Stocks, Bonds, & The Dollar Dumped On Dismal-Data & Trade-Tensions

A quadruple-whammy of not-awesome trade-related comments today spoiled the party…

-

0602ET *TRUMP TO RESTORE TARIFF ON STEEL SHIPPED FROM BRAZIL, ARGENTINA

-

1035ET *TRUMP WILL INCREASE TARIFFS IF NO CHINA DEAL, ROSS TELLS FOX

-

1200ET *TRUMP AIDE SAYS IT’S UP TO CHINA IF DEAL WILL BE MADE THIS YR

-

1230ET *CHINA TO RELEASE ‘UNRELIABLE ENTITY LIST’: GLOBAL TIMES

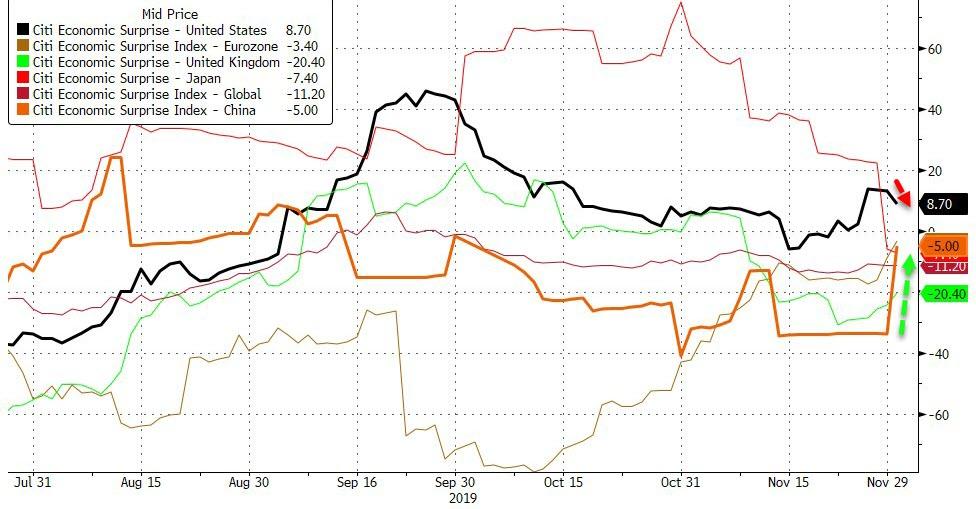

And then US Macro data poured cold water on China and EU economic hope as construction spending plunged and manufacturing ISM disappointed significantly.

Source: Bloomberg

But that ‘surprising’ surge in a government-provided survey of manufacturers in China was offered up as evidence that (despite US weakness) everything will be ok and the trough is in…

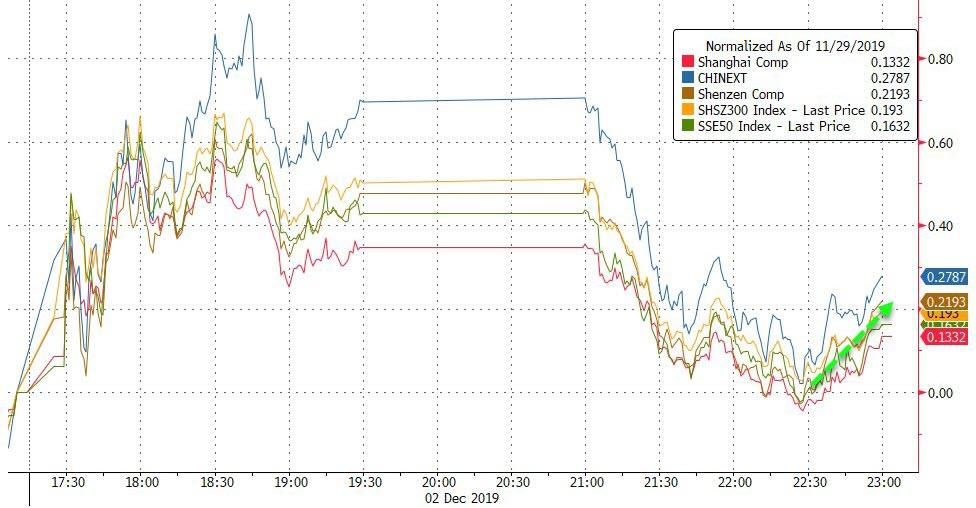

Chinese stocks clung to very modest gains overnight (trade headlines hit after the China close)…

Source: Bloomberg

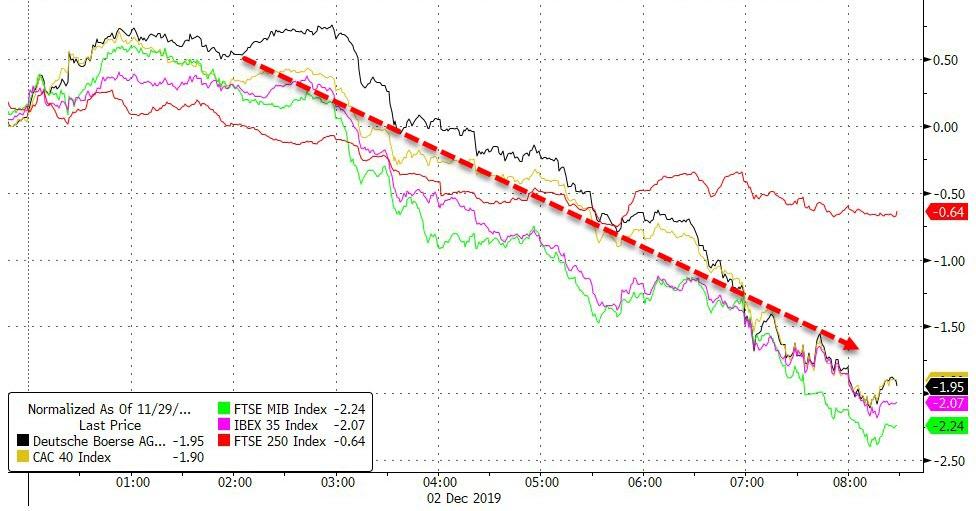

European stocks were hammered on trade turmoil (despite PMIs beating expectations)…

Source: Bloomberg

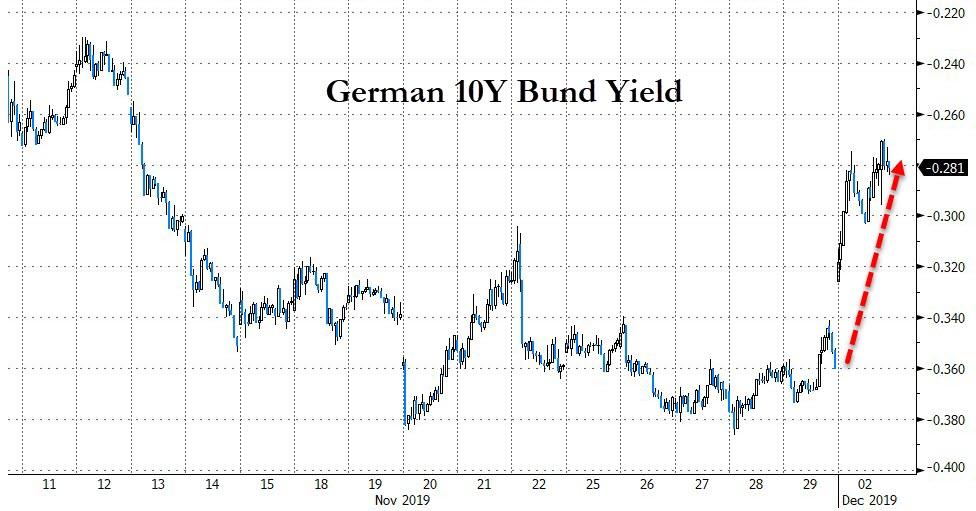

And European bonds were also down (in price) along with stocks (10Y Bunds +8bps)…

Source: Bloomberg

US equities suffered their biggest daily drop in 6 weeks…

Dow futures were down over 400 points from the overnight highs…

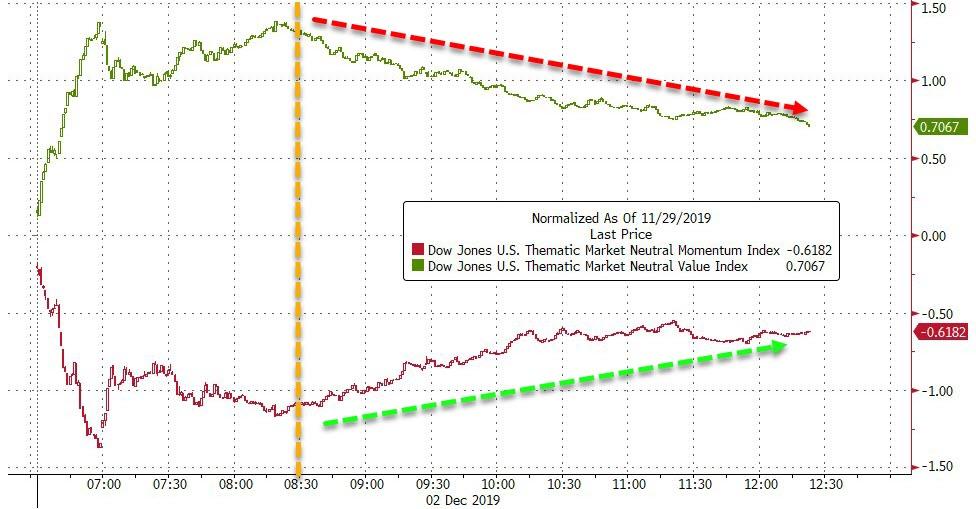

Momo was dumped at the open but the trend in value/momo reversed around the European close…

Source: Bloomberg

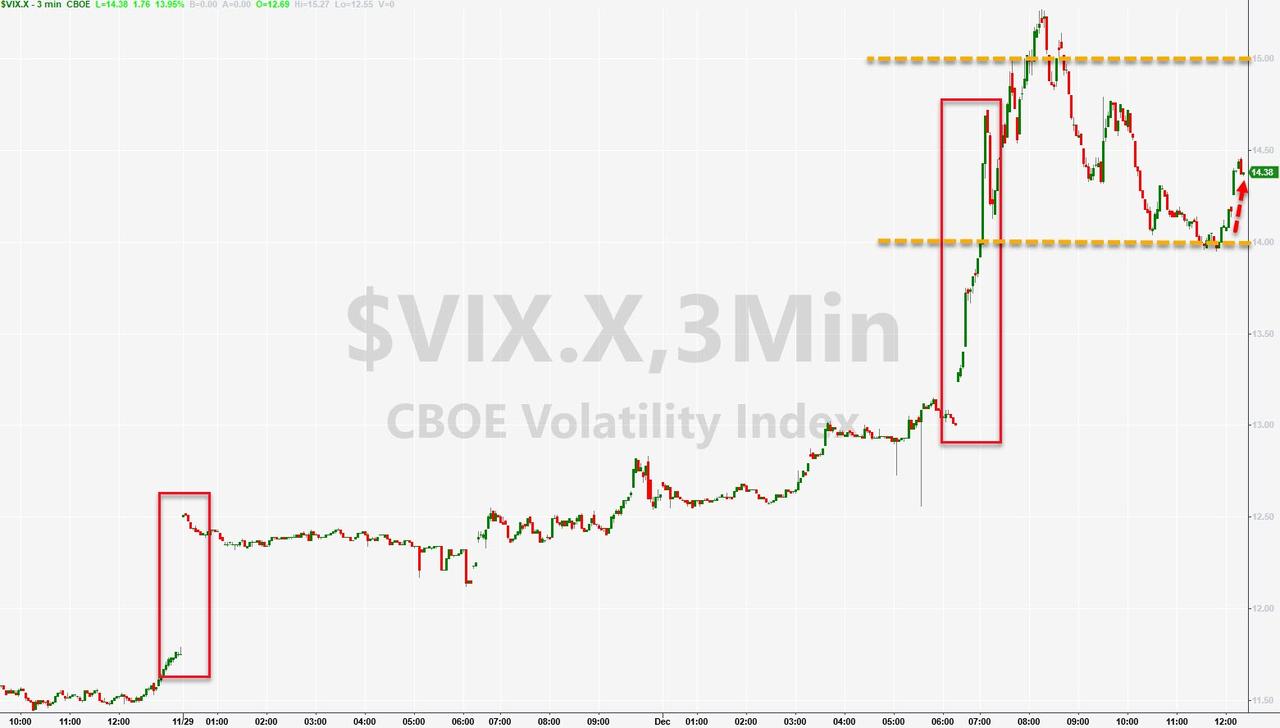

VIX spiked above 15 intraday but once again vol-sellers returned after Europe’s close…

Source: Bloomberg

Credit was smashed today (after last week’s insane surge)…

Source: Bloomberg

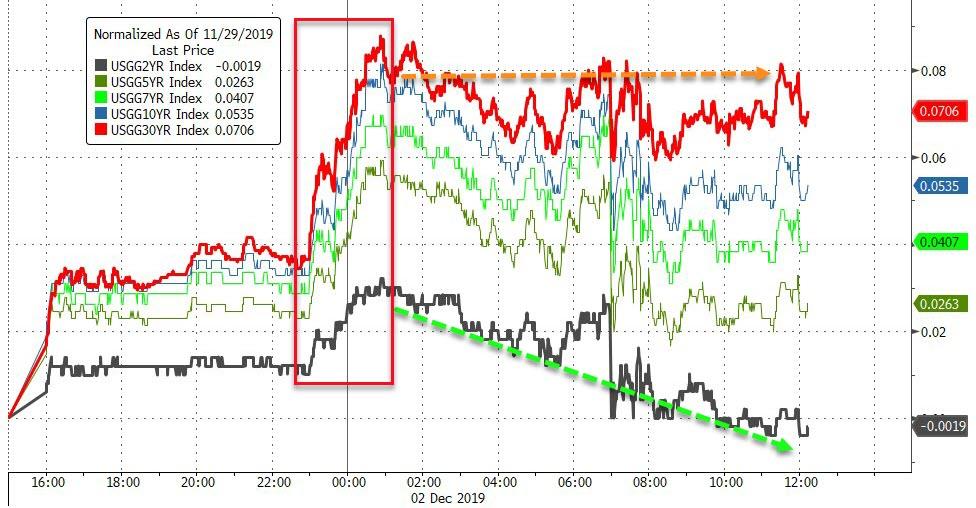

Treasury yields surged on the day, led by the long-end (2Y was marginally lower in yield)…

Source: Bloomberg

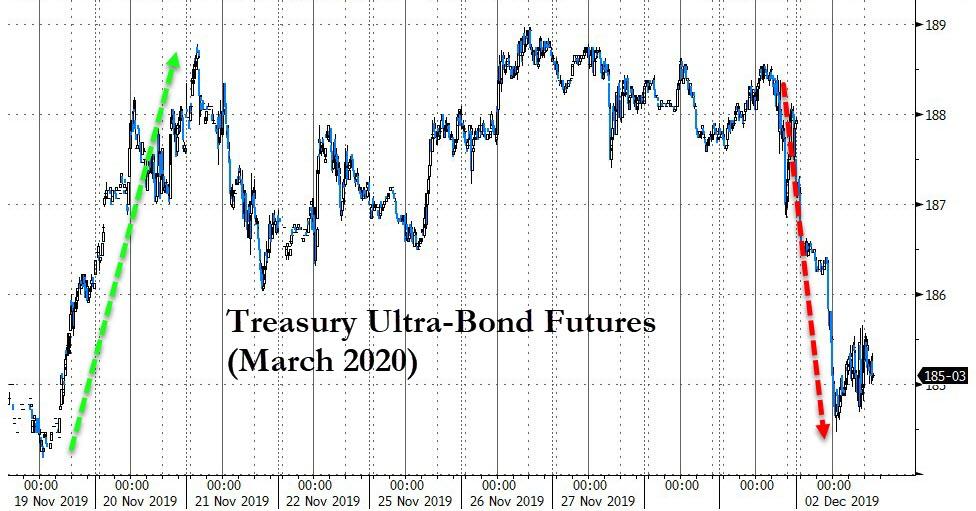

Most notably, the ultra-bond futures collapsed overnight (hitting a 3-point limit circuit breaker)…

Source: Bloomberg

And today saw a major steepening of the yield curve… (the yield curve move has the smell of rate-locks given the underlying macro data, but we will have to wait and see what the calendar looks like – high-grade dealers expect this week to bring $15b-$20b in supply. This is likely to be December’s busiest week, with just about $25b for the full-month in store, according to estimates — that’s $8b more than last year and in line with the $23b that priced in December 2017)

Source: Bloomberg

The dollar was dumped today (biggest daily drop in 6 weeks)…

Source: Bloomberg

…breaking down through its 50- and 100-day moving-averages…

Source: Bloomberg

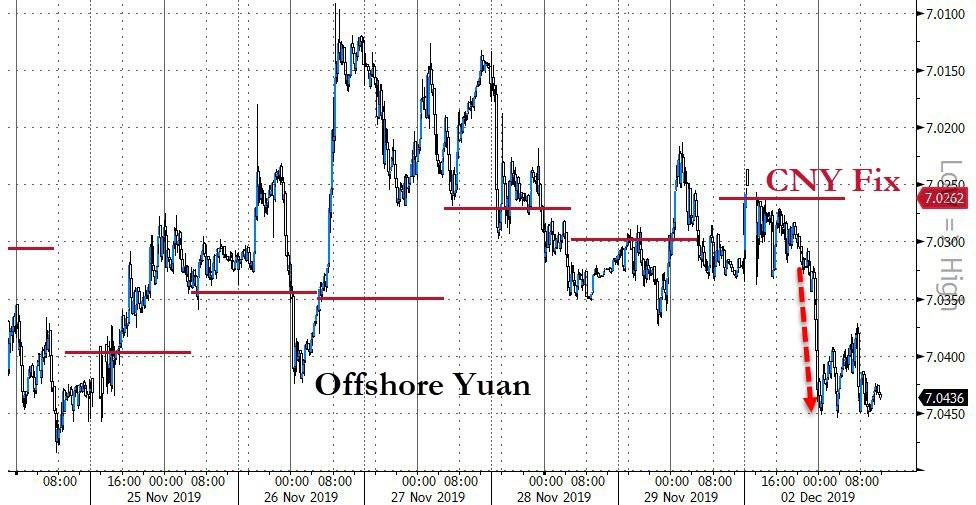

Yuan also lost ground as trade-deal hope faded…

Source: Bloomberg

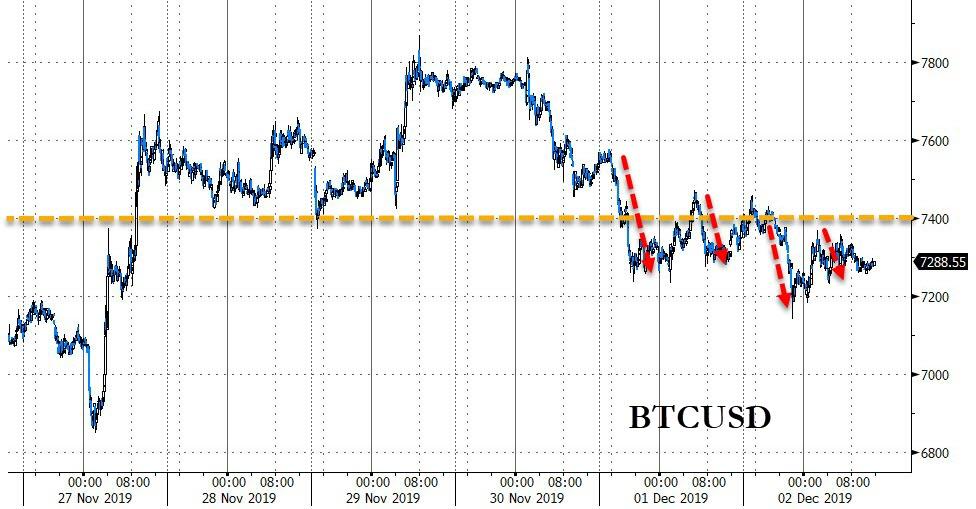

Cryptos extended losses over the weekend and pushed lower still today…

Source: Bloomberg

Bitcoin has been unable to get back above $7400…

Source: Bloomberg

Gold, Copper, and Silver ended the day lower (despite a tumbling dollar) but oil popped on Saudi calls for more production cuts/extensions at OPEC (as its Aramco IPO looms)…

Source: Bloomberg

But, with regard to oil, it is still a lot lower than before Friday’s plunge…

“This whole week is going to be based on OPEC speculations,” said James Williams, president of London, Arkansas-based WTRG Economics.

All the precious metals are green for 2019, but palladium is by far the biggest winner…

Source: Bloomberg

Finally, today was the worst day for a balanced portfolio of stocks and bonds since mid-August…

Source: Bloomberg

Additionally, as Bloomberg’s Garfield Reynolds notes, global equities are gliding serenely into the end of 2019, even in the face of a dire economic landscape. To justify an exuberance that looks anything but rational, global activity will need to turn around dramatically.

Source: Bloomberg

The 2019 FOMO rally’s resilience has taken it far enough in the face of a cloudy forecast. Any declines from here could get very steep indeed.

And then there’s this…

Source: Bloomberg

And the US is just as bad (if not worse)…

Source: Bloomberg

And this…

Source: Bloomberg

Tyler Durden

Mon, 12/02/2019 – 16:00

via ZeroHedge News https://ift.tt/33EBfOQ Tyler Durden