Bonds & Bullion Bid, Stocks Skid As Stimmy-less Sentiment Slumps

The day started off with an exuberant buying-panic in Small Caps at the US cash open (as the rest of the majors were sold). That lasted around 12 minutes before Small Caps reversed that maniacal spike and everything accelerated into the red and beyond into the European close. A brief bounce ensued, only for that rip to be sold and as the old “WSB” names started to rise, so Small Caps and the rest of the major indices tumbled in the last hour. Nasdaq managed to close green, none of the other majors did with Small Caps the laggards (from up 1% at the open to down 1% at the close)

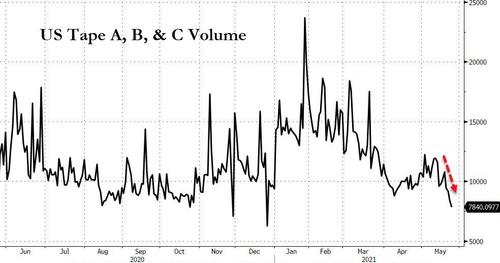

Amid the lowest volume of the year…

Source: Bloomberg

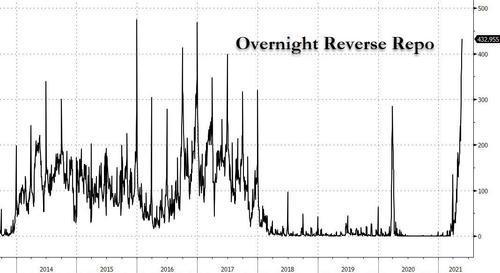

Sentiment slipped for the first time this year with buying plans crashing. New home sales crashed… and home prices are exploding… and RRP volumes are exploding…

Those old “WSB” short-squeeze names were back today…

Source: Bloomberg

With GME topping $200 once again…

And AMC even more aggressively bid…

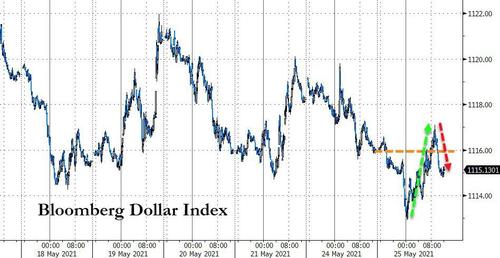

The dollar ended slightly lower despite China’s best efforts overnight…

Source: Bloomberg

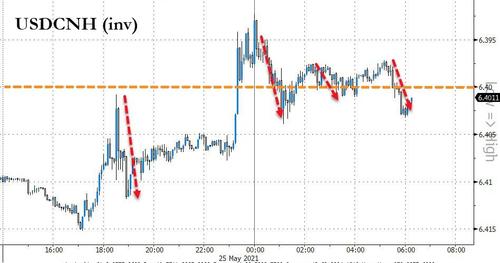

As China told its banks to buy USD to intervene in the Yuan’s strength…

Source: Bloomberg

Bonds were aggressively bid too – down around 4bps across the curve – helped by a rock solid 2Y auction…

Source: Bloomberg

With 10Y tumbling below 1.60 and accelerated down to critical level near its lowest close in over two months…

Source: Bloomberg

Real yields are continued to revert lower (catching up with Gold’s signal)…

Source: Bloomberg

Gold futures surged back above $1900 – almost back in the green for the year…

Silver rallied back above $28 today…

WTI ended very marginally lower on the day, stalling around the $66.50 level once again ahead of tonight’s inventory data…

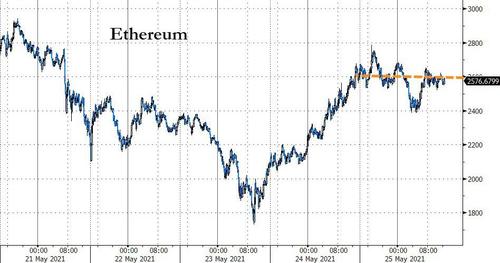

Cryptos were mixed today, though generally lower in the majors. Ethereum oscillated around $2600…

Source: Bloomberg

And Bitcoin hovered around $38k after briefly tagging $40k…

Source: Bloomberg

Finally, it is pretty clear that there are some serious issues occurring under the hood of ‘calm’ in these markets as the size of RRPs is exploding in a massive rejection of The Fed’s liquidity spigot…

Source: Bloomberg

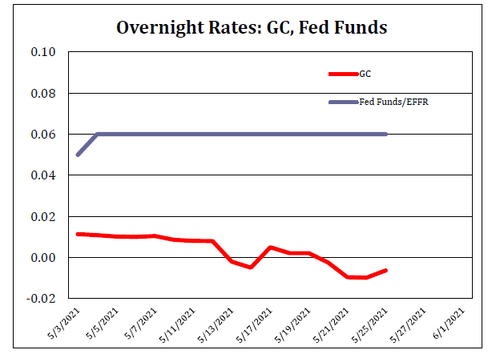

And, as Curvature notes, “Yesterday, GC averaged at -.0099%, which was the lowest non-quarter-end, non-year-end average EVER. The previous record low was -.0078% on March 19.”

And we all know what “reality” the ‘market’ faces, if The Fed ever stops… (and don’t forget SF Fed’s Daly admitted today that they’re “talking about talking about tapering…”)

Trade accordingly.

Tyler Durden

Tue, 05/25/2021 – 16:01

via ZeroHedge News https://ift.tt/3fOXM3D Tyler Durden