Stellar 3Y Auction Sees Surge In Foreign Demand

We start another week of Treasury auctions with today’s 1pm sale of $58BN in 3Y bonds and it was nothing short of a whopper.

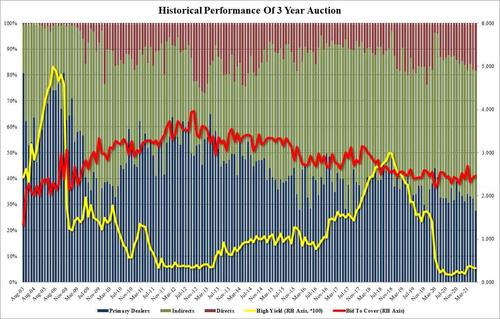

With a high yield of 0.325%, this was the 2nd consecutive 3Y auction where the yield has declined (down from 0.329% in May and 0.376% in April). The reason for this: investors increasingly have to shift further out on the curve to park “safe” securities now that short-term funding markets are at or near zero. The auction also stopped through the When Issued 0.326% by 0.1bps, a rebound to last month’s 0.2bps tail.

The Bid to Cover jumped from 2.422 in May to 2.467, the highest since March and above the 6-auction average of 2.436.

But it was the internals where the demand for today’s paper truly shone as Indirects rushed to get as much as they could, and were allotted 54.2%, a big jump from last month’s 49.6% and the highest since October 2020. And with Directs of 18.3% practically unchanged from 18.1% last month, this left Dealers holding on to just 27.6% of the final takedown, the lowest since December 2019 when Dealers were awarded just 27.1%.

Overall, a blockbuster of an auction…and the last thing record bond shorts needed as they debate whether to keep holding on to underwater positions ahead of Thursday’s CPI print or to book losses and dump it.

And with that attention now shifts to tomorrow’s 10Y benchmark offering, and certainly to Thursday’s 30Y sale which will come just hours after what is expected to be another blowout inflation print.

Tyler Durden

Tue, 06/08/2021 – 13:13

via ZeroHedge News https://ift.tt/2TUUJ2B Tyler Durden