Meme Meltup: Traders Stumped As Gamestop, AMC Soar On Massive Volume

Don’t look now but the meme stocks are back.

Having crept higher in recent days, both Gamestop and AMC, the two most popular meme stocks which shook the hedge fund industry in February when several prominent hedge funds suffered massive losses on their shorts, have exploded higher today, with GME up as much as 18%…

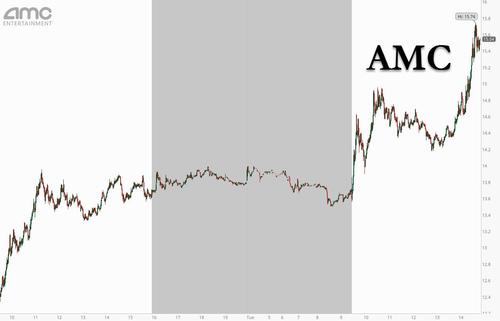

… and AMC close behind, up 14%.

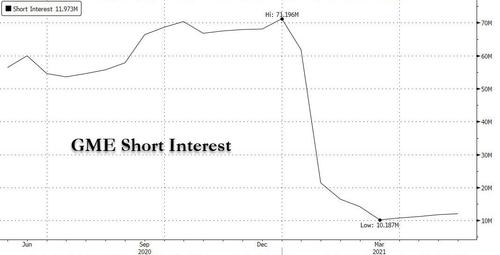

The move may be a ramp in sympathy because while GME short interest is a pale shadow of its former glorious self…

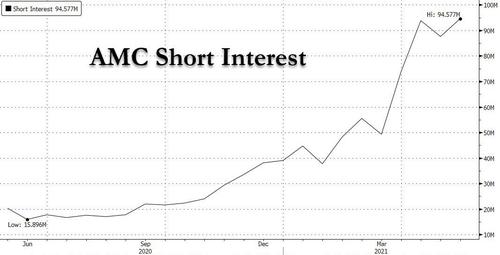

… AMC’s short interest has soared back to all time highs.

Whatever the reason behind the buying frenzy, volumes are massive: more than 123 million shares of AMC had changed hands by 2:35 p.m. in New York, making it the second most traded stock with a value greater than $1; 8 million shares of GME had traded, more than double what’s been seen over the past 10 sessions.

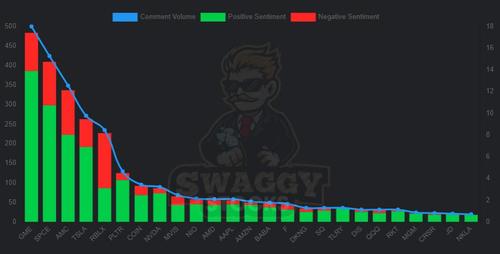

Helping the spike is the resurgence of positive mentions on WallStreetBets of both GME and AMC, which are the 1st and 3rd most discussed stocks today.

Meanwhile, Bloomberg notes that retail investors on social media platforms like Twitter and Stocktwits extended intraday rallies in mid-afternoon trading on Tuesday as volumes accelerated. AMC has continued to rally as hashtags like #NOTAPENNY trended on Twitter and the company was the most mentioned on Stocktwits.

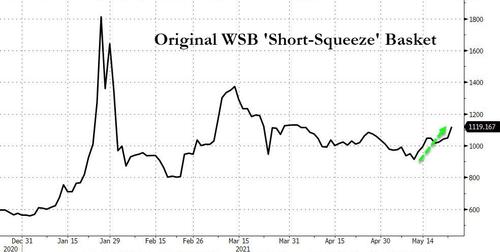

The surge in memo stocks has helped push the original WSB “short-squeeze” basket to the highest level since early April…

… while a basket of the 37 so-called meme stocks tracked by Bloomberg jumped 5.7% to trade above its 50-day moving average for the first time since March. Other stocks to rally in afternoon trading include Koss +11%, Naked Brand +5.6%, Express +4.3%, Sundial Growers +4.2%.

While there is no clear catalyst driving today’s melt up, there have been some whispers that with Amazon buying the MGM portfolio and moving into videogaming, it may seek to acquire a new brick and mortar chain to compliment its Whole Foods expansion.

Should the ramp continue, and if we are indeed set for a repeat of the torrid February meme meltup, expect a vicious spike in the illiquid overnight session where the bulk of the buying was concentrated during the epic late January/early February meme meltup, especially if one or more hedge funds are again caught short and are forced to cover.

which hedge fund is GME going to blow up now

— zerohedge (@zerohedge) May 25, 2021

Tyler Durden

Tue, 05/25/2021 – 15:07

via ZeroHedge News https://ift.tt/3hPefaw Tyler Durden