Stalled Treasury Yields Are In Need Of New Narrative

By Ven Ram, Bloomberg reporter and Markets Live commentator

The dynamics that spurred Treasury yields higher in the first quarter have paused for now, suggesting that the next wave of selling may have to wait for a rebound in real yields and inflation pricing. Treasury 10-year yields have stalled around 1.60% after inflation expectations moderated, while real rates and term premiums declined, stealing the impetus from bearish expressions on long-dated bonds.

A simulation based on factors such as real rates, inflation expectations and expected economic growth suggests that 10-year real rates and 5y5y swaps need to climb by 30 basis points each from Monday’s close for the key nominal yield to approach 2%.

Real yields, which surged more than 45 basis points in the first quarter, have since retreated. The pace of increase through March — the fastest since 2016 when the Federal Reserve was tightening rates — proved unsustainable, raising the question of whether real rates will climb back into positive territory anytime soon. Remember that the key rate was well above 0% as recently as last year, before the pandemic struck.

Real rates are now near the lowest they have ever been, both in absolute terms and in relation to forecast economic growth. The gap between this year’s forecast GDP growth of 6.50% and the 10-year real rate is about 736 basis points, the widest it’s been in Bloomberg data going back nearly a quarter of a century.

Meanwhile, term premiums have also declined, eroding the compensation needed to adjust for maturity differences and underscoring why yields have retraced.

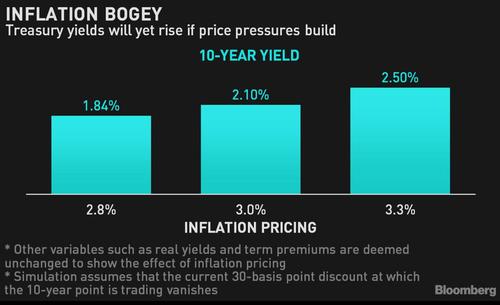

While expectations for price pressures have moderated, they seem to have the scope to climb at a quicker pace than real rates should realized inflation continue to print higher. The chart below shows the isolated effect of a surge in inflation pricing, holding all other factors constant.

With economists raising their forecasts for inflation each quarter through March next year, markets’ forward pricing may approach 3% in the coming months. Indeed, investors were anticipating inflation above 3% in the run-up to Fed’s taper announcement in May 2013.

While the Fed has made it clear that it will look through one-off and transitory inflationary signals, a print that is considerably higher than what is already penciled in by economists (allowing for base effects and like) would set a cat among the pigeons. That would also spur a divergence among Fed policy makers, with possibly enough breaking ranks to cause concern about the evolving trajectory of inflation.

While policy makers’ current monetary stance and recent comments have put a taper discussion on the back burner, a revival of the debate by the Fed itself may be just the impetus the market needs to send yields higher.

To be sure, 10-year Treasuries were trading at a discount of about 30 basis points on my model as of Monday, suggesting that despite the recent dalliance, the market’s bias is for higher yields. While a retracement toward fair value can’t be ruled out as a tactical play, the strategic direction for yields may be pointing north — should the economic recovery continue apace.

Tyler Durden

Wed, 05/26/2021 – 10:10

via ZeroHedge News https://ift.tt/34h4TMG Tyler Durden