“What Were You Thinking?” Part Deux

Tyler Durden

Thu, 07/09/2020 – 13:11

Authored by Jesse Felder via TheFelderReport.com,

A couple of years ago I wrote a blog post titled, ‘What Were You Thinking?’ in reference to a famous Scott McNeely quote from the aftermath of the Dotcom bust:

At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?

McNeely was the Founder and CEO of Sun Microsystems, one of the most popular and most overvalued stocks during the height of the stock market mania that peaked 20 years ago. He saw his stock price rise from $10 in the beginning of 1999 to over $60, and over 10-times revenues as he notes, at its peak just a year later and then fall back under $10 over the next two years. In other words, he had a front row seat in the roller coaster that was the Dotcom bubble and so his thoughts on the episode are especially interesting.

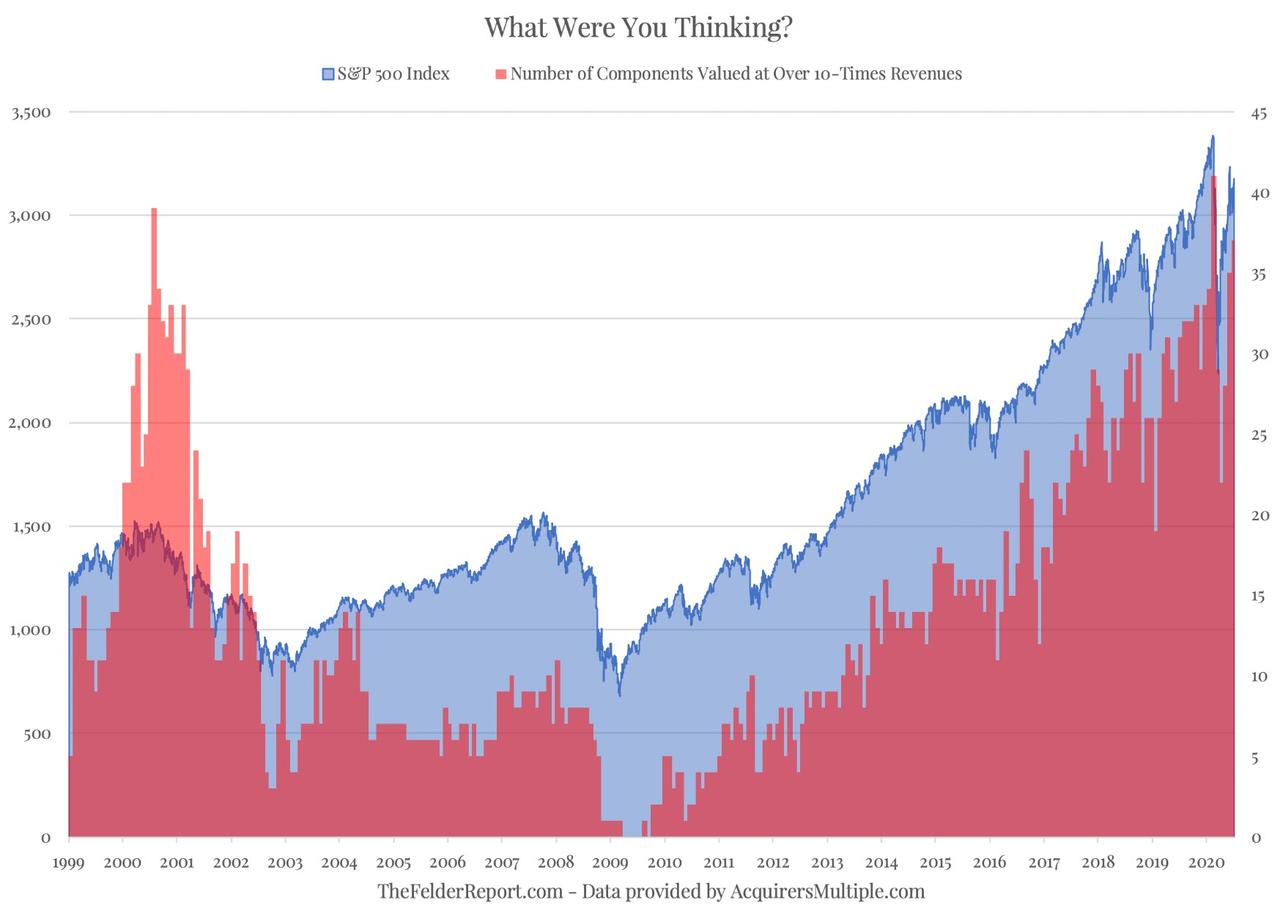

Even more interesting, however, may be the fact that only a few months ago there were even more companies within the S&P 500 Index that trade above this “ridiculous” valuation level than there were back in 2000 (thank you Tobias Carlisle and AcquirersMultiple.com for providing the data).

What’s more, even as we find ourselves in the midst of the worst economic crisis in modern history, there are still more stocks that trade above 10-times revenues today (37) than there were in March of 2000 (30), the month the Nasdaq put in its infamous peak before falling 75% over the subsequent two years.

Now that we are entering earnings season, these numbers could get even more interesting. With the Nasdaq at new highs and sales for S&P 500 companies expected to fall 11.1% in the second quarter (according to Factset), there’s a good chance we could set a new record set for the number of components trading above 10-times revenues.

And at some point, we will look back on this time and ask newbie day traders and passive investors alike, “what were you thinking?”

via ZeroHedge News https://ift.tt/38IqBuu Tyler Durden