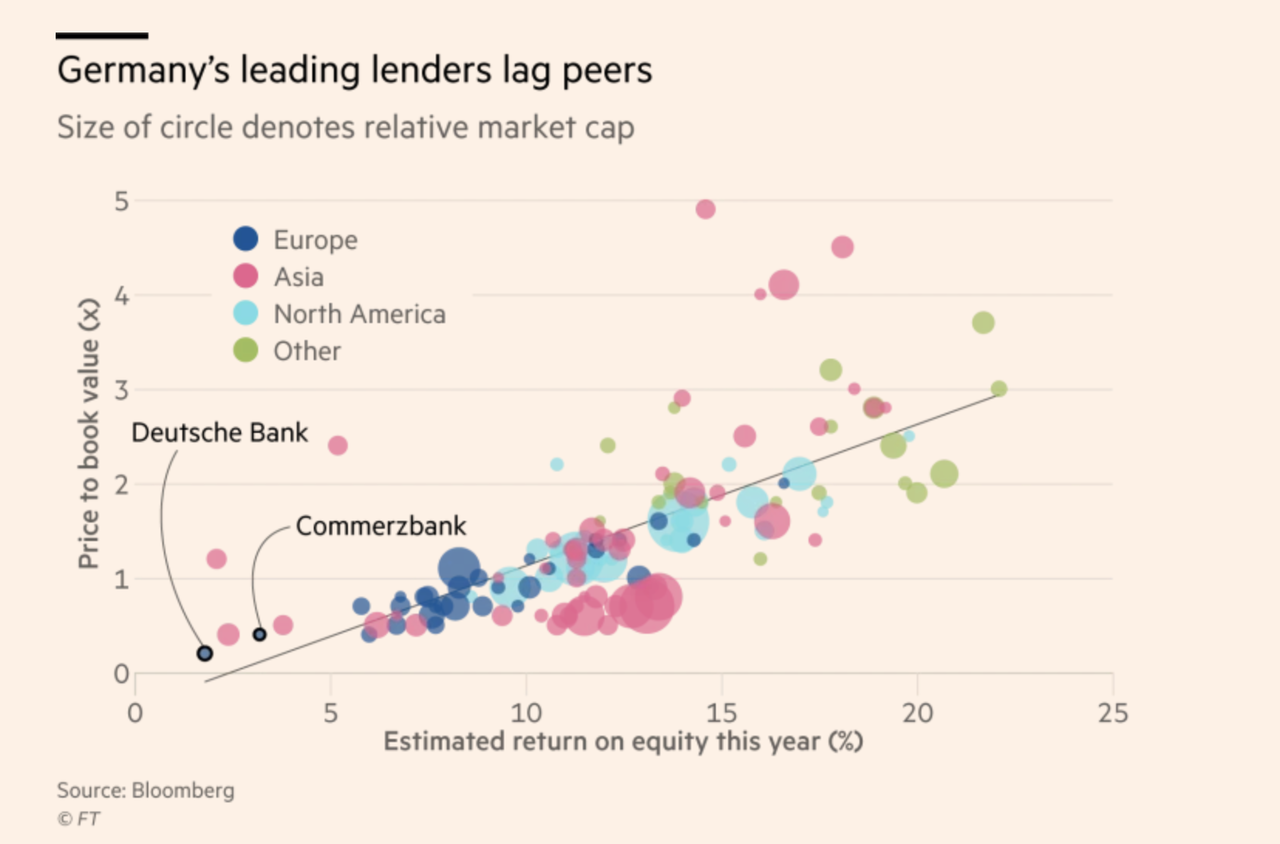

Ever since it became apparent that the Deutsche Bank-Commerzbank tie-up wasn’t meant to be after all, despite incessant lobbying from the German Finance Ministry over the objections of pretty much every other stakeholder, both Deutsche Bank shareholders as well as the bank’s still-relatively-new CEO have probably been wondering: What’s next for Europe’s least-favorite perennially troubled megabank?

Well, as DB’s management team scrambles to close a deal with UBS to merge the Swiss bank’s once-storied asset-management business with DWS, the asset-management arm that functions as a separate corporate entity controlled by Deutsche, Bloomberg and the FT have effectively confirmed what most shareholders have been hoping for: Despite Sewing and Chairman Paul Achleitner’s insistence that the investment bank is vital to Deutsche’s future, it’s probably time for Deutsche to take an axe to its long-suffering investment bank (the bank has already reportedly been considering the ring-fencing of its most toxic businesses and assets in a shadow ‘bad bank’).

Specifically, the bank’s equities business (and more specifically, it’s US equities trading business) will likely be on the chopping block.

But even a restructuring would be difficult, coming with many up-front costs, according to analysts quoted by Bloomberg:

With a Commerzbank deal gone, Deutsche Bank’s only move is “a more radical investment bank restructure, with a potential exit from the U.S. region and the equities product line,” Citigroup Inc. analysts wrote in a note on April 29. Such a move would be difficult. Restructuring costs would hit upfront, and revenue would be squeezed at first, potentially exacerbating rather than fixing Deutsche Bank’s core problem. In any case, that option seems off the table. Achleitner and Sewing say the trading and corporate finance businesses are crucial. “Every executive has to constantly adjust to a changing market environment,” Achleitner told the Financial Times. “But in this regard, we are not talking about strategy, we are talking about execution” of the existing plan.

As if the bank needed another incentive, Reuters reported a few days back that Deutsche’s US operation – which would be greatly curtailed or shuttered entirely in a restructuring – is once again in danger of failing one of the Fed’s stress tests.

In a detailed insider account of the factors that inspired Sewing’s decision to walk away from merger talks (according to the FT, though it had been announced as a mutual decision, the idea to walk away was first broached by Sewing and his team, who argued that financing the deal would be too burdensome).

As one regulator put it:

“Calling the merger off wasn’t a strategic decision,” a top regulator said. “They could just not afford the deal.” “Without the one-off [accounting and tax] effects the transaction would have triggered, the deal stacked up,” the person said, adding it was “unsettling…[that] both banks do not have enough firepower to bring forward a merger that makes strategic sense.” Deutsche disputes that it lacked firepower to do the deal.

But while Commerzbank’s steady corporate business will make it an ideal acquisition target for another European lender (UniCredit and ING have reportedly been weighing bids), DB has no obvious path to finally shed the mantle of ‘most hated bank in Europe’.

via ZeroHedge News http://bit.ly/2DKa4be Tyler Durden