Global Economic Activity May Have ‘Bottomed’ But Don’t Expect Any ‘V-Shaped’ Recovery; Fathom

A new report from Fathom’s Recession Watch indicates global economic activity may have troughed in the last several weeks, but that doesn’t guarantee a V-shaped recovery.

We noted on Tuesday that Goldman Sach’s coronavirus activity tracker showed some signs of life amid an unprecedented collapse in aggregate demand.

Here are the highlights from Fathom’s report:

-

Global economic activity may have hit its trough in the past couple of weeks

-

But output is likely to remain below pre-COVID 19 levels for an extended period

-

It is unclear how much restrictions can be relaxed while keeping R below 1

-

Excess mortality data from a range of countries suggest official figures understate the COVID-19 impact on deaths

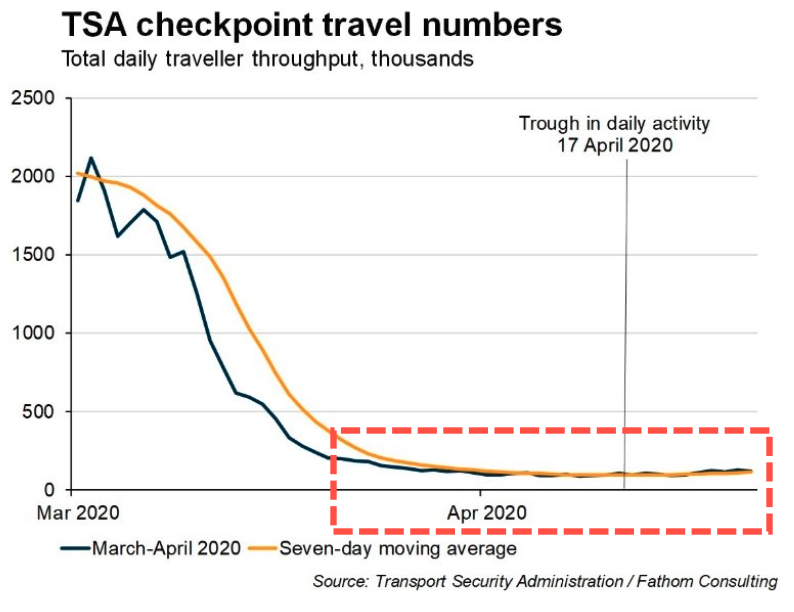

Fathom points out that relaxation in strict social distancing measures has been seen in Europe and the US. It suggests that global economic activity could be finding a trough. Shown below, the bottom in air travel occurred 12 days ago. The report said, “Global GDP may have stopped declining, but is still at levels well below those from just a few months ago.”

While a bottoming in global economic activity could certainly be possible, the research firm said, “it is too early to identify real green shoots.”

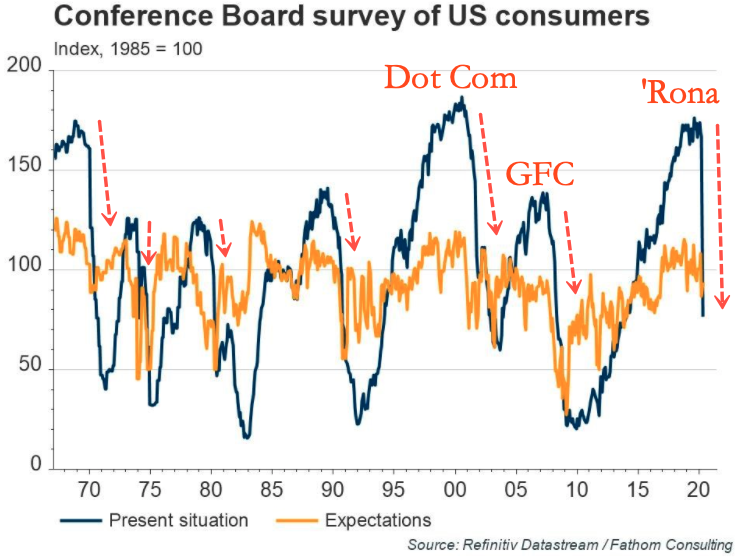

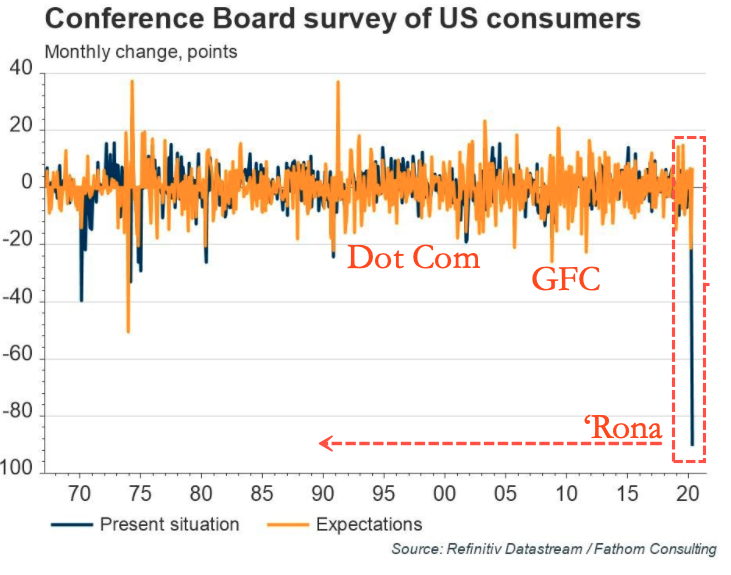

“The US Conference Board survey of American consumers offers some dose of optimism. Its measure of households’ ‘present situation’ fell by a record 90.3 points in April, which was more than double the previous record monthly decline. However, the ‘expected’ situation actually increased by 7 percentage points after declining in March. Are US consumers already pricing in a swift recovery? Perhaps. Large fiscal and monetary stimulus has supported asset prices and should keep incomes broadly stable in the coming months even for those who have lost their job. The pessimistic interpretation is that consumers remain too sanguine about the medium-term economic and health consequences of COVID-19.”

And this is absolutely shocking…

“It is now clear that while entry into lockdown was swift, exit will not be. Estimates of the New York COVID-19 reproductive rate suggest that this figure has dropped to 0.8 and is therefore consistent with a gradual erosion of the virus. It is a big improvement from COVID-19’s reproductive rate without mitigation, which is thought to be around 2.5 or 3. But it remains very close to the critical threshold of 1, which separates erosion and expansion of the virus. Moreover, that figure bottomed around two weeks after lockdown and has remained broadly stable since then, suggesting measures to reduce it further such as centralised quarantine of infected patients would not be politically palatable. More importantly, it means that even gradual restrictions on New Yorkers risk moving the reproduction rate back above 1, leading to increasing daily caseloads. Indeed, reports from Germany yesterday said its reproduction rate had risen to above 1.

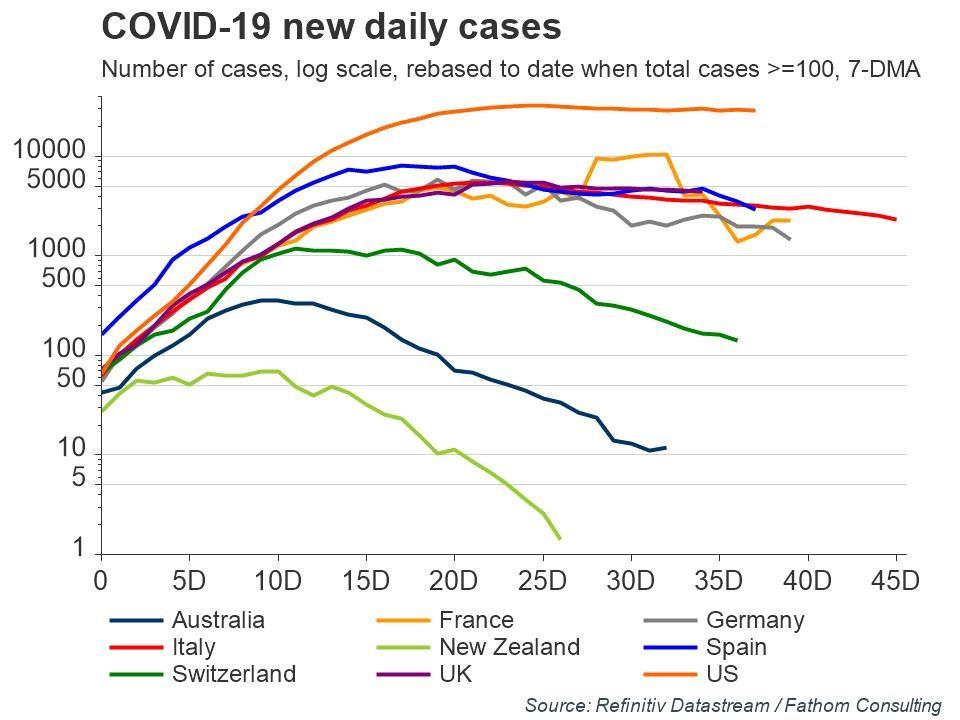

While almost all countries are following similar approaches, there appears to be a difference between those who want to flatten and those who want to bend their curves. Countries such as Australia and New Zealand seem to be trying to suppress the virus entirely, with daily new cases below 100 before relaxing restrictions. That is consistent with bending. Getting cases to such low levels should mean that future test-and-trace strategies are more achievable. In contrast, countries in Europe and individual US states appear willing to ease lockdown measures subject to the constraint of the reproduction rate being below 1 and the health system not being overwhelmed, even if that means an ongoing spread of the virus.”

“Further signs of a different approach come from the UK government, which appears to have changed one of its five rules for exiting the lockdown. Previously, no exit would be considered before the government was confident of no “second peak of infections”. That language has since been changed to no “second peak of infections that would overwhelm the NHS”. The distinction is key. The latter suggests comfort with rising cases as long as there is increased NHS capacity to deal with them. (The construction of new hospitals in recent weeks suggests that there is.) It points to a desire on the part of policymakers for easing the UK lockdown earlier rather than later even if it means continued transmission of the virus.

This more relaxed approach will almost certainly boost economic activity earlier than a world of more extended lockdowns but it comes with risks. For one, some citizens will be less willing to resume normal economic activity with ongoing cases and fatalities. Moreover, attempting to fine-tune restrictions risks moving too fast, particularly if the reproduction rate is only slightly below 1, perhaps leading to a re-introduction of more severe restrictions. For those reasons, it is difficult to see economic activity returning to pre-virus levels anytime soon. Our most likely, and most optimistic, scenario sees GDP in Europe and the US 5% below 2019 levels through 2021. The risks to that, however, are skewed to the downside.”

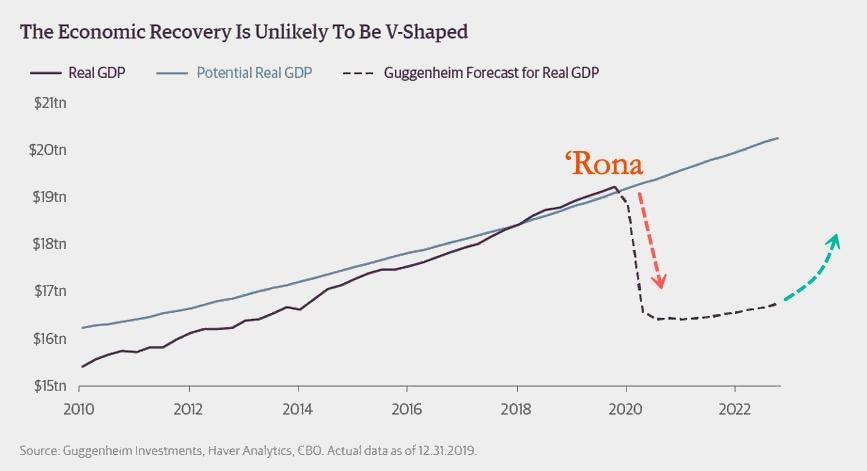

As for the duration of the recovery returning the US to pre-corona levels, well, Scott Minerd, the chief investment officer of Guggenheim Investments, believes it could take upwards of “four years” for a recovery to take place adding that “to think that the economy is going to reaccelerate in the third quarter in a V-shaped recovery to the level where gross domestic product (GDP) was prior to the pandemic is unrealistic.”

Even though, as per Fathom’s call, the global economy might have found a bottom after one of the worst crashes in history – that doesn’t necessarily mean a V-shaped recovery is ahead, preferably something of a U-shaped or even L-shaped could be seen.

Tyler Durden

Wed, 04/29/2020 – 15:45

via ZeroHedge News https://ift.tt/2YiYmze Tyler Durden