As The Crisis Deepens, Keep An Eye On Illinois’ Unpaid Bills

Authored by Ted Dabrowski and John Klingner via Wirepoints.org,

The depth of the financial and economic impact of the Coronavirus is impossible to predict since we don’t know how far the virus will spread or how long the economic shutdown will last. But we do know that pension shortfalls will jump, borrowing will increase and the state budget hole will widen dramatically. Unfortunately, it will take months before all those numbers are reported and summed up.

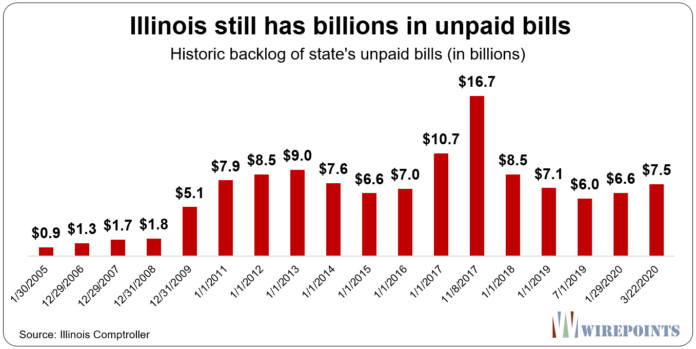

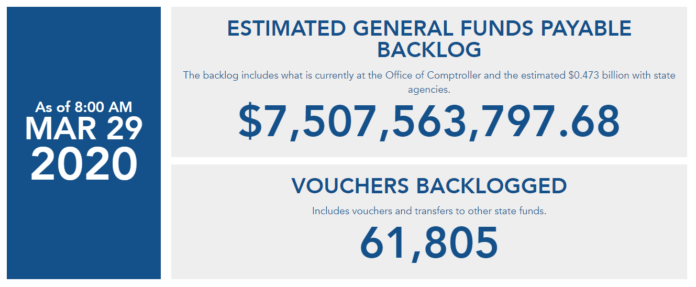

In the meantime, one number Illinoisans can keep an eye on is the state’s unpaid bill backlog, which currently stands at just over $7.5 billion. The state has been notorious for not paying its bills on time since 2005 and its backlog jumped to $17 billion in 2017.

As the Coronavirus crisis deepens, don’t be surprised if unpaid bills begin rising again.

Keep in mind that the unpaid bill number can be manipulated in many ways – we’ve covered that in detail – so the state can make the backlog look better than it really is. However, the backlog can serve as a limited gauge, in conjunction with other numbers, for how the state’s finances are holding up under the shutdown.

Illinois pols have constantly overpromised pension benefits, passed unbalanced budgets and hiked spending, all of which have left the state with a chronic bill backlog.

There’s a real human cost to that backlog, which has long been an indicator of Illinois’ deadbeat status. Those billions should have already been paid to thousands of contractors across the state, many of them small businesses and social service providers which are among the hardest hit by the shutdown.

The pressures on the state are going to be intense as sales and income taxes and a host of other revenues shrink along with the economic freeze. The Commission on Government Forecasting and Accountability expects revenue losses of over $8 billion for the state over the next few years. Unless the government reduces its operating costs in line with the shutdown – which it shows no signs of doing – expect the backlog to jump.

Unpaid bills reached a high of over $16 billion in 2007, but the state government borrowed $6 billion via long-term bonds to bring the backlog down to just over $9 billion in November of 2017. This time around, unless the federal government steps in, borrowing money will be much more difficult. Barring some type of bailout, it’s easy to see the bill backlog rising again.

For sure, other numbers will eventually reveal the true depth of just how unprepared Illinois was for this crisis. But in the meantime, just follow the unpaid bills.

Read more about the impact of the Coronavirus on Illinois:

-

State of Illinois provides first look at possible revenue impact from downturn

-

Focus On Chicago’s Immediate Crisis, Mayor Lightfoot, Not Political Grandstanding

-

‘Act of God’: Illinois Teachers Get Full Pay, Pension Accrual While Schools Are Closed

-

Will Recession Revive Discussion of Municipal Bankruptcy and Bankruptcy-for-States?

-

Stock market meltdown, collapsing bond rates will wreak havoc on Illinois’ weakest pension plans

Tyler Durden

Tue, 03/31/2020 – 20:05

via ZeroHedge News https://ift.tt/2JveiWw Tyler Durden