Oilmageddon: Surveying The Aftermath

Black gold meet black swan…

A strike on a Saudi refinery overnight sparked initially chaotic scenes in markets globally, but by the end of the day things had calmed a little – perhaps as the eye of the margin-call storm passes overhead.

Brent soared almost 20% initially but faded a little during the day, breaking above all its major moving averages…

Source: Bloomberg

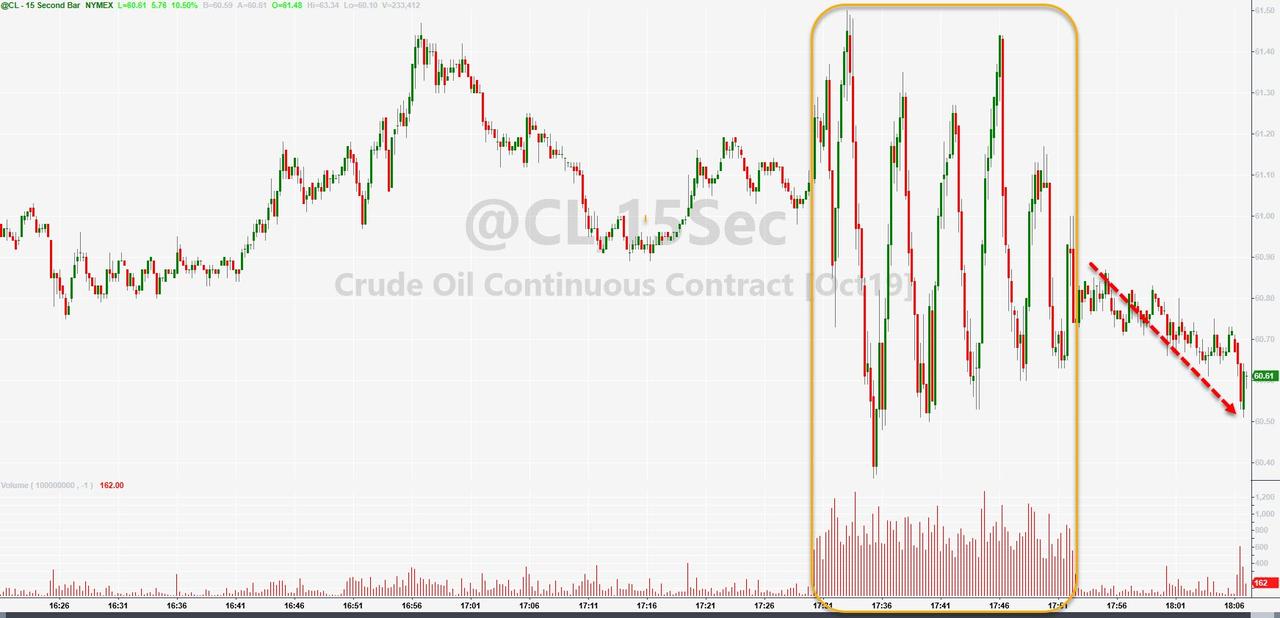

WTI soared too and squeeze back up to overnight highs ahead of the NYMEX close, ran the stops, then faded…

And don’t forget the machines wreaked havoc overnight…

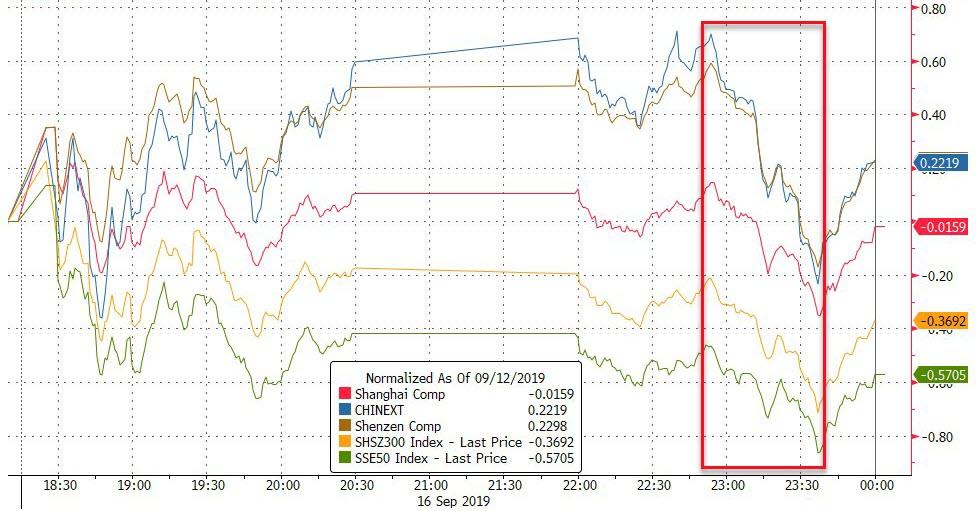

Chinese equities were mixed (having been off on Friday) with the majors lower and small cap, tech higher (despite a full house of ugly macro data)…

Source: Bloomberg

And European stocks opened down hard and were unable to regain green…

Source: Bloomberg

The broad US equity markets were mixed with Small Caps dramatically outperforming and the S&P 500 leading the losers (with Trannies down)…

Futures show the initial pain was significant but the dip-buying algos were not going to stand around and let that happen…

Energy stocks all soared…

Source: Bloomberg

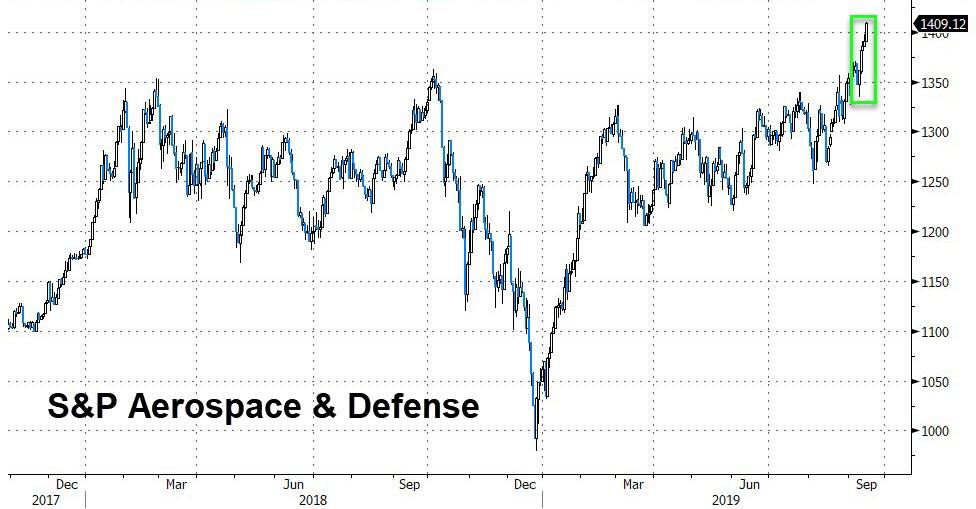

As did Defense stocks (war is good)

Source: Bloomberg

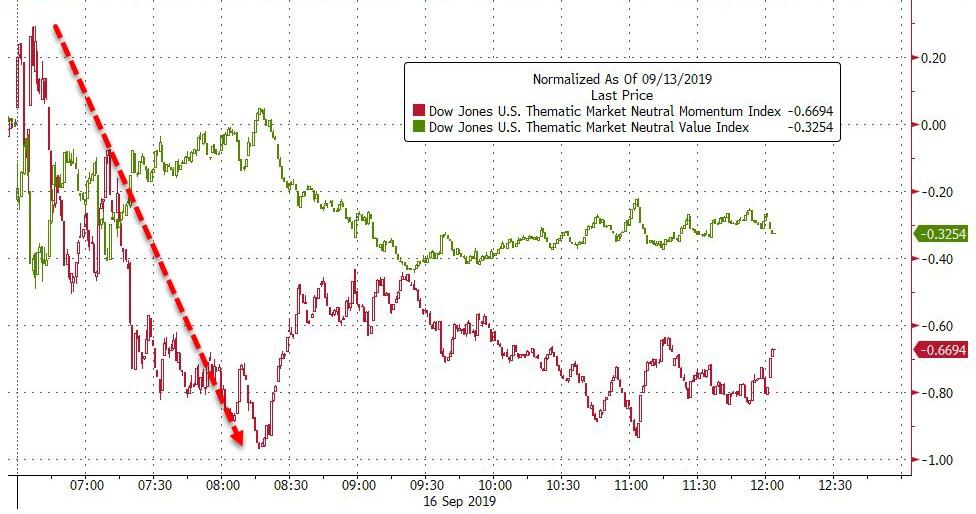

Both Momentum and Value stocks were weaker today…

Source: Bloomberg

“Most Shorted” stocks were squeezed once again!!

Source: Bloomberg

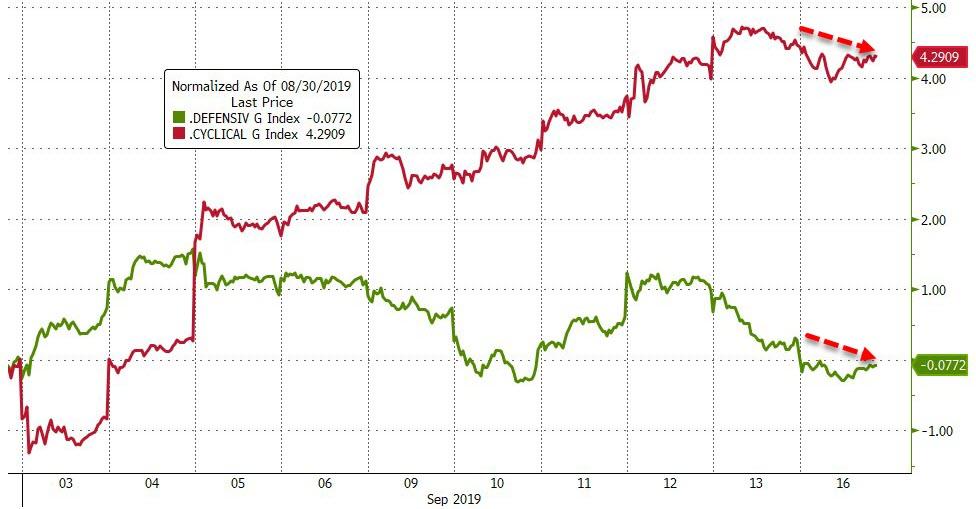

Cyclicals and Defensives were weaker on the day…

Source: Bloomberg

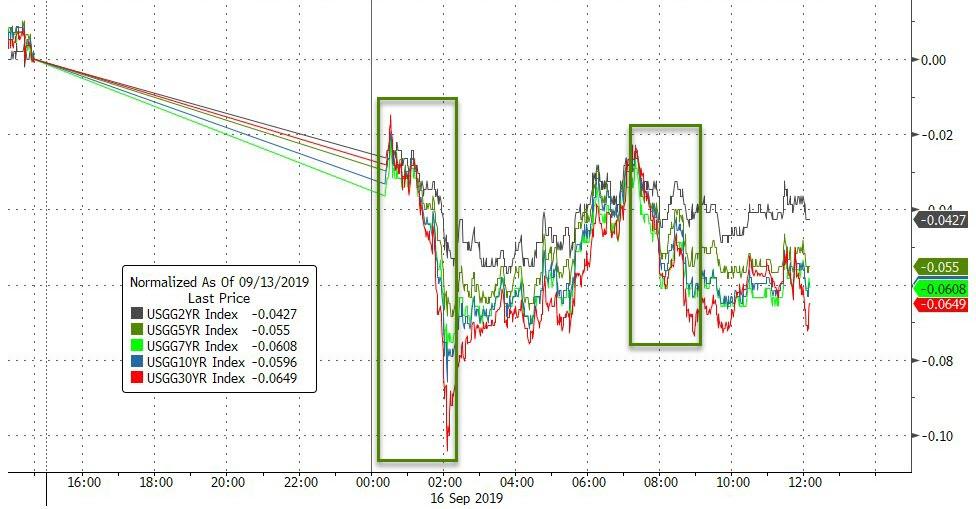

Treasury yields were notably lower on the day as safe-haven bids dominated (and issuance was de minimus)…

Source: Bloomberg

10Y Yields reversed at the critical downtrend line…

Source: Bloomberg

The Dollar soared from the opening kneejerk lower, back to pre-Draghi levels…

Source: Bloomberg

Yuan fell to its overnight fix and stabilized…

Source: Bloomberg

Cryptos were mixed with Bitcoin lower and Altcoins higher..

Source: Bloomberg

Bitcoin tumbled around 8amET, but held above $10,000 for now…

Source: Bloomberg

Of course, commodityland was dominated by crude’s surge but we note that copper slipped lower…

Source: Bloomberg

Gold futures surged back above $1500 and despite an effort to crack them lower, held their gains…

Silver outperformed, testing back up to $18…

And Oil ‘VIX’ surged to its highest since Dec 2018…

Source: Bloomberg

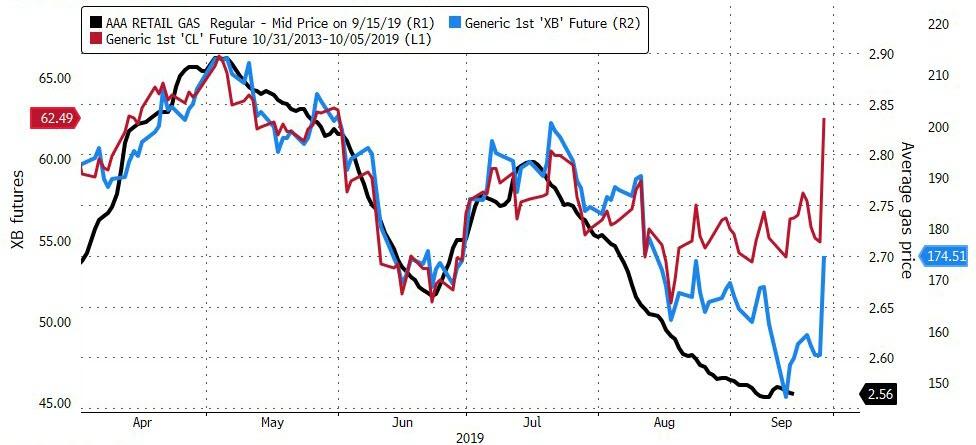

Hold on tight for your gas prices to surge at the pump…

Source: Bloomberg

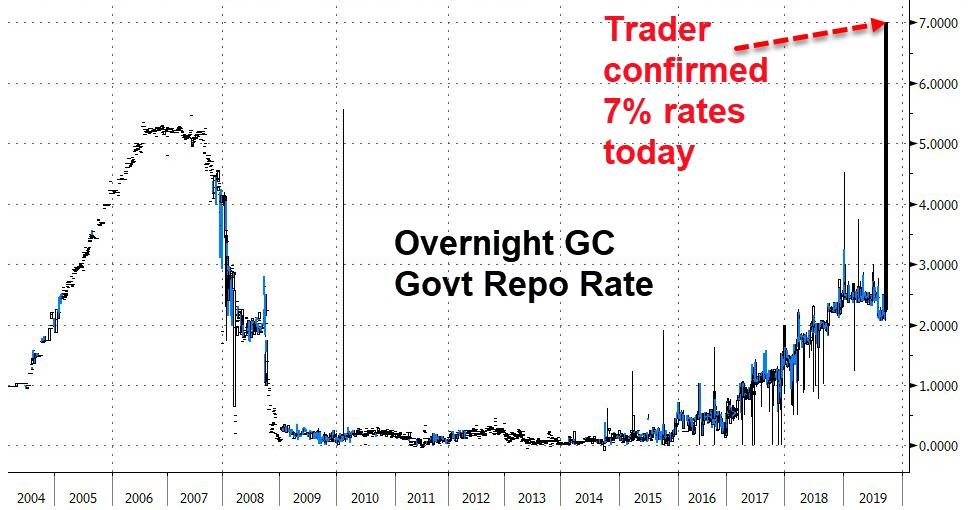

Finally, as we detailed here, something much more significant broke today than the oil market… Repo rates exploded to 7% intraday (according to one repo trader)

Source: Bloomberg

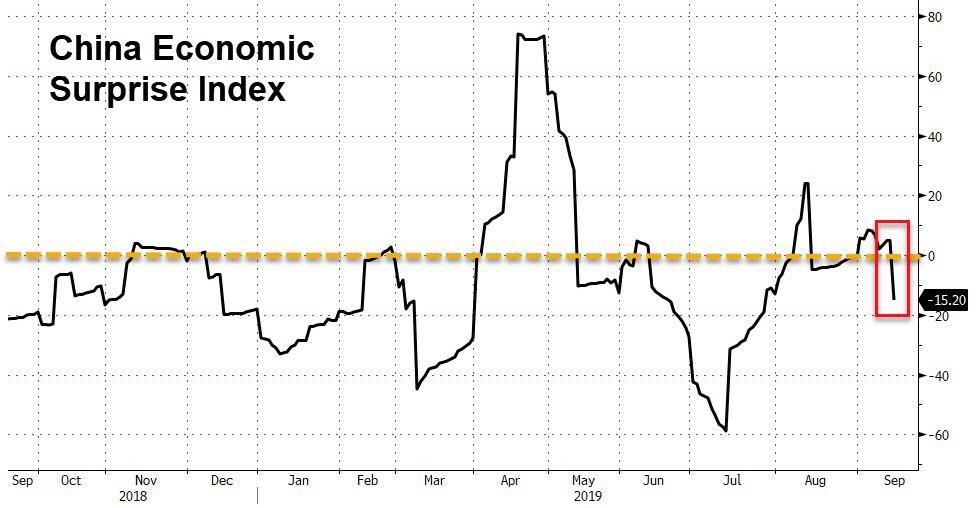

And China’s economic data dumped overnight…

Source: Bloomberg

Tyler Durden

Mon, 09/16/2019 – 16:00

via ZeroHedge News https://ift.tt/30oq1MF Tyler Durden