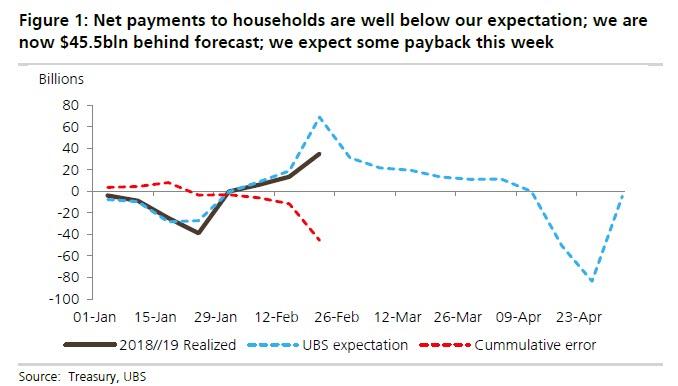

Two weeks ago we reported that as a result of less tax withholding in 2018, millions of Americans (who got more money in their pocket in 2018 compared to 2017) will be “angry” once they see the amount of their tax refund. Now, with tax session approaching its peak, we can quantify just how big the “shortfall” at least relative to taxpayer expectations and Wall Street estimates will be. As UBS calculates, the realized net payments to households are now running below the bank’s forecast, with the cumulative shortfall rising to a whopping $45.5bln, an amount which could have significant adverse implications on Americans’ spending habits if most taxpayers had expected their 2019 refund to be similar to 2018.

That said, there is a specific reason why refunds have been running behind expectations: last week’s dramatic shortfall in tax refunds arises largely from timing of refunds that include the earned income tax credit and the child tax credit. According to the Department of Treasury, the IRS had processed less than half of those payments, whereas in 2018 all such credits had been completed (Treasury statement). As a result, in 2018, Treasury issued $60bln in refunds on February 22. On the same day in 2019, refunds were $24.5bln.

So, if one assumes Treasury’s estimate of 50% is correct, we should get another bulk payment of equal size next week. Another reason to expect makeup this week is from the calendar. Last year, the 22 fell on a Thursday, this year on a Friday. That timing, while seeming inconsequential, could easily have pushed payments from last week to this week, according to UBS.

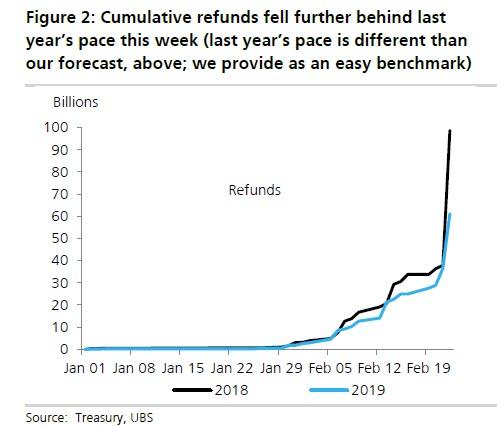

Still, whatever the reason, refunds are now well behind last year’s pace as shown in the chart below…

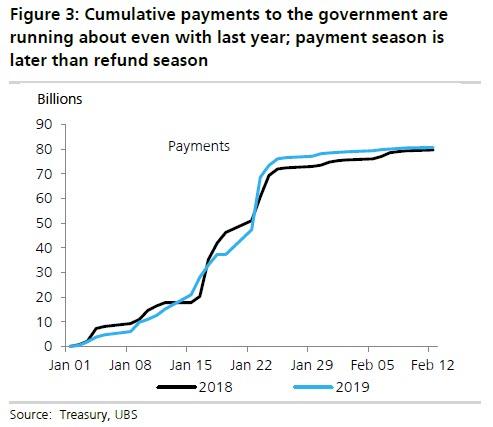

… even as the gap between tax payments this year and last narrowed to near zero (payment season starts in late March).

Calendar issues aside, UBS asks why might refunds be smaller or larger than last year, and provides the following observations:

The IRS tries to set withholding rates to minimize payments and refunds at filing, aiming for a small net positive. But tax reform made meeting this goal hard, resulting in great uncertainty over tax refunds (and may have led to the sharp recent drop in retail sales). Three factors drive that uncertainty.

1. Fewer households qualify for AMT, reducing April tax payments.

2. Increases in the child tax credit boost refunds.

3. Withholding tables for 2018 were likely not adjusted correctly.

As a result, nobody—not Wall Street, not economists, not the US government—knows whether refunds will be larger or smaller than in past years, as small changes in the assumptions on any of the three factors lead to large changes in net payments to households. Accordingly, individual analysts track tax payments and refunds relative to historical data and their own forecasts of weekly net payments to households (the sum of refunds and tax payments).

And lest there be any confusion, as we explained two weeks ago, lower tax refunds, of course, say nothing about the size of the 2017 tax cuts. Refunds represent an overpayment of taxes during the year not the level of taxes paid overall. Nonetheless, and this should be obvious to most, refunds influence the timing of household spending, with UBS warning that a substantial shortfall in net payments to households will reduce consumption in 2019.

This would have potentially adverse consequences for the US economy, but it doesn’t stop there.

According to Bloomberg, fewer people getting refunds will give U.S. Democrats, who now hold a majority in the House of Representatives, an opening to question how much the tax law benefited the middle class – even though as noted above the net amount of tax paid between withholdings and refunds may well have declined! That said, only about 45% of voters approve of the tax cut, according to recent polls, and many Republicans in high-tax states already lost their seats in the 2018 midterm elections due to the changes in the deductibility of state and local taxes. Looking ahead to the 2020 presidential election, dissatisfaction with the tax law may give Democrats an opening to promise tax changes of their own, ones that favor the middle class, even if in reality all the democrats will do is give the optical illusion of beneficial tax reform, one which boosts tax withholdings and results in a modest increase in refunds, which however, successfully fool most of the people most of the time into believing they ended up paying less taxes.

via ZeroHedge News https://ift.tt/2GPBZd0 Tyler Durden