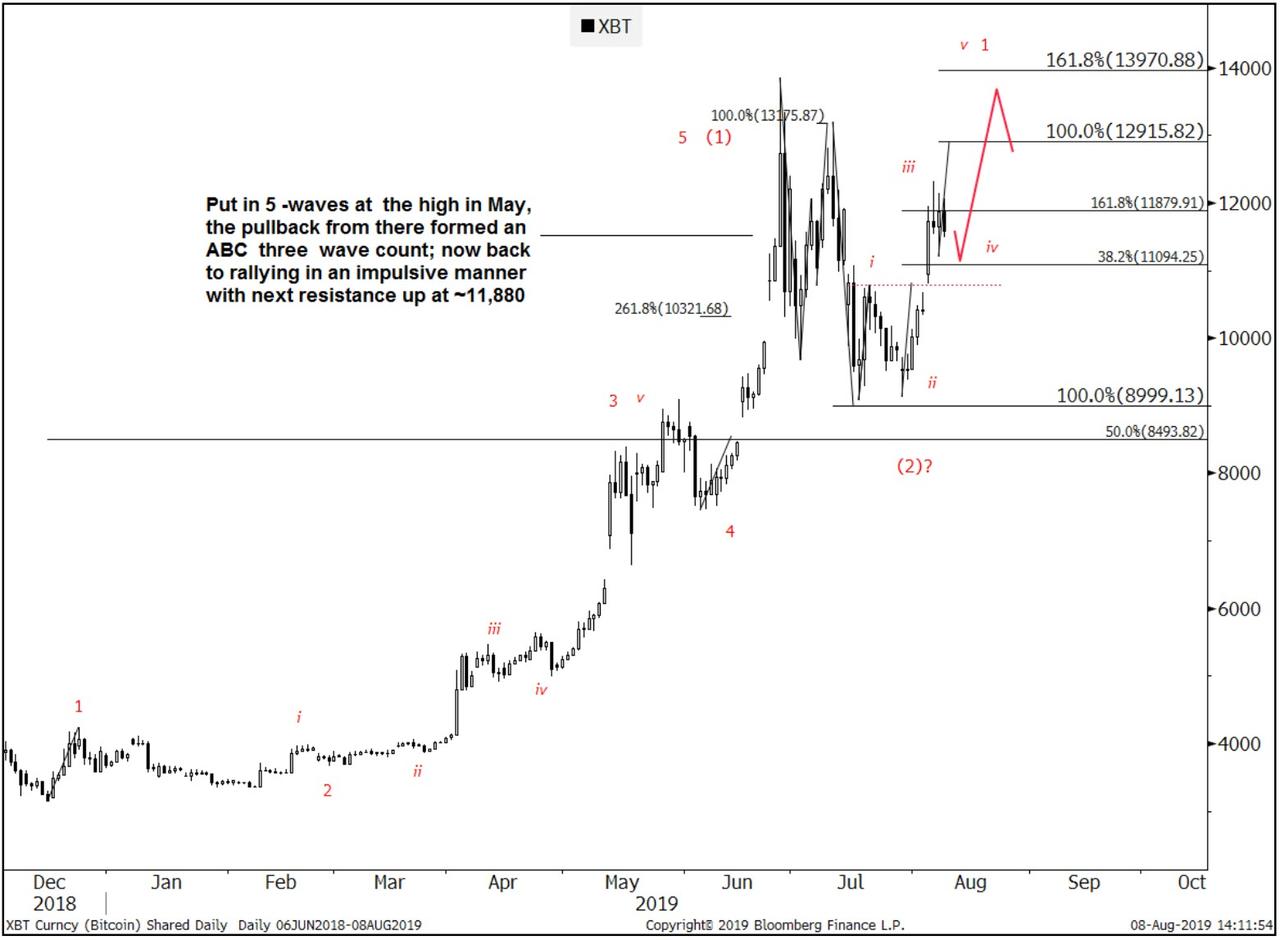

In a recent note to clients, Goldman Sachs published a bullish forecast for Bitcoin price. The forecast is based on Elliott Wave Theory, which projects market trends by identifying extremes in investor psychology, along with price highs and lows.

image courtesy of CoinTelegraph

Via Goldman Sachs,

It’s tested/held the target for wave iii of v from July at 11,880 and now Bitcoin has a short-term target of $13,971…

A pullback from there should find support near/around 11,094. As long as it avoids any contact with the top of wave i at 10,791, there’s still room for at least one more leg higher towards 12,916 and 13,971. Reaching these levels could mean completing a v wave count from July. Bottom line, watch for signs of a short-term top/consolidation once satisfied.

That being said, in the bigger scheme of things, this might still be the first leg of another 5-wave count similar to the trend that lasted from Dec. ’18 through Jun. ’19. Said another way, any such retracement from 12,916-13,971 should be viewed as an opportunity to buy on weakness as long as it doesn’t retrace further than the 9,084 low.

View: Tactically higher targeting between 12,916 and 13,971. Might hold once reached, consolidate for a period of time before resuming higher. Short-term stop 10,791.

If global negative-yielding debt continues to soar, and tensions in Hong Kong (and now Argentina) remain, one wonders what safe-haven flows would do to Bitcoin.

Finally, it is worth noting, as Cointelegraph reported, in the last month Goldman has gone from “looking at [the] potential” of launching its own virtual token, to making hires to accelerate the program.

via ZeroHedge News https://ift.tt/2YJFSto Tyler Durden