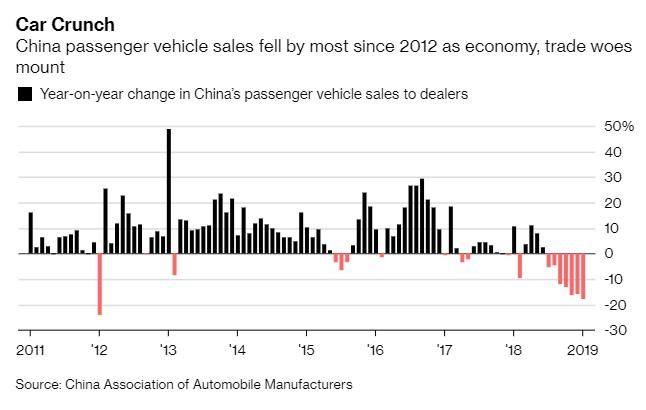

A new deflationary tide is rising amid the battleground that is China’s auto industry, where manufacturers and dealers are scrambling to try and find a solution to tumbling demand, and while many have resorted to generous incentives and loan offers for consumers to regain market shares, Bloomberg reports that so far none of the measures have succeeded in stimulating the moribund local car markets.

Incentives and reductions totaling more than 10% of the sticker price are now common, while interest free loans are also being offered to try and lure car buyers to showrooms, especially outside of China’s major cities. For now, however, buyers still aren’t taking the bait and car sales continue to decline this year in China, after their first annual drop in more than two decades.

Making matters worse, amid the slowdown of the world’s second largest economy consumers are starting to do away with big purchases in general. There’s also an argument surfacing that heavy incentivizing could wind up doing more harm than good to automakers’ finances, possibly setting up for more layoffs, restructurings and mergers in the industry. Shi Jianhua, a deputy secretary general of China Association of Automobile Manufacturers, said: “2019 should be a year of the survival of the fittest and we may see more merger and reorganization cases in the auto industry.”

The changes may negatively affect smaller Chinese manufacturers more than larger ones, who can offset poor Chinese sales with sales from other countries. But customers of cheaper brands in China tend to live in smaller cities and are often more easily affected by the slowing economy.

Cui Dongshu, secretary general of China Passenger Car Association told Bloomberg that “the sales slump is adding more pressure on Chinese brands. The speed of the industry reshuffle will be accelerated.” By reshuffle he also means a potential wave of mass corporate defaults.

Smaller companies like Chongqing Changan Automobile., Brilliance China Automotive Holdings and BAIC Motor have seen their stock prices get cut in half or more over the past year. But that doesn’t mean global brands aren’t facing headwinds as well. Companies like Hyundai Motor Co. and Jaguar Land Rover parent Tata Motors Ltd. blamed China for slipping to quarterly losses last year while Suzuki Motor Corp. pulled out of China altogether.

Meanwhile, desperate to put a price floor below the rapidly deflating Chinese auto market, in late January Beijing urged authorities to roll out measures to help boost vehicle sales in rural areas, noting that a similar effort about a decade ago helped revive demand. While local governments have yet to make any announcements, automakers are moving ahead with offers their own.

For instance, BAIC cut about $1000 off the price of its Senova Zhidao sedan. Buyers also have the option of choosing a $149 down payment or 0% interest for three years. Volkswagen said this month that it will offer an incentive package valued as much as $1800 for rural consumers that need to replace their aged models with new ones. Chongqing Changan said it would provide up to $3300 worth of incentives, as well.

Translation: sharply lower prices, which for those not versed in macroeconomics has a very ominous synonym: deflation, something China simply can not allow.

A BAIC motor dealership employee, Tom Feng, said he and his colleagues are doing everything they can to reach out to rural customers, including handing out flyers at shopping malls and supermarkets. They are also driving around in new vehicles to spur interest. Confirming the worst case scenarion, Xu Haidong, an assistant secretary general at CAAM, said that “there is no easy solution to revive car demand. Car consumption hinges on the overall economic development.”

And that “development”, as we know, isn’t going well.

via ZeroHedge News https://ift.tt/2INPWd4 Tyler Durden