Via AdventuresInCapitalism.com,

I have been highly critical of the Profitless Prosperity Sector (a.k.a the Ponzi Sector). The sector consists of companies that are effectively Ponzi Schemes; in that they have accelerating losses but show blistering growth rates in order to attract new capital. This all worked fine when companies kept their free floats small enough to be manipulated like Tesla (TSLA – USA) or stayed private and used artificial transactions to mark-up equity values to loot various Middle Eastern princelings and other pockets of dumb money, like Softbank (9984 – Japan).

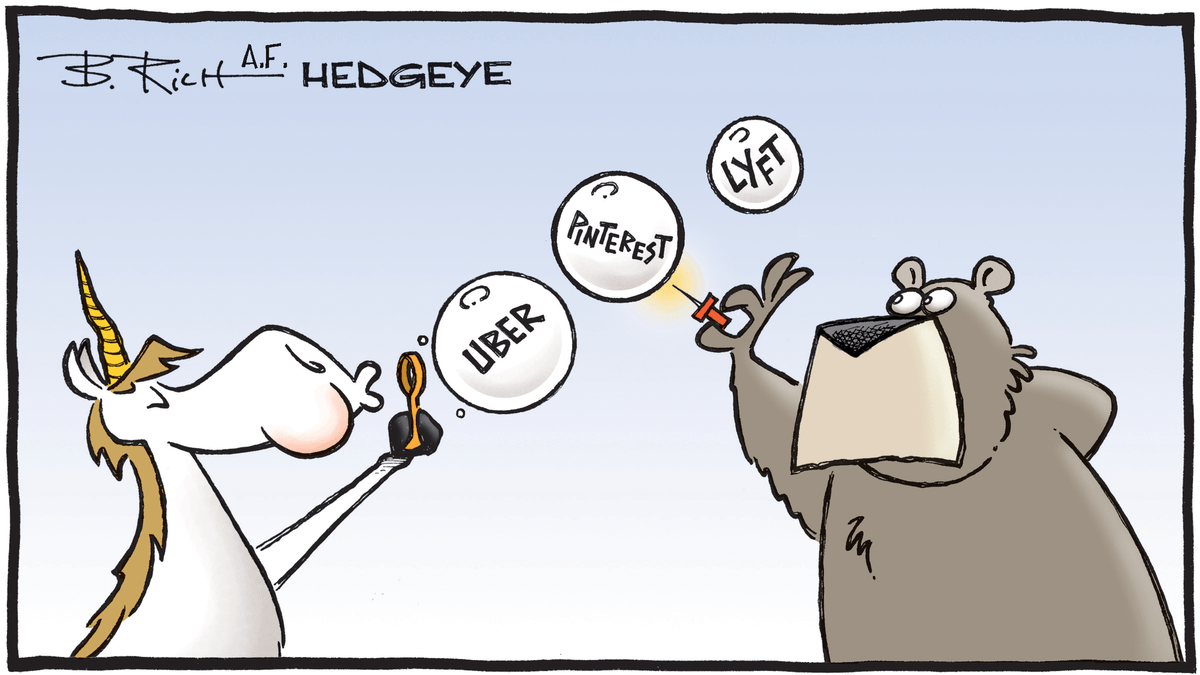

The LYFT (LYFT – USA) IPO showed the first cracks in this scheme.

Now with the UBER (UBER – USA) IPO, the Ponzi Sector may finally be peaking.

On Friday, May 9, we saw conclusive proof that there simply isn’t enough dumb money left to fund endless operating losses, while simultaneously absorbing all the VC shares that are desperately seeking exits before their various Ponzi Schemes detonate. Remember, a Ponzi Scheme dies when more money goes out than comes in. This is especially true of schemes that rely on greater fool theories where most purchasers feel that they are “in on the scheme,” and will sell out to someone stupider than them in the future. When it becomes obvious that there are no more “bag-holders,” look out below.

I have been in the equity markets for two decades and have seen many failed IPOs where a stock broke pricing. I cannot remember an IPO that was this prominent where the stock didn’t at least open for trading at the IPO price. Hell, UBER never even traded a single share at the IPO price. This means that anyone who bought the IPO now has a loss. Even many of the VCs who bought in late stage, pre-IPO rounds are staring at losses. Retail investors may be stupid, but they’re still Pavlovian—if Ponzi Sector IPOs trade up, they’ll keep chasing them; with hefty losses on LYFT and now UBER, they are going to be gun-shy. Who else is going to buy this crap? A lot of anxious Ponzi Sector financiers are suddenly wondering the answer to that question.

Looking back to 2000, I remember that the tech bubble didn’t quite pop after the blow-off top. Rather, it deflated a bit and chopped around in a range. It was the endless rounds of insider lock-up expirations during the fall, that killed the bubble. You see, many of these companies had IPOs where tiny percentages of the float would list, the shares would rocket as crooked analysts promoted the stock and day-traders using margin accounts lifted offers. Within weeks, these things would trade with valuations in the billions. Then, 6 months later, tens of millions of shares would unlock and the insiders would sell as fast as legally possible. When your cost basis is a nickel, do you care if you get $200 or $100 or even $10 a share? You just sell, and you sell even faster if you know the company needs to raise additional equity capital to make payroll.

If you think of the Ponzi sector as a discrete asset class with a finite supply of dumb capital ultimately allocated to it; then every time there is another IPO or capital raise, that finite pool of capital is stretched further. To fund one Ponzi Scheme, investors must either use leverage or sell some other Ponzi Sector bellwether—which may be why many of the Ponzi Sector stalwarts are beginning to leak lower. Now that the big IPOs are coming, they are running out of dumb capital to absorb it all—even before we get to multi-billion-dollar recurring capital raises and insiders dumping en masse.

It is said that they don’t ring a bell at the top. Instead, in the “bubble economy,” LYFT uses newly raised shareholder capital to endlessly blast you with $5 single-use vouchers (thanks bag-holders; I won’t have to pay for a ride for years into the future).

I don’t short, I very rarely buy puts. However, if Uber cannot regain the IPO price in the next few days, I think the top is in for the Ponzi Sector. In that case, I have a long list of money-losing scams to get short—especially as they near lock-up expirations.

Stay tuned, the back half of 2019 may turn out to be a whole lotta fun…

via ZeroHedge News http://bit.ly/2JgBUjH Tyler Durden