Submitted by Harris Kupperman from Adventures in Capitalism

I’m writing to you from the beach in Larnaca, Cyprus. It’s 6am and I’m jetlagged, hopped up on coffee and ready to get exploring.

Why Cyprus? Next week, I’m speaking at the annual VALUEx Caspian conference in Baku, Azerbaijan, hosted by my good friend Isaac Schwartz of Robotti & Company Advisors www.valuexkz.com. To break up the flights, I stared at a map and Cyprus seemed to be roughly on the path there. Unfortunately, after I booked the first leg, I realized that to get from Cyprus to Baku, you have to go 20 hours out of your way and transfer through Moscow. Who says global travel isn’t an adventure?

However; I have another reason for going to Cyprus. You see, a few years back, Cypriot banks did some pretty stupid things. They made some dodgy property development loans, over-expanded in consumer lending and when they ran out of bad investments in Cyprus, decided to diversify and buy almost $6 billion in Greek sovereign debt, which was almost immediately written off.

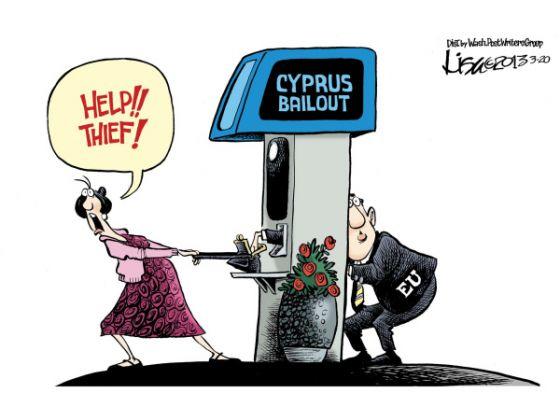

The ECB showed up, saw a smoldering crisis and decided that the prudent decision was to turn it into a raging bonfire. “Hold my beer, we’re gonna bail-in the banks.”

Depositors with more than EUR 100,000 lost 47.5% of their deposits. This was justified by pointing to the Russian connection in Cyprus—yes, Cypriot banks had Russian depositors. However, plenty of Cypriots also lost half their deposits. More importantly, the bail-in led to capital flight, lack of investment and a further round of detonation of the Cypriot economy. (I wrote about this back in 2013).

Even after the bail-in, the Cypriot banking system was still effectively insolvent. The ECB decided that the best way to solve for this, would be to force the banks to de-lever. This sounds fine in theory, but NPEs are hard to restructure or sell. Therefore, to de-lever, you reduce new lending and let performing loans run off your books. If you continue to reduce your performing loans each year, at some point, all you have left are non-performing loans. Hence, despite plenty of NPE exits and asset sales over the past few years, Cypriot banks still have dangerously high NPE ratios. Even worse, when you stop lending, businesses suffer and asset values decline, leading to an increase in new NPE formations. Logic would state that the only way to solve for this is to grow the loan book, dilute the NPE exposures with new performing loans and then use retained earnings to rebuild the capital base. Please, don’t ask the ECB to use logic.

We all take banks for granted. Imagine not being able to get basic working capital loans, not being able to get a mortgage, not being about to effect transactions for fear of keeping capital in the Cypriot banking system. In the ECB’s desire to hurt a few Russians, they hurt over 1 million Cypriot citizens.

As I prepared for my trip to Cyprus, I looked over my notes (Part 1, Part 2, Part 3 )from my trip to Greece a year and half ago. Same dilemma, same bureaucratic cure, same economic malaise. Glad I talked myself out of buying Greek banks. You’d think that these guys at the ECB would learn by now. The difference, is that whereas the demographics and macro situation in Greece is weak, those metrics are going in the other direction in Cyprus.

Cyprus has just over 1 million people, it is a low-tax jurisdiction in the EU and tax evasion is ALWAYS in a bull market. Non-performing loans are finally being restructured, property values are starting to recover and the Cypriot economy is back to growth. Most importantly, it appears that a whole lot of natural gas has been discovered off the coast of Cyprus. While it will take many years before this discovery becomes tax revenue, every step along the way will lead to foreign investment, more high paying jobs and new capital in the banking system. Basically, there’s now a catalyst for the recovery.

In any case, I’m in Cyprus. I’ll be taking a bunch of meetings, visiting some historic ruins and drinking too much Zivania (Cyprus’ answer to Raki). Basically, the same recipe I’ve used to learn about every other country I’ve visited. Now, it’s time to wake up my wife and get going.

To be continued…

via ZeroHedge News http://bit.ly/2Kfq0bd Tyler Durden