US Treasury Starts Off New Decade With Medicore, Tailing 3Y Auction

The US Treasury has started off the new year, and decade, of Treasury coupon issuance with a bit of a dud in the form of a mediocre, tailing 3Y auction.

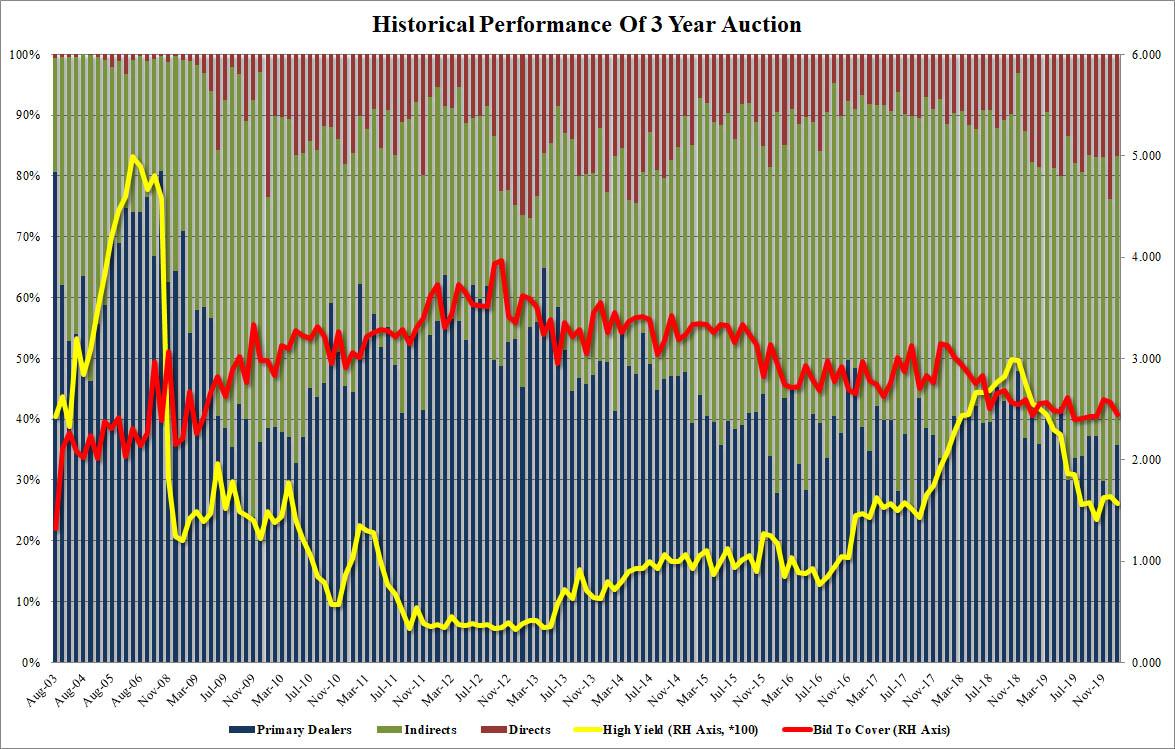

The sale of the $38BN in 3Y paper (CUSIP Z29), stopped at a high yield of 1.567%, tailing the When Issued 1.564% by 0.3bps, the first tail for this tenor since October 2019. The yield was also the lowest since October, and below both November and December’s high yield which were both at 1.630% and higher.

The Bid to Cover was also mediocre at best, dropping from 2.56 in December to 2.45, and below the six-auction average of 2.47.

The internals were mediocre at best too, with Indirects taking down 47.5%, down from 49.1% last month, below 48.3% recent average and the lowest since October; Directs also slumped, ending with a 16.7% allotment, down from 23.8% last month and also below the recent auction average. As a result of the drop in the buyside, Dealers were left holding 35.8%, sharply higher than December’s 27.1%, and the most since October.

Overall, a rather soggy auction start to year and a decade that will see trillions and trillions in new debt sold by the US.

Tyler Durden

Tue, 01/07/2020 – 13:16

via ZeroHedge News https://ift.tt/2tBFmik Tyler Durden