The politicos are out crowing of the booming US economy confirmed by today’s jobs report.

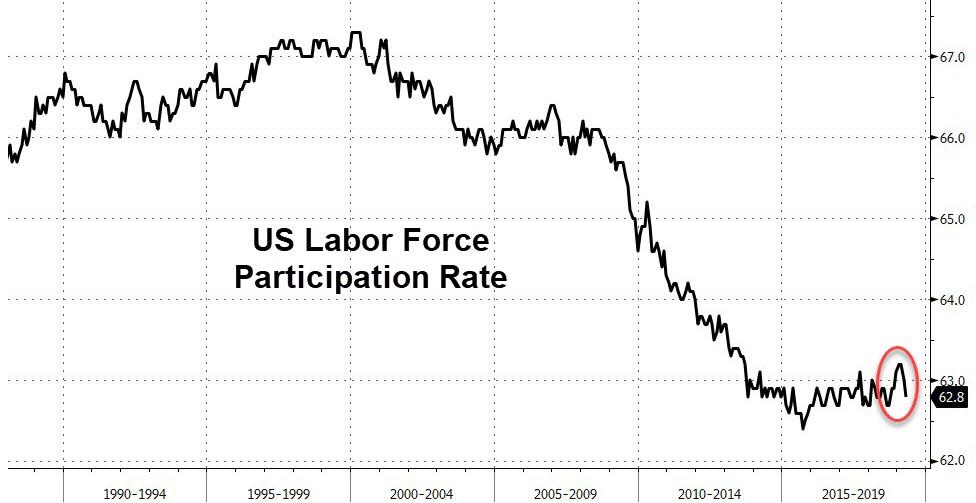

Despite a worrying retracement in the participation rate:

But, as Southbay Research explains, beneath the headline figures, payrolls are slowing…

Supply Chain Hiring Grinds to a Halt, Services Takes Over

-

Manufacturing (+4K)

-

Trade & Transportation (+5K)

No surprise here, as ISM and other data was pointing to a pullback in these sectors.

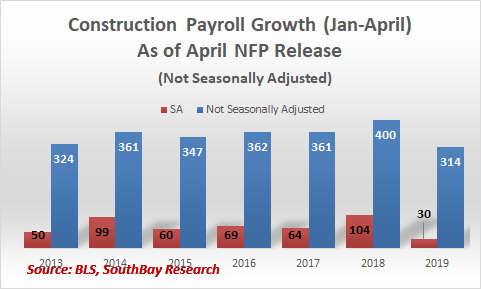

Also, the jump in Construction (+33K) was called out in our forecast.

This is catch-up seasonal hiring and not a trend. For May, expect additional catch-up hiring to keep this figure up.

Services Roars Ahead on One-Offs

Weakness in Trade, Transportation was offset by strength in:

-

Financial (+12K) jumped on real estate as low rates boosted home buying

-

Landscaping (+20K) on catch-up seasonal hiring

-

Healthcare (+53K) including an unusual jump in Social Services (+26K)

-

Food Services (+25K)

Of the 202K additional Services Payrolls, at least 46K is one-time and will not repeat next month (Landscaping + Social Services)

And then there’s unusually strong Municpal Government Hiring

Strong one-off local government hiring (+27K) added to the party

Key Trend: Under the Headline Figure, A Payroll Slowdown is underway

-

Manufacturing retreats (+4K)

-

Construction continues (Construction + 33k, Real Estate Financial +8K)

-

Consumer spending is moderating (Trade, Transportation +5K)

-

Services Hiring is moderating. For example, Temp Workers +17K in April but only +12K total the last 3 months

April’s strong number is the final rebound from February’s weakness (aka catch-up seasonal hiring). Coming up next month: Slower Payroll Growth.

via ZeroHedge News http://bit.ly/2WnRNrp Tyler Durden