S&P futures and global equities fell on Monday after their worst week of 2019, as hopes of an imminent U.S.-China trade deal were crushed with sentiment souring significantly over the weekend, as neither side showed a willingness to budge, raising fears of a fresh round of tit-for-tat tariffs. The dollar surged, the yuan tumbled and Treasuries rallied as traders walked in to the following sea of red.

With the barbs now coming fast and furious as Trump tweets out a new provocation to Beijing literally every several minutes, most recently warning that “China should not retaliate-will only get worse!” while China said that it will “never surrender” to external pressure, though stopped short of announcing how Beijing will retaliate to the latest round of US tariffs, the US and China appeared at a deadlock over trade negotiations as Washington demanded promises of concrete changes to Chinese law and Beijing said it would not swallow any “bitter fruit” that harmed its interests.

“Looks like we are just slowly ebbing away. More tweets from Trump over the weekend stoking the fires for a trade war,” said John Woolfitt at London-based Atlantic Markets.

As a result, contracts on the S&P 500 slid 1.3%, erasing much of Friday’s miraculous rebound, and pointing to a big drop at the U.S. open.

In Europe, the Stoxx Europe 600 index quickly slumped negative as almost every industry sector retreated. With no date scheduled for a resumption in bilateral Sino-U.S. talks, shares dropped in all principal Asian markets except Hong Kong, which was closed for a holiday.

Earlier Asian stocks also dropped sharply as Chinese shares tumbled, with the benchmark Shanghai Composite and the blue-chip CSI 300 shedding 1.2% and 1.8%, respectively, while Hong Kong’s financial markets were closed for a holiday. Japan’s Nikkei average sank as much as 1.0% to hit its lowest level since March 28, before closing down 0.7%.

The trade war hit emerging market stocks, which were down 0.7 percent, hovering near January lows. JPMorgan said it had reduced its emerging markets risk for the second time in as many months on Monday following the set-back in U.S-China trade talks.

“How far this escalates is what the market is really worried about as we haven’t really got full details of what the U.S. will do and how China will retaliate. The important thing is what’s the impact on growth, and that’s what the market is really fearing,” said Justin Oneukwusi, portfolio manager at Legal & General Investment Management.

“The risk of a full-blown trade war has materially increased, even though both sides seem to still want a trade deal and talks are expected to continue,” UBS economist Tao Wang said.

Making matters worse, on Monday Washington is expected to announce it is raising tariffs on all remaining imports from China, worth approximately $300 billion. “Our base case is for limited progress and Chinese retaliation,” said Michael Hanson, head of global macro strategy at TD Securities.

In FX, the big outlier was the offshore Chinese yuan, which fell to its lowest levels in more than four months at 6.90 to the dollar.

While most other major currencies were relatively calm with the euro steady at $1.1230, the yen led gains across the Group-of-10, climbing along with Treasuries, as haven bids mounted on trade war concerns. A gauge of dollar strength rallied for the first time in three days while the pound was little changed as the Brexit deadlock continued with the U.K. Prime Minister planning to re-open discussions with the European Union

In digital currencies, Bitcoin continued to move higher, holding onto gains over weekend. Bitcoin jumped more than 10% on Saturday and is up more than 90% YTD, rising to a nine-month high of $7,585.00 on Sunday.

In rates, 10-year Treasury yields fell to the lowest level since late March; The U.S. Treasury bond yield curve between three-month and 10-year rates inverted on Monday for the second time in a week, with the 10-year yield now standing 0.0025% above the shorter-maturity bill. Viewed as a classic warning signal of a looming U.S. recession, the curve inverted last Thursday for the first time since March,.

In commodities, oil futures rose on increasing concerns about supply disruptions in the crucial producing region of the Middle East where Saudi Arabia said two of its tankers were “sabotaged.” Brent crude futures rose 0.5% to $71.00 a barrel and U.S. West Texas Intermediate futures were up marginally at $61.73 per barrel. Trade-sensitive commodities including soybeans and cotton fell. Most base metals retreated as traders reassessed the demand outlook given the threats to global economic growth. Other raw materials were also caught in the crossfire of the trade impasse, with China’s cotton futures plunging by the daily limit.

There are no economic events due today, with Fed Vice Chair Clarida and Dallas Fed President Kaplan set to speak; STERIS, StoneCo, Take-Two, and Tencent Music are among companies reporting earnings.

Latest US-China Trade War updates:

- President Trump suggested that he thinks China felt they were being beaten so badly on negotiations that they may as well wait around for next election, but warned that a deal will become far worse for them if it is negotiated during his second term and that it would be wise for China to act now but he loves collecting big tariffs.

- White House economic adviser Kudlow said China has invited US Treasury Secretary Mnuchin and Trade representative Lighthizer to China to continue trade talks, while he also suggested that it is US importers are paying for the tariffs instead of China and that both sides will lose in the trade war.

- US and China trade negotiators were said to be at odds on 3 major issues including disagreement on removal of all remaining tariffs, differences in wording of the agreement and with China said to view US import targets as unrealistic. In related news, Chinese press accused the US of obstructing progress on bilateral trade talks.

- China’s Mofcom Spokesman Geng states that there is currently no information on a US President Trump and Chinese President Xi meeting at the upcoming G20 summit.

- China Global Times Editor believes that China has not released countermeasures immediately as China may be drafting a plan that will have precise effects, making sure it hits the US while minimizing damage to itself.

- China Auto Industry Association says US auto tariffs will have a large impact on Chinese auto parts exports.

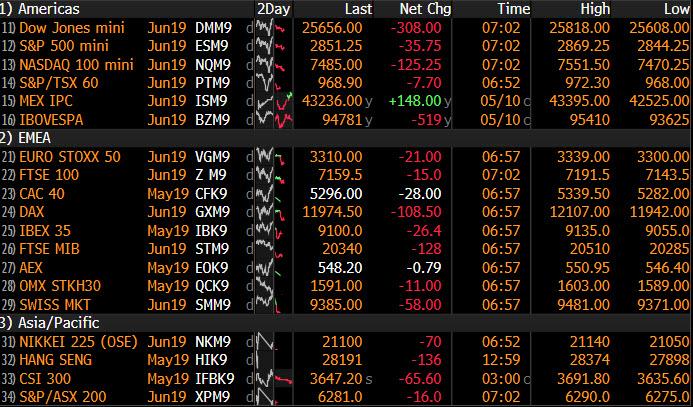

Market Snapshot

- S&P 500 futures down 1.3% to 2,851.00

- STOXX Europe 600 down 0.6% to 374.98

- MXAP down 0.7% to 155.94

- MXAPJ down 0.8% to 514.38

- Nikkei down 0.7% to 21,191.28

- Topix down 0.5% to 1,541.14

- Hang Seng Index up 0.8% to 28,550.24

- Shanghai Composite down 1.2% to 2,903.71

- Sensex down 0.02% to 37,456.47

- Australia S&P/ASX 200 down 0.2% to 6,297.59

- Kospi down 1.4% to 2,079.01

- German 10Y yield fell 0.9 bps to -0.054%

- Euro down 0.02% to $1.1231

- Italian 10Y yield unchanged at 2.309%

- Spanish 10Y yield fell 0.3 bps to 0.975%

- Brent futures up 1.4% to $71.57/bbl

- Gold spot down 0.2% to $1,283.32

- U.S. Dollar Index little changed at 97.31

Top Overnight News

- The emerging stalemate in U.S.-China trade negotiations grew out of an earlier deadlock over how and when to remove existing American tariffs that provoked Beijing to threaten to walk away from talks, highlighting what people briefed on the discussions say are widening fundamental differences between the two sides

- A measure of Japan’s current economic health indicates there is a good chance the economy is in recession, a development that could heighten debate over whether Prime Minister Shinzo Abe will postpone a planned sales tax hike for a third time

- U.S. equity futures slid, extending the stock market’s biggest weekly decline of the year, as a weekend of back-and-forth trade squabbling kept investors glued to news screens as earnings season wound down

- Theresa May is promising to reopen Brexit talks with the European Union to try to breathe life back into negotiations with the opposition Labour Party and take the U.K. out of the bloc by the summe

- Italian Prime Minister Giuseppe Conte suspects Matteo Salvini may be preparing to bring down the populist coalition, Corriere della Sera reported Sunday. Silvio Berlusconi, a potential partner for Salvini if he wants to form a more conventional center-right government, told La Stampa that his party is ready for another election

- The White House is considering conservative economist Judy Shelton to fill one of the two vacancies on the Federal Reserve Board of Governors that President Donald Trump has struggled to fill

- Japanese Prime Minister Shinzo Abe’s support surged after the country’s first imperial abdication and accession in two centuries — a highly watched event fanning national pride that boosted his standing ahead of a July upper house election

Asian stocks and US equity futures began the week negative as focus remained on the US-China trade tensions with US President Trump unwilling to backdown in a Twitter tirade during the weekend in which he alleged that China loves ‘ripping off’ America. Furthermore, President Trump suggested China may have felt they were being beaten so badly on negotiations that it may want to wait around for the next election but warned that a deal will be far worse for them if it is negotiated during his second term, while he also recently stated that the process has begun to place additional tariffs at 25% on the remaining USD 325bln of Chinese goods. ASX 200 (-0.2%) and Nikkei 225 (-0.7%) were negative with Australia led lower by weakness in financials after index top-component CBA reported a decline in Q3 profits and as ANZ Bank shares traded ex-dividend, while Tokyo sentiment was weighed by currency flows and a deluge of earnings, with the “Sell in May…” idiom holding true as the Japanese benchmark sits on losses of around 1000 points month to date. Elsewhere, the Shanghai Comp. (-1.2%) was also weaker amid the absence of Hong Kong participants and due to the ongoing trade dispute with negotiators said to be at odds on 3 major issues including disagreement on removal of all remaining tariffs as well as the wording of a deal and with China said to view US import targets as unrealistic, while the PBoC also skipped open market operations again which resulted to a daily net liquidity drain of CNY 20bln. Finally, 10yr JGBs were relatively flat with only minimal support seen despite the negative risk tone and BoJ’s presence in the market for a total JPY 750bln in 1yr-5yr JGBs.

Top Asian News

- Japan’s ‘Worsening’ Economy Could Fuel More Talk of Tax Delay

- Lira Tumbles as Turkey Inc. Rushes to Buy Dollars After Rally

- Malaysia Bubble Tea Chain Said to Seek $72 Million IPO Next Year

- MSCI Adds China Stocks Just When Foreigners Don’t Want Them

European equities are following on from the downbeat Asia-Pac trade [Eurostoxx 50 -0.5%] as focus remains on US-China trade developments after the two sides failed to reach a deal on Friday. Indices are experiencing broad-based losses, although the FTSE 100 (Unch) is outperforming as heavyweights BP (+1.2%) and Shell (+1.5%) rose to the top of the index amid price action in energy markets. Sectors are mostly in the red with the Energy sector (+1.0%) clearly outperforming whilst defensive sectors are buoyed by the uninspiring risk sentiment. Auto names are largely subdued by the trade spats with the US, ahead of the potential US auto import tariffs by May 18, although some desks expect a delay to the deadline given US’ standstill with China. Meanwhile, Renault (-1.4%) shares took a dive after Le Monde reported that the Co. are said to have discovered a failing of their anti-pollution system. Elsewhere, Thyssenkrupp (-6.3%) rests at the foot of the Stoxx 600 after calling off their deal with Tata Steel, which sparked some concerns amongst Indian shareholders and UK unions. Back to trade, JPM acknowledges that there is no visibility in regards to the next trade move, with sentiment to potentially worsen before getting better, although the analysts to expect a compromise as the most probable outcome as the sides have too much to lose heading into the upcoming US election and the 70yr anniversary of the People’s Republic of China. “In a sense, the more markets suffer near term, the more are they likely to bounce, as key actors are forced to deescalate” JPM concludes.

Top European News

- Vodafone Falls Most Since January on Dividend Cut Speculation

- Barclays Hires Ex-Nomura Banker Brown for Equity Capital Markets

- Casino Plunges to 8-Month Low After Kepler Downgrades to Reduce

- Vodacom Updates Profit Target on Growth From African Purchase

In FX, JPY/CHF/USD – Aversion is spreading if not quite running rife or reaching FTQ proportions and the catalyst is the failure to find a compromise on trade after the latest round of talks between the US and China. Hence, the Yen and Franc are outperforming, with the former eyeing 109.60 vs the Dollar and strong resistance at 109.50 that has held twice, while Usd/Chf is now under 1.0100 from 1.0200+ recently and Eur/Chf is testing bids below the 200 DMA (1.1341). However, the DXY is also deriving underlying support ahead of 97.000 and a key chart level just above the big figure that has been tested on a couple of occasions (circa 97.150) as the Greenback registers gains against riskier/high beta G10, and the Greenback rallies more broadly vs EMs.

- GBP/EUR – Minor exceptions to the major rule as Cable retains its grip of 1.3000, albeit only just as UK PM May faces yet another tough week of Brexit negotiations and prepares for a showdown on Thursday with the 1922 committee that is urging her to set a resignation date. Similarly, the single currency remains above 1.1200 within a relatively tight 1.1224-45 range with the base coinciding with the 30 DMA and the headline pair also flanked by decent expiry options (1.4 bn between 1.1190-1.1200 and 1.3 bn from 1.1240 to 1.1250).

- AUD/NZD/CAD/NOK/SEK – All on the receiving end of investor angst and with the Aussie and Norwegian Krona also undermined by data in the form of housing finance, investment lending and mortgages, and Q1 GDP as Norway’s mainland growth slowed more than expected and contracted in total SA terms. Aud/Usd is back below 0.7000 as a result and not far from 2019 lows (stripping out the early January ‘flash crash’ trough), while Eur/Nok has touched 9.8500 as Eur/Sek hit 10.8500 and decade highs. Elsewhere, the Kiwi and Loonie are also suffering from safe-haven positioning and sub-0.6600 and 1.3400 respectively, with the latter also wary of expiry interest in decent size, albeit not close to current levels (1 bn at the 1.3300 strike and 1.1 bn at 1.3550).

- EM – As noted above, more depreciation across the region with the Cny ending well down from PBoC midpoint fix levels at 6.8700+ vs 6.7954 and Cnh through late December 2018 lows at 6.9070. Meanwhile, not even a narrower than forecast March current account deficit has saved the Try from another decline through 6.0000 and brief fall to 6.1000 having rebounded towards the 21 DMA (5.9409) at one stage and on the back of heavy intervention (4.5 bn touted).

- Bank of Thailand says the nation may be added to US currency manipulators watch list but adds they have not intervened in THB for advantage in trade with US. (Newswires)

In commodities, WTI (+1.4%) and Brent (+1.5%) prices have been on the rise as the complex sets aside trade woes and focus on a number of supply-side developments. 1) Over the weekend, two Saudi oil tankers were attacked off the coast of UAE, on the way to the Persian Gulf to load oil. The UAE stated that the tankers have been damaged although the OPEC producer did not mention the precise nature of the incident. The Saudi Energy Minister condemned the attacks, which comes at a time of heightened tensions in the area following US deploying carriers, bombers and defence missiles to the region amid friction with Iran, although nobody has claimed responsibility for the attack thus far. 2) State-side, the Houston shipping channel is closed following the collision between a tanker and two oil barges which resulted in a spill of 9k barrel of reformate (intermediate stage in the production of gasoline). Cleaning is underway, although the shipping disruptions caused are likely to cause a backlog on imports and exports. 3) Sources noted that Russia produced 11.16mln of oil thus far in May, down from April’s 11.23mln, whilst the oil intake by the Transneft pipeline fell 6% vs. April’s average volumes. As a reminder, this week sees the release of the OPEC and IEA Monthly Oil Reports followed by the JMMC meeting over the weekend as the cartel is seemingly shifting towards extending supply curbs past June, however, a revaluation may be needed given the rising threats on the supply-side. Elsewhere, precious metals are largely unchanged as a firm Dollar caps gains for gold (-0.2%) and silver (-0.4%). Meanwhile, copper (-1.0%) prices are heavily pressured by the overall risk-averse tone and demand disruptions from the US-China trade war, whilst iron ore futures benefitted as steelmakers replenish its stock of the base metal. Saudi Energy Minister Al Falih condemned an attack on 2 Saudi vessels that were sabotaged on Sunday morning near UAE.

US Event Calendar

- May 13-May 15: Mortgage Delinquencies, prior 4.06%

- May 13-May 15: MBA Mortgage Foreclosures, prior 0.95%

- 9:05am: Fed’s Rosengren, Clarida Makes Remarks at Fed Listens Event

- 1:20pm: Fed’s Kaplan Speaks At Community Forum In Brownsville, Texas

DB’s Jim Reid concludes the overnight wrap

Happy Monday. My weekend was defined by 83 seconds. The length of time I actually thought Liverpool might win the league after 29 long years. Alas no, as Man City only took that long to equalise after going behind. It was all downhill from then. The rest of the weekend was mostly spent trying to ensure the children and dog didn’t ruin our new house. When you’ve spent a fortune on a nice new kitchen it’s a bit stressful to have children ride around it at speed on toy bikes and cars bumping into woodwork as they corner bends. Not to mention bolognese sauce being flung onto expensive tiles.

Global markets had some dents and chips taken out of it last week and without stating the obvious it’s all about US/China trade negotiations at the moment. We’ll recap later how last Sunday’s sudden and dramatic escalation impacted various global asset prices on the week but first let’s make a few observations and see where we are with the latest news.

What has blindsided me over the last week was that I genuinely thought Mr Trump’s rhetoric had completely changed since the huge sell off in Q4 last year. It seemed to me that his 2019 language was all about getting a deal and maybe that he was starting to prepare for the 2020 election campaign and to ensure the economy wasn’t at risk from a major trade war. Clearly I misread the signs but it could still be a brief escalation before a deal over the next few weeks/months. However the stakes have been raised enough for it to be tough for either side to back down imminently so one wouldn’t expect the news flow to rapidly improve in the near term. It doesn’t help that the Chinese economy has stabilised and that the S&P 500 is back close to record highs even with a small sell off last week. So there is no immediate need for anyone to backtrack. As such, markets will likely struggle for a while although last week they did try to rally back a few times as softer trade headlines and rhetoric brought us back from larger falls.

So where do we stand as we go to print? Mr Trump tweeted about trade several times over the weekend. Yesterday, he said “we are right where we want to be with China” and that the Chinese “LOVE ripping off America!” This is probably not the tone from a man who is about to backtrack on his threats. On Saturday, he had said that it would be wise for China to get a trade deal now or risk worse terms after his re-election in 2020. This hints at evidence that maybe the Chinese are thinking that playing a medium-term game of gambling on a new President in 2020 would be preferable to signing up to something now. The rhetoric from China also continues to pin blame on the US for trade talks failure with the People’s Daily (Communist Party’s mouthpiece) saying in a front-page commentary over the weekend that the US should take full responsibility for the setbacks because it went back on its word and imposed more levies while adding, “that cast a shadow on the trade talks and directly led to the fruitless outcome”. Elsewhere, the Xinhua news agency carried an article on Sunday touting that the escalating tariffs will do more damage to American companies while hurting both sides and later carried a commentary saying that China can overcome any difficulties as long as it remains confident while listing a number of reasons for the nation’s confidence, including strong leadership, a superior socialism system and a united people. Again not words of a nation looking for a ladder to climb down.

In the meantime, the USTR Robert Lighthizer has said that the Trump administration will today release details of its plans for tariffs on an additional $300 billion of imports from China. All these weekend comments came after Friday’s trade talks ended without much sign of progress. China Vice Premier Liu He said to domestic media after the talks that the U.S. must remove all extra tariffs, agree targets for purchases of Chinese goods in line with real demand, and that the text of any deal needs to be “balanced” to ensure the “dignity” of both nations.

The next step is to see what retaliation China implements. DB’s Zhiwei Zheng believes they will increase tariffs on USD60bn of US exports to China. It announced this list of goods last year but the tariff was not fully implemented. Zhiwei’s key question after that is whether the US will move to impose tariffs on the remaining around USD300bn of Chinese exports (Lighthizer overnight suggests we’ll learn more on this later). As our Chinese team have previously discussed in their notes they are significantly different from the other Chinese exports, as they include mostly consumer goods such as smartphones, computers, and textiles, and US consumers are more dependent on China for these goods. So there are ways this could get more painful, especially as these goods are well integrated into the global supply chain.

If you’re looking for good news it is that the two sides seem to be continuing talks and that Mr Trump’s personal relationship with President Xi Jinping seems to still be strong on the surface and the former is always keen to praise the latter in public pronouncements. Yesterday Larry Kudlow, Trump’s top economic adviser, told Fox News that Trump would meet with Chinese President Xi Jinping during the G20 meeting in late June.

Asia markets are heading lower this morning with the Nikkei (-0.52%), Shanghai Comp (-0.99%) and Kospi (-1.00%) all down. 10yr USTs are 3.2bps lower. EM Fx is trading weak again this morning with the onshore yuan -0.45% to 6.8570, the weakest since January. Elsewhere, futures on the S&P 500 are down -1.02%. In commodities, CBT Soybean futures are down -0.90% and corn futures are down -0.71%. Markets in Hong Kong are closed for a holiday.

The moves in Asia follow a difficult week. However on Friday US equities staged another impressive rebound throughout the afternoon session. The catalyst was an improvement in the tone of rhetoric from the negotiators on both sides of the trade dispute. Secretary Mnuchin called the talks “constructive,” while Liu He said that they went “fairly well.” The two parties agreed to hold additional talks in Beijing in the near future, but did not formalise any plans. This is slightly out of date now but the S&P 500 having traded down as much as -1.58% retraced all of this to close +0.37% higher as the situation evolved. That rebound of +1.98% off the lows was the third instance of a +1% rally off the lows last week, the best since the second week of January. The S&P 500 nevertheless ended the week -2.18% lower on the week, its worst week since December. The DOW and NASDAQ ended the week -2.12% and -3.03% lower (+0.44% and +0.08% Friday) respectively. Banks and semiconductors underperformed, falling -3.19% and -5.85% (-0.74% and +0.14% Friday) respectively. Utility stocks outperformed, falling only -0.71% on the week (+1.73% Friday). In Europe, the STOXX 600 ended down -3.39% (-0.32% Friday), with European banks underperforming even more sharply, down -6.34% (+0.12% Friday).

Two-year treasury yields ended the week -6.7bps (+0.8bps Friday) while 10-year yields fell -5.8bps (+2.5bps Friday). Bund yields fell back into negative territory after dipping -7.0bps on the week (+0.2bps Friday). The dollar index weakened -0.20% (-0.05% Friday), but much of that was driven by discrete euro strength, which rallied +0.31% (+0.16% Friday). EM currencies were the bigger losers, shedding -0.57% (+0.25% Friday) with the Chinese yuan leading losses after retreating -1.60% (-0.11% Friday).

Moving on to other news and Brexit stories are staring to build again. Press reports suggest that the UK is mulling reopening Brexit talks with the EU with the PM’s office saying over the weekend that the government will explore with the EU this week how to rewrite the outline political agreement on future customs ties. A meeting is scheduled today involving Labour officials and the senior government negotiating team including May’s de facto deputy David Lidington and her chief of staff Gavin Barwell where they are due to bring together all the work and proposals from the past month of talks. Elsewhere, latest opinion polls in the UK are indicating that support for Nigel Farage’s Brexit Party is soaring with the Opinium survey for the Observer newspaper indicating that the Brexit Party would take 34% of the vote in the May 23 European Parliament elections, compared with 21% for Labour and just 11% for the Conservatives. A reminder that through most of Q1 the Conservatives were polling just under 40%. They’ve been hit hardest by the failure to deliver Brexit.

In other news, Italian daily Corriere della Sera reported yesterday that Prime Minister Giuseppe Conte is suspecting that deputy premier Matteo Salvini may be preparing to bring down the populist coalition as he is trying to put immigration back at the top of the political agenda with a grab for control over shipping in Italian waters. The report went on to add that Conte fears the move is a “landmine” that will give Salvini an excuse to end the populist coalition within weeks and as a result is mulling delaying a cabinet meeting at which the above would be discussed to defuse the situation.

As for this week, other than that the latest trade developments, data highlights include China’s key activity indicators, US retail sales and Germany Q1 GDP. There’s also plenty of Fedspeak to look forward to as well as comments from various ECB speakers. Wednesday is the key day with the April activity indicators due in China which includes industrial production, retail sales and fixed asset investment. At the time of writing the consensus is for that data to show that China’s economy has continued to stabilise at the start of Q2. The focus in Europe on Wednesday then turns to the Q1 GDP reports for Germany and the Euro Area. The preliminary forecast for Germany is for a +0.4% qoq reading with weakness in manufacturing offset by strength in services and also a boost from construction. Remember Germany only narrowly avoided a technical recession at the end of last year. The reading for the Euro Area will be a second look with the preliminary reading showing a better-than-expected +0.4% qoq. It’s expected that the second reading will show a similar print. Finally the US session ends with the April retail sales report which is expected to show a +0.4% mom core print and +0.3% mom control group reading. We’ll also get the April industrial production print in the US on Wednesday where the consensus is for a +0.1% mom rise. The rest of the week’s data (and central bank speakers) will be in the day by day week ahead at the end.

Before we go through this day by day guide it’s worth touching on Friday’s slightly softer than expected US CPI report which saw front-end treasury yields fall a few basis points. Core CPI came in at 0.1% mom (vs 0.2% expected), 2.1% yoy (in-line), with the 3m annualised rate sliding to 1.6% – the lowest rate since July 2017.

via ZeroHedge News http://bit.ly/2Hh720a Tyler Durden