Stellar 2Y Auction Reeks Of Deflation With Strongest Metrics Of 2021

Up until mid-May, the prevailing narrative and conventional wisdom on Wall Street (as the latest BofA Fund Manager Survey confirmed) is that an inflationary shockwave had been unleashed and the Fed would have no choice but to taper and hike rates much earlier than it has projected. Then, over the past two weeks, commodities finally cracked and the reflationary narrative got hammered, with benchmark 10Y yields, breakevens and real rates all sliding in unison as the real most popular trade on Wall Street (not bitcoin but “reflation”) was rapidly unwound and tech stocks spiked.

Well, there was positively a whiff of deflation from the just concluded sale of $60BN in 2Y notes which was by and far the strongest auction of 2 year paper not only in 2021 but for the past year.

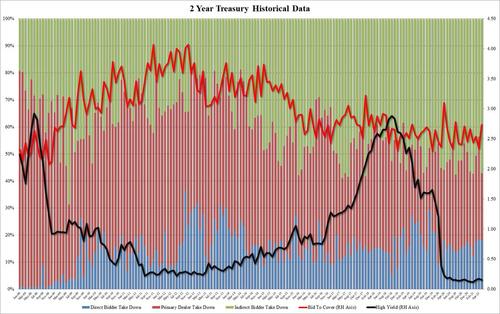

Printing at a high yield of 0.152%, this was a 2.3bps drop from April and the same as March. Furthermore, printing 0.7bps inside the When Issued, this was the strongest auction as measured by the Stop Through going back to April 2020 when the world was caught in a deflationary collapse and everyone was rushing to the safety of TSYs.

The bid to cover was especially notable, soaring to 2.736 from 2.339 in April and the highest since August 2020.

Completing the deflationary picture – and surging demand for short-term paper – Indirects took down 57.1% of the auction, far above last month’s dismal 43.6% and the highest since February. And with Directs taking down 18.03%, Dealers were left holding just 24.9%, the lowest since November 2019.

Altogether, a blockbuster 2Y auction, and one which was more notable for what it signaled, and that is that the bond market is suddenly far less convinced that the Fed will be hiking rates in the next two years.

Tyler Durden

Tue, 05/25/2021 – 13:14

via ZeroHedge News https://ift.tt/2QVKtG8 Tyler Durden