Mystery Gain Makes Chinese Stocks Exciting Again

By Bloomberg reporter and commentator Sofia Horta e Costa

China’s battle to maintain stability in its financial markets took a surprising shift on Tuesday when stocks surged the most since July, buoyed by record buying via exchange links in Hong Kong. Traders will be keen to see whether the gains extend on Wednesday.

There were few obvious catalysts for the rally, which came after an almost three-month stretch where the CSI 300 Index appeared stuck in a tight trading range. It may be that investors shifted cash from the commodities market as authorities intensified their efforts to cool price gains in raw materials. Mutual funds may be looking to juice their returns to make up for a lackluster few months. Perhaps traders are betting officials want to see a strong market leading up to the 100th anniversary of the Chinese Communist Party on July 1.

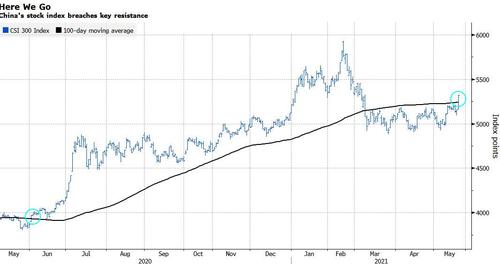

Bullish technicals added grease to Tuesday’s gains, with the CSI 300 closing 77 points above its 100-day moving average — a difficult resistance level for the index since March. The CSI 300 last breached that line almost exactly a year ago, just before one of the fastest rallies in Chinese stocks of the past decade. The yuan punched past 6.4 per dollar in offshore trading — also a key level for chart watchers — further enticing overseas buyers of Chinese assets.

Whatever the trigger — and in China, such outsized gains are often driven by sentiment — the sudden stock rally is another example of how quickly a trading frenzy can start in China. Imported inflation and capital inflows are complicating monetary decisions for the central bank, which has pledged to stick to its tightening path with no “sharp turn” in policy. Endorsing an even stronger yuan to offset inflation — an idea floated by one official before the article was deleted — would be a risky strategy if Beijing wants to avoid one-way bets. Ensuring a “basically stable” currency remains a key priority for financial stability.

For now, kicking the ball of money into the stock market and away from commodities may be the lesser of two evils. At least higher stock prices won’t pressure inflation, and the wealth effect might even provide a much-needed boost to consumer confidence. For a government obsessed with control, an overheating stock market would be more easily tamed than an overheating economy.

Tyler Durden

Tue, 05/25/2021 – 22:05

via ZeroHedge News https://ift.tt/3uqJNG9 Tyler Durden