WTI Rebounds After Inventory Draws Across Crude & Products

WTI slipped back below $66 this morning as investors weighed signs of an improving demand outlook in some regions against the prospect of more crude supply flowing from Iran.

“The potential for a return of Iranian oil supply into the market has been keeping oil prices from gaining further,” said ING analyst Warren Patterson.

The swings in crude and product stocks in the last couple of weeks have been noisy thanks to the Colonial Pipeline shutdown. This week we should start to put that behind us, although product stocks may still be impacted.

API

-

Crude -439k (-1mm exp)

-

Cushing -1.153mm

-

Gasoline -1.986mm (-1.1mm exp)

-

Distillates -5.137mm (-2mm exp)

DOE

-

Crude -1.66mm (-1mm exp)

-

Cushing -1.008mm

-

Gasoline -1.745mm (-1.1mm exp)

-

Distillates -3.013mm (-2mm exp)

Analysts expected inventory draws across the entire complex and last night’s API data confirmed that and the official data just confirmed that further with significant drawdowns in stocks across crude, gasoline, and distillates (7th week in a row)…

Source: Bloomberg

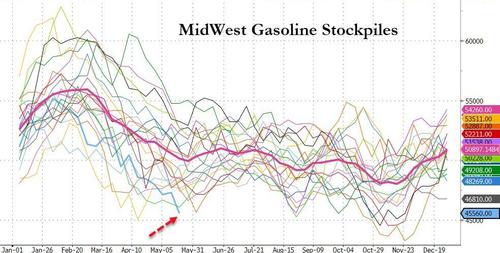

It is also worth noting, as Bloomberg points out that Midwest gasoline stockpiles are of great interest with a big travel weekend ahead starting at the end of the work week. This means more folks getting out of Chicago and Detroit to breathe in the forest air in places like Wisconsin and Upper Michigan for Memorial Day.

Source: Bloomberg

In the mid-March EIA report, Midwest gasoline inventory was at a seasonal low dating more than 21 years, with 45 million barrels on hand. That means PADD 3 gasoline stockpiles have not been this low at this time of year this century.

US crude production remains ‘disciplined’ still despite strong gains in oil prices and rig counts…

Source: Bloomberg

WTI hovered around $65.50 ahead of the print

“In our view, the fundamental situation on the oil market remains balanced,” said Commerzbank analyst Eugen Weinberg, adding that Brent “will make a renewed bid for the $70 per barrel mark in the next few days.”

Tyler Durden

Wed, 05/26/2021 – 10:34

via ZeroHedge News https://ift.tt/2SvRVrW Tyler Durden