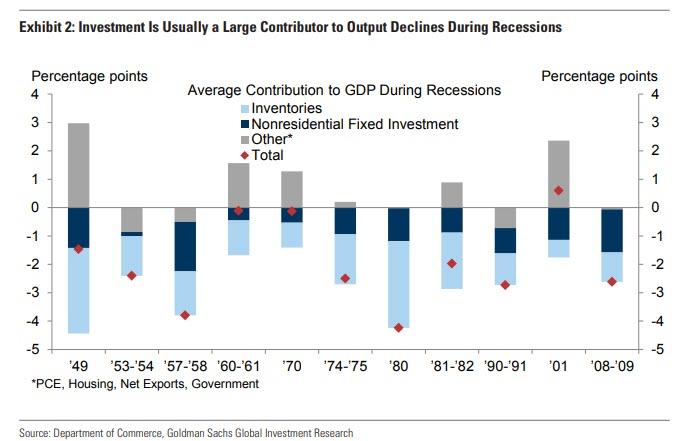

So what does Goldman say? On one hand, the empirical evidence is hardly encouraging. As the bank admits, “in the past, business investment—which is closely tied to profitability—has often been a large contributor to economic recessions. Additionally, weaker corporate profits have often led to significant tightening in our financial conditions index (FCI).”

Expanding on this, Goldman next estimates that a 10% decline in profits lowers GDP growth by 0.6pp, “with contributions from the capex profitability and FCI channels.” And so, if earnings growth were to slow 15% – as consensus now expected, this would imply a nearly 1% direct hit to GDP growth. With GDP already tracking around just above 1% based on various nowcasts, that would put the US precariously close to 0% growth.

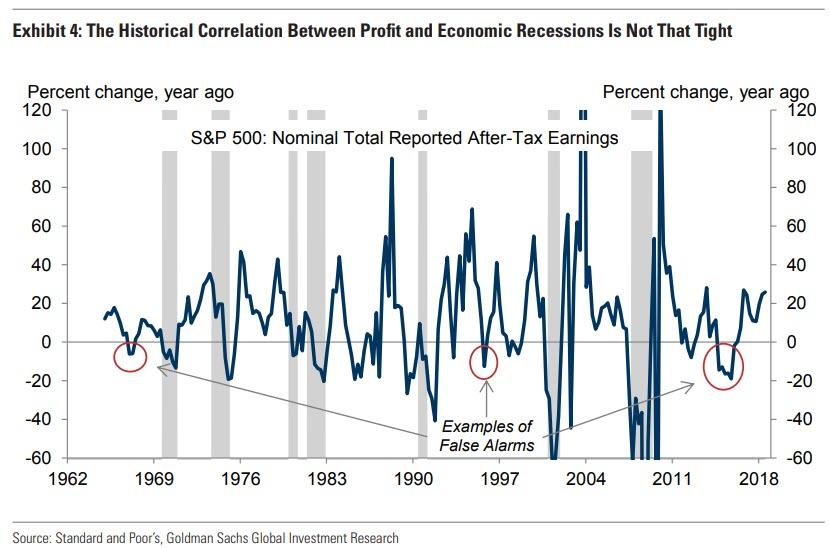

That’s the bad news, because as noted above Goldman’s note was not to cement the recession narrative but to deflect from it. To do that, Goldman observes the historical track record, to analyze the historical signal from earnings recessions and revisions to earnings forecasts. The good news here is that, as the chart below shows, the historical correlation between earnings recessions— defined as quarters with negative year-over-year profit growth — and official, NBER economic recessions is not all that tight, and in fact, “13 of the 22 S&P 500 earnings recessions on record were not followed by an economic recession within the next two years.” Here Goldman highlights both 1995 and especially the 2015 EPS swoon to note that earnings recession have on various occasions sent false alarms about economic recessions, even though economists have demonstrated that the 2015 earnings recession indeed morphed into a “mini” industrial recession. Still, due to the reliance on the service sector, the broader US economy was spared an all out economic contraction.

But Goldman’s bigger point is that even though the US will likely enter an earnings recession, it is expected to be shallow and short-lived. This is a key distinction, at least in Goldman’s model, as the bank finds that “short-lived earnings recessions and earnings downgrades provide little information about growth and recession risk.” Furthermore, the bank’s analysis of earnings revisions suggests that “the FCI tightening effect from a weaker outlook for profit growth on equity and credit markets has occurred already, has likely weighed on recent activity data and is accounted for in our baseline economic forecast.”

But most importantly, much of the Q4 tightening in financial conditions, which to Goldman is the main channel through which weaker profits lower growth, has been unwound by the recent FCI easing.

Translation: the Fed’s dovish U-turn (and the market’s cheering of China’s gargantuan credit injection) appears to have prevented an outright economic recession.

So to summarize Goldman’s cheerful take on the upcoming earnings recession, the bank lays out 4 reasons why it does not anticipate an economic recession:

- First, the historical correlation between earnings and economic recessions is not all that tight. In fact, 13 of the 22 S&P 500 earnings recessions were not followed by a recession within two years.

- Second, lower corporate tax rates contributed nearly half of the roughly 20% growth in S&P 500 earnings in 2018. Much of the profit slowdown reflects the well-anticipated fading of this one-off factor, with minimal growth effects.

- Third, much of the Q4 FCI tightening—the main channel through which weaker profits lower growth—was already reflected in recent activity data and has been unwound by the recent easing.

- Fourth, while cheaper oil and higher labor costs lower profits, their growth effects are mixed. The energy sector’s healthy financial position should limit the hit to energy capex. Comparing industries with high and low labor costs, Goldman finds that faster wage growth raises capex growth as firms substitute capital for labor. Importantly, cheaper oil and higher wages should also support consumption.

Goldman’s punchline: “Taken together, weaker profit growth is likely to weigh somewhat further on economic activity but does not indicate an impending economic recession. The key reasons are that much of the Q4 FCI tightening has been unwound by the

recent easing and that much of the slowing in profits reflects factors with limited growth effects, such as the tax one-off, cheaper oil, and higher wages.”

So if Goldman is right, and an economic recession is averted, what then? The simplest answer is that this would be great news for Trump, who at this rate will soon again have an S&P at fresh all time highs to boast about on Twitter, especially if some trade “deal” is announced with China, and according to recent media reports, Trump is eager to put the entire trade war episode behind him even if that result in a fracture with his hawkish trade advisor Robert Lightizer, but more importantly, come June when the current expansion will become the longest on record, the president will (constantly) remind the public that he has yet another economic record under his belt. As for the implications for the 2020 presidential election, when the US will have once again skirted a full-blown recession, they are self-explanatory.

via ZeroHedge News https://ift.tt/2Etwcra Tyler Durden