Goldman’s Dismal Quarter: Prop Trading Plunges; IBanking Slides; Average Comp Crashes

Moments after JPM officially launched Q3 earnings season with a set of impressive results, which saw FICC and IBanking revenues surge, even as equity trading unexpectedly dropped, it was Goldman’s turn and what it reported was decidedly less pleasant for its shareholders.

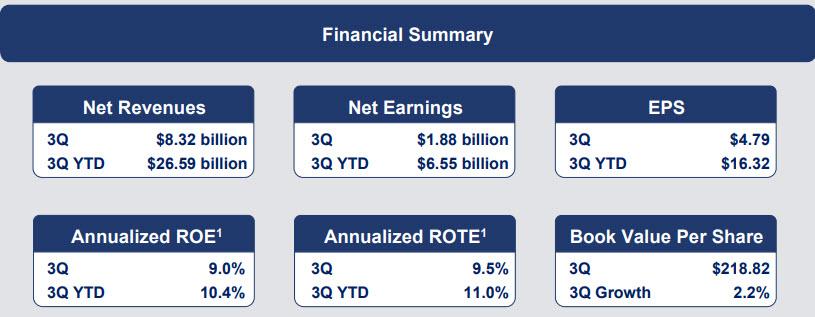

Goldman reported Q3 EPS of $4.79, missing the consensus estimate of $4.86, and down a whopping 24% from $6.28 a year ago; meanwhile Goldman appears to have given up on chasing the “$10BN revenue per quarter” goal, and in Q3 the bank reported revenue of $8.32BN, down 3.8%, and below the $8.91BN estimate.

A quick look at the non-trading aspect of Goldman’s income statement (yes, now that Goldman is becoming a retail bank, “it’s a thing”), the bank reported net interest income of $1.01 billion in Q3, missing the estimate of $1.04 billion.

However it was the trading aspects of Goldman’s revenue that were the key focus, and it was here that things got ugly:

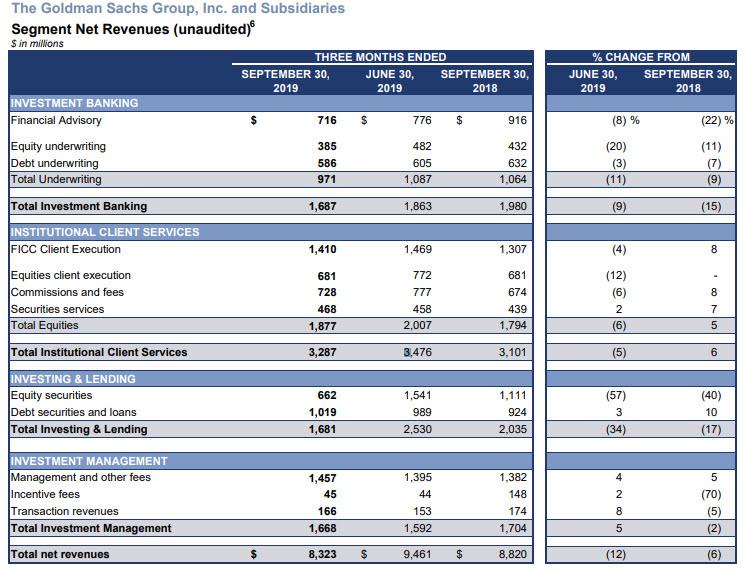

First the good news: similar to JPMorgan, Goldman reported a modest beat in FICC, while it also showed an improvement in equity sales and trading, to wit:

- 3Q equities sales & trading revenue $1.88 billion, +4.8% y/y, estimate $1.82 billion

- 3Q FICC sales & trading revenue $1.41 billion, +7.9% y/y, estimate $1.35 billion

As a result, total 3Q trading revenue rose 6.1% to $3.29 billion, solidly beating the estimate of $3.17 billion.

And now the bad news: here, too, like JPM, Goldman’s Ibanking revenues slumped, tumbling a whopping 15% to $1.69BN from $1.98BN, and missing the estimate of $1.80 billion. As Bloomberg notes, Goldman’s ibankers delivered their worst showing in David Solomon’s tenure as chief executive officer amid choppy markets and marquee deals that failed to come to market.

But the biggest disappointment was also what helped propel Goldman’s revenue higher last quarter, namely its “investing and lending group”, i.e. prop trading, which after reporting $2.5BN in revenue in Q2, tumbled to just $1.68BN in Q3, a whopping 11% drop from a year ago, and the lowest prop trading total since Q4 2017.

Commenting on this sharp drop, Goldman said that net revenues in equity securities were $662 million, 40% lower than the third quarter of 2018, “reflecting significantly lower net gains from investments in private equities as well as net losses from investments in public equities.” Meanwhile, “net revenues in debt securities and loans were $1.02 billion, 10% higher than the third quarter of 2018, driven by significantly higher net interest income. The third quarter of 2019 included net interest income of $891 million.”

Said otherwise, the days when Goldman was Wall Street’s greatest prop trading desk are long behind it and Goldman is now becoming a full-fledged retail bank, which while boosting net interest income, is crushing the bank’s other legacy sources of revenue.

There was more bad news: as Bloomberg notes, the firm took a $267 million markdown on its public equity investments such as Uber, Avantor and Tradeweb Markets, and probably also took a markdown in its stake in WeWork after its IPO collapsed. The losses fueled the worst performance in more than three years for the bank’s equity investments in public and private companies. As Bloomberg adds, “the slump in prized holdings will add to a perception that the investments are subject to unpredictable swings even as the firm works to provide more disclosure.”

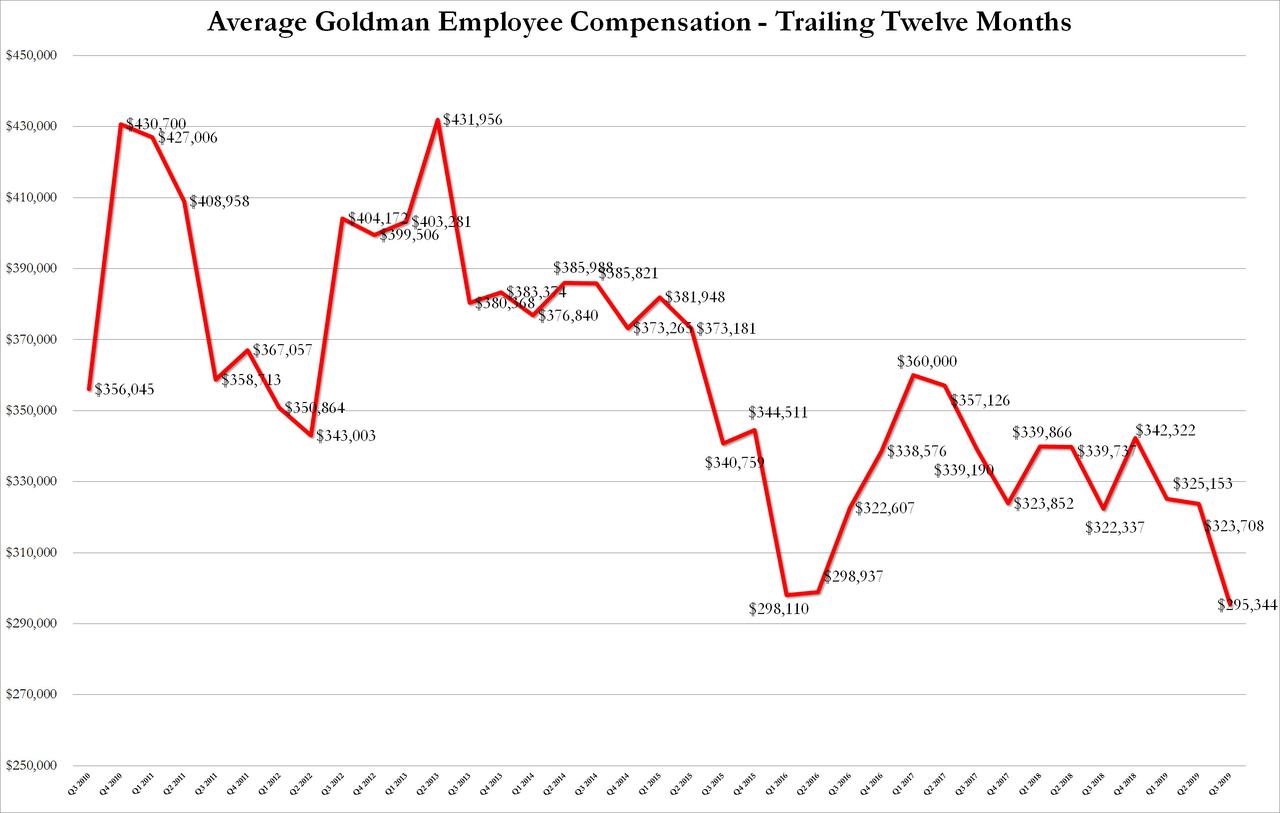

And the worst news by far, at least for Goldman’s employees: now that the bank is a shadow of its former Ibanking powerhouse self as it scramble to rediscover itself as a plain vanilla retail bank, average banker compensation plunged, with the bank recording a paltry $2.7BN in compensation benefits in the quarter even as it hired a whopping 2,200 FTE workers this quarter, the most in one quarter since the financial crisis due to timing of campus hires and acquisition of United Capital, and of course, hiring more retail bankers for its Marcus division. As the chart below shows, net of accruals, Goldman’s average employee compensation plunged from $323K to $295K, only the third sub-$300K print this decade and the lowest average comp since the financial crisis.

Meanwhile, with the Fed now cutting rates, it will be interesting to see just how Goldman grows its retail bank and hopes to harvest deposits as it competes with every other banks for retail money, especially after the firm recently cut for the third time the amount of interest it pays depositors with online savings accounts. Good luck to all Goldman retail bankers.

Tyler Durden

Tue, 10/15/2019 – 08:23

via ZeroHedge News https://ift.tt/31dkjhb Tyler Durden