Key Events In The Week Ahead: PMIs, ISMs, Payrolls And Politics

While the period after Thanksgiving is traditionally when trading desks wind down for the year as most PMs and algos head for the hills of Aspen and Chamonix, there is still economic data to digest with this first week of December hosting a number of critical events that will set the agenda for markets running up to Christmas.

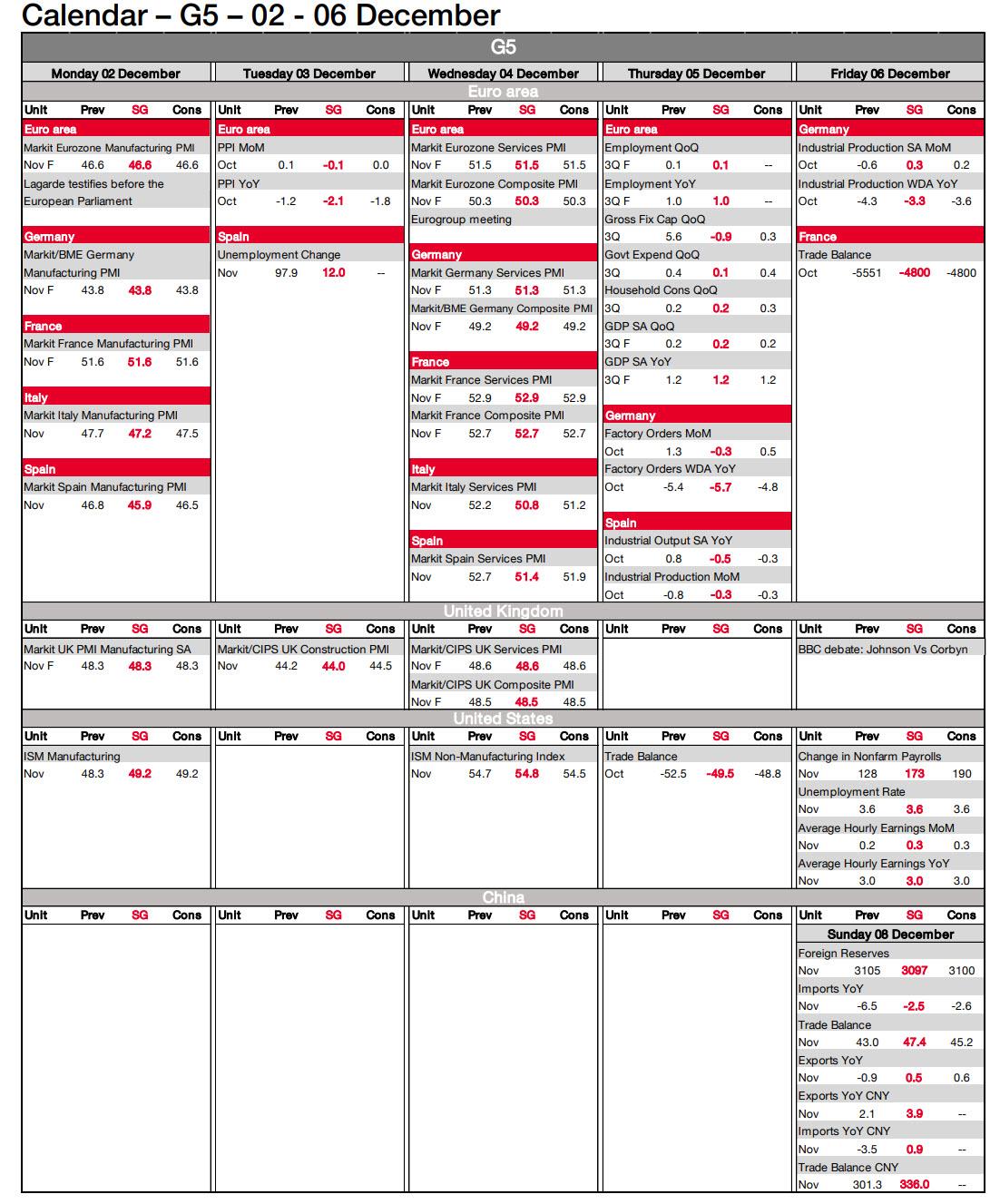

As DB’s Jim Reid notes, data releases include global PMIs (today and Wednesday), the US jobs report (Friday) and the US ISM figures (today and Wednesday). We’ll hear from ECB President Lagarde (today), and get policy decisions from central banks in Canada (Wednesday), Australia (Tuesday) and India (Thursday), while there’ll be another UK election debate between the two main party leaders (Friday) and a NATO leaders summit in London (Tuesday-Wednesday). With only just over a week to the U.K. election all eyes on whether Trump’s visit to London (starting today ahead of NATO) creates political capital for the opposition parties keen to link Mr Trump to Mr Johnson. Finally the German SPD 3-day party conference starting on Friday is now a must watch given the shock leadership results over the weekend.

Today is global manufacturing PMI day before the services and composite PMIs come out on Wednesday. China has given the world a boost by seeing the official manufacturing gauge at 50.2 (49.5 expected), the first 50+ print since April and up from 49.3 in October. Non-manufacturing rose to 54.4 (consensus 53.1) from 52.8 last month. There is some chatter about strong seasonal helping but overall this will be seen as positive news. Meanwhile, China’s November Caixin manufacturing PMI also came in higher than consensus at 51.8 (vs. 51.5 expected).

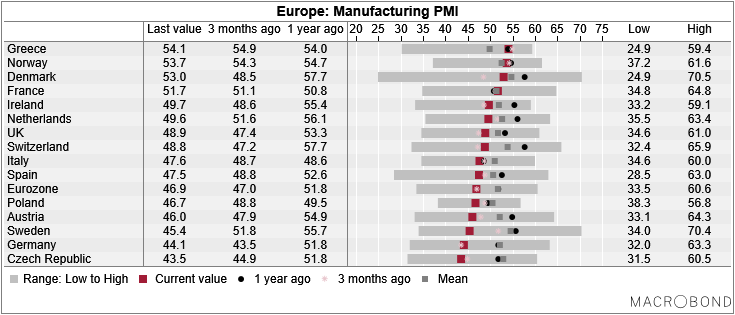

Moving forward and as for the rest of the global PMIs, the flash numbers mean we do have some initial indications of how the global economy performed into November but if momentum is improving this can be picked up between the flash and final numbers. The flash Euro Area services PMI fell to 51.5 while the manufacturing reading rose to 46.6, and the consensus is expecting the final Euro Area PMI readings to remain in line with the flash ones. A breakdown of European PMIs is shown below courtesy of Swiss Life:

In the US, we’ve also got the ISM releases, with the manufacturing report today before the non-manufacturing index comes out on Wednesday. The manufacturing reading has been below 50 since August (49.2 expected, 48.3 last month), although the non-manufacturing index has held up better, at 54.7 last month.

The other big highlight of the week comes with the US jobs report on Friday. In October, the +128k increase in nonfarm payrolls was the slowest pace of job growth since May but was better than expected with upward revisions to earlier months. The consensus is looking for a rebound to +190k in November. Meanwhile the unemployment rate and average hourly earnings yoy growth are expected to remain at 3.6% and +3.0% respectively. Other US data on factory orders, the trade balance and durable goods orders on Thursday will also help set the tone through December.

In Europe, slightly less is happening in terms of data aside from the PMIs, but we will see German factory orders and industrial production figures released for October on Thursday and Friday respectively. With the German economy having avoided a technical recession in Q3 with +0.1% qoq growth, attention will focus on whether the data heading into Q4 has shown further signs of stabilization. Finally, for the Euro Area as a whole, Thursday sees the October retail sales figures coming out, along with the final reading for Q3 employment and GDP.

Turning to central banks, with the Fed in their blackout period, the main event this week is likely to be ECB President Lagarde’s appearance before the Economic and Monetary Affairs Committee of the European Parliament today. This is the first Monetary Dialogue with the committee since Lagarde became ECB President, and it’ll be worth keeping an eye on whether she talks about the upcoming strategic review of monetary policy.

Other political events to watch out for include the annual UN climate change conference in Madrid from today, which will be taking place over the next two weeks. Then here in London we have a summit of NATO leaders on Tuesday and Wednesday. And finally, ahead of the UK general election on December 12, there’ll be the second head-to-head debate between Prime Minister Johnson and Labour leader Corbyn on Friday.

Courtesy of DB here is a day-by-day calendar of events:

Monday

- Data: November manufacturing PMIs from South Korea, Indonesia, Japan, China, India, Russia, Turkey, Italy, France, Germany, Euro Area, South Africa, UK, Brazil, Canada, US and Mexico, Japan November vehicle sales, US November ISM manufacturing, October construction spending, South Korea final Q3 GDP, Japan November monetary base

- Central Banks: ECB’s Lagarde, Rehn, Holzmann speak

- Politics: UN Climate Change conference begins

Tuesday

Data: UK November construction PMI, Euro Area October PPI, Australia final November services and composite PMIs

- Central Banks: Reserve Bank of Australia decision, ECB Executive Board nominees Panetta and Schnabel speak

- Politics: NATO summit begins

Wednesday

- Data: November services and composite PMIs in Japan, China, India, Russia, Italy, France, Germany, Euro Area, UK, Brazil and US, Australia Q3 GDP, US weekly MBA mortgage applications, November ADP employment change, ISM non-manufacturing index

- Central Banks: Bank of Canada decision, Fed’s Quarles speaks

Thursday

- Data: Germany October factory orders, November construction PMI, Euro Area October retail sales, final Q3 employment, GDP, US November Challenger job cuts, weekly initial jobless claims, October trade balance, factory orders, final October durable goods orders, nondefense capital goods orders, Canada October international merchandise trade, Japan October labour cash earnings, household spending

- Central Banks: Reserve Bank of India decision, BoJ’s Harada, Fed’s Quarles speak

Friday

- Data: Germany October industrial production, France October trade balance, Italy October retail sales, Canada November unemployment rate, net change in employment, US November nonfarm payrolls, unemployment rate, average hourly earnings, final October wholesale inventories, preliminary December University of Michigan sentiment, October consumer credit

- Politics: German SPD party conference begins, UK TV debate between Prime Minister Johnson and Labour leader Corbyn.

* * *

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the ISM manufacturing index on Monday, the ISM non-manufacturing index on Wednesday, and the November employment report on Friday. There no speaking engagements from Fed officials this week, reflecting the December FOMC blackout period.

Monday, December 2

- 10:00 AM ISM manufacturing index, November (GS 50.1, consensus 49.5, last 48.3); Our manufacturing survey tracker edged up by 0.2pt to 51.2 in November, following stronger regional manufacturing surveys on net. After its first increase following six straight declines in October, we expect the ISM manufacturing index to rise 1.8pt further to 50.1 in November.

- 10:00 AM Construction spending, October (GS +0.6%, consensus +0.4%, last +0.5%): We estimate a 0.6% increase in construction spending in October, with scope for increases in both private and public construction spending growth.

Tuesday, December 3

- There are no major economic data releases scheduled.

Wednesday, December 4

- 08:15 AM ADP employment report, November (GS +135k, consensus +155k, last +125k); We expect a 135k gain in ADP payroll employment, reflecting some drag from increased jobless claims and lower October payrolls. While we believe the ADP employment report holds limited value for forecasting the BLS nonfarm payrolls report, we find that large ADP surprises vs. consensus forecasts are directionally correlated with nonfarm payroll surprises.

- 10:00 AM ISM non-manufacturing index, November (GS 54.9, consensus 54.5, last 54.7); We expect the ISM non-manufacturing index to edge up by 0.2pt to 54.9 in the November report, partly reflecting further improvement in our non-manufacturing survey tracker (+1.1pt to 54.5).

Thursday, December 5

- 08:30 AM Initial jobless claims, week ended November 30 (GS 215k, last 213k); Continuing jobless claims, week ended November 23 (last 1,640k): We estimate jobless claims increased by 2k to 215k in the week ended November 30, following a 15k decline in the prior week.

- 08:30 AM Trade balance, October (GS -$48.5bn, consensus -$48.9bn, last -$52.5bn): We estimate the trade deficit decreased by $4.0bn in October, reflecting a decline in the goods trade deficit.

- 10:00 AM Factory Orders, October (GS flat, consensus -0.5%, last -0.6%); Durable goods orders, October final (last +0.6%); Durable goods orders ex-transportation, October final (last +0.6%); Core capital goods orders, October final (last +1.2%); Core capital goods shipments, October final (last +0.8%): we estimate factory orders were flat in October following a 0.6% decrease in September. Durable goods orders moved up in the October advance report, driven in part by an increase in aircraft orders.

Friday, December 6

- 08:30 AM Nonfarm payroll employment, November (GS +195k, consensus +190k, last +128k); Private payroll employment, November (GS +195k, consensus +190k, last +131k); Average hourly earnings (mom), November (GS +0.3%, consensus +0.3%, last +0.2%); Average hourly earnings (yoy), November (GS +3.1%, consensus +3.1%, last +3.0%); Unemployment rate, November (GS 3.6%, consensus 3.6%, last 3.6%): We estimate nonfarm payrolls increased 195k in November, reflecting a 46k rebound from the end of the General Motors strike and a modest rebound in employer surveys following the de-escalation of the trade war. We also note that November payroll growth tends to accelerate in tight labor markets, as labor supply constraints may incentivize firms to pull forward hiring or reduce end-of-year layoffs. On the negative side, the late Thanksgiving holiday this year (the 28th) may reduce the number of retail workers included in the November payroll figures. We also expect a 5k drag in Census employment following the completion of this year’s address canvassing. We estimate an unchanged unemployment rate at 3.6%, as the household survey may be due for a pause after 407k average gains over the prior three months. Finally, we estimate average hourly earnings increased 0.3% month-over-month and 3.1% year-over-year, reflecting favorable calendar effects, scope for a rebound in supervisory earnings, and continued wage pressures.

- 10:00 AM University of Michigan consumer sentiment, November preliminary (GS 98.0, consensus 97.0, last 96.8); We expect the University of Michigan consumer sentiment index increased by 1.2pt to 98.0 in the preliminary December reading, following firm readings in other confidence measures.

- 10:00 AM Wholesale inventories, October final (last +0.2%)

Source: Deutsche Bank, Goldman

Tyler Durden

Mon, 12/02/2019 – 09:21

via ZeroHedge News https://ift.tt/3809kfm Tyler Durden