Boeing Cut To Just Above Junk, S&P Warns “Recovery Remains Highly Uncertain”

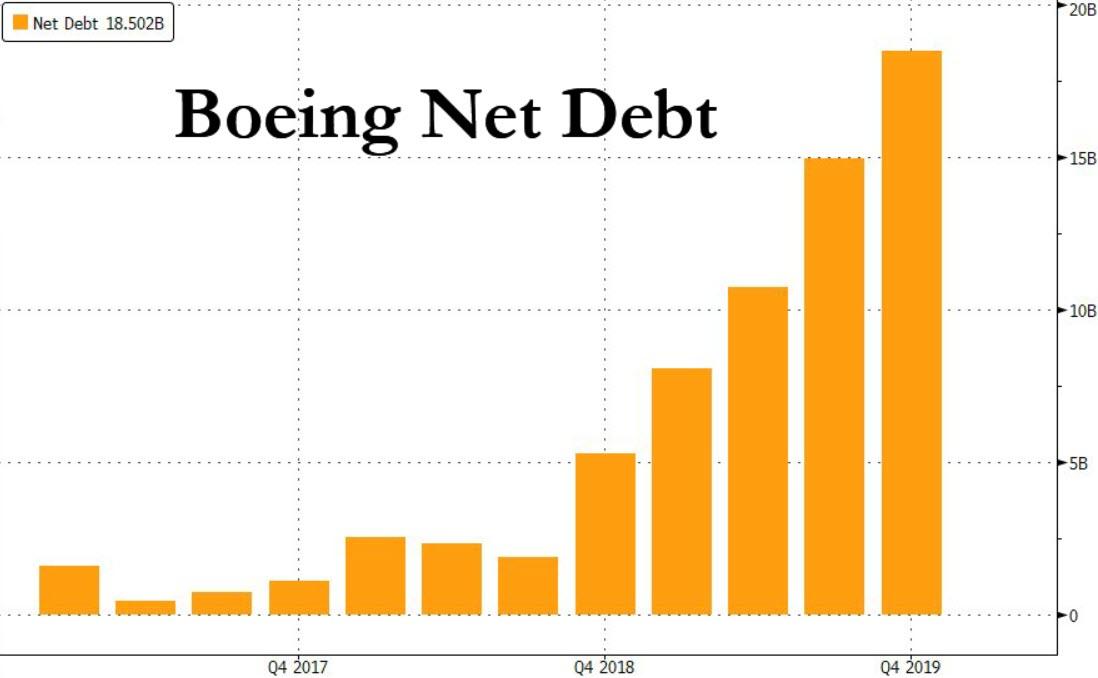

With total debt (in public bonds & loans outstanding) of $34.2 billion, net debt soaring…

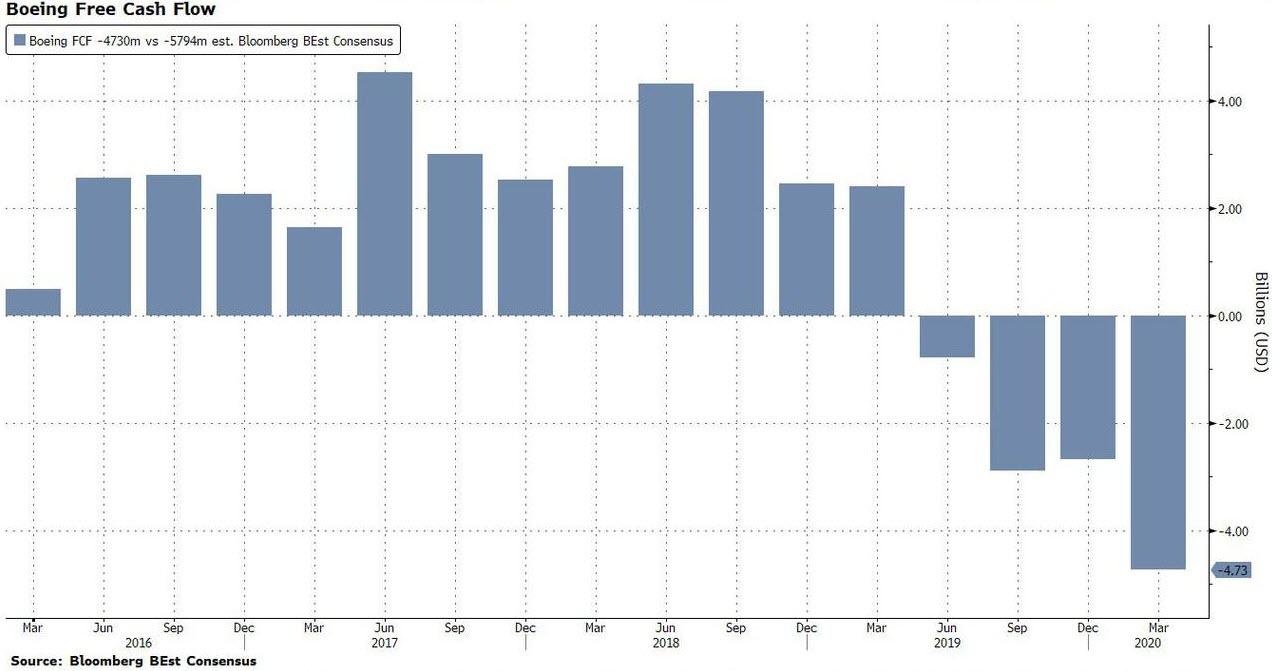

…and having burned through $4.7 billion in cash in the first quarter, it is perhaps no surprise S&P took the ax to Boeing’s credit rating.

As a reminder, Moody’s downgraded Boeing to Baa2 (BBB equivalent) with a negative outlook on April 10th, and now S&P goes one step further with a cut to BBB- (one notch above junk).

Credit markets are actually a little more positive than stocks here (thanks Mr.Powell)…

Boeing Co. Downgraded To ‘BBB-/A-3’ From ‘BBB/A-2’ On Coronavirus Impact, Outlook Stable

-

Boeing Co.’s earnings and cash flow over the next few years are likely to be lower than we had previously expected due to the impact of the coronavirus on aircraft demand, with the pace of recovery in air travel still highly uncertain.

-

Therefore, we are lowering our issuer credit ratings on the company to ‘BBB-/A-3’ from ‘BBB/A-2’ and are removing the ratings from CreditWatch, where we placed them with negative implications on Jan. 23, 2020.

-

The stable outlook reflects credit ratios that should improve in 2021 due to higher 737 MAX deliveries, with funds from operations to debt of 25%-30% and free operating cash flow to debt of 20%-25%.

S&P Global Ratings today took the rating actions listed above.

Earnings and cash flow are now likely to be much weaker than we expected for at least the next two years. We now expect free cash flow to be an outflow of $19 billion-$20 billion in 2020 and an inflow of $9 billion-$10 billion in 2021. This compares to our previous forecast for free cash flow to be an outflow of $11 billion-$12 billion in 2020 and an inflow of $13 billion-$14 billion in 2021. The significant decline is due to lower aircraft deliveries and aftermarket sales resulting from the impact of the coronavirus on air travel, lower deposits from airlines as they try to conserve cash, and the costs of operational disruptions. This is only partially offset by the company’s efforts to reduce costs to match lower demand.

The total cash outflow (after dividends and acquisitions, but before changes in debt) in 2020 will be similar to our previous expectations at around $20 billion due to the company suspending its $4.6 billion annual dividend and terminating its planned joint venture (JV) with Embraer S.A., which required a $4.2 billion investment.

Total balance sheet debt is still expected to peak at more than $46 billion, up from about $39 billion on March 31, 2020. However, earnings are likely to be much lower due to the lower deliveries and about $2.1 billion in charges related to the KC-46A tanker, further delays on the 737 MAX, costs to fix a problem with earlier generation 737s, and the costs of temporary halting production. We now expect funds from operations (FFO) to debt of 0% to negative 5% in 2020 (previous expectation was 5%) and 25%-30% in 2021 (previous expectation was 30%). However, this forecast is highly uncertain and does not include a possible material increase in pension liabilities due to lower discount rates and poor asset returns in 2020.

Environmental, social, and governance (ESG) factors relevant to the rating action:

Health and Safety

The stable outlook reflects credit ratios that should improve in 2021 as MAX deliveries increase, with FFO to debt of 25%-30% and free operating cash flow (FOCF) to debt of 20%-25%, if the impact of the coronavirus on aircraft demand is not materially greater than we expect.

We could lower the rating if we do not expect FFO to debt to improve above 20% or FOCF to debt above 10% in the next 12-24 months and we believe the company’s competitive position has deteriorated significantly. Additionally, we could lower the rating if the cash outflow in 2020 is significantly greater then we expect and the company is not able to raise funds in the bank or capital markets or through the various government coronavirus support programs, leading to a deterioration in liquidity.

This could occur if:

-

MAX certification is delayed further resulting in fewer deliveries, higher compensation to airlines, and lower margins on the program.

-

Aircraft deliveries or aftermarket sales are below our expectations or there are significant order cancelations due to lower demand. This could result from the impact of the coronavirus on air travel being greater or lasting longer than we forecast.

-

Operations are significantly disrupted due to government restrictions to slow the pandemic, employee illness, or supplier issues.

-

The company is not able to successfully reduce costs to match lower demand.

-

We believe the MAX grounding has materially impaired the company’s competitiveness in the narrowbody market, resulting in lower profitability and cash generation.

-

Management resumes dividends and share repurchases before significantly reducing debt taken on to deal with the MAX grounding and coronavirus impact.

-

The pension liability increases materially, resulting in significantly higher required contributions.

Although unlikely, we could raise the rating if we believe FFO to debt will increase above 25% and FOCF to debt above 15% for a sustained period.

This could occur if:

-

Air travel recovers faster than we expect, limiting the impact on aircraft demand and resulting in higher than expected aircraft deliveries.

-

The company successfully reduces costs to match expected demand and there are no material disruptions to operations.

-

MAX certification is not further delayed.

-

Management maintains a conservative financial policy, dedicating all cash flow to reducing debt.

Of course, even if it were cut to junk, The Fed would just scoop it all up and save another zombie.

The downgrade comes after Boeing sent out a separate letter to employees just as it reported earnings. CEO Dave Calhoun said the company is targeting a 10% cut through voluntary layoffs, natural turnover and “involuntary layoffs as necessary.” The reduction will be even deeper – with a 15% employment drop – at the company’s jetliner and services units, as well as in its corporate functions operation.

In his message to employees, Calhoun calls the news on job cuts “a blow during an already challenging time.”

Tyler Durden

Wed, 04/29/2020 – 17:15

via ZeroHedge News https://ift.tt/2VPcgaK Tyler Durden