Futures Rebound On Fake Chinese Data, Ahead Of Slump In US Payrolls

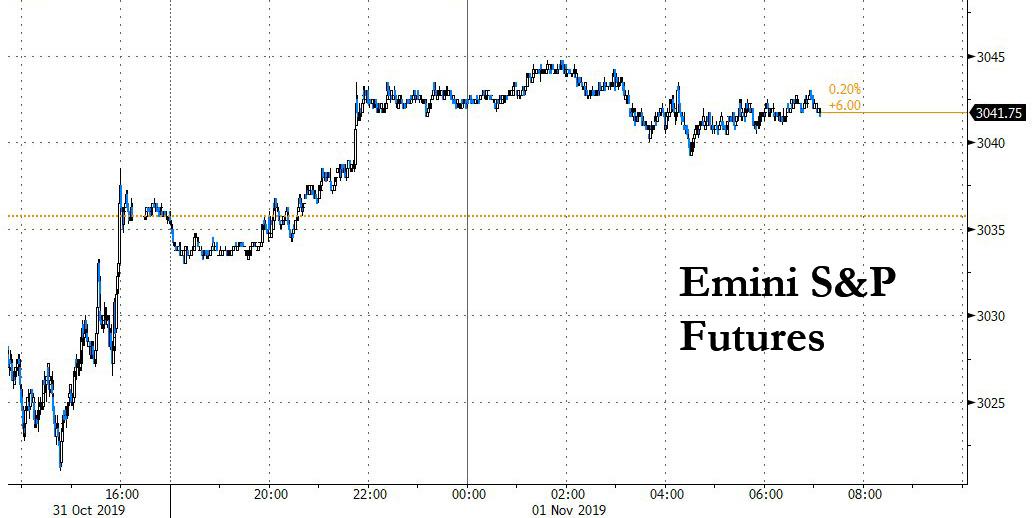

US stock index futures gained on Friday alongside European and Asian markets, after a surprise rise in China’s “other” manufacturing activity survey boosted sentiment, offsetting fading trade deal optimism, as investors awaited a crucial U.S. jobs report.

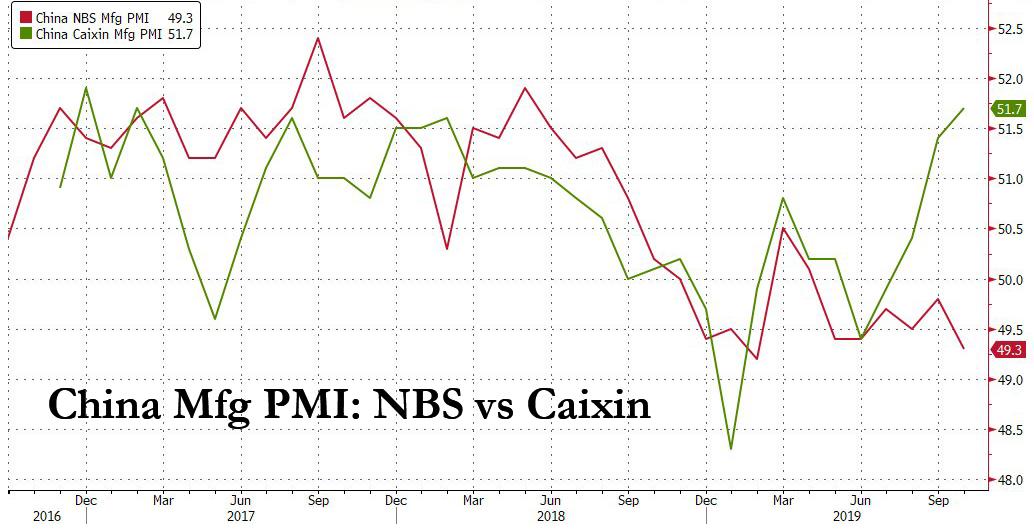

One day after China’s official NBS PMI tumbled to post-crisis low, confirming a manufacturing recession and depressing risk sentiment around the globe, China’s Caixin PMI survey showed manufacturing in the world’s second-largest economy paradoxically expanded at the fastest pace in more than two years in October. Indeed, the schizophrenic divergence between the two PMIs reached a level unseen before, confirming once again that when it comes to fake data, nobody does it like China.

As futures rose, Europe’s Stoxx 600 Index advanced, as miners and industrial goods makers led the way after. Earlier in the session, Asian stocks climbed, led by technology firms, as Chinese manufacturing continued to pick up in October with new orders rising at the quickest pace since January 2013. Markets in the region were mixed, with China leading gains and Indonesia retreating. The Topix closed little changed, as Daiichi Sankyo slumped and Keyence surged after reporting earnings. Two measures of the Japanese labor market softened in September, with the jobless rate unexpectedly rising from a 27-year low. The Shanghai Composite Index gained 1%, reversing earlier losses after the release of positive manufacturing data. China Merchants Bank and Ping An Insurance Group were among the biggest boosts. India’s Sensex added 0.2%, supported by IndusInd Bank and ITC, as better-than-expected company earnings buoyed sentiment.

The US Labor Department’s non-farm payrolls data is likely to show jobs growth slowed sharply last month, weighed down by a strike at General Motors, while the unemployment rate is expected to tick up from near a 50-year low of 3.5% (see our full preview here). Also of interest to investors would be the Institute for Supply Management’s (ISM) manufacturing report due at 10 a.m. ET, which is expected to show the PMI index rose to 48.9 in October from a 10-year low of 47.8 a month earlier.

Markets were looking for footing on the first day of the month after being rattled on Thursday as Chinese officials cast doubts about reaching a comprehensive long-term trade deal with the U.S., even as the two sides close in on signing a “phase one” agreement. Investors will look for the next catalyst in the monthly U.S. non-farm payrolls report due on Friday and a read on American manufacturing for October. On the trade front, negotiators are expected to hold a call today.

“Markets participants, as well as maybe even the Fed, have been very optimistic” on the trade truce, Tiffany Wilding, chief U.S. economist at Pacific Investment Management Co., told Bloomberg TV. “We can see some more deterioration there.”

European bonds drifted lower, while the pound stayed positive after data showed that U.K. manufacturing almost returned to growth last month amid Brexit stockpiling.

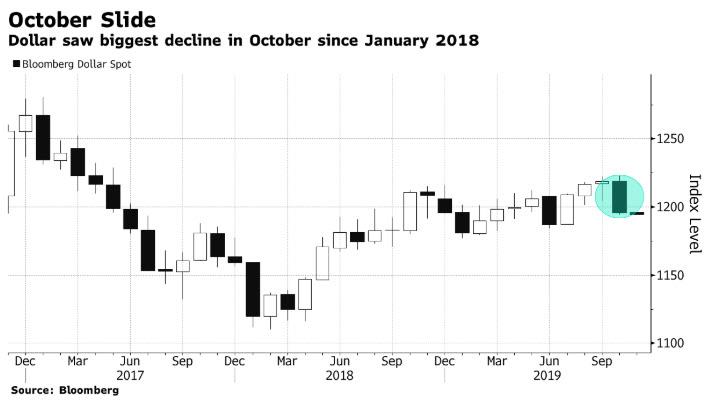

In FX, the dollar was little changed against most G-10 peers ahead of U.S. labor data and a series of speeches by Federal Reserve officials; it followed the biggest monthly decline for the greenback since January 2018.

Elsewhere, the yen held gains and the Bloomberg Dollar Spot Index trimmed the morning’s losses after hitting the lowest since July. Norway’s krone climbed against G-10 peers as unemployment fell. The rand edged lower against the dollar before a ratings decision.

In commodities, oil edged higher though still headed for its biggest weekly loss in a month on swelling American stockpiles. Gold slipped after surging more than 1% on Thursday.

Looking at the day ahead, the obvious data focus is the US employment report for October and ISM manufacturing for October. We’ll also get the final October manufacturing PMI and September construction spending data. The only data of note this morning is the final October manufacturing PMI for the UK. Meanwhile it’s a busy day for Fedspeak headlined by Clarida, while Kaplan, Quarles, Daly and Williams are due to speak. Earnings highlights include Exxon, Chevron and AbbVie.

Market Snapshot

- S&P 500 futures up 0.2% to 3,041.00

- STOXX Europe 600 up 0.4% to 398.19

- MXAP up 0.3% to 163.68

- MXAPJ up 0.5% to 524.51

- Nikkei down 0.3% to 22,850.77

- Topix down 0.03% to 1,666.50

- Hang Seng Index up 0.7% to 27,100.76

- Shanghai Composite up 1% to 2,958.20

- Sensex unchanged at 40,130.48

- Australia S&P/ASX 200 up 0.09% to 6,669.10

- Kospi up 0.8% to 2,100.20

- German 10Y yield fell 1.0 bps to -0.417%

- Euro up 0.04% to $1.1156

- Italian 10Y yield fell 6.6 bps to 0.582%

- Spanish 10Y yield fell 0.5 bps to 0.232%

- Brent futures down 0.7% to $59.79/bbl

- Gold spot little changed to $1,513.66

- U.S. Dollar Index little changed at 97.29

Top Headline News from Bloomberg

- The U.K.’s main political parties are going into their third election in five years promising the most-radical shakeup in the nation’s economy in decades. Boris Johnson’s Conservatives want to implement a Brexit deal which economists say could leave the economy a substantial 3.5% smaller in the long-run. That’s compared with staying in the European Union — one possible outcome of Labour’s policy of holding a second referendum

- Donald Trump’s presidency stands on its most treacherous ground after the House voted Thursday to approve and proceed with its impeachment inquiry. He may be the first president to run for a re-election after being impeached

- Trump said Johnson’s Brexit deal will make it difficult for the British prime minister to strike a trade deal with the U.S. after the U.K. leaves the EU and that the two countries could “do much bigger numbers” if Johnson made a cleaner break with the EU

- Minouche Shafik is the U.K. government’s favored candidate to take over the top job at the institution, according to the BBC. She is currently director of the London School of Economics and Political Science and, if appointed to the BOE, would be its first female chief

- Asia’s factory hubs remained in the doldrums in October despite anticipation that the U.S. and China are moving toward an interim trade agreement. Purchasing manager indexes for South Korea, Japan, Malaysia and Indonesia remained in contraction territory

- China’s PMI data show a pick up but a rare, simultaneous bout of weakness is hitting Chinese bonds and stocks, exposing growing unease about the dual brunt of slowing output growth and rising prices in the world’s second-largest economy

Asian equity markets mostly staged a turnaround of the weak lead from Wall St. where sentiment was dampened after mixed trade rhetoric stoked further US-China uncertainty and with participants tentative ahead of US NFP data, although risk appetite has somewhat improved with the help of encouraging Chinese Caixin Manufacturing PMI data. ASX 200 (+0.1%) was relatively flat as resilience in commodity related stocks just about offset the continued underperformance in the largest weighted financials sector, while Nikkei 225 (-0.3%) lagged and suffered the ill effects of the currency-risk dynamic. Hang Seng (+0.7%) and Shanghai Comp. (+1.0%) were initially weighed by a substantial weekly liquidity drain and after reports suggested that China had doubts about the possibility of a long-term trade deal with US President Trump amid concerns of his impulsive nature, although Chinese bourses later recovered following better than expected Chinese Caixin PMI data which matched its highest since February 2017. Finally, 10yr JGBs extended on the prior day’s rally following recent comments from BoJ Governor Kuroda who continued to stress the possibility for lower rates, while prices were also supported amid underperformance of Japanese stocks and with the BoJ present in the market for JPY 350bln in 5yr-10yr JGBs.

Top Asian News

- Don’t Call It Stagflation, But China Assets Flash Economic Worry

- Bank Run in Rural China Tests Faith in Thousands of Lenders

- Mongolian Coal Giant Is Said to Select Banks for $1 Billion IPO

- Top Indian Automaker Posts First Jump in Sales in Nine Months

Major European Bourses are slightly firmer (Euro Stoxx 50 +0.2%) with the region buoyed by encouraging Chinese Caixin Manufacturing PMI which helped boost sentiment during APAC hours. Trade this morning has been tentative as is usually the case ahead of the US labour market report, with some gains handed back ahead of the release with US ISM Manufacturing PMI also on the docket. Sector performance is reflective of an improved risk tone; Tech (+0.7%), Energy (+0.7%), Materials (+0.5%), Industrials (+0.7%) and Consumer Discretionary (+0.7%) are all firmer, while Utilities (-0.3%), Consumer Staple (+0.3%) and Health Care (+0.1%) lag. Financials (U/C) are also lower; yields have broadly failed to recover since yesterday’s downbeat Chicago PMI and post-FOMC, while stock specific news in the form Danske Bank’s (-3.1%) earnings could also being weighing, after the Co. narrowed its FY19 net outlook to the lower end of range with further potential downside as the Russian Central Bank revoked the Co.’s license for its Russian unit. Elsewhere, stock specifics; DSV (+7.5%) shares are bid after solid earnings. Elsewhere, better than expected results from US Steel (X) is giving a boost to ThyssenKrupp (+1.6%) and Salzgitter (+0.5%). Softer earnings also see Aker ASA (-4.2%) shares under pressure, while Fiat Chrysler (+1.6%) opened lower amid ongoing protestation from various labour unions against the Co.’s proposed merger with Peugeot (+3.3%).

Top European News

- Danske Cuts Outlook as Compliance Costs, Negative Rates Bite

- Billionaire Rokke’s Aker Drops After More Ghana Oil Delays

- SNB Can’t Get the Banks Off Its Back About Negative Rates

- Nokia Staff Say Internal Politics Distracting Managers From 5G

In FX, the DXY seems to have stabilised after its post-FOMC reversal, with the index holding above the 97.000 level in a confined 97.162-348 range and the restrained trade reflecting the overall tone that often pans out in the run up to US labour data. Indeed, Usd/major pairings and even Dollar/EMs are relatively quiet and contained bar the odd exception.

- G10 – As noted above, not much deviation across the board even though data and manufacturing PMIs have thrown up some surprises, like the more encouraging Chinese Caixin survey overnight. The Kiwi continues to outperform and sits firmer on the 0.6400 handle vs its US counterpart, while the Aussie appears wary about hefty option expiries at the 0.6900 strike and with the Aud/Nzd cross capped at 1.0750. Elsewhere, Cable only got a brief/modest lift from a significant UK PMI beat as sub-components were less upbeat and Brexit stock-piling flattered the headline number. Note also, expiry interest resides close by (1.1 bn at 1.2950) and 0.8600 is still proving impenetrable in Eur/Gbp pending the looming Brexit Party pre-election conference, as Eur/Usd remains solid around 1.1150 where a massive 3.1 bn expiries reside. Meanwhile, the Loonie remains rooted to 1.3150 and Franc is pretty resilient between 0.9855-75 and around 1.1000 vs the single currency amidst very mixed Swiss macro releases (CPI back in deflation, but retail sales and manufacturing PMI recovering quite well). Conversely, Scandi PMIs diverged further to provide some respite for the Norwegian Krona vs its Swedish peer and the Euro, as Eur/Nok tests 10.2000 vs Eur/Sek sticky above 10.7000.

- EM – Contrasting fortunes for the Lira and Rand, as the former felt the weight of a bleak Turkish manufacturing PMI, but the latter took comfort from a decent improvement in SA (though still sub-50) awaiting Moody’s ratings review.

In commodities, crude markets are treading water with little in the way of significant price action to report after the complex benefitted from the tailwind of firmer than expected Chinese PMI data. In fitting with market’s broader tentative feel, ranges are thin ahead of key today’s US data. For now, WTI Dec’ 19 and Brent Jan’20 contracts are consolidating around the USD 54.50/bbl and USD 59.90/bbl marks respectively. US Secretary of State Pompeo stated that the US is to impose further Iranian sanctions and nuclear curbs. Metals are similarly tentative ahead of headline US data; gold is holding onto yesterday’s gains, despite a recovery in risk appetite, and is rangebound around the USD 1510/oz mark for now. Meanwhile, Copper has stabilised after yesterday’s steep declines but been unable to garner significant impetus on the back of promising Chinese data. “The more downbeat sentiment came from China’s power sector” notes ING, “which is a key area for copper consumption”. Investment in power network infrastructure over the first nine months of 2019 declined 12.5% Y/Y, according to the Chinese Electricity Council.

US Event Calendar

- 8:30am: Change in Nonfarm Payrolls, est. 85,000, prior 136,000; Change in Private Payrolls, est. 80,000, prior 114,000

- 8:30am: Unemployment Rate, est. 3.6%, prior 3.5%

- 8:30am: Average Hourly Earnings MoM, est. 0.3%, prior 0.0%; YoY, est. 3.0%, prior 2.9%

- 9:45am: Markit US Manufacturing PMI, est. 51.5, prior 51.5

- 10am: ISM Manufacturing, est. 48.9, prior 47.8; Employment, prior 46.3; New Orders, prior 47.3

- 10am: Construction Spending MoM, est. 0.2%, prior 0.1%

- Wards Total Vehicle Sales, est. 17m, prior 17.2m

DB’s Jim Reid concludes the overnight wrap

Welcome to the world of Mrs Lagarde’s ECB tenure which also brings in the month of November. I can’t believe 2019 is already coming towards an end. I might get our Data Innovation Group to explain to me why time seems to accelerate as you get older and also why retirement seems to also get further away. There must be an equation for this.

As it’s the start of a new month, Craig has already published our monthly performance review where he showed that risk appetite returned to markets once again in October as the trade war, Brexit and liquidity in the US all improved relative to where they were at the start of the month. Interestingly for YTD there now isn’t a single asset in our sample with a negative total return. If we look at the last 13 years of returns over the first 10 months of a year, this has never happened before under our sample of assets. After 2018 being close to the worst year on record for the number of assets in negative territory this shows the high vol there is in markets regardless of what standard vol measures suggest. See Craig’s note here for the month and YTD performance numbers.

How markets fare on the first day of November (and perhaps for the rest of the month) will likely depend on the data in the US with the October employment report and October ISM manufacturing report under the spotlight. As we’ll see below China’s Caixin PMI has beaten expectations this morning in contrast to the official number yesterday. What stops this from being an even bigger day is that European PMIs will be delayed until next week due to today’s All Saints holiday. So we have that to look forward to then. The consensus for payrolls today is for an +85k nonfarm payrolls reading which as a reminder follows +136k in September. DB is at +50k. Some of the expected weakness partly reflects the GM strike impact so there may well be some noise in the data. The expectation is for it to reduce employment by 46k but the second round industry impacts could increase this. Our economists also noted that Census hiring could have an impact so private payrolls may be a better print to watch. DB is again below consensus at 40k and think the weakness goes beyond ones offs. As for the rest of the report, the unemployment rate is expected to increase one-tenth to 3.6% and earnings rise +0.3% mom.

Arguably the ISM data will be more important, given the potential distortions from one-offs and also considering the weaker China PMIs this week. October’s data is expected to improve on the month prior with a 49.0 print expected versus 47.8 in September. Expect the market to be highly tuned into the new exports orders component which is typically seen as a leading indicator. See here for DB’s preview (published last night) of these two big releases today.

Yesterday’s Chicago PMI won’t have raised much hopes for today’s ISM however after the October reading dropped nearly 4pts to 43.2 (vs. 48.0 expected). That is the lowest since a one-off plunge at the end of 2015 and prior to that you have to go back to July 2009 to find the last time it was lower. That data contributed to a sharp rally for Treasuries with 10y yields down -8bps and thus further extending the post-Fed move. They are now over 15bps lower than the peak during the middle of Wednesday. At the front end 2y yields also dropped -7.3bps which flattened the 2s10s curve a little to 16.3bps. The market is now pricing around a 30% chance of a cut at the Fed meeting in December which compares to 22% post the Fed meeting on Wednesday. The Fed were pretty confident about the outlook just 36 hours ago and there were a lot of eyebrows raised yesterday over that assessment after the data.

Meanwhile US equity markets closed lower but around half a percentage point above their session lows with the S&P 500 closing down -0.3% and NASDAQ down -0.14% with the results from Apple and Facebook the previous night at least helping to buffer some of the move. A Bloomberg story noting that officials in China were said to doubt a long-term trade deal is possible with Trump got plenty of airtime but ultimately shouldn’t be seen as a great surprise especially ahead of the election. Importantly it also didn’t refer to the phase one agreement already well on the way. On that note President Trump tweeted that the US and China are working on selecting a new site for the signing of that deal and will be announced “soon”. In other news we learnt yesterday that the House voted by 232 to 196 to begin open hearings into the Trump impeachment measure. While markets were non-fussed expect plenty of twists and turns left in this.

This morning in Asia markets are largely trading higher after a surprise beat from China’s Caixin manufacturing PMI (details below). Chinese bourses are leading the advance with the CSI (+1.28%), Shanghai Comp (+0.71%) and Shenzhen Comp (+0.96%) all up. The Hang Seng (+0.44%) and Kospi (+0.41%) are also up while the Nikkei is down (-0.48%). The strength of Japanese yen – which is trading at three week highs – is weighing on the Nikkei. The US dollar index is also trading down a further -0.14% (-0.30% yesterday) this morning, marking five continuous days of declines in a week (if it holds) for the first time since December 2017. Elsewhere, futures on the S&P 500 are up +0.28% and yields on 10y JGBs are down -4.4bps to -0.197% after yesterday’s rally in USTs. WTI crude oil prices are up +0.52% this morning while spot gold prices are down -0.17% after advancing by +1.16% yesterday.

As for overnight data releases, China’s October Caixin manufacturing PMI came in at 51.7 (vs. 51.3 expected), marking the third month in a row of being above 50 and in stark contrast to the official manufacturing PMI (October print at 49.3) which has remained below for the past six months. The output sub index rose to 53.0 (vs. 52.5 last month), the highest reading since December 2016 while the new orders component also rose from last month to the highest since January 2013. So clearly quite a contrasting message from the two PMIs. The difference between the Caixin PMI and the official PMI is that the former is more geared towards SMEs/private sector/exporters so arguably gives a better picture of private sector activity while the later captures a broader swath of companies. Meanwhile, Japan’s final October manufacturing PMI printed one-tenth lower than the initial read at 48.4.

Back to the other data that was out yesterday, the September core PCE reading in the US was a shade softer than expected (0.0% vs. +0.1% expected) although it was largely known from the GDP report on Wednesday. The Q3 ECI was in line at +0.7% qoq while jobless claims ticked 5k higher to 218k.

In Europe there was a moderate upside surprise in the Q3 GDP reading for the Euro Area of +0.2% qoq (vs. +0.1% expected) however our economists have made the point that the latest data signal for Q4 is slightly weaker and the latest Eurostat survey implies that not only manufacturing but also consumer uncertainty has reached its highest levels since the Great Recession. Meanwhile the October core CPI reading for the Euro Area was a tenth ahead of expectations at +1.1% yoy. In other news, Reuters reported that new ECB President Lagarde is to keep Draghi’s top aides which at the margin might be a positive given policy continuity although it might depend on what you think of current policies. It’s worth flagging that Lagarde will be making her first public engagement as President on Monday at 6pm GMT. For completeness, equity markets in Europe spent most of the day in the red yesterday with the STOXX 600 ultimately closing down -0.49%. Bond markets mirrored the moves in the US though with 10y Bunds back down -5.2bps.

Finally to the day ahead, where the obvious data focus is the US employment report for October and ISM manufacturing for October. We’ll also get the final October manufacturing PMI and September construction spending data. The only data of note this morning is the final October manufacturing PMI for the UK. Meanwhile it’s a busy day for Fedspeak headlined by Clarida, while Kaplan, Quarles, Daly and Williams are due to speak. Earnings highlights include Exxon, Chevron and AbbVie.

Tyler Durden

Fri, 11/01/2019 – 07:53

via ZeroHedge News https://ift.tt/326u6Ws Tyler Durden