Inflation… Or Speculation?

A funny thing happened on the way to a hyped-inflationary future…

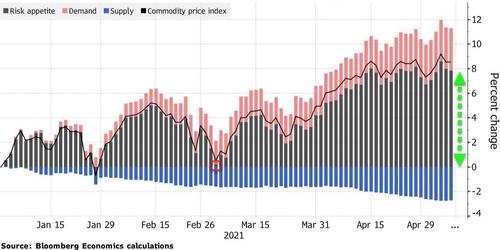

In the great inflation debate (transitory or not), the rally in everything from copper to soybeans to lumber has been a point in favor of the reflation hawks. But, as Bloombergs Tom Orlik notes, movements in commodity prices this year have been mainly driven by risk appetite, not fundamental demand or shortages of supply.

In other words, a majority of the realized ‘inflation’ in commodity prices is really driven by speculation on that inflation.

As SocGen’s Albert Edwards recently pointed out (echoing Bloomberg’s John Authers’ recent note), there is a “reflexivity” to investors’ belief in rising inflation.

For when they pile into commodities as an investment vehicle to benefit from rising inflation, they create substantial upstream cost pressures – as has been highlighted by PMI corporate surveys. Beyond the cascading effect of upstream commodity price pressures, headline CPIs are also quickly impacted as food and energy prices rip higher.

In addition to this, the observation by investors that industrial commodity prices are rising only serves to reaffirm their belief about cyclical strength and rising inflation – most especially “Dr Copper”, which many investors see as extremely sensitive to economic conditions.

The circular, or as George Soros terms it, ‘reflexive’ nature of financial markets makes them extremely vulnerable to being whipsawed. Yet because of the current extreme momentum it would take a very heavy weight of evidence to convince this market to reverse direction.

However, as the recent rapid decline of numerous industrial metals (and lumber) from their peak suggests, a rise in commodity prices driven primarily by speculation is also prone to a sudden reversal, so the inflationistas’ argument may not be as strong as it first appears, and the debate is far from over.

By way of contrast, Goldman Sachs disagrees, noting there is a long history of attributing paradigm shifts in prices to speculation.

China’s current crackdown on commodity speculation mirrors similar moves by the US in the mid-2000’s.

When commentators are unable to understand what is driving such a paradigm shift in prices, they attribute it to speculators – a common pattern throughout history which has never solved fundamental tightness.

Goldman goes on to argue that speculators reflect fundamentals and reduce volatility (we would beg to differ in the current craziness – see GME?), suggesting that data shows net-specs track fundamentals as the specs simply translate fundamental information into price discovery.

History shows that banning them typically leads to more price volatility.

And discouraging precautionary inventory building by consumers will leave China even more exposed to crowding out by US firms who are able to pass commodity inflation through to consumers, raising prices dollar for dollar with raw material costs.

However, as Albert Edwards ominously warns, when commodity prices do start to fall, expect a major reversal in inflation sentiment. And expect momentum to become as self-reinforcing and reflexive on the way down just as it was on the way up! Indeed, technical developments in the bond market suggest the wind may have already changed direction.

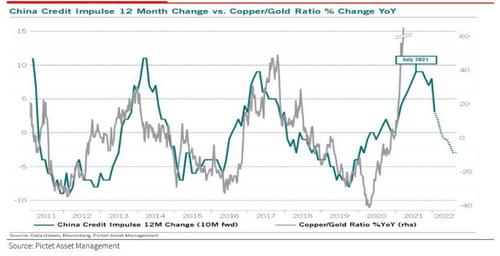

While so many investors are focused on President Biden’s super-loose (some would say crazily loose) fiscal stance in the US, they are missing the deflationary impulse heading down the tracks from China.

So despite the euphoric optimism about the strength of the global economic cycle and its inflationary implications, investors may be in for a major cyclical shock – relative to expectations.

Tyler Durden

Sat, 05/29/2021 – 09:55

via ZeroHedge News https://ift.tt/3yP1bI8 Tyler Durden