US Manufacturing Growth Slows As New Orders, Imports Slump

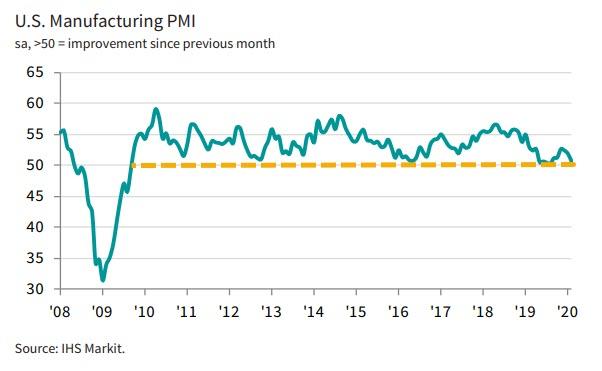

Janaury’s (and preliminary February) data signaled mixed messages in the US manufacturing sector with ISM bouncing aggressively and PMI sliding for the 3rd straight month (but both in expansion – above 50).

Markit US Manufacturing PMI fell from 51.9 to 50.7 (below the flash print of 50.8) – 3rd straight month of declines – as new order growth slowed to nine-month lows.

ISM US Manufacturing survey disappointed, dropping from 50.9 to 50.1 (barely above contraction) amid contraction in new orders, and employment.

Source: Bloomberg

PMI remains very near the weakest levels since 2009…

And in the ISM data, three of five components fell, led by the biggest drop in production since 2018.

The gauge of supplier deliveries also rose to the highest level since 2018 — indicating slower delivery times that may be due to supply disruptions from the coronavirus. The imports index swung into contraction, falling the most on record to 42.6, the lowest reading since 2009. Export orders grew at a slower pace.

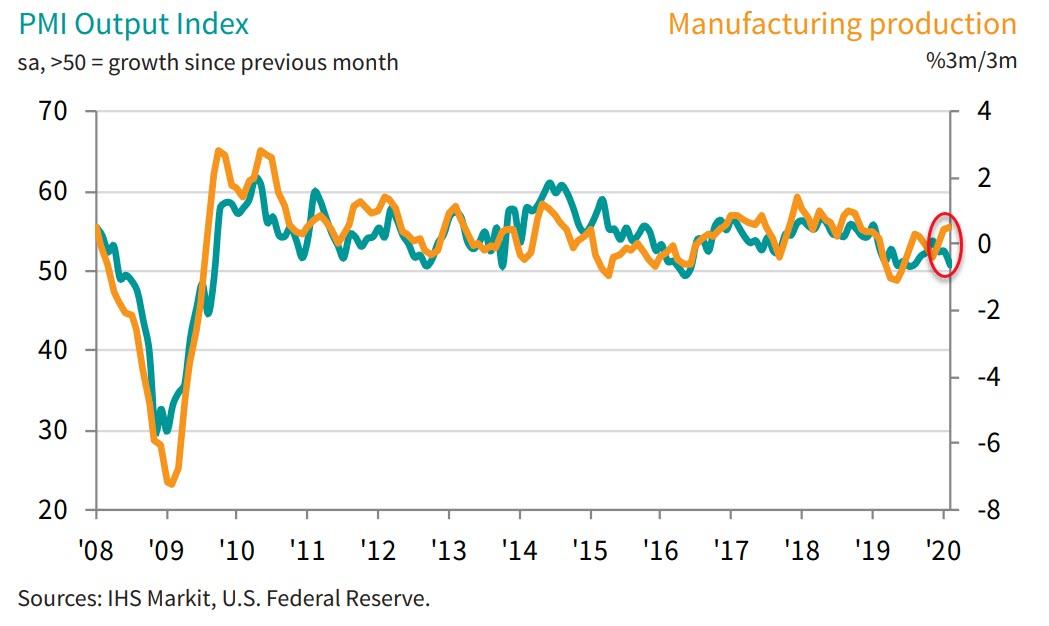

Supply chain delays stemming from supplier factory shutdowns in China and the outbreak of coronavirus led to a further deterioration in vendor performance, which reportedly held back output and the processing of backlogs due to a shortage of components. As a result, firms registered a renewed rise in outstanding business and a drop in pre-production inventories.

Chris Williamson, Chief Business Economist at IHS Markit said:

“Manufacturing production and order book trends deteriorated markedly in February as producers struggled against the double headwinds of falling export sales and supply chain delays, both in turn often linked to the coronavirus outbreak.

“Any growth in sales was once again largely driven by domestic consumers, though even here the rate of growth was weakened considerably compared to late last year.

“Historical comparisons against official data indicate that the survey is consistent with factory production and orders both falling at annualised rates of around 3%, with manufacturing jobs being lost at a monthly rate of roughly 20,000.

“While trade war fears have eased, helping push firms’ expectations for future growth to the highest since last April, coronavirus-related supply chain issues threaten to constrain production in coming months. At the same time, companies have become increasingly concerned that the COVID-19 outbreak will also hit demand, which is reportedly already cooling amid uncertainly leading up to the presidential election. Recent stock market volatility could also further dampen consumer spending and deter business investment.”

Sadly for the hopefuls, there is not enough here to shake The Fed’s confidence that

-

“the fundamentals of the U.S. economy remain strong” (Powell),

-

“I wouldn’t want to to prejudge the March meeting” (Bullard),

-

“there is some risk, but basically I think the U.S. outlook looks pretty good” (Yellen),

-

“I think it pays to be patient” (Kaplan).

Will they still cut?

Tyler Durden

Mon, 03/02/2020 – 10:05

via ZeroHedge News https://ift.tt/39g5kYH Tyler Durden