75% Of Millennials May Never Be Able To Afford Owning A House

More so than with Gen X and the Baby Boomers, housing has become indelibly tied up with the millennial identity. That’s largely because economic hardship – or at the very least, stagnation and heavy debt – is perhaps the single defining characteristic of the generation that came or age during or just after the financial crisis nearly destroyed the global economy.

And while many had hoped that millennials would find their footing and their economic prospects would improve with time, sadly, that’s just not the case for many millennials.

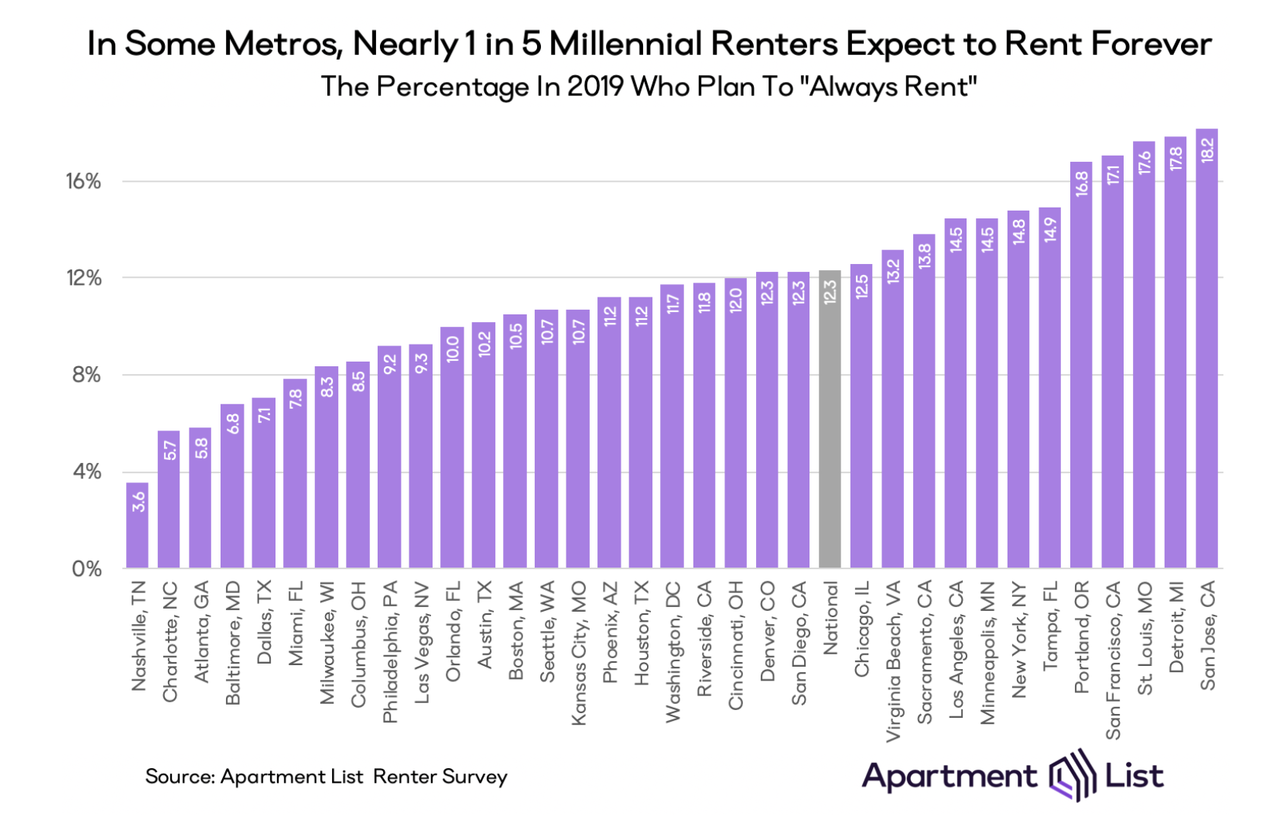

And in its latest study of millennial attitudes toward the housing market, Apartment List found that a growing percentage of those surveyed said they fully expected to be renters forever. Unsurprisingly, the percentage of respondents who felt that homeownership would be forever out of reach was higher in expensive urban enclaves like NYC, and many cities across the state of California.

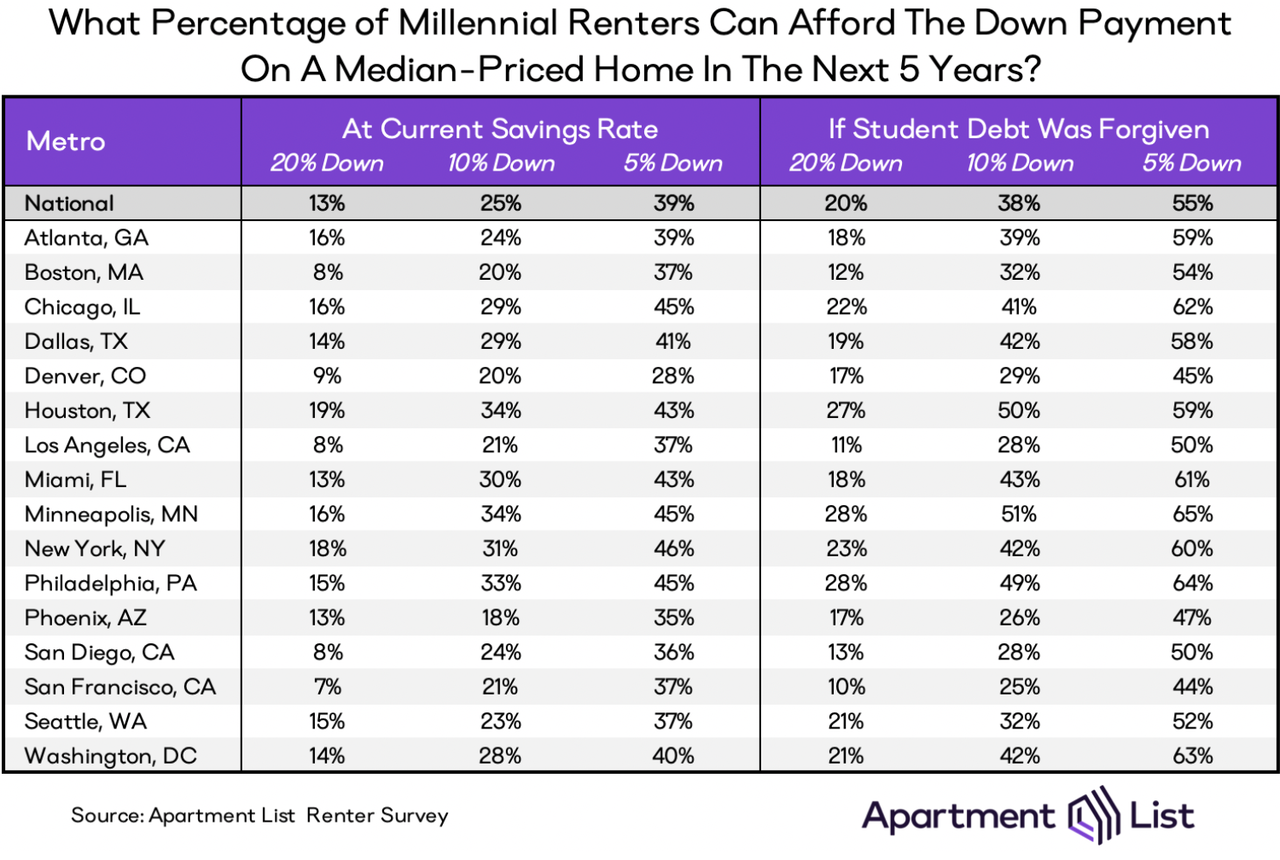

But perhaps the most alarming finding from the study stems from the researchers examination of student debt and how the burden of making their monthly loan payments impacts their ability to save for a down payment. At the current savings rate, just 25% of millennial renters will be ready to put down 10% on a median-priced starter home in the next five years (typically, buyers need 20% down to get a mortgage). That means 75% of millennials likely won’t be able to afford a down payment any time soon.

To better understand the barrier created by student debt, Apartment List tried to simulate Bernie Sanders’ proposal to take all student debt payments and apply them to down payments instead. Apartment List found that the effect would be significant: Across the country the percentage of millennials who would soon be able to afford a 10% down payment on a median condo would rise from 25% to 38%.

After more than a decade of decline, the national homeownership rate is finally climbing again. But the Apartment List study is unfortunately just the latest to show that the situation for millennials hasn’t improved. Half of millennials have nothing saved for a downpayment (despite being dangerous close to – or past – the age of 30). If this keeps up, millennials can ditch that tired sobriquet for something more appropriate: Generation Rent.

Tyler Durden

Mon, 11/25/2019 – 20:45

via ZeroHedge News https://ift.tt/34r8Xso Tyler Durden