Markets ‘Feel The Bern’ As Global Growth Scare Accelerates

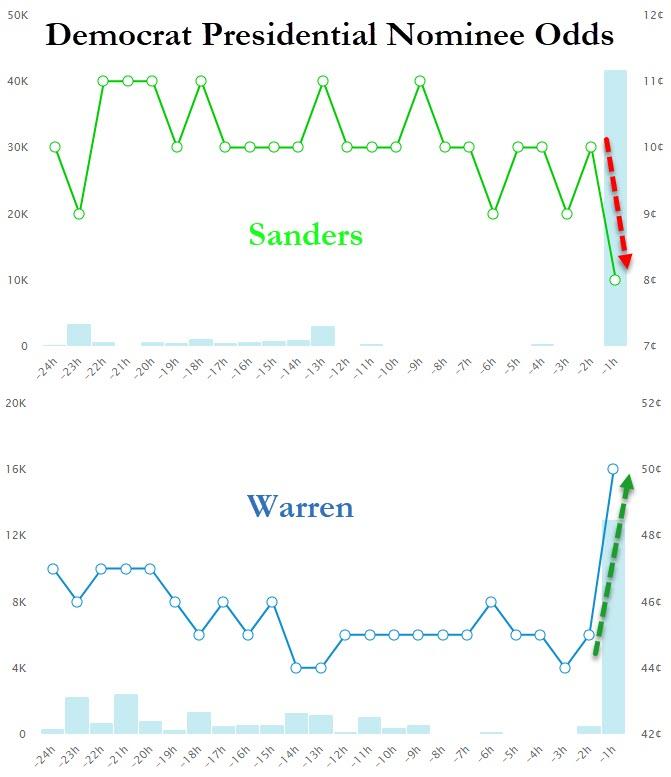

A manufacturing catacl-ism, a disappointing ADP jobs print, NY PMI plunges, crude builds (demand?), and fears about Bernie’s health sparking panic over Warren’s lead. But Fed’s Williams says they have the tools (well in one way he might be right there) and they promise to use them earlier this time… The (stock) market didn’t seem to buy it (even as the dollar and long bond ended unchanged)…

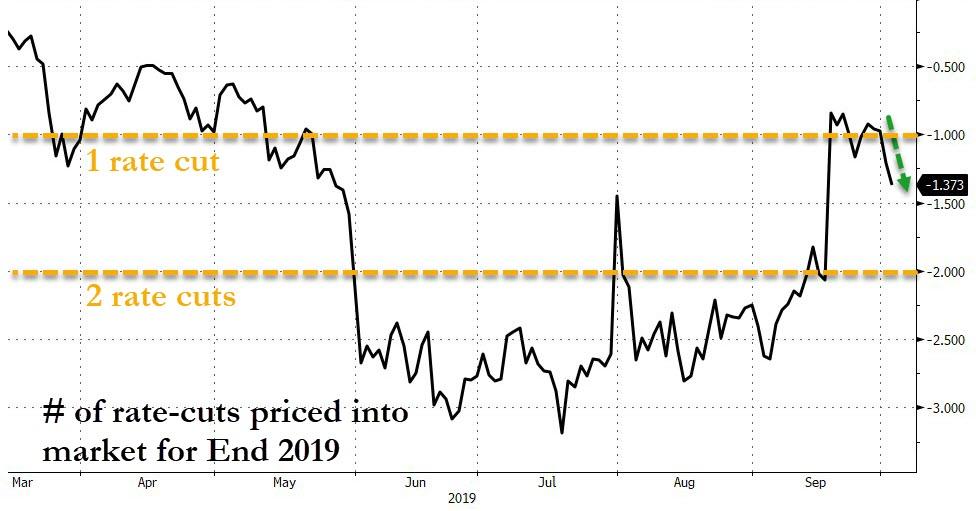

Although the market’s demand for rate-cuts in October is soaring…

Source: Bloomberg

China remains closed but US-based China ETF remains lower on the week…

Source: Bloomberg

Europe was a bloodbath with UK’s FTSE 100 crashed today, dropping 3.2% – the most since Jan 2016…

Source: Bloomberg

US markets cratered today led by Trannies…

Trannies are down 5% so far this week…

The Dow is down 1000 points from the catacl-ism…Some have argued today’s drop accelerated when Bernie Sanders headlines hit…

Sparking this…

And all the major US equity indices have broken below key technical levels… (Russell 2000 <200DMA, rest below 100DMA)

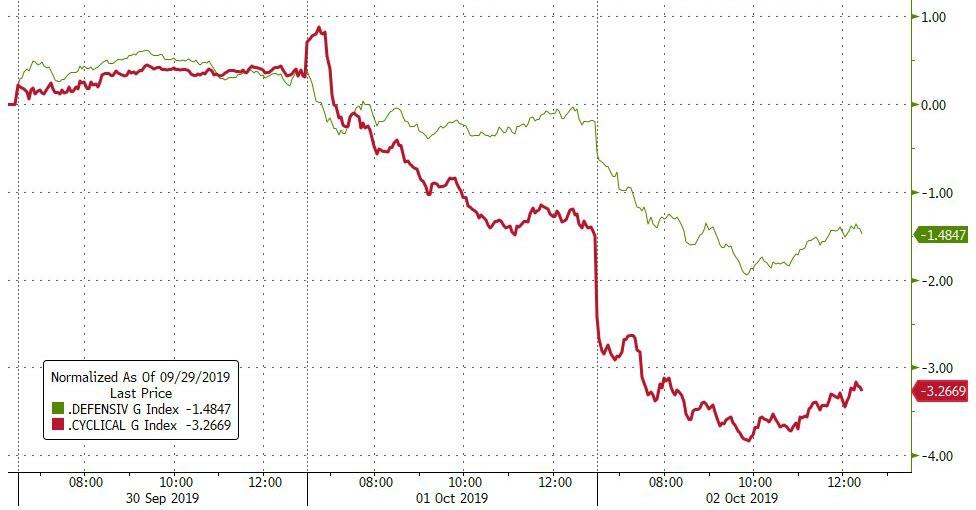

Both Defensives and Cyclicals were hit today, but Cyclicals considerably worse…

Source: Bloomberg

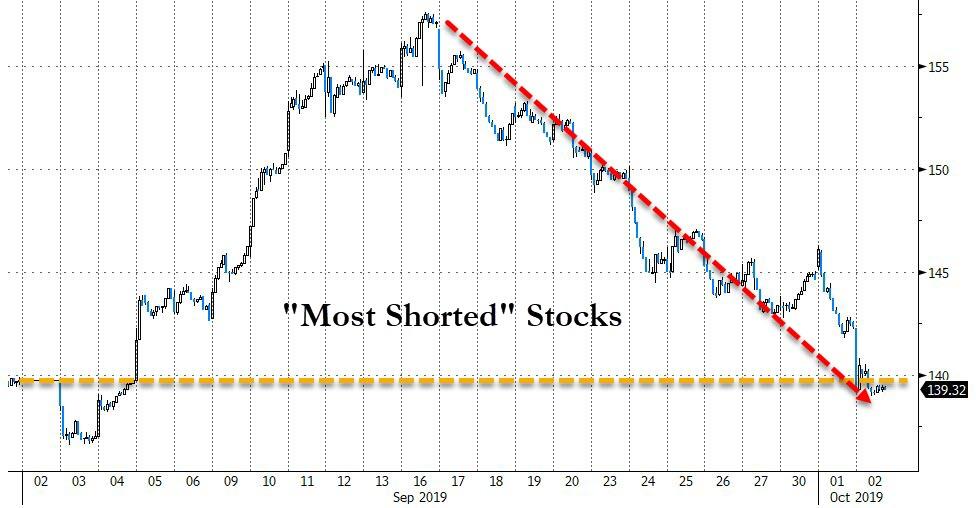

“Most Shorted” stocks fell for the 10th day in the last 12 after a huge squeeze to start September…

Source: Bloomberg

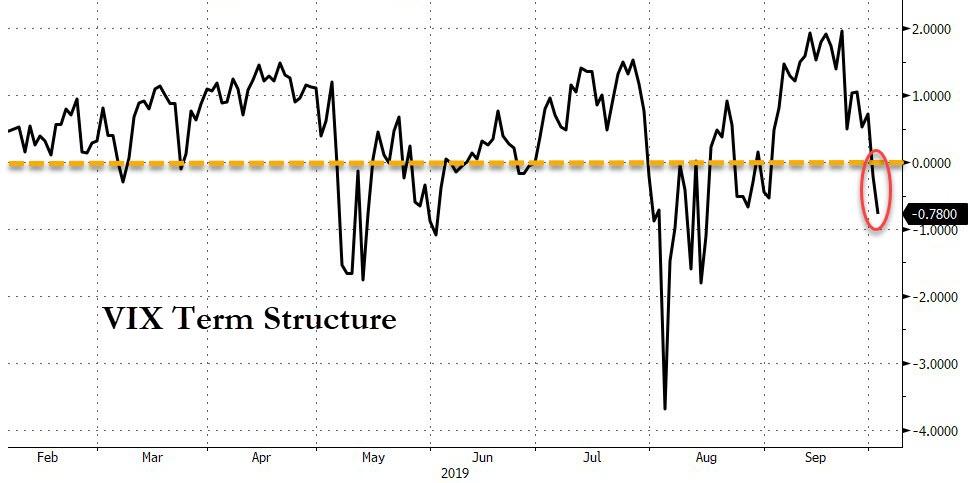

VIX topped 21 intraday and the term structure fell back into inversion…

Source: Bloomberg

Credit markets are starting to crack wider…

Source: Bloomberg

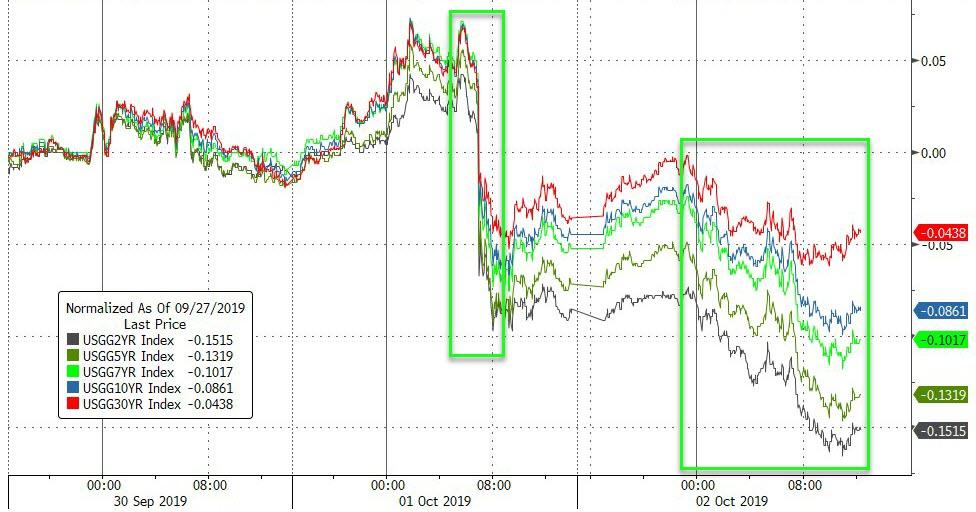

Treasury yields were down across the curve today but there was a very notable outperformance at the short-end (2Y -6bps, 30Y -0.5bps)

Source: Bloomberg

10Y Yields fell back below 1.60%…

Source: Bloomberg

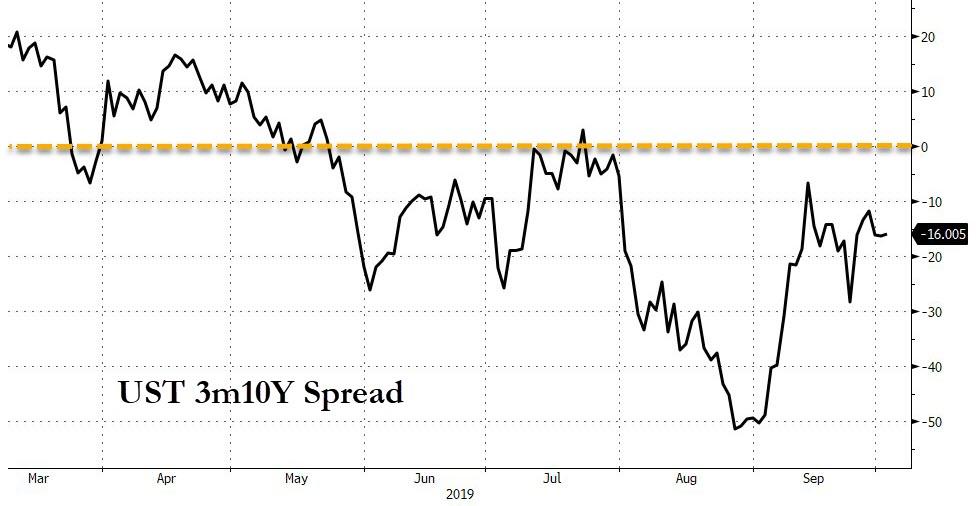

The yield curve (3m10Y) remains inverted…

Source: Bloomberg

And the market shifted more dovishly – now pricing in 1.37 rate cuts by end 2019…

Source: Bloomberg

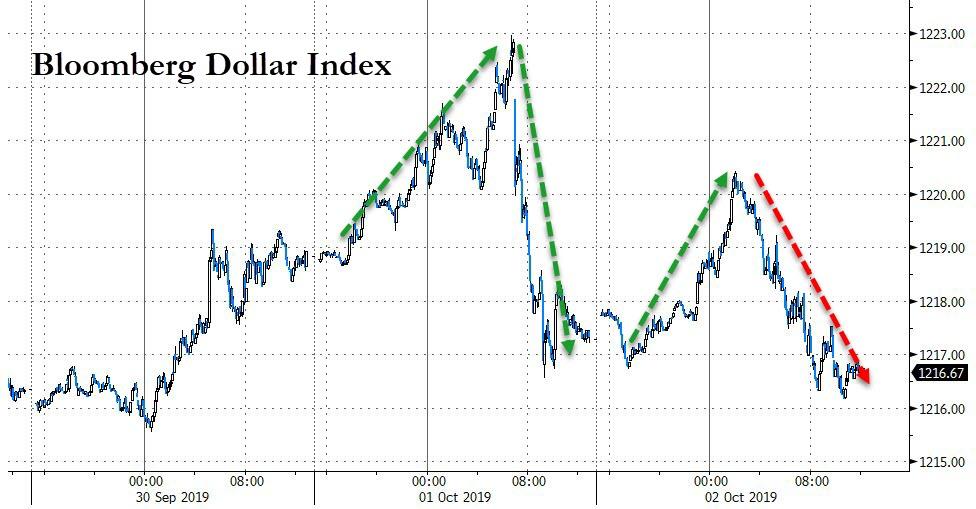

The Dollar was very modestly lower on the day, mimiccing yesterday’s rollercoaster ride…

Source: Bloomberg

Amid all the chaos, cryptos were ‘stable’…

Source: Bloomberg

Precious metals were bid today, back into the green for the week as oil tumbled after a big surprise crude build…

Source: Bloomberg

Gold futures surged back above $1500…

WTI tumbled to near 2-month lows – unchanged in almost 4 months – after a surprise crude build today, erasing all the Saudi attack gains…

Gold topped stocks once again year-to-date…

Source: Bloomberg

Finally, after being buoyed by ‘use-it-or-lose-it’ spending from the US in September, global macro data is collapsing fast…

Source: Bloomberg

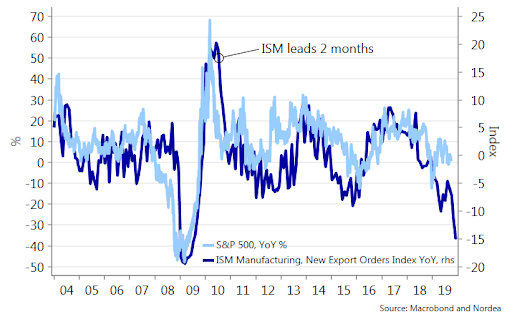

Why ISM Manufacturing matters…

And, if you want to see what propaganda charted looks like, here it is…

Spread between positive & negative sentiment concerning consumer & manufacturing found in major T.V. news programming: financial media can’t get more bifurcated over demand & supply-sides of economy@DataArbor pic.twitter.com/YcANvwmprP

— Liz Ann Sonders (@LizAnnSonders) October 1, 2019

Just keep buying stuff ‘Murica!!

Tyler Durden

Wed, 10/02/2019 – 16:00

via ZeroHedge News https://ift.tt/2pnzGWR Tyler Durden