Rabobank: An “Epoch-Marking” Moment In Treasury Yields Is Imminent

Submitted by Michael Every of Rabobank

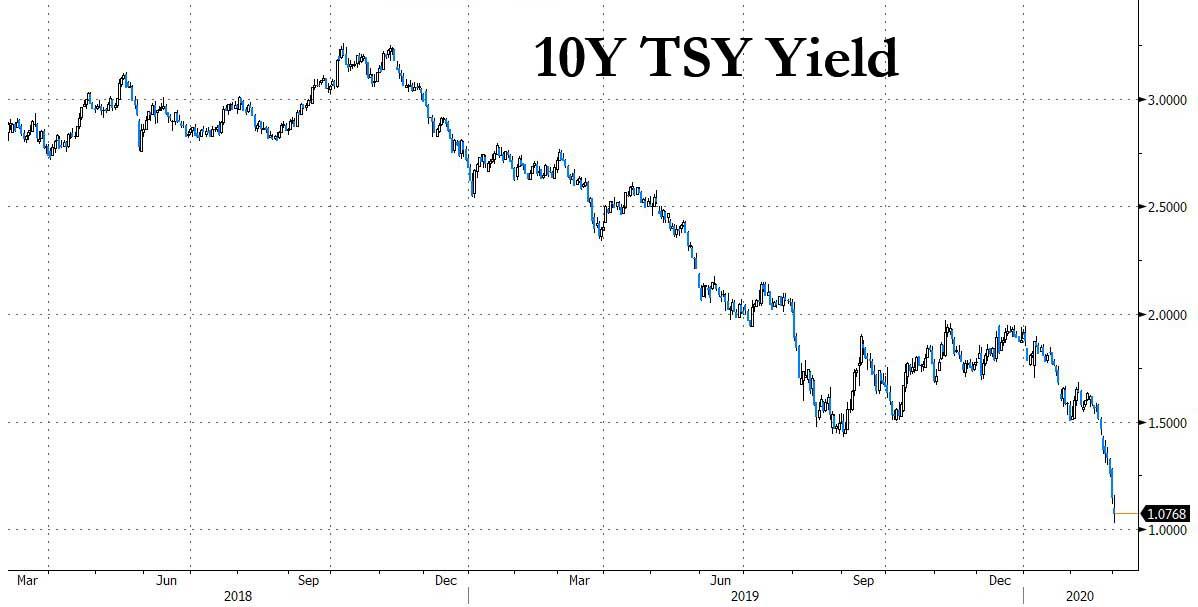

The 1%

On Friday I was briefly conversing with the head of our Rates Strategy team about the virus and markets. As equities and US Treasury 10-year yields plummeted in tandem, we mused over how long it would be before we printed the psychological and epoch-marking sub-1% level. “Not long after the first US virus death,” was the conclusion.

Well, here we are. As the White House adopts a far more sombre tone, one US citizen has died from Covid-19, and clusters of cases continue to spread across the States with no link to China. Panic buying is being seen in places. In Iran, things are reported to be totally out of control, or so the social media rumors have it when the country is still closed off after the recent violent crackdown on protests, and when official news-flow is still Panglossian. In Europe, cases are also soaring exponentially and lockdowns are slowly spreading. No meetings of over 5,000 people now says France: because at 4,999 the virus isn’t transmissible, obviously. No cessation to free movement either, because EU27 > COVID19. In short, the virus trend surely says “sub-1%” imminently.

Indeed, Monday morning in Asia we saw the US 10-year hit 1.03% before rebounding back to 1.10% again, and 10-year Aussies trade at 0.68%, through the level of the OCR. In Japan, 10-year JGBs got to -0.18%.

The cause for the yield plunge was obvious. Saturday’s China PMI data were frankly shocking. Manufacturing was at 35.7 and services at 28.9: these are not recessionary levels, but outright depressionary. The private Caixin PMI was also awful at 40.3, again saying a deep downturn is biting. Of course, the real issue is if we get a V-shaped recovery in output – or in virus infections. Optimists, and Chinese stocks this morning, are cheering the former – and Chinese stocks are always freely traded and never, ever manipulated by the authorities, as well all know. Realists, and NASA satellite imagery of no pollution over China, lean towards the latter: as does one anecdotal, unsubstantiated report trending over the weekend that China has been ordering factories to leave the lights on to make them look busier from space and to boost electricity output in case pesky foreigners start trying to use that as a GDP proxy.

The cause for the yield bounce, apart from Potemkin Chinese stocks, purely technical functions, and Goldman Sachs saying they see this all as a brief blip, are remaining hopes that ‘central banks have this’. For example, Friday saw Fed Chairman Powell step in with a public statement: “The fundamentals of the U.S. economy remain strong. However, the coronavirus poses evolving risks to economic activity. The Federal Reserve is closely monitoring developments and their implications for the economic outlook. We will use our tools and act as appropriate to support the economy.” He didn’t actually do anything over the weekend, as the whispers had had it, but at least he mentioned that he has noticed what is going on. The BOJ this morning has also come out and made clear that it too has noticed that things are not going well (and recall Japan was already in recession, which today’s Q4 capex data at -5.0% only underlines). That is again being seen as positive. On such slim hopes are attempted market rallies based, it seems.

As the rest of the world outside China heads for the same kind of voluntary and obligatory virus lockdowns and NOT-BAU as are already the case in China, raising the question of who China will be selling all its output to once it finally gets up and running again, what is the Fed going to do and how is it going to help? Let’s say they do nothing: they look heartless. Through 1% we go. Let’s say they go 25bp: they look ridiculous. How does 25bp off Fed Funds compensate for a rolling economic panic and lockdown, and for simultaneous supply shocks and demand destruction? Through 1% we go. Let’s say they go 50bp: they then risk looking powerless. After a brief rally in stocks and yields, everything will reverse and the question will be asked “What difference does another 25bp on top of 25bp make?” – and that’s the Fed’s biggest gun being sniffed at. Through 1% we go.

Of course, with our equity-obsessed Fed it’s fairly clear what they will eventually do. Even more so when President Trump is of one mind with the Fed in that key regard, as he used a virus press briefing to lambast the central bank again, adding “We need a Fed that’s going to be a leader,” and asking why the US doesn’t have the lowest interest rates in the world, as if this were a competition. Which it may well soon be.

Talking of the 1%, there might also be some temporary lift for equities and yields today from the South Carolina Democratic primary results. There, voters resoundingly rejected an ageing, white, wealthy, handsy, gaffe-prone president surrounded by Ukraine-related family scandals… by opting for Joe “White Walker” Biden over Bernie Sanders and his anti-1% message. Expect much US media exhaling and talk of a Comeback even as Bernie remains ahead in 10 of the 14 states voting tomorrow on Super Tuesday.

Apart from viruses and caucuses, Europe wakes up today worrying about two other things: The UK and Turkey, and the two are arguably linked. Trade negotiations with the U.K. have started badly and are going to get worse now PM Johnson is allegedly playing hardball by making security contingent on trade access: no trade deal, no automatic UK military support for Europe. With the US also threatening the same, who will be defending Europe? Not Europe, based on its defence-spending plans under the proposed post-Brexit budget. For many countries the 1% figure of military spending to GDP is still closer than the 2% that NATO and the US would like to see.

Meanwhile, Turkey is threatening to reopen its borders and openly encourage Syrian refugees to flow West again: just what an increasingly-populist, virus-struck EU needs to see. President Erdogan has made clear the price for stopping this refugee flow: Europe and the US must give him military support vs Syria (read Russia), where he has just shot down two Syrian jets and blown up a Russian air defence system (not the expensive one he just bought from Russia, which has seen questions asked in the US over how Turkey can also stay in NATO). With the US leaving Afghanistan and in no mood to get dragged directly into a new pointless war, Turkey looks most unlikely to get the support it wants. In which case, what? Uncertainty and unpleasantness for the EU – and more reason to buy bonds.

Frankly, I am sure you can find 99 Dailies written in the Asian time-zone that are more upbeat than this one, especially the ones using official Chinese and/or Fed inputs as their output. In this regard (and only in this regard!) I am happy to be in the 1% – and let the rest eat cake.

Tyler Durden

Mon, 03/02/2020 – 10:54

via ZeroHedge News https://ift.tt/3cnThub Tyler Durden